Fatty Acids Market Size, Share, Trends, Industry Analysis Report: By Type (Unsaturated and Saturated), Form, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 115

- Format: PDF

- Report ID: PM1511

- Base Year: 2024

- Historical Data: 2020-2023

Fatty Acids Market Overview

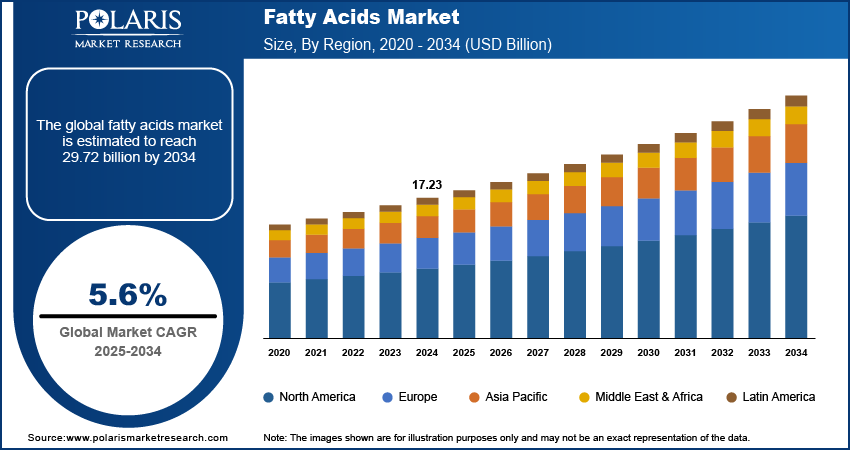

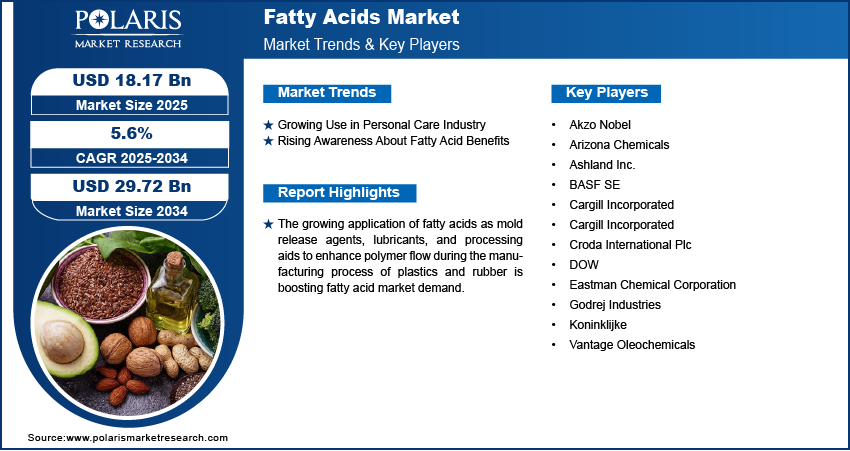

The global fatty acids market size was valued at USD 17.23 billion in 2024. The market is projected to grow from USD 18.17 billion in 2025 to USD 29.72 billion by 2034, at a CAGR of 5.6% from 2025 to 2034.

Fatty acids are chemical molecules found in fats and oils that serve as the foundation for lipid formation. These acids are composed of carbon, hydrogen, and oxygen atoms that form a hydrocarbon chain and a carboxyl head group. Fatty acids are classified based on the number of carbon atoms and double bonds they contain.

The booming plastics and rubber industries, particularly in emerging countries, are driving the growth of the market for fatty acids. These industries widely use fatty acids as mold release agents, lubricants, and processing aids to improve the flow of polymers during production processes. In addition, the rising use of fatty acids in nutraceuticals and pharmaceutical products and industrial and household cleaning are contributing to the market expansion. Fatty acids are also used in various industrial applications like lubricants, resins, and additives for paints and coatings, and plastics, hence boosting fatty acids market dynamics.

The introduction of favorable regulatory policies, improvements in supply chain management, and growing demand for functional foods and dietary supplements are a few of the key market trends anticipated to drive market development in the coming years. The shifting consumer patterns towards the use of fatty acids are expected to create several fatty acids market opportunities during the forecast period. Developing nations with growing populations and increasing disposable incomes represent significant growth opportunities.

