Fermentation Chemicals Market Share, Size, Trends, Industry Analysis Report, By Product (Alcohols, Enzymes, Organic Acids, and Others); By Application; By Region; Segment Forecast, 2023-2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3313

- Base Year: 2023

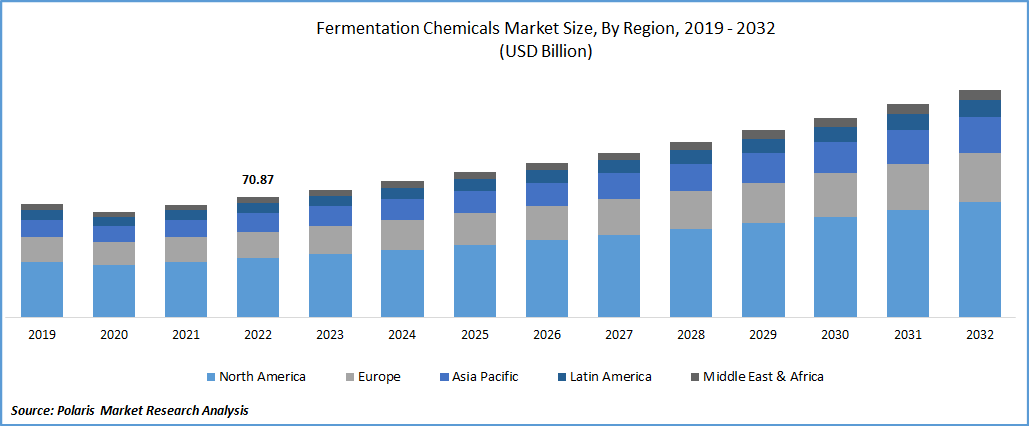

- Historical Data: 2019-2022

Report Outlook

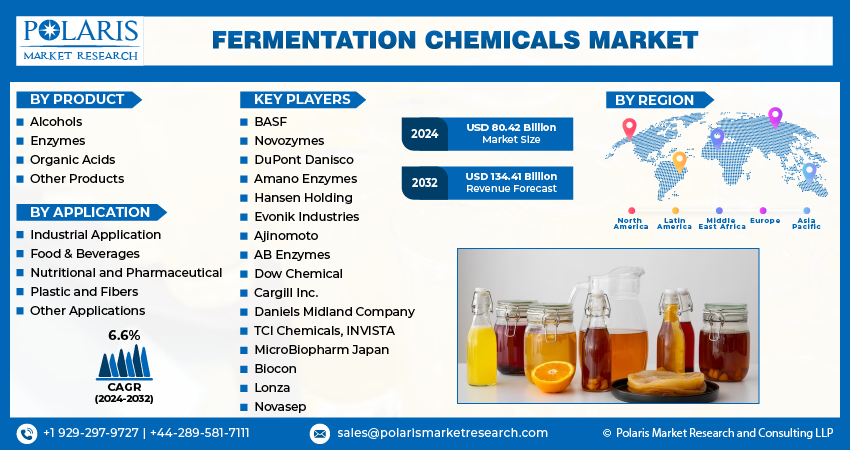

The global fermentation chemicals market was valued at USD 75.49 billion in 2023 and is expected to grow at a CAGR of 6.6% during the forecast period. The extensive rise in the demand for bio-based feedstock across various industrial applications and the growing need and demand for methanol and ethanol to meet the requirements of several end-use applications worldwide are among the major factors driving the growth of the global market. Moreover, the increasing popularity of the product to reduce the overall fermentation time, manufacturing costs, and energy use through speeding up the chemical process and implementation on developing more innovative and advanced products to cater to the rising demand for several industries are further likely to stimulate the market growth in the upcoming years.

To Understand More About this Research: Request a Free Sample Report

For instance, in July 2022, Evonik Industries announced the launch of its latest non-animal-derived collagen named ‘Vecollan,’ a highly pure and soluble collagen produced through fermentation. The fermentation-based production process offers a triple-helix structure that mimics the properties of natural collagen and makes it suitable for use in medical, pharmaceutical, and other life science applications.

Moreover, the rising absence of various types of feedstock, such as corn, sugarcane, and soybean, among others, inadequate required quantities has shifted the focus of several industries towards fermentation chemicals. Apart from this, the increasing emphasis on using bio-based chemicals in place or petrochemicals and surging concerns regarding carbon discharge are pushing the industry players to opt for bio-based chemicals, thereby influencing the demand and penetration of the product across the globe. However, the process for obtaining the products like bioplastics, biofuels, polymers, and polylactic acid is very complex and includes various techniques that result in an overall cost increase of over 10%, hampering the market growth and demand.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the fermentation chemicals market. The emergence of the deadly virus has resulted in various stringent regulations, including lockdowns, trade barriers, and movements, due to which many manufacturing facilities were temporarily closed and high disruptions in the global supply chain to be seen. Moreover, the shortage of raw materials and the required workforce declined product production during the pandemic.

