FEP Heat Shrink Medical Tubing Market Size, Share, Trends, Industry Analysis Report: By Product Type (Standard FEP Heat Shrinking Tube and Peelable Heat Shrinking Tube), Ratio, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5347

- Base Year: 2024

- Historical Data: 2020-2023

FEP Heat Shrink Medical Tubing Market Overview

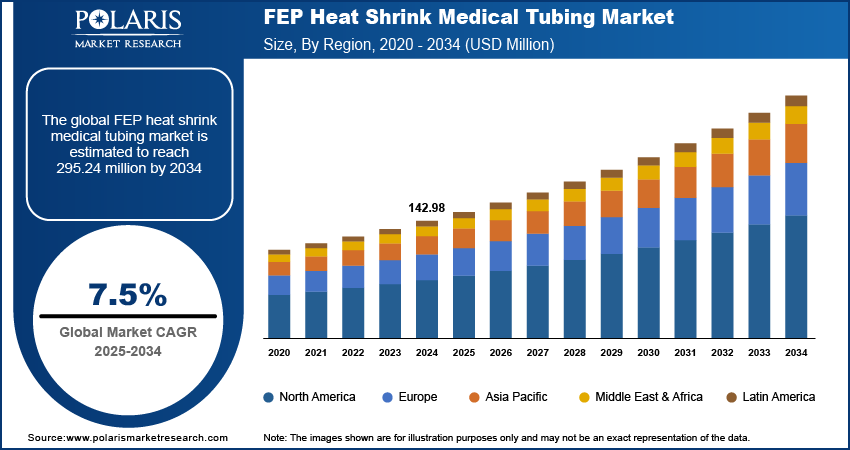

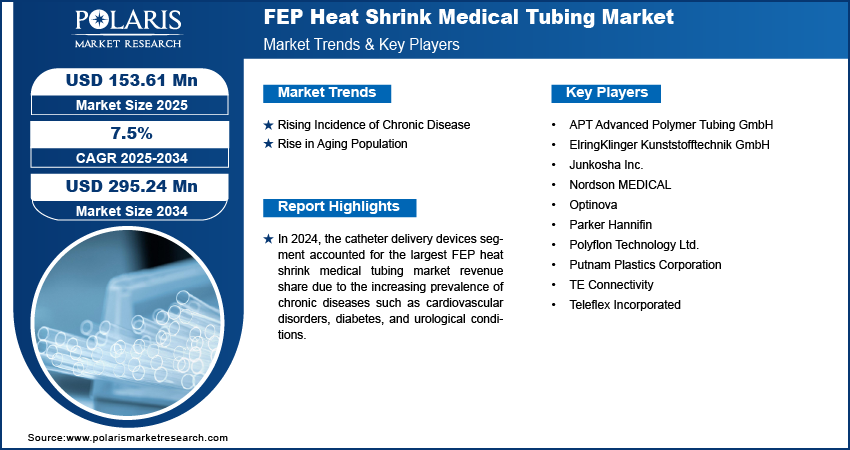

Global FEP heat shrink medical tubing market size was valued at USD 142.98 million in 2024. The market is projected to grow from USD 153.61 million in 2025 to USD 295.24 million by 2034, exhibiting a CAGR of 7.5% during the forecast period.

FEP (Fluorinated Ethylene Propylene) heat shrink medical tubing provides insulation, protection, and a low-friction surface. It shrinks when heat is applied, creating a tight, secure fit around the covered components. The increasing adoption of minimally invasive surgical procedures has led to a surge in demand for medical devices such as catheters and endoscopes, which rely on FEP heat shrink tubing for insulation and protection.

The rise in wearable medical devices, such as continuous glucose monitors and portable diagnostic devices, is driving the need for flexible and durable tubing. This heightened demand for minimally invasive surgical and wearable medical devices is propelling the FEP heat shrink medical tubing market growth.

To Understand More About this Research: Request a Free Sample Report

The growth of medical device manufacturers in emerging markets is fueling the demand for medical tubing, particularly as the Asia-Pacific region invests in strengthening its healthcare systems. Moreover, the increased investment in healthcare infrastructure and the development of medical technology is fueling the need for advanced medical tubing. This surge in demand for medical tubes is expanding the FEP heat shrink medical tubing market demand.