To Understand More About this Research: Request a Free Sample Report

Fatty Acids Market Dynamics

Growing Use in Personal Care Industry

The consumption of cosmetics and personal care products has increased significantly in recent years, driven by shifting consumer lifestyles, rapid urbanization, and rising disposable incomes. Fatty acids are widely used in several products in the personal care industry. Fatty acids such as stearic acids, lauric acids, and oleic acids are suitable for use in cosmetics and toiletries. Coconut oils, with their high lauric acid content, make excellent foaming agents for shampoos and shaving creams. Linoleic acid is also known for its use in skin creams and cleansing creams. Thus, the rising use of fatty acids in personal care products is boosting the fatty acids market revenue.

Rising Awareness About Fatty Acid Benefits

Public awareness and research are increasingly highlighting the crucial role of fatty acids, especially omega-3 and omega-6, in various health benefits and disease prevention. This is leading to a growing emphasis on their importance in nutrition and overall well-being. Hence, consumers are increasingly seeking foods and supplements rich in unsaturated fatty acids, recognizing their potential for improving heart health, reducing inflammation, supporting brain function, and enhancing overall well-being. This awareness of fatty acid benefits is driven by growing scientific evidence linking them to improved cardiovascular, brain, and overall health, coupled with increased emphasis on healthy eating and wellness.

Fatty Acids Market Segment Insights

Fatty Acids Market Assessment by Type Insights

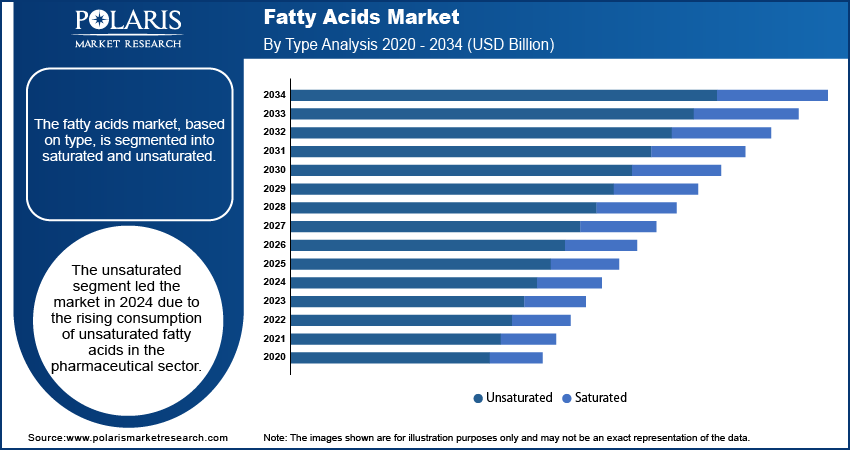

The fatty acids market, based on type, is segmented into saturated and unsaturated. The unsaturated segment led the market with a 79.1% revenue share in 2024, driven by its high consumption in the pharmaceutical sector. Unsaturated fatty acids are primarily extracted from nuts, avocados, canola, olive oil, and soybeans. These acids can reduce inflammation, stabilize cardiac rhythms, and improve blood cholesterol levels. They also assist with the production of chemokines, which improve the immune system by attracting immune cells to the infected area. These various benefits of unsaturated fatty acids have contributed to the segment’s dominant position in the global market.

The saturated segment is gaining traction in some end-use applications, including crayons, rubbers, metals, and waxes. Saturated fatty acids are primarily derived from plant oils and animal fats. They are also naturally present in animal species. In addition to aiding in weight loss, they lower both high-density lipoprotein (HDL) cholesterol and low-density lipoprotein (LDL) cholesterol. The rising use of saturated fatty acids in the food & beverage industry is expected to drive the segment’s growth in the coming years.

Fatty Acids Market Evaluation by Form Insights

Based on form, the fatty acids market is segmented as capsule, powder, and oil. The oil segment dominated the market with a 57.3% revenue share in 2024 due to its growing use in the food & beverage and pharmaceutical industries. Fatty acids are extracted from animals in the form of oil and then are primarily used in various industries such as food & beverage, pharmaceutical, and cleaning products. The powdered version of the fatty acids is primarily utilized in home cleaning, pharmaceuticals, food and beverage, as well as industrial applications. In the food and beverage industry, it is utilized in powdered form in sports drinks, energy bars, and various baked goods, among others. The product is commonly utilized as capsules, primarily in the pharmaceutical, nutraceutical, and personal care sectors.

