Face Shields Market Size, Share, Trends, Industry Analysis Report: By Product, Type (Disposable and Reusable), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: pdf

- Report ID: PM5467

- Base Year: 2024

- Historical Data: 2020-2023

Face Shields Market Overview

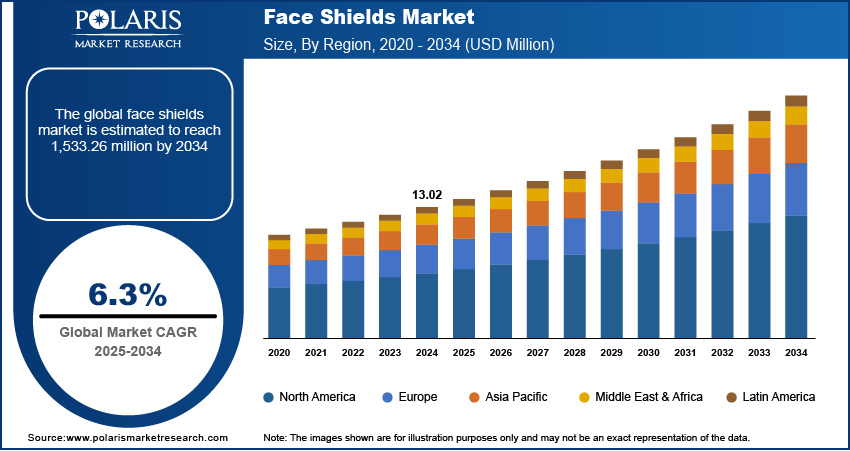

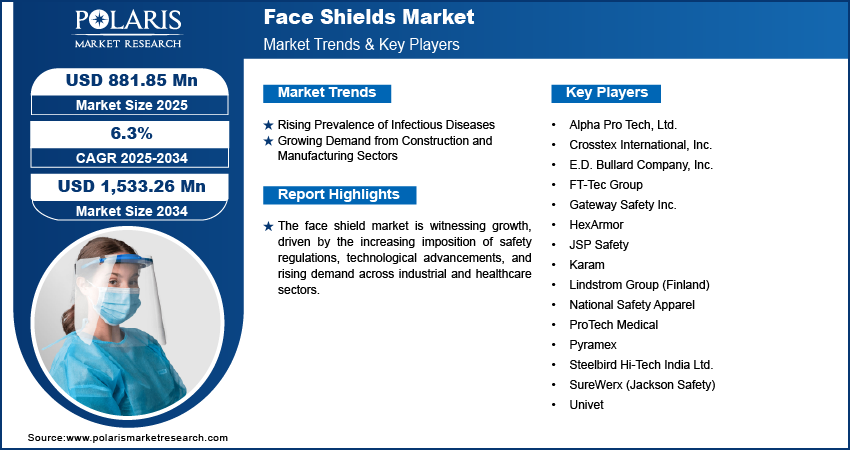

The global face shields market size was valued at USD 830.46 million in 2024. It is expected to grow from USD 881.85 million in 2025 to USD 1,533.26 million by 2034, at a CAGR of 6.3% during 2025–2034.

A face shield is a protective transparent barrier worn over the face to safeguard against hazardous substances, airborne particles, and potential impacts. The face shields market growth is driven by the imposition of stringent safety regulations across industries like healthcare, manufacturing, and construction. Regulatory bodies worldwide have implemented strict workplace safety norms, particularly in healthcare, manufacturing, and construction, mandating the use of face shields to minimize occupational hazards. According to ILO research released in November 2023, work-related fatalities account for 2.6 million of all work-related deaths. An additional 330,000 fatalities are caused by work-related incidents. Compliance with these regulations has led to increased adoption of face shields, providing improved protection for workers. Moreover, growing awareness of personal protective equipment (PPE) and its role in preventing infections and injuries has reinforced face shield market demand.

To Understand More About this Research:Request a Free Sample Report

In addition to regulatory compliance, technological advancements in materials and design have especially influenced the face shield market growth. Innovations such as lightweight, antifog, and impact-resistant materials have improved user comfort and durability, making face shields more efficient and user-friendly. For instance, in February 2023, Paulson Manufacturing launched face shields that are compatible with climbing-style safety helmets from various manufacturers, such as Kask and Petzl, designed specifically for harsh industrial environments with weight-compensating features. Improved ergonomic designs, such as adjustable headgear and optical clarity, have increased their appeal across various sectors. Additionally, the integration of reusable and sustainable materials aligns with the growing emphasis on eco-friendly PPE solutions. These advancements improve protection and also contribute to broader industry adoption, driving further face shield market expansion.

