Farming as a Service Market Size, Share, Trends, Industry Analysis Report: By Service Type (Farm Management Solutions, Production Assistance, and Access to Markets), By Delivery Model, By End-User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 115

- Format: PDF

- Report ID: PM5086

- Base Year: 2023

- Historical Data: 2019-2022

Farming as a Service Market Overview

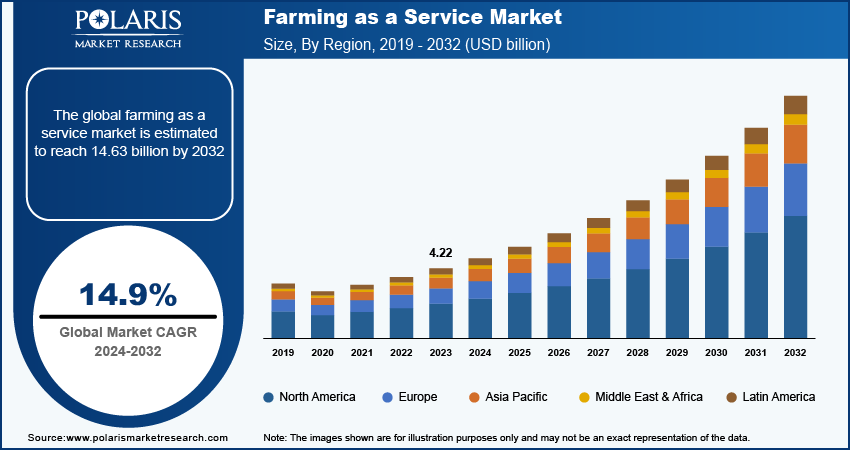

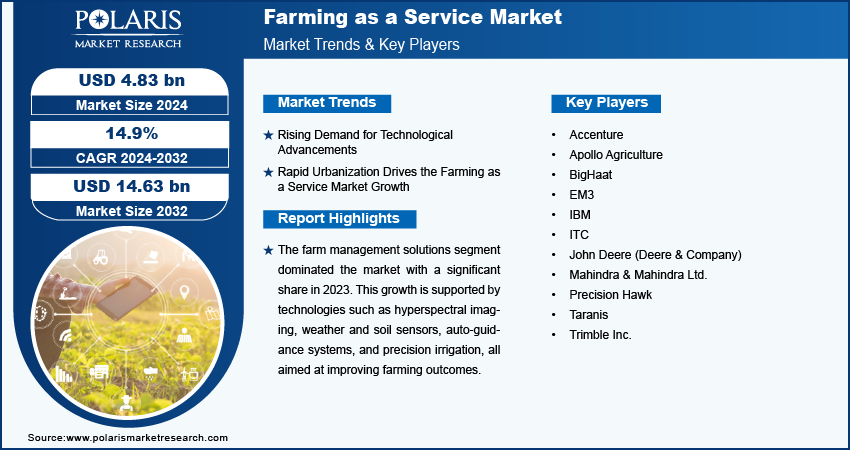

The global farming as a service market size was valued at USD 4.22 billion in 2023. The farming as a service market industry is projected to grow from USD 4.83 billion in 2024 to USD 14.63 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 14.9% during the forecast period.

Farming as a service (FaaS) market refers to agricultural services enabled by technology such as IoT (Internet of Things), AI (Artificial Intelligence), and data analytics, which are offered to farmers on a subscription or pay-per-use basis. These services aim to enhance productivity, efficiency, and sustainability in farming practices by providing real-time monitoring, analysis, and recommendations tailored to specific agricultural needs.

The demand for food security and sustainability is intensifying as global population growth and climate change place distinctive pressures on agriculture. Farming as a Service (FaaS) emerges as a pivotal solution by integrating advanced technologies like precision agriculture, IoT, and AI. These tools enable farmers to optimize resource utilization, minimize waste, and boost productivity. FaaS empowers farmers to make informed decisions that enhance yields while conserving resources by harnessing real-time data on soil health, weather patterns, and crop conditions.

