Explosion-Proof Light Fixtures Market Size, Share, Trends, Industry Analysis Report: By Light Source (LED, Fluorescent, Incandescent, and Others), Product Type, Material Type, Installation Type, End-Use Industry, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5435

- Base Year: 2024

- Historical Data: 2020-2023

Explosion-Proof Light Fixtures Market Overview

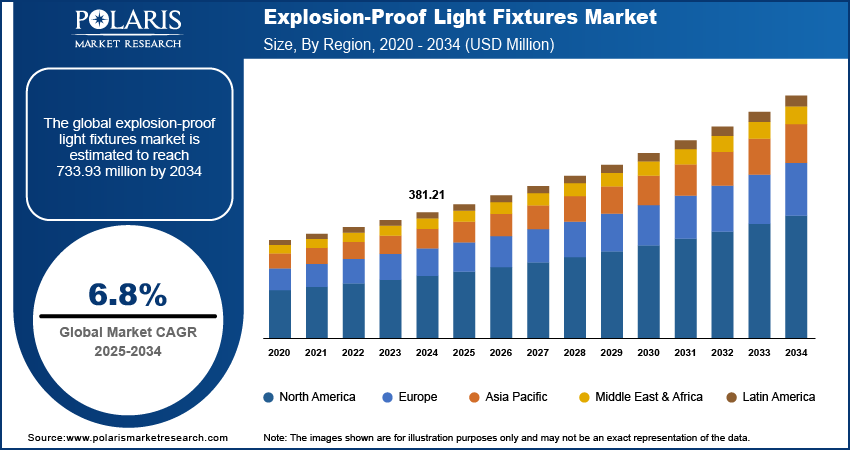

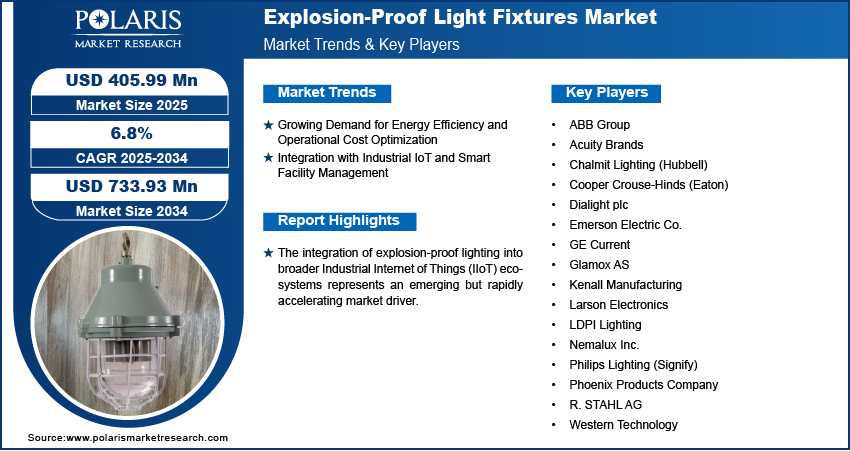

The global explosion-proof light fixtures market size was valued at USD 381.21 million in 2024 and is expected to reach USD 405.99 million by 2025 and USD 733.93 million by 2034, exhibiting a CAGR of 6.8% during 2025–2034.

The explosion-proof light fixtures market encompasses specially designed lighting solutions engineered to prevent ignition in hazardous environments containing flammable gases, vapors, liquids, or combustible dust. These fixtures feature robust housings and specialized construction that contain potential sparks or excessive heat, preventing them from igniting surrounding atmospheres. Primarily serving industrial sectors where explosive conditions exist, these fixtures balance safety compliance with illumination performance while meeting stringent regulatory standards for hazardous location equipment across global markets.