Face Shields Market Dynamics

Rising Prevalence of Infectious Diseases

Infectious disease outbreaks and amplified concerns regarding cross-contamination have increased the demand for effective personal protective equipment (PPE), particularly in healthcare, laboratories, and public safety environments. According to a 2021 analysis by our world in data, the US reported ∼560,843 deaths caused by infectious diseases in 2021. Face shields provide an added layer of defense by covering the entire face, reducing exposure to respiratory droplets and other contaminants, as these protective barriers play a crucial role in minimizing the transmission of pathogens. Their use extends beyond medical settings, gaining traction in public spaces, transportation, and workplaces where close contact poses a risk of infection. Thus, as awareness of infection control measures and the prevalence of infectious diseases continue to grow, the adoption of face shields remains essential to providing safety across various sectors.

Growing Demand from Construction and Manufacturing Sectors

Face shields are essential in environments where workers are exposed to hazardous materials, flying debris, chemical splashes, and intense heat. Regulatory standards mandate the use of protective face gear to reduce occupational injuries. For instance, in April 2024, OSHA's Safety and Health Information Bulletin outlined head protection requirements, detailing Types I/II and Classes G/E/C of protection, selection criteria for different work environments, and proper inspection, maintenance, and storage procedures to ensure worker safety. Additionally, advancements in industrial safety practices in various sectors such as construction and manufacturing have increased the focus on ergonomic and durable PPE solutions, improving worker comfort and compliance, as these industries require robust protective gear to assure safety. Therefore, as construction and manufacturing activities expand globally, the demand for high-quality face shields continues to rise, reinforcing their role in workplace safety.

Face Shields Market Segment Analysis

Face Shields Market Assessment by Product Outlook

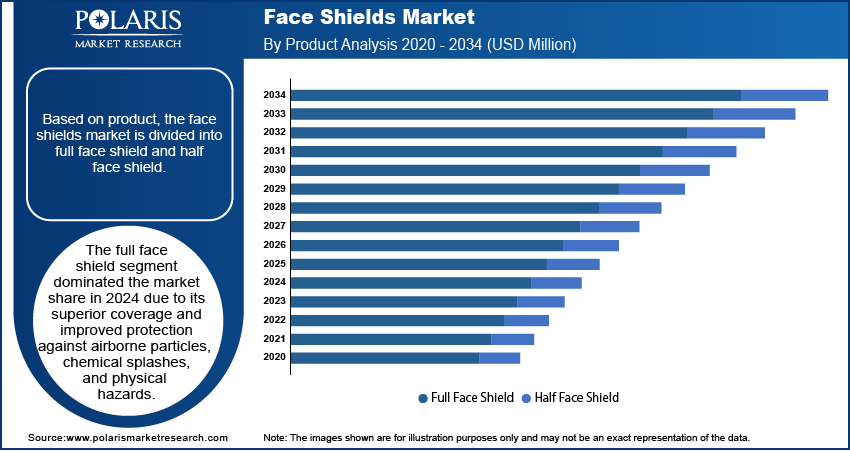

The global face shields market segmentation, based on product, includes full face shield and half face shield. The full face shield segment dominated the face shields market share in 2024 due to its superior coverage and improved protection against airborne particles, chemical splashes, and physical hazards. Unlike half face shields, full-face shields offer complete facial protection, making them the preferred choice in industries requiring high safety standards, such as healthcare, chemical, and manufacturing. Their effectiveness in preventing direct exposure to contaminants and hazardous substances has driven their widespread adoption across various sectors. Additionally, advancements in lightweight materials and anti-fog coatings have improved user comfort and visibility, further supporting the dominance of this segment. Thus, as workplace safety regulations become more stringent, the full face shields market demand continues to strengthen, solidifying their market leadership.

Face Shields Market Evaluation by End Use Outlook

The global face shields market segmentation, based on end use, includes healthcare, chemical, construction, oil & gas, manufacturing, and others. The healthcare segment is expected to witness the fastest growth during the forecast period, driven by the increasing focus on infection control and worker safety in medical settings. Healthcare professionals rely on face shields as a critical component of personal protective equipment (PPE) to prevent exposure to infectious diseases, blood borne pathogens, and respiratory droplets. The rising number of healthcare facilities, coupled with the growing awareness of protective measures, has accelerated demand for high-quality face shields. Furthermore, advancements in medical-grade face shields with anti-glare, antifog, and disposable options have improved their usability and compliance within healthcare environments. Therefore, as infection prevention protocols become stricter, the adoption of face shields in the healthcare sector is expected to expand significantly.

