Fermented Ingredients Market Size, Share, Trends, Industry Analysis Report: By Product Type, Form (Liquid and Dry), Process, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 125

- Format: PDF

- Report ID: PM5364

- Base Year: 2024

- Historical Data: 2020-2023

Fermented Ingredients Market Overview

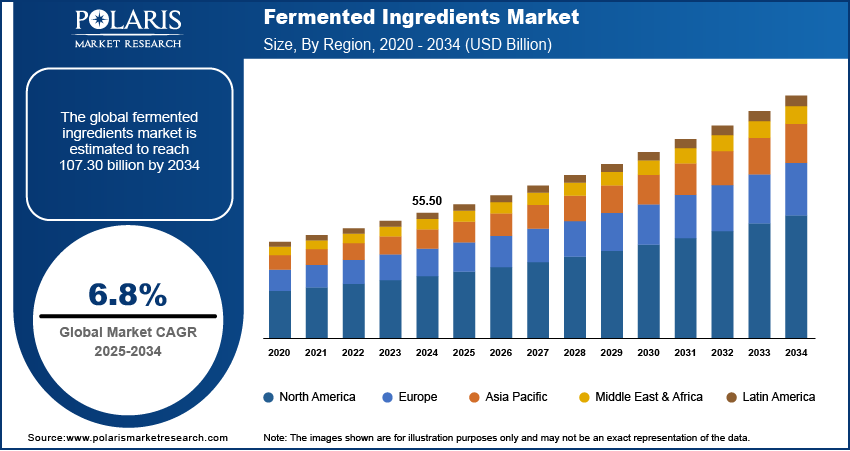

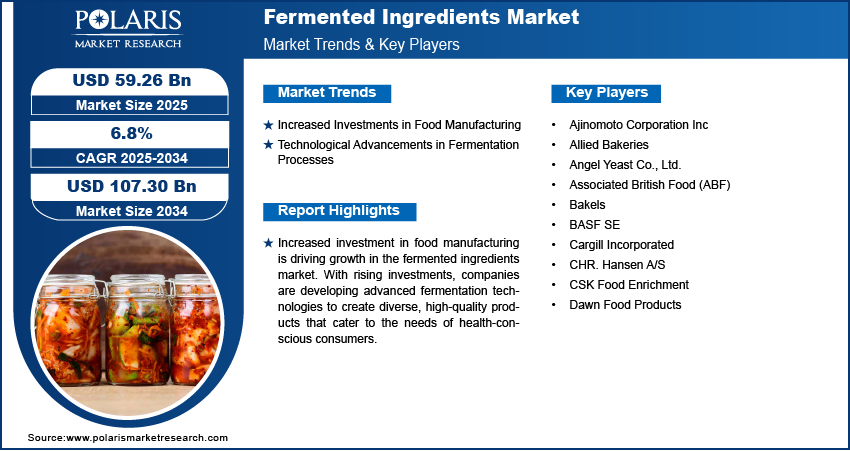

The global fermented ingredients market size was valued at USD 55.50 billion in 2024. The market is projected to grow from USD 59.26 billion in 2025 to USD 107.30 billion by 2034, exhibiting a CAGR of 6.8% from 2025 to 2034.

Fermented ingredients are food products that have undergone a controlled fermentation process, during which microorganisms like bacteria, yeast, or molds convert sugars and starches into acids, gases, or alcohol. This process enhances the nutritional profile, flavor, and digestibility of the ingredients, often introducing beneficial compounds such as probiotics and postbiotics.

The fermented ingredients market growth is being significantly driven by rising awareness of the health benefits associated with fermented products. Consumers are becoming more informed about the positive effects of fermentation on gut health, immunity, and overall well-being. This heightened awareness has led to an increase in demand for functional foods that incorporate probiotics, prebiotics, and other bioactive compounds derived from fermentation. As people seek healthier lifestyles and natural food options, manufacturers are responding by developing innovative products that highlight the nutritional advantages of fermented ingredients.

To Understand More About this Research: Request a Free Sample Report

The fermented ingredients market is growing due to the increasing popularity of probiotics, which are known for their health benefits. Consumers are actively seeking products that support gut health, digestion, and overall wellness, leading to a higher demand for probiotic-rich fermented foods. This trend has encouraged manufacturers to innovate and expand their product lines by incorporating probiotics into a wide range of items, from dairy to supplements.

Fermented Ingredients Market Dynamics

Increase Investments in Food Manufacturing

Increased investments in food manufacturing are driving the fermented ingredients market expansion as companies seek to innovate and expand their product lines. For instance, according to Invest India, total foreign direct investment (FDI) in the Indian food processing sector reached USD 11.08 billion from April 2000 to March 2022, and manufacturers are more inclined to develop advanced fermentation technologies. These investments are enabling the creation of diverse, high-quality fermented products that cater to consumer demand for health and wellness.

