Feed Phosphates Market Share, Size, Trends, Industry Analysis Report, By Type (Dicalcium, Monocalcium, Mono-dicalcium, Defluorinated, Tricalcium); By Livestock; By Form; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3978

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

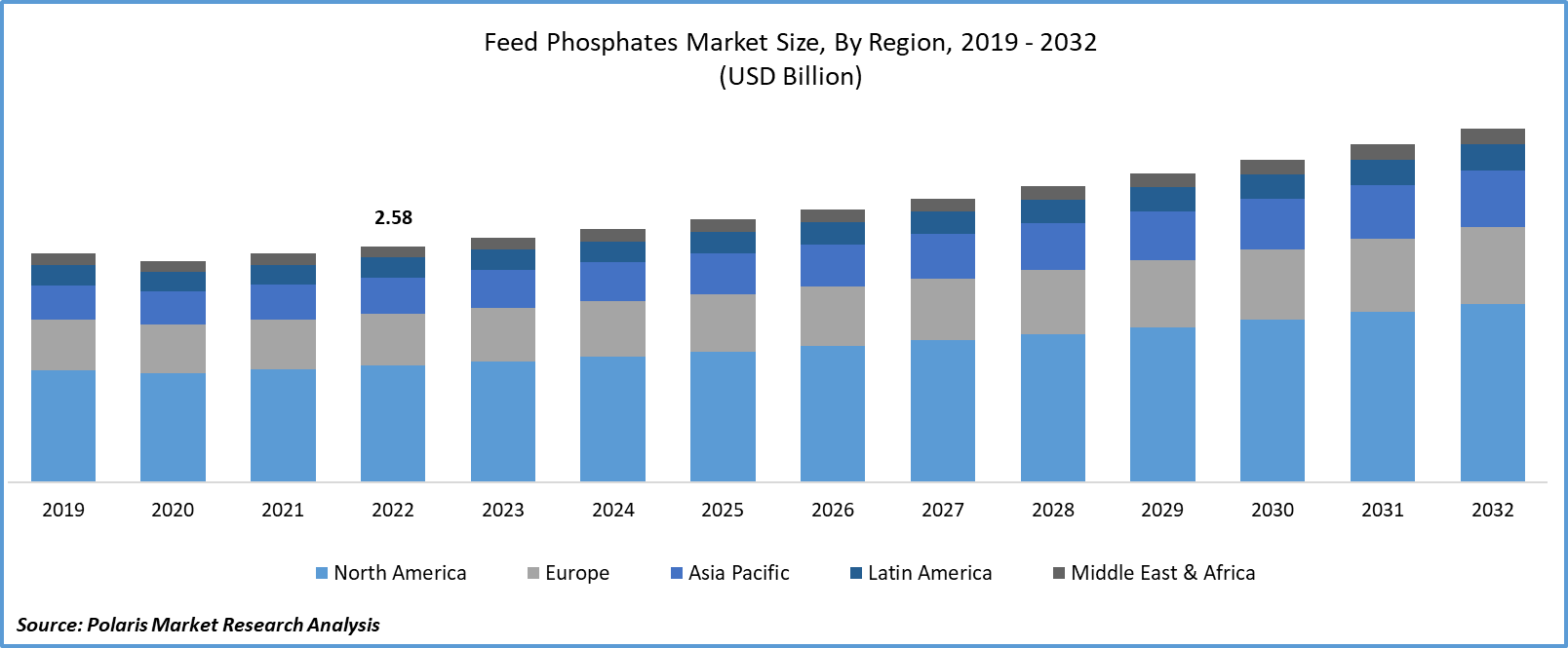

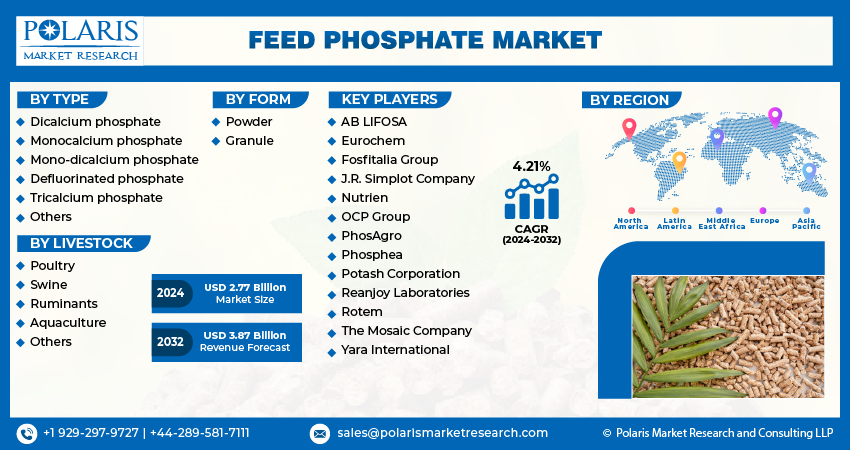

The global feed phosphates market was valued at USD 2.67 billion in 2023 and is expected to grow at a CAGR of 4.21% during the forecast period.