Moreover, FaaS supports sustainable farming practices by promoting efficient water and energy usage, reducing greenhouse gas emissions, and adopting regenerative agricultural techniques. These advancements increase food security by ensuring reliable crop yields drive the growth of farming as a service market.

To Understand More About this Research: Request a Free Sample Report

Automation and mechanization are becoming increasingly important in the agricultural sector, particularly in regions facing labor shortages. The growing demand for efficient and dependable farm management is fueling the expansion of farming as a service (FaaS) solutions, which leverage advanced technologies like robotics and autonomous machinery to enhance the agricultural sector.

Farming as a Service Market Trends

Rising Demand for Technological Advancements

Market CAGR for farming as a service is being driven by technological advancements such as precision agriculture, IoT (Internet of Things), AI (Artificial Intelligence), and robotics. Precision agriculture allows farmers to optimize inputs, such as water, fertilizer, and pesticides, resulting in higher yields and reduced environmental impact. For instance, in April 2024, AGCO launched PTx, a precision ag portfolio integrating technologies from Precision Planting and PTx Trimble, aimed at enhancing farming efficiency and global connectivity.

Furthermore, the Internet of Things (IoT) links sensors and devices throughout farms, allowing for real-time monitoring of soil conditions, weather patterns, and crop health. After that, Artificial Intelligence (AI) analyzes the extensive data gathered from these IoT devices to deliver actionable insights, such as predicting crop diseases and optimizing planting schedules.

Farm as a service (FaaS) leverages these technologies to offer integrated and efficient farming solutions. By combining precision agriculture techniques with AI-driven analytics and robotics, FaaS providers deliver tailored services to farmers, enhancing productivity and sustainability. Farmers can access advanced tools and expertise on-demand, empowering them to make informed decisions that optimize resource usage and improve crop yields. FaaS exemplifies technology that can transform traditional farming into a data-driven, responsive industry capable of meeting future food demands efficiently. Thus, the aforementioned technological advancements drive the growth of farming as a service market.

Rapid Urbanization Drives the Farming as a Service Market Growth

The demand for fresh and sustainably sourced food grows significantly due to the rising urban population. Also, it boosts the demand for FaaS providers to utilize their technologies to optimize farming practices and enhance productivity. These providers, such as Trimble, Taranis, and others, play a crucial role in bridging the gap between rural agricultural production and urban consumer markets. Using precision agriculture techniques and smart farming technologies, Farming as a service (FaaS) allows for the efficient use of resources like water and land. This ensures a consistent supply and quality of produce to urban areas, addressing food security concerns and supporting local economies by fostering closer connections between rural farming communities and urban consumers.

FaaS solutions also offer scalability and flexibility, accommodating diverse urban landscapes and consumer preferences. By bringing farms closer to urban areas through vertical farming, hydroponics, and other innovative methods, FaaS providers contribute to a more sustainable and resilient food supply chain driving farming as a service market revenue.

Farming as a Service Market Segment Insights:

Farming as a Service, Service Type Insights

The global farming as a service market segmentation, based on service type, includes farm management solutions, production assistance, and access to markets. The farm management solutions segment dominated the market with a significant share in 2023. Farm management software offer comprehensive tools for optimizing farm operations, enhancing productivity, and improving decision-making. These solutions integrate data analytics, remote sensing, and advanced monitoring to streamline resource use and manage crops and livestock more effectively, addressing challenges faced by modern farmers that drive the segmental growth in the market. This growth is supported by technologies such as hyperspectral imaging, weather and soil sensors, auto-guidance systems, and precision irrigation, all aimed at improving farming outcomes.

The demand for precision farming is further accelerated by escalating water scarcity issues and the imperative to conserve natural resources. Within farm management services, production assistance includes various components such as equipment rentals (e.g., tractors, combines), labor support, utility services, and agricultural marketing, contributing to the comprehensive ecosystem of modern agricultural practices.

