EVA Solar Films Market Size, Share, Trends, Industry Analysis Report: By Type (Normal EVA Films, Anti-PID EVA Films, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM5066

- Base Year: 2023

- Historical Data: 2019-2022

EVA Solar Films Market Outlook

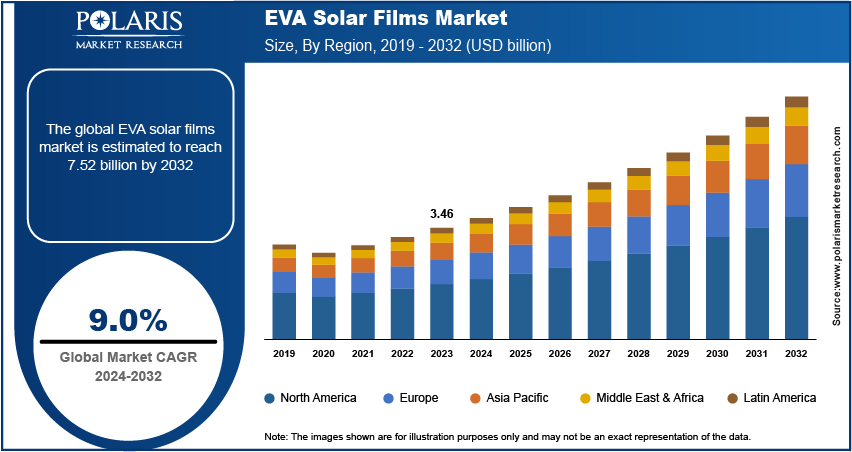

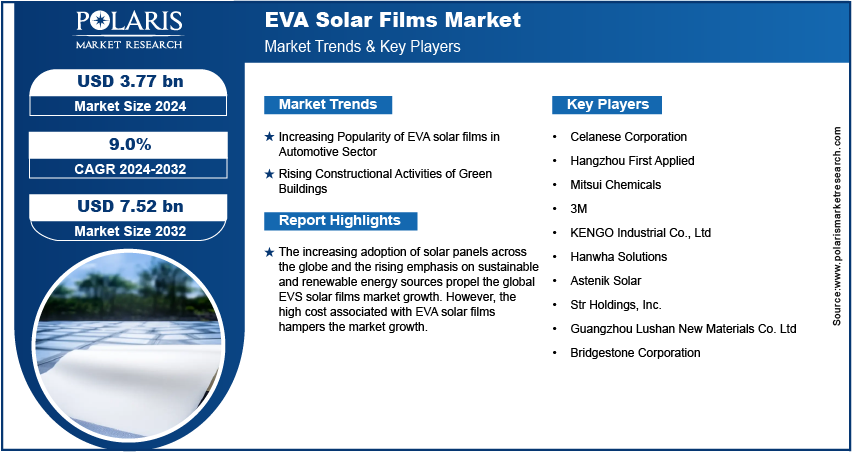

The EVA solar films market size was valued at USD 3.46 billion in 2023. The market is anticipated to grow from USD 3.77 billion in 2024 to USD 7.52 billion by 2032, exhibiting a CAGR of 9.0% during 2024–2032.

EVA Solar Films Market Overview

The increasing adoption of solar panels across the globe drives the global EVA solar films market. Ethylene-Vinyl Acetate (EVA) solar films are a crucial part of photovoltaic (PV) panels. They act as an encapsulant, providing insulation and protecting the solar cells from environmental damage such as moisture, UV radiation, and mechanical impacts. Therefore, the increasing installation of solar panels fuels the need for EVA solar films.

To Understand More About this Research: Request a Free Sample Report

The rising emphasis on sustainable and renewable energy sources propels the global EVS solar films market. The shift toward renewable energy often involves expanding solar energy markets into new regions and applications. This global expansion leads to increased installations of solar panels and consequently, a greater need for EVA films to meet the growing demand as EVA films are essential components of solar panels used to protect and stabilize the solar cells.

EVA Solar Films Market Drivers and Opportunities

Rising Constructional Activities of Green Buildings

There are rising constructional activities of green buildings across the world. As per a published report, there are over 105,000 LEED-certified green buildings in 185 countries worldwide. Green buildings prioritize the use of renewable energy sources to reduce their environmental footprint. Solar panels, which require EVA films as crucial encapsulants, are a key component of these energy-efficient buildings. Therefore, the surging construction activities of green buildings drive the global EVA solar films market.

Increasing Popularity EVA solar films in Automotive Sector

Integrating solar technology into vehicles has become a prominent trend as automotive manufacturers seek innovative ways to enhance vehicle efficiency and reduce carbon footprints. EVA films are essential in these applications, serving as encapsulants that protect and enhance the performance of solar panels installed on vehicles. This growing adoption of solar panels in automotive design directly fuels the demand for EVA films. Thus, the increasing popularity of EVA solar films in the automotive sector is expected to create an immense opportunity for the market during the forecast period.

EVA Solar Films Market Restraint

High Cost of EVA Solar Films

EVA films are a fundamental component of solar panels, serving as an encapsulant to protect and enhance the performance of solar cells. When the cost of these films is high, it directly increases the production costs of solar panels. Higher panel costs make solar energy systems more expensive, which may deter potential buyers, particularly in price-sensitive markets or among cost-conscious consumers, thereby impeding market growth.