These phosphates are a crucial component of an animal's diet because they promote healthy bone development, boost optimal growth, and enhance gut health. Animal productivity depends heavily on nutrition. A balanced diet for animals is advantageous from economic and welfare perspectives but also an expensive ingredient in animal feed as mineral supplements. One of the important minerals for skeletal development, energy metabolism, and cell signaling is phosphorus, which is also a component of nucleotides. The growing innovations by companies and researchers in the nutritional sector are revealing new growth opportunities for the feed phosphate market.

Feed phosphate is defined as inorganic salts that are derived primarily from phosphoric acid. It’s an integral component of animal nutrition and plays a crucial role in enhancing the health and performance of livestock. Feed phosphates have high phosphorous content, which is a fundamental mineral vital for ensuring the optimal physiological functioning of various animals. Along with fulfilling their basic nutrition requirement, feed phosphates can contribute to the bone development and energy metabolism of animals. Livestock, including swine, cattle, and poultry, often need additional phosphorous supplementation owing to the insufficient levels of phosphate in natural feed sources.

Phosphates occur widely in nature as phosphate rocks or fluropatites. However, they can’t be consumed by livestock directly and must be converted to make them digestible by animals. Feed phosphates offered by the feed phosphates market key players come in a variety of forms. They include dicalcium phosphate, monocalcium phosphate, mono-dicalcium phosphate, Defluorinated phosphate, and tricalcium phosphate. With the rising demand for livestock, the need for feed phosphates is anticipated to rise over the forecast period.

To Understand More About this Research: Request a Free Sample Report

For instance, in June 2022, a study published in Research Gate focused on finding the potential benefits and importance of phosphorus in farm animals. It revealed that overfeeding phosphorus will lead to nutritional disorders relevant to calcium metabolism.

Moreover, the food industry with the fastest rate of growth in the world is aquaculture. Over 50% of the aquaculture-produced foods used in human consumption play a crucial role in the world's food production. Feed phosphates are highly used in aqua-feed to provide nutritional content along with overall growth.

However, the need for more awareness about the required amount of phosphorus for livestock is leading to over- and under-feeding of feed additives, which is affecting the well-being of animals. This is restraining the adoption of phosphorus among livestock producers with the lower availability of livestock feed expertise.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the feed phosphates market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Growth Drivers

The Growing Demand for Livestock, Including Dairy and Poultry, is Creating a Need for Feed Phosphates

Commercial animal production has increased because of the rising global demand for protein, facilitating a need for inorganic phosphate supplements, which offer vital minerals for the development of strong teeth and bones in poultry, swine, cattle, and pets and play a significant part in the animal feed business. Typically, only 30% of the phosphorus required by livestock and poultry is present in vegetable feeds. Even so, only half of this sum is really absorbed; it is an essential component of life. The widespread incorporation of meat products into food intake is driving the demand for livestock production and, in turn, the need for feed phosphates in the study period.

Report Segmentation

The market is primarily segmented based on type, livestock, form, and region.

|

By Type |

By Livestock |

By Form |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Dicalcium Phosphate Segment is Expected to Witness the Highest Growth During the Forecast Period

The dicalcium phosphate segment is projected to grow at a CAGR during the projected period, highly influenced by its chemical properties in assisting livestock welfare. Dicalcium phosphate in poultry feed at the proper ratios can enhance eggshell quality, leading to more marketable eggs and fewer breakings, driving use of this chemical in poultry feed formulations. Furthermore, it is helpful for maintaining bone health in ruminants like cattle and sheep. Its potential benefits as a feed supplement for livestock, poultry breeding animals, and aquaculture animals to facilitate feed digestion and increase the weight of the chicken in order to boost meat, milk, and egg production are further boosting the demand for dicalcium phosphates in the coming years.