Farming as a Service Delivery Model Insights

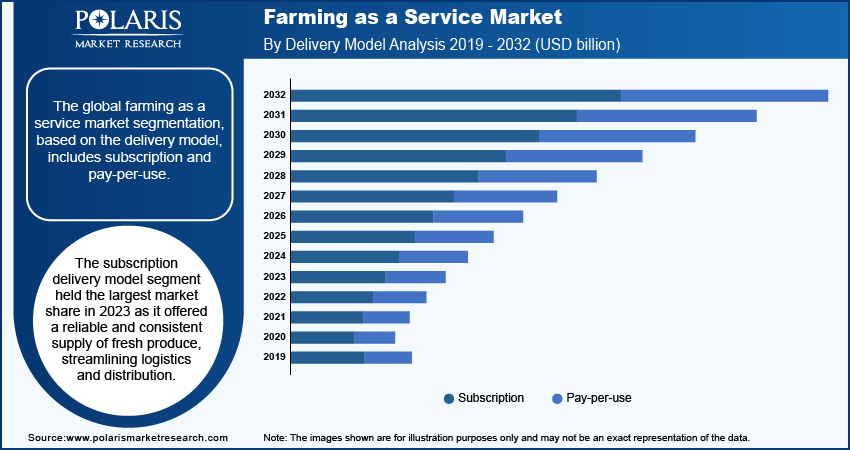

The global farming as a service market segmentation, based on the delivery model, includes subscription and pay-per-use. The subscription delivery model segment held the largest market share in 2023 as it offered a reliable and consistent supply of fresh produce, streamlining logistics and distribution. This model ensures regular deliveries, enhances customer convenience, and builds strong, ongoing relationships between consumers and providers, making it highly attractive in the growing demand for convenient and sustainable food solutions.

Furthermore, FaaS companies offer various subscription plans tailored to different farm sizes and needs. These plans provide access to services such as precision farming, crop monitoring, equipment leasing, pest control, soil analysis, irrigation management, and the expertise of agronomists or agricultural consultants. Due to these services, the subscription delivery model segment is expected to grow significantly during the forecast period.

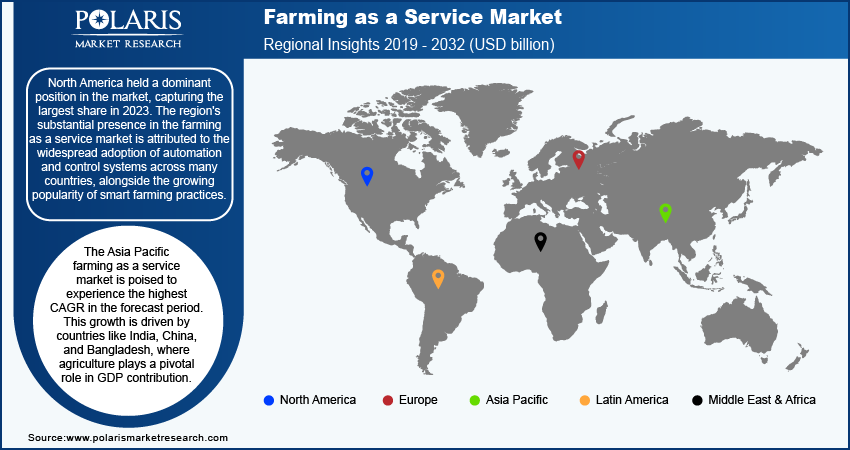

Farming as a Service Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America held a dominant position in the market, capturing the largest share in 2023. The region's substantial presence in the farming as a service market is attributed to the widespread adoption of automation and control systems across many countries, alongside the growing popularity of smart farming practices. North American region is known for its extensive farming economy and large average farm sizes. According to the USDA and agricultural reports, North America currently cultivates approximately 897,400,000 acres, and specifically, the U.S. has approximately 897.4 million acres of cultivated land, with the average farm size being around 445 acres. This drives the increased utilization of agriculture farming as a service solutions. Additionally, North America's robust economic resources and favorable policy environment for technological advancements contribute to its dominance in the market.

