Fatty Acid Esters Market Size, Share, Trends, Industry Analysis Report: By Product [Medium Chain Triglycerides (MCT), Sucrose Esters, Glycol Esters, Polyol Esters, Glyceryl Monostearate, Isopropyl Esters, and Others], Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 115

- Format: PDF

- Report ID: PM1480

- Base Year: 2024

- Historical Data: 2020-2023

Fatty Acid Esters Market Overview

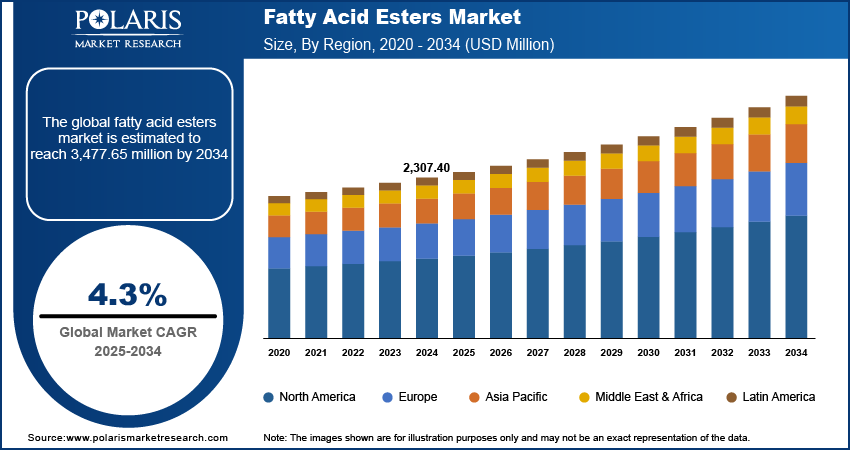

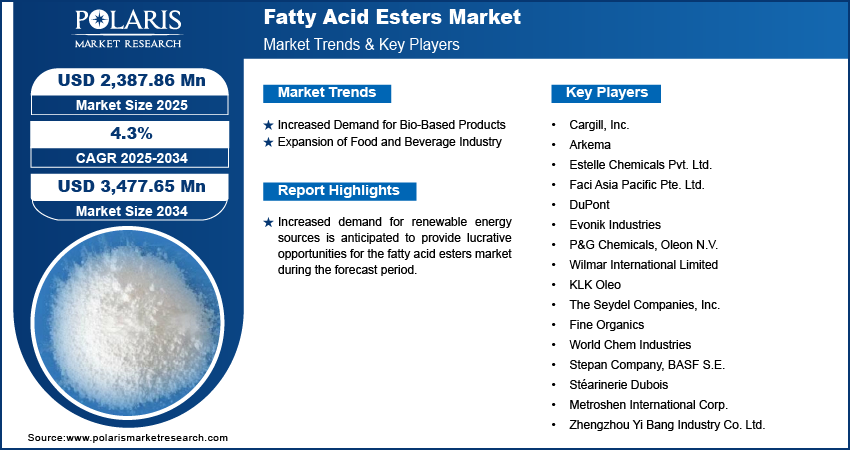

The global fatty acid esters market size was valued at USD 2,307.40 million in 2024. The market is projected to grow from USD 2,387.86 million in 2025 to USD 3,477.65 million by 2034. It is projected to exhibit a CAGR of 4.3% from 2025 to 2034.

Fatty acid esters are an ester type synthesized by dehydrating fatty acids with alcohol. As industrial active ingredients, these esters find a wide range of applications across several sectors, including cosmetics, food, and pharmaceuticals.

The increasing demand for bio-based products, growing awareness about the health benefits associated with fatty acid esters, and rising applications in pharmaceuticals are among the key factors driving the fatty acid esters market growth. Advancements in manufacturing processes, which have enabled the development of high-quality fatty acid esters, further contribute to their increased adoption.

To Understand More About this Research: Request a Free Sample Report

Fatty acid esters, especially methyl esters, which have properties closer to those of conventional diesel fuels than pure vegetable oils, are increasingly being used as substitutes for several chemicals in the food and cosmetics industries. This shift from chemicals to fatty acid esters is anticipated to drive the fatty acid esters market development in the coming years. Increased demand for renewable energy sources is projected to provide lucrative fatty acid esters market opportunities during the forecast period.