Industry Dynamics

Growth Drivers

The increasing safety concerns regarding plastic dumping and overflowing landfills, which is fueling the PHA market and various government sanctions which makes bioplastics packaging mandatory and several incentives for green packaging companies through tax rebates across both developed and developing economies, are key factors expected to drive the demand and growth of the global fermentation chemicals market over the projected period. Furthermore, with the expansion of the worldwide population and economies of major developing nations like India and China, the consumption of meat products is growing significantly; coupled with the change in individual dietary preferences worldwide, the demand for fermentation chemicals is predicted to increase drastically, as they are being widely adopted in the meat market as important animal feed additives due to its nutritional values.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

For Specific Research Requirements: Request for Customized Report

Alcohol segment accounted for the largest market share in 2022

The alcohol segment accounted for the largest market share in 2022 and is expected to retain its position throughout the anticipated period. The growth of the segment market can be largely attributed to increasing product applications across a wide range of end-user industries, including food & beverages and pharmaceuticals, along with the growing utilization in industrial applications as a solvent. Additionally, there has been a tremendous rise in the consumption of alcohol in pharmaceutical applications for the production of products, including antiseptics, anesthetics, liniments, lotions, and drugs, which are further likely to fuel the demand and growth of the segment market over the next coming years.

The enzymes segment is projected to grow considerably over the forecast period, which is highly attributable to its increased popularity for speeding up reactions without affecting or changing their original chemical makeup. In addition, the growing need and demand for biofuels across the globe are further escalating the adoption of the product, as it is being widely used in the pre-treatment of biomass for the creation of biofuels. Along with this, the penetration of the product as a catalyst is likely to grow significantly in the coming years, as consumers are becoming more and more aware of the value of products with longer shelf life, thereby influencing the segment market growth.

Food & beverages segment is anticipated to witness highest growth during forecast period

The food & beverages segment is anticipated to witness the highest growth throughout the forecast period, which is highly driven by increasing demand for food and drinks across the globe with the extensive rise in the global population coupled with the increasing concerns regarding the health and well-being are encouraging manufacturers of food and beverages to adopt the good fermentation processes in the manufacturing facilities. Moreover, due to their exceptional nutritional benefits, the widespread consumption of a variety of dairy products, including yogurt, kefir, sour cream, and cheese, is also propelling the demand for fermentation chemicals across the globe.

The industrial applications segment held a significant market revenue share because of the continuous rise in investments in biotechnology and a high focus on producing a variety of renewable raw materials. The surging adoption of green chemistry and various regulations for industrial and commercial purposes, along with the preferences for naturally derived goods to chemically generated food additives, mainly in terms of preservatives, antioxidants, colors, flavors, and vitamins, which in turn, has propelled the product penetration across the globe.

North America region dominated the global market in 2022

The North American region dominated the global market in 2022 and is expected to maintain its dominance over the projected period. The regional market growth can be mainly attributed to the growing consumption of chemicals by a large range of industries such as pharmaceuticals, food & beverages, and industrial, among others, along with the robust presence of major manufacturers and suppliers for cosmetics, foods & drinks, and pharmaceutical products, especially in countries like US and Canada.

APAC is projected to grow fastest over the study period, mainly driven by the rising per capita income of the middle-class population and significant expansion in the food and beverage sector, especially in developing countries like India and China. In addition, the increasing government support for new coming startups through several favorable initiatives and schemes and promoting the use of fermentation chemicals to boost the food product's quality and shelf life, which in turn propels the demand and growth of the market in the region.

Competitive Insight

Some of the major players operating in the global fermentation chemicals market include BASF, Novozymes, DuPont Danisco, Amano Enzymes, Hansen Holding, Evonik Industries, Ajinomoto, AB Enzymes, Dow Chemical, Cargill Inc., Daniels Midland Company, TCI Chemicals, INVISTA, MicroBiopharm Japan, Biocon, Lonza, and Novasep.

Recent Developments

- In June 2022, Solvay announced the launch of its two new bio-based surfactants, developed through the fermentation process of rape-seed oil & sugar. These products are suitable for a wide range of applications in cosmetics & personal care products, including conditioners, face washes, creams, & shampoos.

- In July 2022, Novozymes introduced new products, Innova Apex & Innova Turbo, two more advanced yeasts designed to break fermentation bottlenecks. It enables ethanol producers to improve and maximize their fermentation process to more efficiently achieve their targets and business goals.

Fermentation Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 80.42 billion |

|

Revenue forecast in 2032 |

USD 134.41 billion |

|

CAGR |

6.6% from 2024- 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BASF SE, Novozymes, DuPont Danisco, Amano Enzymes USA Co. Ltd., Chr. Hansen Holding A/S, Evonik Industries, Ajinomoto Co. Inc., ADM, AB Enzymes, Dow Chemical Company, Cargill Inc., Daniels Midland Company, TCI Chemicals Pvt. Ltd., INVISTA, MicroBiopharm Japan Co. Ltd., Biocon, Lonza, and Novasep. |

FAQ's

key companies in fermentation chemicals market are BASF, Novozymes, DuPont Danisco, Amano Enzymes, Hansen Holding, Evonik Industries, Ajinomoto, AB Enzymes, Dow Chemical, Cargill Inc.