The explosion-proof light fixtures market growth is driven by increasingly stringent safety regulations across global industrial sectors. Regulatory frameworks such as ATEX in Europe, NEC/NFPA 70 in North America, and IECEx international standards have established comprehensive classification systems for hazardous locations that mandate specific lighting solutions based on explosion risk factors. These regulations continuously evolve to address emerging safety concerns, with recent amendments focusing on improved testing methodologies and certification requirements. Compliance is non-negotiable for industrial operators, as violations can result in substantial financial penalties, facility shutdowns, insurance coverage invalidation, and potential criminal liability for executives in cases of safety negligence. The need to maintain compliance with these ever-evolving regulatory standards creates a persistent demand for certified explosion-proof lighting solutions that meet or exceed the latest requirements.

To Understand More About this Research: Request a Free Sample Report

The continuous expansion of industrial infrastructure in sectors dealing with explosive atmospheres boosts the explosion-proof light fixtures market development. Global investments in oil and gas extraction, refining, chemical processing, pharmaceutical manufacturing, and mining operations has created extensive networks of facilities where explosive atmospheres exist during normal operations. The development of new processing technologies and production methodologies has expanded hazardous zone classifications within existing facilities. Additionally, the geographical expansion of industrial operations into previously undeveloped regions has created entirely new markets for explosion-proof lighting solutions. This infrastructure growth extends beyond traditional heavy industry to include specialized applications such as grain processing, battery manufacturing, and additive manufacturing facilities, where evolving production processes create explosive dust or vapor hazards requiring appropriate lighting solutions.

Explosion-Proof Light Fixtures Market Dynamics

Growing Demand for Energy Efficiency and Operational Cost Optimization

The imperative to reduce energy consumption and operational costs has become a significant factor fueling the explosion-proof light fixtures market demand. Modern LED explosion-proof fixtures can reduce energy consumption by 60–80% compared to traditional lighting technologies while extending maintenance intervals by factors of 5–10 times. These efficiency improvements translate to substantial cost savings over installation lifespans, particularly in 24/7 operational environments where lighting represents a significant portion of facility energy consumption. The extended service life of advanced explosion-proof fixtures significantly reduces maintenance frequency in hazardous areas, where simple lamp replacement can require extensive safety procedures, equipment shutdowns, and specialized personnel. As industrial operators increasingly focus on total cost of ownership rather than initial acquisition costs, the operational and energy efficiency advantages of advanced explosion-proof lighting technologies have become compelling value propositions beyond basic safety compliance.

Integration with Industrial IoT and Smart Facility Management

The integration of explosion-proof lighting into broader Industrial Internet of Things (IIoT) ecosystems represents an emerging but rapidly accelerating market driver. Modern explosion-proof light fixtures increasingly incorporate sensor technologies, networking capabilities, and data analytics functionalities that transform them from passive illumination devices into active components of intelligent facility management systems. These connected lighting systems provide real-time monitoring of fixture performance, predictive maintenance capabilities, energy consumption analysis, and emergency response coordination. The strategic value of these integrated capabilities extends well beyond traditional lighting functions, as they contribute to overall facility safety monitoring, operational efficiency, and regulatory compliance documentation. As industrial facilities increasingly implement comprehensive digital transformation initiatives, the demand for explosion-proof lighting solutions that seamlessly integrate with these broader technological ecosystems continues to expand.