FEP Heat Shrink Medical Tubing Market Dynamics

Rising Incidence of Chronic Disease

The increasing incidence of chronic diseases and the growing number of global healthcare treatments is contributing to the rising demand for FEP heat shrink medical tubing. For instance, according to the World Health Organization (WHO), there were an estimated 20 million cancer cases in 2022. It is expected that the number of new cancer cases will surpass 35 million in 2050, signifying a substantial 77% increase from 2022. This rise in cancer cases is expected to generate a heightened demand for medical tubing especially for FEP heat shrink medical tubing, thereby fueling the market growth.

Rise in Aging Population

The global aging population is driving a significant increase in demand for medical procedures and devices. Older individuals are more prone to chronic conditions and require ongoing care, making long-term care and health monitoring essential sectors for growth. For instance, according to the World Health Organization (WHO), the worldwide elderly population aged 60 and above is projected to reach 1.4 billion by 2030, up from 1 billion in 2020. This demographic will require more medical interventions, leading to increased demand for durable and safe medical tubing. This trend is anticipated to boost growth in the FEP heat shrink medical tubing market.

FEP Heat Shrink Medical Tubing Market Segment Insights

FEP Heat Shrink Medical Tubing Market Assessment by Application Insights

The global FEP heat shrink medical tubing market segmentation, based on application, includes catheter delivery devices, surgical and vascular instruments, fixing flexible joints, and other applications. In 2024, the catheter delivery devices segment accounted for the largest FEP heat shrink medical tubing market revenue share. This is due to the increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and urological conditions, which necessitate frequent medical interventions and long-term management. The increasing demand for minimally invasive procedures has led to a surge in the adoption of catheter-based treatments, which reduce recovery times and lower the risk of complications compared to traditional surgeries.

For instance, percutaneous coronary intervention (PCI), where drug-eluting catheters are used to administer the medication directly to affected arteries, minimizing the risk of restenosis (a narrowing of a blood vessel). These advanced catheters use FEP heat shrink tubing to improve performance by providing a smooth, biocompatible surface for safe and effective drug delivery. This contribution in treating cardiovascular conditions has significantly contributed to their substantial growth in the market segment. Additionally, technological advancements in catheter design and materials, such as the integration of high-performance FEP heat shrink tubing for improved durability, flexibility, and biocompatibility, have played a crucial role in driving market growth.

FEP Heat Shrink Medical Tubing Market Assessment Ratio Insights

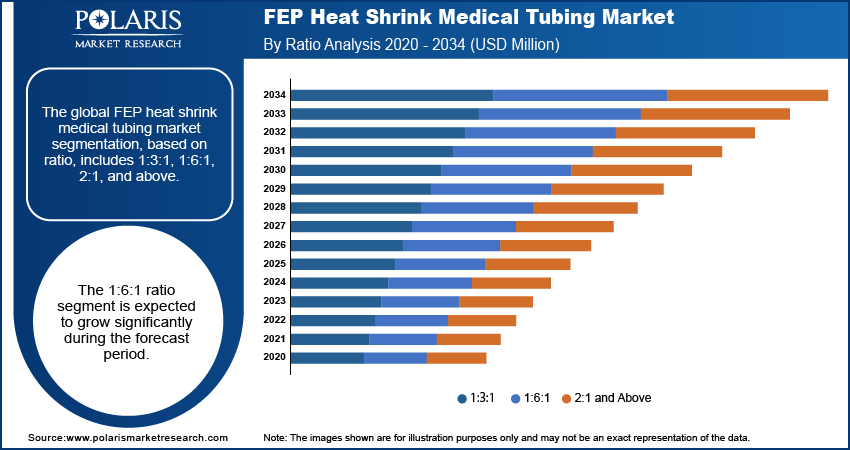

The global FEP heat shrink medical tubing market segmentation, based on ratio, includes 1:3:1, 1:6:1, 2:1, and above. The 1:6:1 ratio segment is expected to grow significantly during the forecast period. The tubing's unique 1:6:1 shrink ratio enables it to shrink to one-sixth of its original diameter, making it an ideal choice for medical applications requiring precision and reliability. This attribute allows the tubing to provide a secure fit around complex and irregularly shaped components, which is crucial in high-precision medical devices such as catheters, guidewires, and endoscopes. The increasing demand for advanced medical procedures is fueling the growth of market revenue, as it offers highly reliable and adaptable solutions. Furthermore, its ability to maintain its properties under high-temperature sterilization processes and provide excellent chemical resistance makes it ideal for a wide range of critical medical applications, contributing to its market growth.