The monocalcium phosphate segment led the industry feed phosphates market with a substantial revenue share in 2022, largely imputable to the prevalence of its use in the animal feed industry. Monocalcium phosphate is a dietary supplement used to augment the diets of livestock and poultry. It replenishes the calcium and phosphorus deficiency during normal metabolism, which helps the neurological, immunological, and reproductive systems operate better and boosts productivity. As a result of MCP's high solubility, diet formulation options are expanded. Additionally, since farm animals can digest it more readily, less of the feed additive is wasted, which also means that runoff has a lower environmental impact. These factors are contributing to the rising demand for monocalcium phosphate as an animal feed.

By Livestock Analysis

Poultry Segment Accounted for the Largest Market Share in 2022

The poultry segment accounted for the largest market. Phosphorus, a vital mineral in poultry diets, is a part of organic compounds involved in carbohydrate, amino acid, & fat metabolism, as well as the metabolism of the neural tissue, blood chemistry, & lipid transport. Furthermore, the laying birds need phosphorus for egg production, skeleton upkeep, and soft tissue growth. The National Research Council recommended 0.32 grams of accessible phosphorus per kilogram of food for laying hens in 1984. The growing importance of phosphate in poultry diets will propel the global market in the future.

The swine segment is expected to grow at the fastest rate over the next few years on account of rising swine production. Feed phosphates are typically used in diets for pigs and poultry in addition to the phosphorus provided by ingredients of both plant and animal origin because of the low concentration and low digestibility of phosphorus in plant ingredients. The rising demand for pork worldwide is fueling the production of swine, necessitating the need for effective feed additives like feed phosphates in the coming years.

By Form Analysis

Powder Form Held the Significant Market Revenue Share in 2022

The powder segment held a significant market share in revenue in 2022, which is largely attributable to its ease of application in feeding livestock. It enables the uniform distribution of feed phosphates to various livestock producers, including poultry, swine, ruminants, and aquaculture. Companies are adopting the powder form of feed phosphorus due to its cost-effectiveness in storage and precise dosage control compared to the granule form. This is driving the demand for powder-form feed phosphorus in the study period.

Regional Insights

Europe Region Registered the Largest Global Market Share in 2022

The European region witnessed the global market with the largest market, owing to the increasing use of food additives on livestock in the region. With an average farm size of 95 ha, the United Kingdom, Denmark, and France have the largest farms overall in the livestock industry. The ongoing consumer interest in meat and dairy products is expanding the production of feedstock in the region, in turn contributing to the demand for feed phosphates in the coming years.

The Asia Pacific region will grow at a rapid pace. The growing population in this region is creating a need for meat products, which, in a way, drives the production of livestock and the need for feed phosphates in the next few years. According to the Food and Agriculture Organization 2023 report, 38% of the world's production of chicken meat was produced in Asia in 2020. This is anticipated to grow in the coming years, driven by ongoing investments in the poultry segment. The ongoing need for meat production due to the growing population will further boost the demand for feed phosphates soon.

Key Market Players & Competitive Insights

The feed phosphate market is witnessing a rapid increase in product upgrades, launches, partnerships, collaborations, mergers, and acquisitions, widening the key market players presence in the market and fueling the availability of products to a wider population. Companies are building strategies to conquer a larger market share in the global market.

Some of the major players operating in the global market include:

- AB LIFOSA

- Eurochem

- Fosfitalia Group

- J.R. Simplot Company

- Nutrien

- OCP Group

- PhosAgro

- Phosphea

- Potash Corporation

- Reanjoy Laboratories

- Rotem

- The Mosaic Company

- Yara International

Recent Developments

- In May 2023, OCP Group completed the acquisition of Fertinagro Biotech to strengthen its commitment to building a strong position in animal nutrition.

Feed Phosphates Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.77 billion |

|

Revenue forecast in 2032 |

USD 3.87 billion |

|

CAGR |

4.21% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Livestock, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Browse for Our Top Selling Reports

Legal Services Market Size & Share

Paper Straw Market Size & Share

SMS Firewall Market Size & Share

Virtual Sports Market Size & Share

Consumer Genomics Market Size & Share

Explore the 2024 market share, size, and revenue growth rate statistics in the field of feed phosphates, meticulously compiled by Polaris Market Research Industry Reports. This comprehensive analysis encompasses a market forecast outlook extending to 2032, along with an insightful historical overview. Experience the depth of this industry analysis by obtaining a feed phosphates complimentary PDF download of the sample report.