Explosion-Proof Light Fixtures Market Segment Insights

Explosion-Proof Light Fixtures Market Assessment by Light Source Outlook

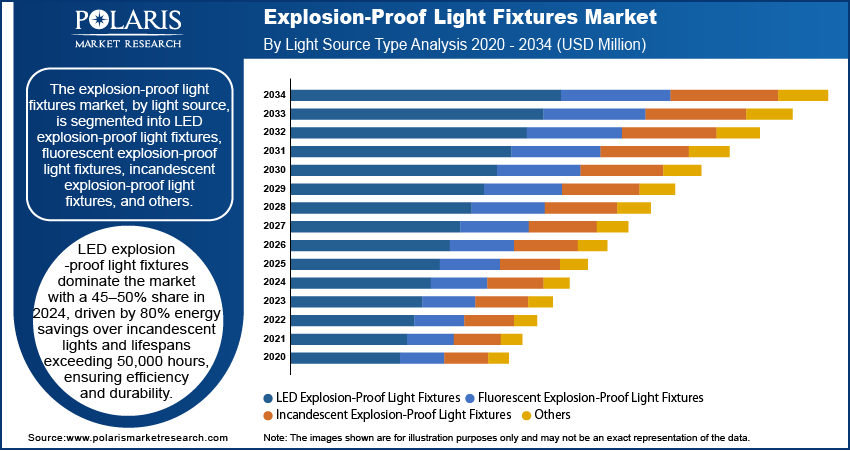

The global explosion-proof light fixtures market segmentation, based on light source, includes LED, fluorescent, incandescent, and others. The LED explosion-proof light fixtures segment holds the largest market share, accounting for 45–50% of the total market value as of 2024. This dominance is fueled by LED's superior energy efficiency, with fixtures consuming up to 80% less power compared to traditional incandescent alternatives while offering lifespans exceeding 50,000 hours. Major industrial facilities have increasingly transitioned to LED explosion-proof fixtures, particularly in continuous operation environments such as oil refineries and chemical plants, where the reduced maintenance and replacement frequency translates to significant cost savings. The inherent design characteristics of LED technology, including lower heat emission, instant start capabilities, and superior performance in extreme temperatures (ranging from -40°C to 65°C), have further solidified their market leadership position.

The fluorescent explosion-proof light fixtures segment represents the fastest-growing segment in the market, projected to register a CAGR of 8.5–9.2% during 2025–2034. This accelerated growth is primarily driven by advancements in fluorescent technology that have significantly increased energy efficiency while reducing environmental concerns related to mercury content by up to 80% compared to older models. The attractive price-to-performance ratio of fluorescent explosion-proof fixtures, typically 25–35% lower in initial investment compared to equivalent LED solutions, has fueled their adoption, particularly in developing economies across Southeast Asia and Latin America. Additionally, recent innovations in fluorescent explosion-proof fixtures have extended operational lifespans to 20,000–25,000 hours while improving light quality metrics, making them increasingly viable alternatives in budget-conscious hazardous location projects that still require reliable illumination performance.

Explosion-Proof Light Fixtures Market Assessment by Product Type Outlook

The global explosion-proof light fixtures market segmentation, based on product type, includes linear explosion-proof lights, high bay & low bay explosion-proof lights, flood & area explosion-proof lights, portable explosion-proof lights, emergency & exit explosion-proof lights, and others. The high bay & low bay explosion-proof lights segment held the largest market share, representing approximately 32–35% of the total revenue as of 2024 This dominance is attributed to their widespread deployment in large-scale industrial facilities with ceiling heights ranging from 15 to 45 feet, particularly in petrochemical refineries, manufacturing plants, and warehouse facilities where hazardous materials are processed or stored. The substantial light output capabilities of these fixtures, typically ranging from 10,000 to 60,000 lumens, make them indispensable for large area coverage while maintaining the illumination intensity required for operational safety and precision work. The market position of high bay and low bay explosion-proof lights is further strengthened by their adaptability to various mounting configurations and the integration of advanced optical designs that provide optimized light distribution patterns specific to industrial facility layouts.

The portable explosion-proof lights segment is experiencing the fastest growth rate. The segment growth is driven by the increasing emphasis on mobility and flexibility in hazardous work environments, particularly for maintenance, inspection, and emergency response applications. The advancement in battery technology has significantly extended operational durations from 4–6 hours to 12–16 hours on a single charge while reducing weight by approximately 30-40% compared to previous generations. Major incidents in confined spaces, particularly in the mining and chemical sectors, have heightened regulatory focus on portable safety equipment, driving explosion-proof light fixtures market expansion. Furthermore, the integration of smart features such as remote monitoring, automatic brightness adjustment, and emergency signaling capabilities has transformed portable explosion-proof lights from basic illumination tools to multifunctional safety devices, substantially increasing their adoption across diverse industrial applications.