FEP Heat Shrink Medical Tubing Market Regional Insights

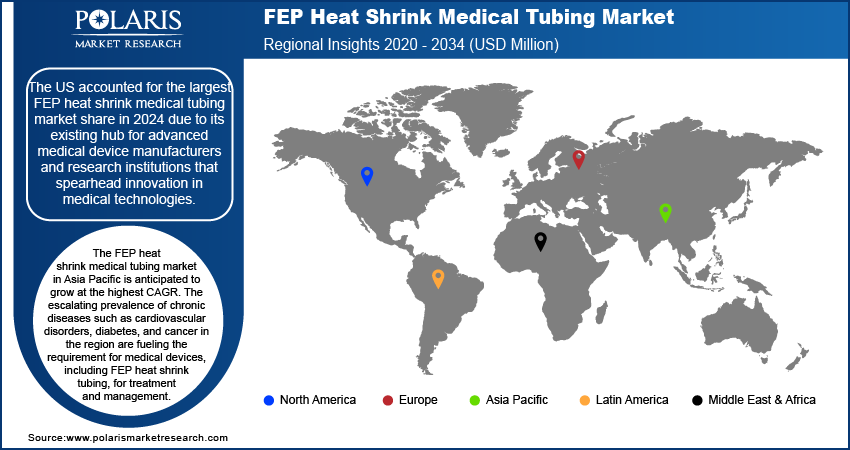

By region, the study provides FEP heat shrink medical tubing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The FEP heat shrink medical tubing market in North America accounted for the largest share. The growing focus on integrating advanced medical technologies and transcatheter techniques in the region has led to a surge in demand for high-performance medical tubing. Additionally, stringent regulatory standards ensure the use of high-quality, biocompatible materials such as FEP, which further drives market growth.

For instance, Zeus, a prominent US medical device company, developed an advanced catheter system for cardiac ablation procedures featuring FEP heat shrink tubing that offers superior insulation and durability. Zeus' range of products, including their ultra-thin PTFE Sub-Lite-Wall liners and FluoroPEELZ peelable fusing sleeves, is enabling design engineers to push the boundaries of device innovation, whether for lead delivery systems, catheter ablation, or cryotherapy catheters. Zeus extrusions are empowering lifesaving innovations to address arrhythmias, dysrhythmias, and hypertension. This innovation enhances procedure performance and safety within the industry. The widespread adoption of such advanced medical devices in North America is expanding the FEP heat shrink medical tubing market.

The US accounted for the largest FEP heat shrink medical tubing market share in 2024 due to its existing hub for advanced medical device manufacturers and research institutions that spearhead innovation in medical technologies.

The FEP heat shrink medical tubing market in Asia Pacific is anticipated to grow at the highest CAGR. The escalating prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer in the region are fueling the requirement for medical devices, including FEP heat shrink tubing, for treatment and management. For instance, in 2022, Cancer Australia Statistics reported 162,163 new cancer cases in Australia, with 88,982 cases in males and 73,181 in females. The increasing number of cancer patients is propelling demand for healthcare treatment and medical devices such as catheters, consequently stimulating the market for FEP heat shrink tubing. Furthermore, the expanding medical device industry in Asia Pacific, fostered by both domestic production and the importation of advanced technologies, is contributing to the growing adoption of FEP heat shrink tubing in various medical applications.

The FEP heat shrink medical tubing market in China is anticipated to grow significantly due to the development and widespread adoption of advanced cardiovascular catheters by leading Chinese medical device manufacturers. These catheters, which utilize FEP heat shrink tubing for their excellent chemical resistance, flexibility, and biocompatibility, are used to treat various health conditions such as coronary artery disease. Thus, the increasing incidence of cardiovascular diseases in China highlights the substantial FEP heat shrink medical tubing market opportunities in the country.