The Asia Pacific farming as a service market is poised to experience the highest CAGR in the forecast period. This growth is driven by countries like India, China, and Bangladesh, where agriculture plays a pivotal role in GDP contribution. Increasing population and growing food demand are key factors propelling this expansion. Additionally, governments across the Asia-Pacific region are actively supporting the adoption of FaaS models in agriculture, increased by improving infrastructure. Further, rising income levels and a focus on food security further boost the demand for innovative farming solutions in this market.

Farming as a Service Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the farming as a service market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, farming as a service industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global farming as a service industry to benefit clients and increase the market sector. In recent years, farming as a service industry has offered some technological advancements. Major players in the farming as a service market, including Accenture, Apollo Agriculture, BigHaat, EM3, IBM, ITC, John Deere (Deere & Company), Mahindra & Mahindra Ltd., Precision Hawk, Taranis, and Trimble Inc.

Accenture is a global professional services company that provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in five segments: media & technology, communications, financial services, health & public service, products, and resources. In November 2022, Accenture Ventures invested in KETOS to advance water intelligence through real-time monitoring, enhancing sustainability efforts and operational efficiencies globally.

Mahindra & Mahindra Ltd (M&M) is a multinational corporation with a diverse presence spanning various sectors, including automotive, aerospace, agri-business, information technology, clean energy, and more. M&M's diversified portfolio extends into numerous sectors, including defense, real estate, retail, hospitality, and financial services. In February 2021, Mahindra & Mahindra launched 'Farming as a Service' (FaaS) in Karnataka, offering agronomy advisory, advanced equipment rentals, precision farming solutions, and digitization support to enhance farming efficiency and income for farmers.

Key Companies in the Farming as a Service market include

- Accenture

- Apollo Agriculture

- BigHaat

- EM3

- IBM

- ITC

- John Deere (Deere & Company)

- Mahindra & Mahindra Ltd.

- Precision Hawk

- Taranis

- Trimble Inc.

Farming as a Service Industry Developments

July 2024: Taranis introduced Ag Assistant, utilizing generative AI to provide agriculture retailers and producers with field-specific insights and actionable recommendations, revolutionizing farm management decisions.

September 2023: Trimble and AGCO formed a joint venture to enhance global mixed fleet precision agriculture solutions, aiming to integrate advanced technologies for increased farming productivity and sustainability worldwide.

March 2024: FMC India launched the Arc farm intelligence platform to optimize crop yields and promote sustainability through precision agriculture in India.

Farming as a Service Market Segmentation

Farming as a Service, Service Type Outlook

- Farm Management Solutions

- Production Assistance

- Access to Markets

Farming as a Service, Delivery Model Outlook

- Subscription

- Pay-per-use

Farming as a Service, End-User Outlook

- Corporate

- Financial Institutions

- Advisory Bodies

- Farmers

- Governments

Farming as a Service, Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Farming as a Service Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4.22 billion |

|

Market size value in 2024 |

USD 4.83 billion |

|

Revenue Forecast in 2032 |

USD 14.63 billion |

|

CAGR |

14.9% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global farming as a service market size was valued at USD 4.22 billion in 2023 and is anticipated to reach USD 14.63 billion in 2032.

The global market is projected to grow at a CAGR of 14.9% during the forecast period, 2024-2032.

North America had the largest share of the global market

The key players in the market are Accenture, Apollo Agriculture, BigHaat, EM3, IBM, ITC, John Deere (Deere & Company), Mahindra & Mahindra Ltd., Precision Hawk, Taranis, and Trimble Inc.

The farm management solution category dominated the market in 2023.

The subscription had the largest share in the global market.