Face Shields Market Regional Insights

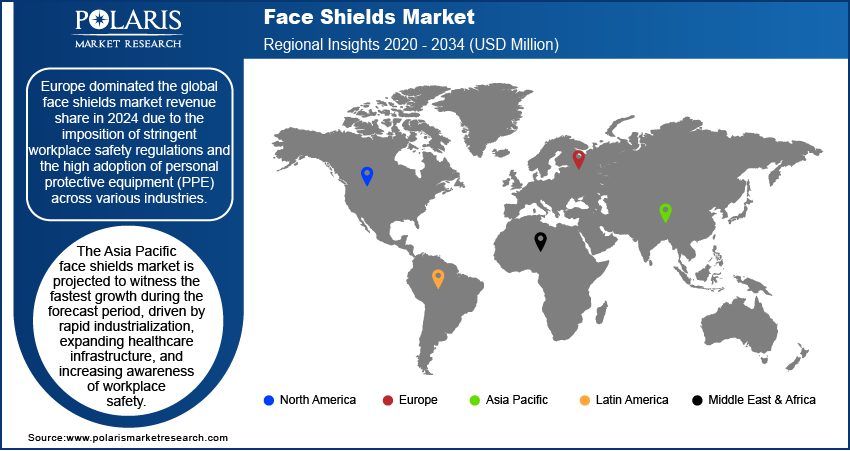

By region, the report provides the face shields market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Europe dominated the face shields market revenue share in 2024 due to the presence of strict workplace safety regulations and the high adoption of personal protective equipment (PPE) across various industries. Strict directives from regulatory bodies have mandated the use of protective face gear in healthcare, industrial, and construction sectors, driving consistent market demand. Additionally, Europe’s well-established healthcare infrastructure and advanced manufacturing capabilities have contributed to the widespread production and utilization of face shields. For instance, in June 2021, Tecman launched Optec, a reusable face shield system featuring bio-sourced materials and multiple cleaning options. The system offers three screen types with antifog properties, designed to provide healthcare workers with effective protection while addressing sustainability goals and comfort concerns. The region’s emphasis on worker safety, coupled with growing public awareness regarding infection prevention, has further reinforced market expansion. Europe has maintained a leading position in the global face shields market with continuous investments in PPE innovation and compliance-driven adoption.

The face shields market size in Asia Pacific is projected to witness the fastest growth during the forecast period, driven by rapid industrialization, expanding healthcare infrastructure, and increasing awareness of workplace safety. The region's booming construction and manufacturing industries have fueled the demand for protective equipment to assure worker safety in hazardous environments, such as face shields. According to a December 2024 report by METI manufacturing production index reached 101.6. Additionally, the rising prevalence of infectious diseases has strengthened the need for PPE in medical and public settings, further accelerating market expansion. Government initiatives promoting occupational safety, coupled with a growing focus on cost-effective and durable protective gear, have also contributed to the region’s rapid market growth. Thus, as the industrial and healthcare sectors continue to expand, Asia Pacific is poised to become a key driver of global market expansion.

Face Shields Market – Key Players & Competitive Analysis Report

The competitive landscape combines global leaders and regional players competing to capture face shield market share through innovation, strategic alliances, and regional expansion. Global players such as Crosstex International, Inc.; E.D. Bullard Company, Inc., and FT-Tec Group Safety leverage robust R&D capabilities and extensive distribution networks to deliver advanced face shield solutions, such as antifog, lightweight, and reusable designs. Face shield market trends indicate rising demand for face shields with improved features, such as UV protection, anti-glare coatings, and ergonomic designs, reflecting advancements in materials science and user comfort. According to face shield market statistics, the market is projected to grow during the forecast period, driven by increasing awareness of workplace safety, the need for infection control in healthcare settings, and the rising prevalence of airborne diseases. Regional companies capitalize on localized needs by offering cost-effective and tailored solutions, especially in emerging markets due to rapid industrialization and increasing healthcare expenditure. The market competitive strategy includes mergers and acquisitions, partnerships with healthcare institutions, and the introduction of innovative products to address the growing demand for high-quality protective equipment. These developments highlight the role of technological innovation, market adaptability, and regional investments in driving the expansion of the face shield industry. Strict workplace safety regulations, the rise of infectious diseases, and the growing adoption of PPE in non-traditional sectors such as education, retail, and hospitality further fuel the market. A few key major players are Alpha Pro Tech, Ltd.; Crosstex International, Inc.; E.D. Bullard Company, Inc.; FT-Tec Group; Gateway Safety Inc.; HexArmor; JSP Safety; Karam; Lindstrom Group (Finland); National Safety Apparel; ProTech Medical; Pyramex; Steelbird Hi-Tech India Ltd.; SureWerx (Jackson Safety); and Univet.