FEP Heat Shrink Medical Tubing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the FEP heat shrink medical tubing market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the FEP heat shrink medical tubing industry must offer cost-effective solutions.

Established industry players and innovative startups dominate the market, competing to capitalize on the growing demand for eco-friendly production methods. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the FEP heat shrink medical tubing market, including APT Advanced Polymer Tubing GmbH, ElringKlinger Kunststofftechnik GmbH, Junkosha Inc., Nordson MEDICAL, Optinov, Parker Hannifin, Polyflon Technology Ltd., Putnam Plastics Corporation, TE Connectivity.

Zeus specializes in advanced polymer solutions, including tubing, catheter componentry, and heat shrink technology. They also offer a wide range of bioabsorbable and implantable medical products, such as sutures. Their expertise expands across various industries, including medical, aerospace, energy, automotive, and fiber optics. Their product portfolio includes biomaterials, reinforced optical fiber, extruded tubing, heat shrinkable tubing, insulated wire, monofilament and drawn fiber, polyimide family, and more. In June 2022, Zeus, a leading developer of advanced polymer solutions, invested in expanding its global manufacturing capacity for catheters.

Junkosha specializes in the production of melt-processable fluoropolymer moldings. The company offers a diverse range of products, including, cables, tubing, wires, connectors, and injection moldings. Moreover, Junkosha also provides comprehensive solutions in the form of assemblies or components. These offerings cater to a wide array of industrial sectors worldwide, encompassing flat panel display, space, transport, medical, information and communications, as well as semiconductor manufacturing processes. In March 2024, Junkosha launched a new Peelable Heat Shrink Tubing solution at MD&M West.

List of Key Companies in FEP Heat Shrink Medical Tubing Industry

- APT Advanced Polymer Tubing GmbH

- ElringKlinger Kunststofftechnik GmbH

- Junkosha Inc.

- Nordson MEDICAL

- Optinova

- Parker Hannifin

- Polyflon Technology Ltd.

- Putnam Plastics Corporation

- TE Connectivity

- Teleflex Incorporated

FEP Heat Shrink Medical Tubing Market Developments

April 2024: Putnam Plastics Corporation, a leader in advanced extrusions for minimally invasive medical devices, launched FEP heat shrink tubing to its extensive portfolio. This offers innovation and customer-centric solutions in the medical device industry.

October 2023: Junkosha launched a larger diameter of peelable heat shrink tubing catheters. The catheter delivery systems for structural heart, abdominal aortic aneurysm (AAA) repair, and transcatheter aortic valve replacement (TAVR) require increasingly complex shapes and constructs for minimally invasive surgeries.

May 2020: Optinovalaunched three new medical quality FEP heat shrink tubing resolutions: FEP QuickShrink 2.0 and FEP Heat Shrink, with shrink ratios of 1.6:1 and 1.3:1.

FEP Heat Shrink Medical Tubing Market Segmentation

By Product Type Outlook

- Standard FEP Heat Shrinking Tube

- Peelable Heat Shrinking Tube

By Ratio Outlook

- 1:3:1

- 1:6:1

- 2:1 and Above

By Application Outlook

- Catheter Delivery Devices

- Surgical and Vascular Instruments

- Fixing Flexible Joints

- Other Application

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

FEP Heat Shrink Medical Tubing Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 142.98 million |

|

Market Size Value in 2025 |

USD 153.61 million |

|

Revenue Forecast in 2034 |

USD 295.24 million |

|

CAGR |

7.5% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global FEP heat shrink medical tubing market size was valued at USD 142.98 million in 2024 and is projected to grow to USD 295.24 million by 2034.

The global market is projected to grow at a CAGR of 7.5% during the forecast period 2024-2032.

North America had the largest share of the global market.

The key players in the market are APT Advanced Polymer Tubing GmbH, ElringKlinger Kunststofftechnik GmbH, Junkosha Inc., Nordson MEDICAL, Optinov, Parker Hannifin, Polyflon Technology Ltd., Putnam Plastics Corporation, TE Connectivity.

The catheter delivery devices segment held the highest share in the FEP heat shrink medical tubing market in 2024.

The 1:6:1 ratio category had the highest CAGR in the global market.