Technological Advancements in Fermentation Processes

The market for fermented ingredients is expected to grow due to technological advancements in fermentation processes. Innovations in bioreactor design and automation, featuring advanced sensors, actuators, and control systems, enable precise monitoring and regulation of fermentation, improving product quality. Additionally, automation reduces the dependency on skilled labor, significantly lowering operational costs for manufacturers. With enhanced efficiency and scalability, companies can increase production capacity while maintaining high standards. As the fermentation process becomes more streamlined and accessible, the entry of a wider range of manufacturers is expected to boost the fermented ingredients market revenue.

Fermented Ingredients Market Segment Insights

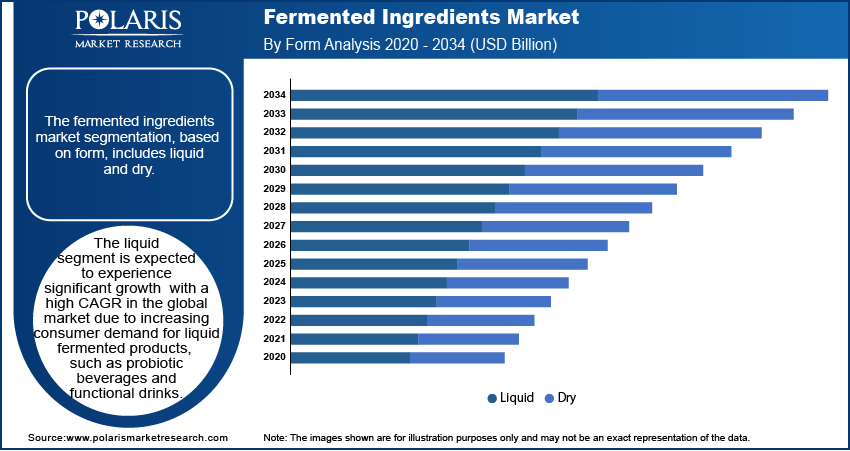

Fermented Ingredients Market Assessment by Form Outlook

The global fermented ingredients market segmentation, based on form, includes liquid and dry. The liquid segment is expected to experience significant growth with a high CAGR in the global market due to increasing consumer demand for liquid fermented products, such as probiotic beverages and functional drinks, which are favored for their health benefits and convenience. Additionally, rising awareness about gut health is expected to drive the growth of the segment.

Fermented Ingredients Market Evaluation by Application Outlook

The fermented ingredients market segmentation, based on application, includes food & beverages, pharmaceuticals, paper, feed, personal care, biofuel, and others. The food & beverage segment is expected to dominate the fermented ingredients market during the forecast period due to the growth in the food and beverage industries, driven by increasing consumer demand for health-oriented products. As more consumers look for functional foods that provide health benefits, manufacturers are incorporating fermented ingredients into a wide range of offerings, including dairy products, beverages, and snack items.

The rising popularity of probiotic-rich foods and drinks is further fueling demand for fermented products as consumers become more health conscious and aware of the benefits of gut health. Additionally, innovations in product formulations are enabling manufacturers to create unique, appealing flavors while maintaining the nutritional benefits of fermentation. Thus, the expansion of the food and beverage industry, coupled with rising demand for health-oriented products, is driving segmental dominance in the global market.

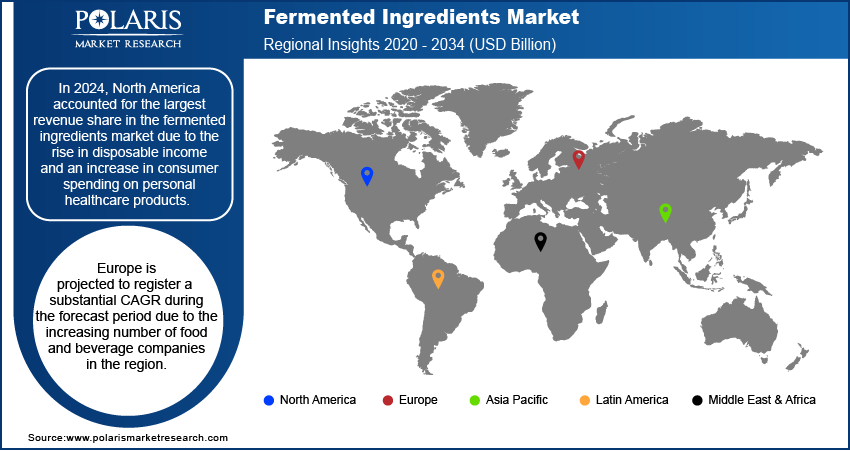

Fermented Ingredients Market Regional Analysis

By region, the study provides the fermented ingredients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the fermented ingredients market due to the rise in disposable income and an increase in consumer spending on personal healthcare products. Health and wellness are being prioritized by individuals, leading to a greater willingness to spend on fermented foods and beverages that offer probiotic benefits and promote overall well-being. This inclination is backed by a growing awareness of the health advantages associated with fermentation, resulting in an increased demand for functional foods.