Explosion-Proof Light Fixtures Market Assessment by Material Type Outlook

The global explosion-proof light fixtures market segmentation, based on material type, includes aluminum, stainless steel, polycarbonate, fiberglass-reinforced plastic (frp), and others. The aluminum segment dominates the explosion-proof light fixtures market revenue with ∼40–45% share as of 2024. This material’s leading position is attributed to its exceptional balance of corrosion resistance, thermal conductivity (approximately 205 W/m·K), and strength-to-weight ratio, making it ideally suited for hazardous environments where chemical exposure and mechanical durability are critical considerations. The cost-effectiveness of aluminum—typically 15-25% lower than stainless steel alternatives—coupled with its excellent heat dissipation properties has made it the material of choice for explosion-proof fixtures in oil and gas facilities, chemical plants, and marine installations. Additionally, aluminum's malleability allows for complex housing designs with precision tolerance control, enabling manufacturers to create fixtures that meet stringent ingress protection ratings (IP66/IP67) while optimizing aesthetic appeal and functional performance in industrial settings.

The polycarbonate segment is experiencing the fastest growth rate. This accelerated adoption is primarily driven by significant advancements in polymer technology that have enhanced impact resistance (now withstanding impacts of up to 20 joules) while extending UV stability from 5–7 years to 10–12 years in outdoor applications. The substantially lower weight of polycarbonate fixtures—approximately 60–70% lighter than equivalent metal alternatives—has drastically reduced installation costs and structural loading requirements, particularly in retrofit projects. Furthermore, polycarbonate's inherent electrical insulation properties eliminate the risk of secondary sparking from the fixture housing itself, an increasingly valuable safety feature recognized by updated safety standards in multiple industries. The material's transparency capabilities also enable innovative designs where the entire housing serves as a light-diffusing element, improving light distribution efficiency by up to 15–20% compared to traditional metal reflector designs.

Explosion-Proof Light Fixtures Market Assessment by Installation Type Outlook

The global explosion-proof light fixtures market segmentation, based on installation type, includes ceiling mounted, wall mounted, pole mounted, hanging/pendant mounted and others The ceiling mounted segment holds the largest explosion-proof light fixtures market share of ∼38–42%. This dominance is attributable to the fundamental layout of industrial facilities where ceiling mounting provides optimal light distribution across work areas while keeping fixtures away from operational activities and potential mechanical damage. The integration of advanced mounting systems featuring vibration isolation (reducing vibration transfer by up to 90%) and precise angle adjustment capabilities has further strengthened the position of ceiling-mounted fixtures, particularly in environments experiencing significant mechanical vibration, such as mining operations and heavy manufacturing facilities. Additionally, ceiling mounting facilitates easier heat dissipation through natural convection, extending component lifespan by 15–25% compared to wall-mounted alternatives in similar environments, while also simplifying maintenance access through standardized mounting heights and positions across industrial facilities.

The pole mounted segment is experiencing the fastest growth rate. This accelerated growth is primarily driven by the expanding outdoor applications in hazardous environments, particularly in oil and gas extraction sites, chemical storage facilities, and wastewater treatment plants where illumination must cover extensive areas while maintaining explosion-proof integrity. The development of composite and reinforced mounting poles capable of withstanding wind loads exceeding 150 mph while maintaining structural integrity in corrosive environments has significantly expanded their deployment. Furthermore, the integration of solar power capabilities with pole-mounted explosion-proof fixtures has revolutionized applications in remote locations, eliminating approximately USD 25,000– USD 40,000 per kilometer in trenching and wiring costs while providing autonomous operation. The ability to cluster multiple fixtures on a single pole at various heights and orientations has also improved lighting design flexibility for complex outdoor hazardous areas, contributing significantly to this installation type's rapid market expansion.