Fatty Acid Esters Market Dynamics

Increased Demand for Bio-Based Products

The rising awareness about the environmental impact of conventional petroleum-based products is fueling the need for bio-based alternatives. Fatty acid esters are obtained from natural, renewable feedstock such as vegetable oil and animal fats, which makes them a sustainable alternative for various applications. The growing emphasis on the utilization of bio-based products across sectors such as pharmaceuticals and personal care continues to boost the fatty acid esters market expansion.

Expansion of Food and Beverage Industry

Fatty acid esters are widely used in the food & beverage industry. The esters are used to provide a smooth texture to ice creams and whipped cream. Also, they find applications as stabilizers, emulsifiers, thickeners, and conditioners. The increased demand for processed foods and beverages is anticipated to drive the demand for fatty acid esters. In addition, the rising popularity of plant-based meat alternatives, which typically use fatty acid esters as texture modifiers and binders, is projected to further contribute to the fatty acid esters market development.

Fatty Acid Esters Market Segment Insights

Fatty Acid Esters Market Outlook by Product Insights

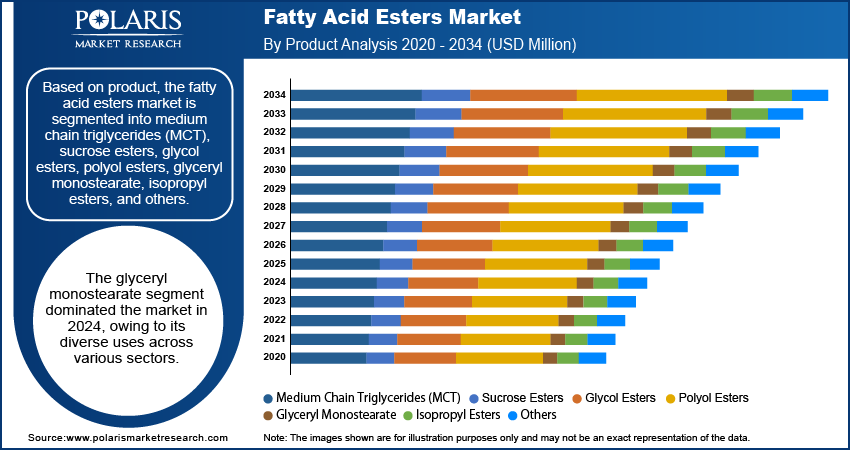

The fatty acid esters market, based on product, is segmented into medium chain triglycerides (MCT), sucrose esters, glycol esters, polyol esters, glyceryl monostearate, isopropyl esters, and others. The glyceryl monostearate segment dominated the market with over 40% revenue share in 2024. Glyceryl monostearate is primarily used in baked goods to improve texture, increase shelf life, and prevent staling. It is also used in the pharmaceuticals sector to stabilize water-in-oil emulsions and control the release of substances in pharmaceuticals. Further, glyceryl monostearate has various other industrial applications in the form of lubricant, preservative, and thickening agent. The diverse uses of glyceryl monostearate contribute to its dominance in the market.

Fatty Acid Esters Market Assessment by Application Insights

The fatty acid esters market, based on application, is segmented into personal care & cosmetics, lubricants, pharmaceuticals, food processing, surfactants & detergents, and others. The personal care & cosmetics segment led the market with over 39% market share in 2024. Growing social media influence has resulted in increased demand for personal care and cosmetic products. This, in turn, has fueled the need for fatty acid esters as they are the primary components in various cosmetic formulations.

Fatty Acid Esters Market Regional Analysis

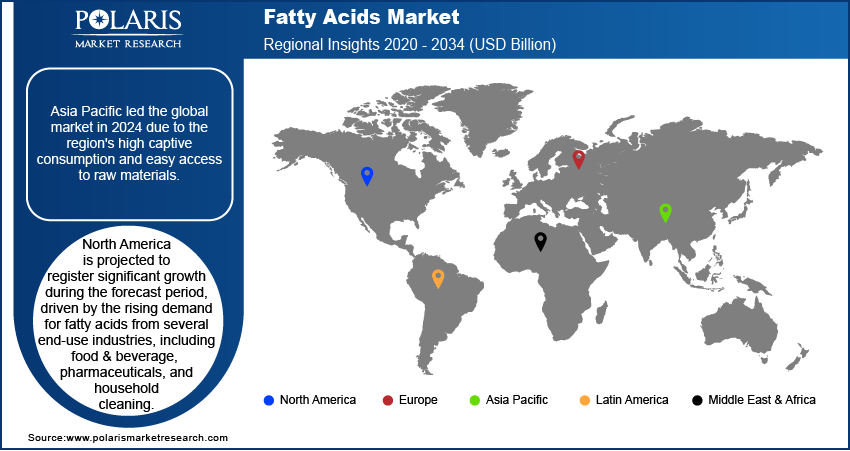

By region, the market report offers fatty acid esters market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market with over 38.5% share of the global revenue in 2024. High standards of living, changing consumer preferences, and a growing focus on beauty and appearance owing to social media influence are a few key factors propelling the fatty acid esters market expansion in the region.