The Europe fermented ingredients market is projected to register a substantial CAGR from 2025 to 2034. This growth is attributed to the increasing number of food and beverage companies in the region. For instance, according to the European Commission, Europe employs 4.6 million people in the food and beverage processing industry. The market expansion is being further propelled by the rising demand for health-focused products, including probiotics and functional foods. Additionally, the overall demand is enhanced by the interest of the pharmaceutical industry in fermented ingredients for nutritional supplements and therapeutics.

The fermented ingredients market in Germany is poised for significant growth due to the expansion of the pharmaceutical industry. For instance, according to Germany Trade & Invest, 140,000 people are employed in the region’s pharmaceutical sector. Pharmaceutical companies are increasingly seeking natural and effective solutions to enhance their product offerings, thereby driving the demand for fermented ingredients. In addition, the rising awareness of the health benefits associated with fermented ingredients and increasing demand for innovative health products, including probiotics and fermented supplements, is positively impacting the regional market growth.

Fermented Ingredients Market – Key Players and Competitive Insights

The fermented ingredients market is always evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing innovative ingredients and catering to the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and greater emphasis on sustainability. Major players in the fermented ingredients market include Ajinomoto Corporation Inc; Allied Bakeries; Angel Yeast Co., Ltd.; Associated British Food (ABF); Bakels; BASF SE; Cargill Incorporated; CHR. Hansen A/S; CSK Food Enrichment; and Dawn Food Products.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. Also, BASF SE offers a diverse portfolio of fermented ingredient products, including bio-based chemicals, enzymes, and probiotics, used in nutrition, personal care, agriculture, and industrial applications for sustainable solutions.

Ajinomoto Co., Inc. is a Japanese multinational corporation founded in 1909, with its headquarters in Chūō, Tokyo. Ajinomoto operates in 34 countries and employs around 34,615 people. The company’s activities are organized into several segments, which include food products, amino acids, and pharmaceuticals. The food products segment encompasses a wide range of offerings, including seasonings, frozen foods, and processed foods. The amino acids segment specializes in producing amino acids for various applications, including pharmaceuticals and animal nutrition, while the pharmaceuticals segment focuses on the development and manufacturing of medicinal products. The company provides a wide range of fermented ingredient products, including amino acids, nucleotides, probiotics, and bio-based chemicals, used in food, nutrition, pharmaceuticals, and industrial applications for sustainable solutions. Ajinomoto's global reach extends across Asia, Europe, North America, and Latin America. In Asia, the company tailors its offerings to local tastes and preferences, whereas in Europe and North America, it primarily serves processed food manufacturers.

List of Key Companies in Fermented Ingredients Market

- Ajinomoto Corporation Inc

- Allied Bakeries

- Angel Yeast Co., Ltd.

- Associated British Food (ABF)

- Bakels

- BASF SE

- Cargill Incorporated

- CHR. Hansen A/S

- CSK Food Enrichment

- Dawn Food Products

Fermented Ingredients Industry Developments

December 2022: Foodiq launched its new ingredient, Fabea+, unlocking the potential of fermented fava beans for plant-based products. This versatile, nutritious powder received industry acclaim at the FI Europe convention and promises to enhance food alternatives globally, without unwanted flavors or odors.

July 2022: Cellavent launched its new fermented turmeric ingredient, Fermentlife Turmeric, offering improved bioavailability and gut health benefits. Created with three Lactobacillus strains, the certified organic product provides a full spectrum of turmeric's bioactive profile for nutraceuticals and food applications globally.

Fermented Ingredients Market Segmentation

By Product Type Outlook (USD Billion, 2020–2034)

- Amino Acids

- Organic Acids

- Biogas

- Polymer

- Vitamins

- Antibiotics

- Industrial Enzymes

By Form Outlook (USD Billion, 2020–2034)

- Liquid

- Dry

By Process Outlook (USD Billion, 2020–2034)

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation

- Anaerobic Fermentation

By Application Outlook (USD Billion, 2020–2034)

- Food & Beverages

- Pharmaceuticals

- Paper

- Feed

- Personal Care

- Biofuel

- Others

By Regional Outlook (USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fermented Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 55.50 billion |

|

Market Size Value in 2025 |

USD 59.26 billion |

|

Revenue Forecast by 2034 |

USD 107.30 billion |

|

CAGR |

6.8% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The fermented ingredients market size was valued at USD 55.50 billion in 2024 and is projected to grow to USD 107.30 billion by 2034.

• The global market is projected to register a CAGR of 6.8% from 2025 to 2034.

• North America had the largest share of the global market in 2024.

• A few of the key players in the market are Ajinomoto Corporation Inc; Allied Bakeries; Angel Yeast Co., Ltd.; Associated British Food (ABF); Bakels; BASF SE; Cargill Incorporated; CHR. Hansen A/S; CSK Food Enrichment; and Dawn Food Products

• The liquid segment is anticipated to experience substantial growth with a significant CAGR in the global market. This growth is due to increasing consumer demand for liquid fermented products, such as probiotic beverages and functional drinks

• The food and beverage segment is expected to lead the market during the forecast period due to the expansion in the food and beverage industries, driven by increasing consumer demand for health-oriented products