Explosion-Proof Light Fixtures Market Assessment by End-Use Industry Outlook

The global explosion-proof light fixtures market segmentation, based on installation type, includes oil & gas, mining, chemical & pharmaceutical, marine & shipbuilding, power generation, food & beverage, waste & water treatment, aerospace & defense, and others. The oil & gas industry holds the largest market share, accounting for approximately 30–35% of the total explosion-proof light fixtures market value. This dominance is propelled by the industry's extensive hazardous area classifications covering extraction platforms, refineries, storage facilities, and distribution networks—environments where flammable gases, vapors, and liquids present persistent explosion risks requiring Class I Division 1 and Division 2 rated fixtures. The substantial scale of oil and gas operations, with typical refineries utilizing 2,000–3,500 explosion-proof fixtures across various process areas, creates significant volume demand. Additionally, the industry's stringent safety protocols, driven by both regulatory requirements and high-profile incidents, have established comprehensive lighting specifications that typically exceed minimum regulatory standards by 15–25%, resulting in higher-value fixture deployments with advanced safety features, redundancy systems, and certification requirements that further boost the segment's market value.

The chemical & pharmaceutical segment is witnessing the fastest growth rate. This exceptional growth is driven by the rapid expansion of pharmaceutical manufacturing facilities worldwide, particularly in Asia Pacific and North America, with capital investments increasing approximately by 12–15% annually. The increasingly stringent regulatory framework governing GMP (Good Manufacturing Practices) environments has elevated lighting requirements beyond basic explosion protection to include particulate control, chemical resistance, and cleanability standards—capabilities delivered by next-generation explosion-proof fixtures. Furthermore, the chemical industry's transition toward automated and continuous production processes has increased the deployment density of explosion-proof fixtures by approximately 25–30% compared to traditional batch processing facilities, as these modern operations require comprehensive illumination for monitoring systems and safety verification. The industry's growing focus on energy efficiency and sustainability initiatives has also accelerated replacement cycles of older fixtures, with approximately 65–70% of chemical and pharmaceutical facilities planning lighting infrastructure upgrades within the next five years.

Explosion-Proof Light Fixtures Market Regional Analysis

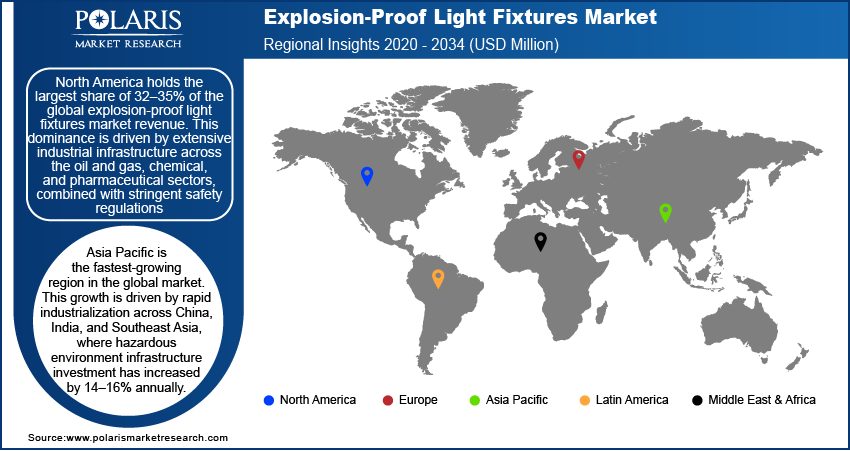

By region, the study provides explosion-proof light fixtures market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of 32–35% in the global explosion-proof light fixtures market. This dominance is driven by extensive industrial infrastructure across the oil and gas, chemical, and pharmaceutical sectors, combined with the imposition of stringent safety regulations such as NFPA 70 and UL 844 standards. The region's manufacturers have leveraged this regulatory environment to develop specialized fixtures commanding 15–25% price premiums over standard industrial lighting. Annual capital investments of USD 85–95 billion in industrial facility modernization have created substantial replacement demand for energy-efficient explosion-proof alternatives.