Fatty Acids Market Regional Analysis

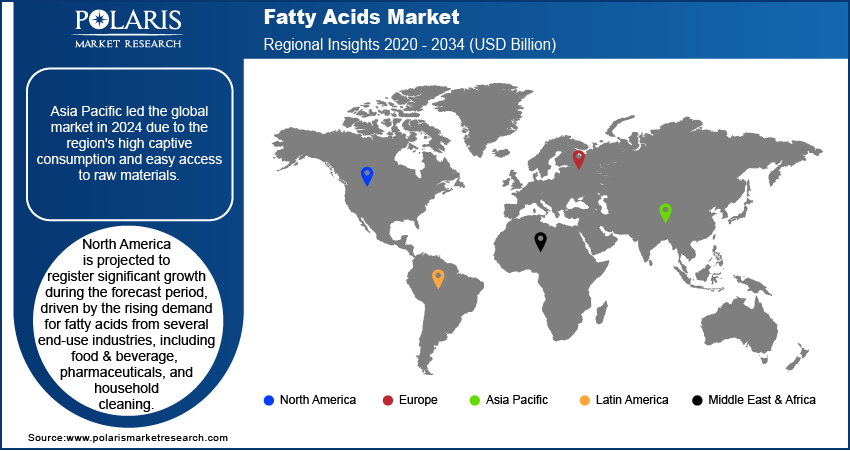

By region, the report offers the fatty acids market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific dominated the global market with a 44.7% revenue share in 2024. Asia Pacific has witnessed an increase in fatty acid production activities due to the region's high captive consumption and easy access to raw materials. The growing food & beverage and healthcare industries in Asia Pacific also contribute to the high demand for fatty acids. In addition, the rising significance of hygiene and immunity-boosting products in emerging nations drives regional market dominance.

The North America fatty acids market is anticipated to witness significant growth during the forecast period. This is primarily attributed to the rising demand for fatty acids from various end-use industries, such as food & beverage, pharmaceuticals, and household cleaning. In addition, the presence of leading market participants and the availability of raw materials is expected to drive market growth in the region.

Fatty Acids Market – Key Players and Competitive Insights

The leading market players are introducing new, innovative solutions to cater to evolving consumer needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their market presence. To expand and survive in a highly competitive market, market participants must offer cost-effective solutions.

In recent years, the market for fatty acids has witnessed several innovation breakthroughs, with the top market participants providing fatty acids that help meet sustainability goals. The fatty acids market report offers a market assessment of all the leading players, including BASF SE, Ashland Inc., Eastman Chemical Corporation, Godrej Industries, Vantage Oleochemicals, Arizona Chemicals, Akzo Nobel, Cargill Incorporated, DOW, Croda International Plc, and Koninklijke.

List of Fatty Acids Market Key Players

- Akzo Nobel

- Arizona Chemicals

- Ashland Inc.

- BASF SE

- Cargill Incorporated

- Croda International Plc

- DOW

- Eastman Chemical Corporation

- Godrej Industries

- Koninklijke

- Vantage Oleochemicals

Fatty Acids Industry Developments

In May 2024, Mega Foods introduced Omega 3-6-9, a plant-based supplement containing 600 mg of Omega and a unique blend of essential fatty acids. The company stated that the product aims to improve and support joint, heart, brain, and vision health.

In June 2024, the Indian Institute of Science (IISC) developed a biocatalyst for converting fatty acids to biofuels. The researchers have created an enzymatic system capable of effectively converting naturally rich and low-cost fatty acids into valuable hydrocarbons known as 1-alkenes, which are potential biofuels.

Fatty Acids Market Segmentation

By Type Outlook

- Unsaturated

- Saturated

By Form Outlook

- Capsule

- Powder

- Oil

By End-Use Industry Outlook

- Food & Beverage

- Household & Industrial Cleaning

- Industrial

- Personal Care & Cosmetics

- Pharmaceutical & Nutraceutical

By Region Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fatty Acids Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.23 billion |

|

Market Size Value in 2025 |

USD 18.17 billion |

|

Revenue Forecast by 2034 |

USD 29.72 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Form By End-Use Industry |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The fatty acids market was valued at USD 17.23 billion in 2024 and is projected to grow to USD 29.72 billion by 2034.

The market is projected to register a CAGR of 5.6% from 2025 to 2034.

Asia Pacific accounted for the largest share of the global market in 2024.

BASF SE, Ashland Inc., Eastman Chemical Corporation, Godrej Industries, Vantage Oleochemicals, Arizona Chemicals, Akzo Nobel, Cargill Incorporated, DOW, Croda International Plc, and Koninklijke are a few of the key players in the market.

The unsaturated segment dominated the market in 2024.

The oil segment held the largest market share in 2024.