Steelbird Hi-Tech India Ltd., founded in 1963, is a helmet manufacturer headquartered in Delhi, India. The company has evolved into a global leader in the helmet industry, operating in over 50 countries worldwide. It is committed to delivering high-quality ISI-marked helmets at competitive prices, focusing on customer satisfaction and innovation. Their product range includes full-face helmets, open-face helmets, and open-cum-full-face helmets, catering to diverse customer needs. In addition to helmets, Steelbird offers accessories, such as face shields, which are crucial for improving rider safety. Face shields protect from wind, dust, and debris, ensuring a safer riding experience. Steelbird's vision is to create a secure world through safe biking experiences, empowering riders with the safest and best helmets globally. The company's relentless pursuit of quality and safety standards has positioned it as a tycoon in the Indian helmet manufacturing sector. Steelbird continues to explore new frontiers in the global market, driven by its mission to protect bike enthusiasts worldwide with a strong legacy and a focus on innovation. The company's commitment to excellence is reflected in its diverse product offerings and customer-centric approach.

National Safety Apparel (NSA) is a manufacturer of protective clothing and safety apparel, headquartered in Cleveland, Ohio. NSA specializes in the design and production of high-quality, made-in-USA safety gear. The company specializes in industrial safety applications, offering protection against hazards such as electric arc flash, welding, molten metal, and flash fires. Their products comply with stringent standards, such as NFPA 70E and OSHA 1910.269. NSA's product range includes a variety of flame-resistant (FR) garments, high-visibility vests, and specialized face shields. The Pureview Face Shield Kits, for example, are designed to provide arc ratings of up to 20 cal/cm², meeting CAT 2, NFPA 70E, and ASTM F2178 standards. These face shields are available with different adapters, such as full brim and universal options, assuring versatility and compatibility with various hard hats. NSA's commitment to innovation and quality has made it a trusted choice for industrial workers across the US. The company's focus on using the latest fabrics and technologies assures that its products protect workers and also improve their comfort and performance on the job.

List of Key Companies in Face Shields Market

- Alpha Pro Tech, Ltd.

- Crosstex International, Inc.

- E.D. Bullard Company, Inc.

- FT-Tec Group

- Gateway Safety Inc.

- HexArmor

- JSP Safety

- Karam

- Lindstrom Group (Finland)

- National Safety Apparel

- ProTech Medical

- Pyramex

- Steelbird Hi-Tech India Ltd.

- SureWerx (Jackson Safety)

- Univet

Industry Development:

- In February 2025: Aspen Surgical appointed Andau Medical as its exclusive distributor in Canada, enhancing distribution efficiency and expanding access to Bard-Parker Blades, Symmetry Surgical Instrumentation, and related products.

- In August 2024: Medline acquired Ecolab Inc.'s global surgical solutions business, including Microtek product lines, strengthening its surgical portfolio. The acquisition added 3,500 employees, improving service quality and industry collaboration.

Face Shields Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Full Face Shield

- Half Face Shield

By Type Outlook (Revenue, USD Million, 2020–2034)

- Disposable

- Reusable

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Healthcare

- Chemical

- Construction

- Oil & gas

- Manufacturing

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Face Shields Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 830.46 million |

|

Market Size Value in 2025 |

USD 881.85 million |

|

Revenue Forecast by 2034 |

USD 1,533.26 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global face shields market size was valued at USD 830.46 million in 2024 and is projected to grow to USD 1,533.26 million by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

Europe dominated the market in 2024.

A few of the key players in the market are Alpha Pro Tech, Ltd.; Crosstex International, Inc.; E.D. Bullard Company, Inc.; FT-Tec Group; Gateway Safety Inc.; HexArmor; JSP Safety; Karam; Lindstrom Group (Finland); National Safety Apparel; ProTech Medical; Pyramex; Steelbird Hi-Tech India Ltd.; SureWerx (Jackson Safety); and Univet.

The full face shield segment dominated the market in 2024.