The US dominates the North American market by holding 75–80% of regional market value share with its massive industrial base of 135+ oil refineries and 13,000+ chemical manufacturing facilities. OSHA's strict enforcement, including penalties up to USD145,027 per willful violation, has accelerated the adoption of certified explosion-proof light fixtures. The US facilities implement new lighting technologies 12–18 months ahead of global counterparts, particularly IIoT-connected fixtures with remote monitoring capabilities. Recent investments of $35-40 billion in chemical plant expansions (2023) have created significant opportunities for advanced explosion-proof lighting systems.

Asia Pacific is the fastest-growing region driven by rapid industrialization across China, India, and Southeast Asia, where hazardous environment infrastructure investment has increased 14–16% annually. The region has seen significant expansion in petrochemical and pharmaceutical manufacturing, with 150+ major facilities under construction. Regulatory frameworks have evolved toward international alignment with IECEx and ATEX standards, creating structured demand for certified solutions. The focus on energy efficiency has positioned LED explosion-proof fixtures (offering 60–70% energy reductions) as standard specifications rather than premium options.

Explosion-Proof Light Fixtures Market Players & Competitive Analysis Report

The competitive landscape of the explosion-proof light fixtures market is characterized by global leaders and regional players competing through technological innovation, strategic partnerships, and market expansion initiatives. The market is highly competitive, featuring a mix of global industrial giants, specialized explosion protection firms, and regional manufacturers. Established players such as Eaton, Emerson, ABB, and Hubbell dominate the market through extensive distribution networks, strong brand credibility, and comprehensive product portfolios that extend beyond lighting to include complete hazardous environment solutions. These companies cater to industries such as oil & gas, chemical processing, and pharmaceuticals, where safety certifications and regulatory compliance are critical. Meanwhile, lighting-focused firms and specialized explosion protection companies differentiate themselves through technological innovation, customization, and expertise in hazardous environment requirements.

The explosion-proof light fixtures market is shaped by the ongoing shift from traditional lighting to LED-based explosion-proof solutions. This transition has allowed lighting specialists such as Signify and Dialight to gain market share by leveraging energy efficiency and advanced illumination technology. At the same time, traditional explosion protection firms emphasize their deep regulatory knowledge and safety expertise, positioning themselves as reliable partners for high-risk applications.

ABB Group is a Swiss-Swedish multinational corporation specializing in electrification, automation, robotics, and industrial solutions. Headquartered in Zurich, Switzerland, ABB operates in over 100 countries, serving industries such as energy, manufacturing, and transportation. The company is a leader in industrial automation and smart electrical systems, leveraging advanced technology to enhance efficiency and sustainability. In the explosion-proof light fixtures market, ABB provides integrated lighting solutions as part of its broader hazardous environment offerings. Its explosion-proof lighting products are designed for heavy industrial applications, including oil & gas, chemical processing, and mining, ensuring compliance with stringent safety standards. ABB’s strong global presence and expertise in electrical infrastructure give it a competitive edge, particularly in projects requiring comprehensive hazardous location solutions. The company continues to innovate in LED-based explosion-proof lighting, integrating smart monitoring systems to improve operational safety and energy efficiency in hazardous environments.

Acuity Brands is a leading American lighting and building management solution provider, headquartered in Atlanta, Georgia. The company specializes in advanced lighting technologies, including LED systems, intelligent lighting controls, and IoT-enabled solutions for commercial, industrial, and residential applications. Acuity Brands has a strong presence in North America and is known for its innovation-driven approach in lighting design and smart infrastructure. In the explosion-proof light fixtures market, Acuity Brands offers hazardous location lighting through its Holophane and Lithonia brands. These solutions are widely used in industrial settings such as chemical plants, manufacturing facilities, and warehouses where safety and durability are critical. The company’s expertise in LED technology and intelligent lighting systems gives it a competitive advantage in energy-efficient explosion-proof lighting. Acuity Brands focuses on integrating smart controls with its hazardous location lighting solutions, enhancing safety, operational efficiency, and compliance with industrial safety standards.

