Factoring Service Market Share, Size, Trends, Industry Analysis Report, By Category (Domestic, International), By Type (Recourse, Non-recourse), By Financial Institution (Banks, Non-Banking Financial Institutions), By End-Use, By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 111

- Format: PDF

- Report ID: PM2059

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

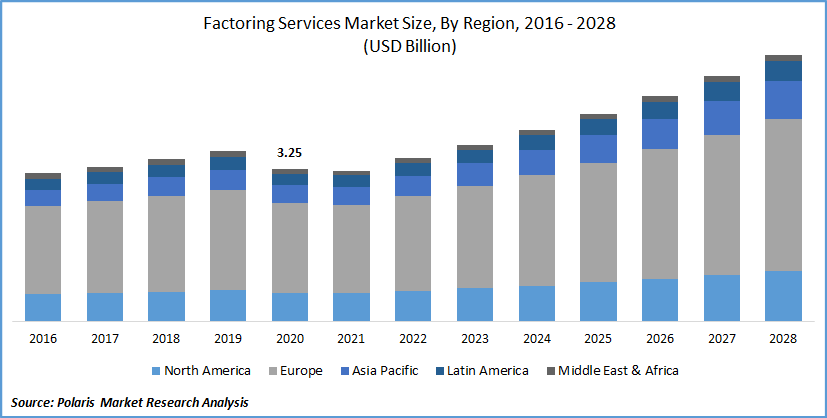

The global factoring service market was valued at USD 3.25 billion in 2020 and is expected to grow at a CAGR of 8.5% during forecast period. The growing number of start-ups and the existence of numerous factoring industries offers diverse financing alternatives that foster market growth of factoring services across the globe. In addition, factors such as better availability of financial resources for effective management of working capital, enhanced management of the inventories, and escalating market demand for further financing options for micro, small and medium enterprises (MSMEs) are pivotal driving factors favoring the market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The widespread COVID-19 pandemic moderately impacts the comprehensive economy of the financial markets and enterprises. This has further resulted in a temporary slowdown in the financial market due to the interruptions in the supply chain and the market demand for financial products and services. Also, the factoring service industry experienced a significant downfall caused by the stock market instability, traveling restrictions, business shut-down in about 40 countries, and reducing trading assurance. In conclusion, the market has faced business disruptions in the wake of the COVID-19 pandemic for a short period.

Industry Dynamics

Growth Drivers

In the present scenario, the implementation of Fintech solutions in Small and Medium Enterprises (SMEs) is increasing, which drives the market growth for factoring service around the world. Emergent awareness related to the progression of financial technology like saving & investment, financial & budgeting planning, borrowing, and payment and transfer fuels the penetration of the Fintech solutions.

Various disbursement service providers are creating trust among the small business vendors to step into the global factoring service industry. For instance, a licensed e-money institution and payment service provider company- International Fintech, presents a Fintech solution for small business players. A company is proposing automated solutions for mass payment and associated services in the overall financial market.

Know more about this report: request for sample pages

As various banks are not inclined to give a lot of paychecks, Fintech's automated solution helps those small vendors. This allows SMEs to deal with Fintech companies and increases the return on investment (RoI) components like third-party insurers or banks. Numerous Fintech Corporation provides considerable authenticity and safety solution that scrutinizes the transaction processes with the SMEs. Hence, the adoption of Fintech solutions in SMEs paves the way for growth in the global market.

Report Segmentation

The market is primarily segmented on the basis of category, type, financial institution, end-use and region.

|

By Category |

By Type |

By Financial Institution |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Category

Among the category segment of factoring services, the domestic segment is the leading segment in terms of revenue generation in 2021. The government's growing efforts for private consumption in countries such as China and India for leading the domestic market demand are a major driving factor for the segment growth. Simple coverage of risk offered by the banks and low costs and fees in contrast to the international offerings contribute to the market development.

International segment is estimated to show substantial growth in the coming period. The growing number of trades in open accounts, mainly from the contractors, presents in the developing nations. Also, the chief importers from the developed nations are taking factoring services as an appropriate choice for the conventional way of financial dealing, which may fuel the segment growth. Moreover, a segment is also growing by the factors such as rising consciousness regarding import & export business operations and an increasing number of international trading across the globe.