The Asia Pacific fatty acid esters market is projected to witness the fastest growth from 2025 to 2034. The rising focus on preventive healthcare and increasing penetration of regional market participants into the organic food product segment are among the key factors driving the market growth in Asia Pacific. In addition, the growing purchasing power of individuals and increasing emphasis on the introduction of new products among market players contribute to the regional market expansion.

Fatty Acid Esters Market – Key Players and Competitive Insights

The key players in the fatty acid esters market are focusing on research and development to enhance their products and services offerings and drive market demand. Furthermore, they are adopting various strategic initiatives, including collaborations, mergers and acquisitions, new product launches, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the fatty acid esters market has witnessed several innovations, with key players seeking to provide advanced solutions that help meet sustainability goals. The fatty acid esters market research report offers a market assessment of all the key players, including Cargill, Inc.; Arkema; Estelle Chemicals Pvt. Ltd.; Faci Asia Pacific Pte. Ltd.; DuPont; Evonik Industries; P&G Chemicals; Oleon N.V.; Wilmar International Limited; KLK Oleo; The Seydel Companies, Inc.; Fine Organics; World Chem Industries; Stepan Company; BASF S.E.; Stéarinerie Dubois; Metroshen International Corp.; and Zhengzhou Yi Bang Industry Co. Ltd.

List of Key Companies in Fatty Acid Esters Market

- Cargill, Inc.

- Arkema

- Estelle Chemicals Pvt. Ltd.

- Faci Asia Pacific Pte. Ltd.

- DuPont

- Evonik Industries

- P&G Chemicals

- Oleon N.V.

- Wilmar International Limited

- KLK Oleo

- The Seydel Companies, Inc.

- Fine Organics

- World Chem Industries

- Stepan Company

- BASF S.E.

- Stéarinerie Dubois

- Metroshen International Corp.

- Zhengzhou Yi Bang Industry Co. Ltd.

Fatty Acid Esters Industry Developments

May 2024: Stepan Company announced the sale of its specialty esters product line to The HallStar Company. The company stated that its specialty esters production plant will continue the manufacturing of esters for Stepan's specialty flavor and food ingredient products and industrial markets.

June 2023: Cargill introduced its new line of sustainable fatty acid esters for the food & beverage industry. According to the company, these fatty esters can be used to create low-VOC solutions for several coating applications, including oil-modified urethanes, alkyd resins, and exterior wood finishes.

Fatty Acid Esters Market Segmentation

By Product Outlook

- Medium Chain Triglycerides (MCT)

- Sucrose Esters

- Glycol Esters

- Polyol Esters

- Glyceryl Monostearate

- Isopropyl Esters

- Others

By Application Outlook

- Personal Care & Cosmetics

- Lubricants

- Pharmaceuticals

- Food Processing

- Surfactants & Detergents

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fatty Acid Esters Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,307.40 million |

|

Market Size Value in 2025 |

USD 2,387.86 million |

|

Revenue Forecast by 2034 |

USD 3,477.65 million |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 2,307.40 million in 2024 and is projected to grow to USD 3,477.65 million by 2034.

The market is projected to register a CAGR of 4.3% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Cargill, Inc.; Arkema; Estelle Chemicals Pvt. Ltd.; Faci Asia Pacific Pte. Ltd.; DuPont; Evonik Industries; P&G Chemicals; Oleon N.V.; Wilmar International Limited; KLK Oleo; The Seydel Companies, Inc.; Fine Organics; World Chem Industries; Stepan Company; BASF S.E.; Stéarinerie Dubois; Metroshen International Corp.; and Zhengzhou Yi Bang Industry Co. Ltd.

The glyceryl monostearate segment dominated the market in 2024.

The personal care & cosmetics segment led the market in 2024.