List of Key Companies in the Explosion-Proof Light Fixtures Market

- ABB Group

- Acuity Brands

- Chalmit Lighting (Hubbell)

- Cooper Crouse-Hinds (Eaton)

- Dialight plc

- Emerson Electric Co.

- GE Current

- Glamox AS

- Kenall Manufacturing

- Larson Electronics

- LDPI Lighting

- Nemalux Inc.

- Philips Lighting (Signify)

- Phoenix Products Company

- R. STAHL AG

- Western Technology

Explosion-Proof Light Fixtures Industry Developments

In March 2024, GRINSAFE lighting manufacturer launched eight explosion-proof lighting products. Seven have received the prestigious UL844 certification, and one is certified under ATEX, reinforcing GRINSAFE's position as an industry leader in safety and innovation.

In January 2023, ARCHON Industries launched new explosion-proof light, EX20-100, designed for hazardous and non-hazardous industrial environments. It was built with high-power LEDs and is UL listed for use in the US and Canada.

In December 2021, a complete line of LED explosion-proof lights was launched by Access Fixtures, meeting industrial safety standards. Designed for hazardous locations, these fixtures were praised for efficiency, durability, and cost-effectiveness.

Explosion-Proof Light Fixtures Market Segmentation

By Light Source Outlook (Revenue – USD Million, 2020–2034)

- LED

- Fluorescent

- Incandescent

- Others

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Linear Explosion-Proof Lights

- High Bay & Low Bay Explosion-Proof Lights

- Flood & Area Explosion-Proof Lights

- Portable Explosion-Proof Lights

- Emergency & Exit Explosion-Proof Lights

- Others

By Material Type Outlook (Revenue – USD Million, 2020–2034)

- Aluminum

- Stainless Steel

- Polycarbonate

- Fiberglass-Reinforced Plastic (FRP)

- Others

By Installation Type Outlook (Revenue – USD Million, 2020–2034)

- Ceiling Mounted

- Wall Mounted

- Pole Mounted

- Hanging/Pendant Mounted

- Others

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- Oil & Gas

- Mining

- Chemical & Pharmaceutical

- Marine & Shipbuilding

- Power Generation

- Food & Beverage

- Waste & Water Treatment

- Aerospace & Defense

- Others

By Distribution Channel Outlook (Revenue – USD Million, 2020–2034)

- Direct Sales

- Distributor/Wholesaler Networks

- Online Sales

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Explosion-Proof Light Fixtures Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 381.21 million |

|

Market Size Value in 2025 |

USD 405.99 million |

|

Revenue Forecast by 2034 |

USD 733.93 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global explosion-proof light fixtures market size was valued at USD 381.21 million in 2024 and is projected to grow to USD 733.93 million by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

In 2024, North America held the largest market share of 32–35% in the global explosion-proof light fixtures market. This dominance is attributed to extensive industrial infrastructure across the oil & gas, chemical, and pharmaceutical sectors, combined with stringent safety regulations.

A few of the key players in the market are ABB Group, Acuity Brands, Chalmit Lighting (Hubbell), Cooper Crouse-Hinds (Eaton), Dialight plc, Emerson Electric Co., GE Current, Glamox AS, Kenall Manufacturing, Larson Electronics, LDPI Lighting, Nemalux Inc., Philips Lighting (Signify), Phoenix Products Company, R. STAHL AG, and Western Technology.

In 2024, the LED explosion-proof light fixtures segment accounted for the largest market share due to LED's superior energy efficiency, with fixtures consuming up to 80% less power compared to traditional incandescent alternatives while offering lifespans exceeding 50,000 hours.

In 2024, the high bay & low bay explosion-proof lights segment accounted for the largest market share.