Insight by End-Use

Based on the factoring service end-use segment, the manufacturing segment is accounted for the largest revenue share. Factors like the intensifying growth of the manufacturing sector in regions like Southeast and South Asian countries are propelling the segment growth. Numerous nations are swapping agrarian economies into manufacturing and export-related activities.

Various regions tend to export goods in the regions such as North Asia, United States, and Europe. Furthermore, several companies in Asian countries are focusing on the low-cost production of goods and services, which increases market demand for more factoring services. Therefore, emerging nations are a hub that requires factor financing that creates a lucrative market growth of the segment across the globe.

The segment of other industries like healthcare and transport & logistics is expected to show the highest CAGR in the near future. Medical factoring services is assisting businesses in conquering liquidity problems created due to deferred payments. This factoring service is chiefly opted by healthcare providers and medical professionals. The intensifying needs for medical professionals and healthcare facilities in the outbreak of the COVID-19 pandemic are further contributing to the increasing market demand, which leads to the segment growth in the forecasting period.

Geographic Overview

Geographically, Europe is dominating the global factoring service market in terms of revenue in 2020. This large share is generally driven by countries such as the United Kingdom, Germany, and France, which typically contribute two-thirds of market share in the region. Furthermore, the rapid growth in the funding provided by the commercial banking sector in these countries promotes regional growth.

Increasing banking and trading activities with the rapidly developing factoring service markets in the Elon Bloc countries, along with the active business operations in the European Economic Zone are fostering market demand for the factoring services in Europe. For instance, according to the Indian Brand Equity Foundation (IBEF), from 2016 to 2020, bank credit rises at a CAGR of 3.57%, and in 2020 total credit grows to USD 1,698.97 billion. As per the RBI, in April 2021, bank credit stood at USD 1.48 trillion, and deposits at USD 2.06 trillion. Thus, these increasing banking activities establish a positive influence of factoring service in the anticipating years.

Moreover, Asia Pacific is estimated to expand at the maximum rate throughout the world in the upcoming period. Asia Pacific comprises the major emerging nations such as India, China, Thailand, Indonesia, Philippines, and Malaysia, along with North America follows over 5,000 factoring service companies in the APAC. These developing countries are obtaining investments from the developed nations which are drenched and exploring the growth prospects in the Asia Pacific market over the forecasting years.

Moreover, the regional governments are also taking significant measures to promote the use of factoring services. For instance, in July 2021, the Indian parliament passed the Factoring Regulation (Amendment) Bill 2020, which is projected to alleviate working capital financing for micro, small and medium enterprises (MSMEs) by enabling more banks and non-banking financial corporations (NBFCs) to enter into the factoring business. This government regulation considering the factoring service will promote market growth in the region.

Competitive Landscape

Some of the major players operating the global factoring service market include ABS Global Factoring, American Receivable, Barclays Bank PLC, BNP Paribas, CapitalPlus Construction Services, China Construction Bank Corporation, CreditGate24, Deutsche Factoring Bank, eCapital Corp., Eurobank, Factor Funding Co, Mitsubishi HC Capital UK PLC, HSBC Group, ICBC China, Kuke Finance, Mizuho Financial Group, Inc., New Century Financial Inc., Universal Funding Corp.

Factoring Service Market Scope Report

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.25 billion |

|

Revenue forecast in 2028 |

USD 5.68 billion |

|

CAGR |

8.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion Volume in kilotons and CAGR from 2021 to 2028 |

|

Segments covered |

By Category, By type, By Financial Institution, By End-Use , By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ABS Global Factoring, American Receivable, Barclays Bank PLC, BNP Paribas, CapitalPlus Construction Services, China Construction Bank Corporation, CreditGate24, Deutsche Factoring Bank, eCapital Corp., Eurobank, Factor Funding Co, Mitsubishi HC Capital UK PLC, HSBC Group, ICBC China, Kuke Finance, Mizuho Financial Group, Inc., New Century Financial Inc., Universal Funding Corp. |