Report Segmentation

The EVA solar films market is primarily segmented on the basis of type, application, and region.

|

By Type |

By Applications |

By Region |

|

|

|

By Type Analysis

Normal EVA Films Segment Accounted for Largest Market Share In 2023

The normal EVA films segment held the largest revenue share in the EVA solar films market in 2023. This dominance is primarily attributed to their established role as the standard encapsulant in solar panel production. Normal EVA films are widely utilized as they effectively protect solar cells from environmental damage, such as moisture and UV radiation, and offer reliable adhesion. Additionally, the established infrastructure and production processes for these films contribute to their dominant market share, as they meet the general needs of the solar industry efficiently and economically.

The anti-PID (Potential Induced Degradation) EVA films segment is projected to register a significant CAGR during the forecast period, owing to their ability to offer superior protection against PID, which significantly impacts the efficiency and lifespan of solar panels. Furthermore, as manufacturers and developers seek to comply with stringent performance and warranty standards, the adoption of anti-PID films is expected to rise, making them a key component in the evolving landscape of solar energy solutions.

By Application Analysis

Crystalline Solar Cells Segment Accounted for Major Market Share in 2023

The crystalline solar cells segment held a major market share in 2023 due to their widespread use and established technology. Crystalline silicon solar cells, which include monocrystalline and polycrystalline types, dominate the market due to their high efficiency and long-term reliability. These cells benefit from a well-developed manufacturing infrastructure and extensive research, which has optimized their performance over time. The broad adoption of crystalline solar cells in residential, commercial, and utility-scale solar installations contributes to their significant market share.

The thin-film solar cells segment is projected to grow at a rapid pace during the forecast period owing to their flexibility, lightweight properties, and potentially lower production costs compared to traditional crystalline cells. Innovations in thin film technology, including improvements in materials and manufacturing processes, enhance the efficiency and performance of these cells, making them more competitive. Additionally, their adaptability for applications in unconventional spaces, such as building-integrated photovoltaics (BIPV) and portable solar solutions, expands their market potential.

Regional Insights

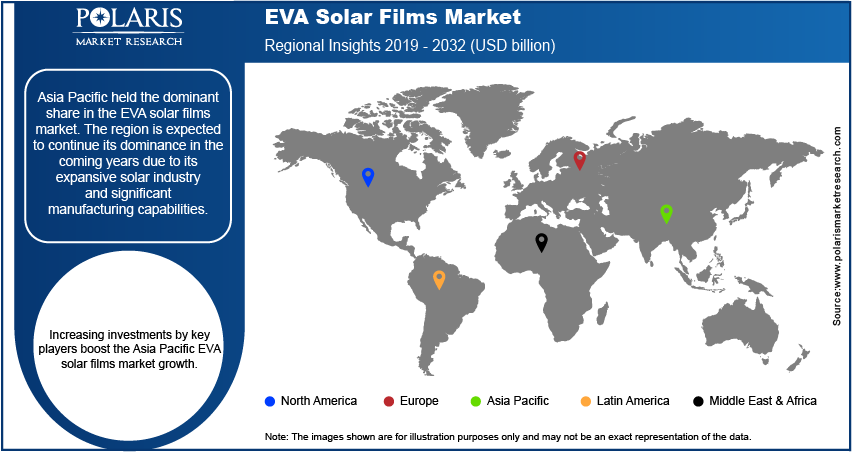

Asia Pacific Registered Largest Share of Global Market in 2023

Asia Pacific held the dominant share of the EVA solar films market and is expected to continue its dominance in the coming years. This is due to its expansive solar industry and significant manufacturing capabilities. Countries such as China and India dominate the regional market, with China leading as the world’s largest producer and consumer of solar technology. The rapid growth in solar installations across Asia Pacific, driven by government policies supporting renewable energy, substantial investments in solar infrastructure, and favorable climatic conditions, fuels the high demand for encapsulant materials such as EVA solar films. In March 2024, Eastern Shenghong launched a new project of construction of the world’s largest manufacturing plant for three solar EVA facilities, with a total budget of 21.6 billion RMB. Increasing investments by key players further boosts the region’s growth.

Key Market Players and Competitive Insights

Major market players are investing heavily in research and development to expand their offerings, which will fuel the EVA solar films market growth in the coming years. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments, including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the EVA solar films market are Hangzhou First Applied; Mitsui Chemicals; 3M; KENGO Industrial Co., Ltd; and Celanese Corporation.

List of Major Players Operating in Global EVA Solar Films Market

- Celanese Corporation

- Hangzhou First Applied

- Mitsui Chemicals

- 3M

- KENGO Industrial Co., Ltd

- Hanwha Solutions

- Astenik Solar

- Str Holdings, Inc.

- Guangzhou Lushan New Materials Co. Ltd

- Bridgestone Corporation

Recent Developments in Industry

- In February 2023, Celanese Corporation, a global specialty materials and chemical company, announced the completion of an ultra-low capital project to repurpose existing manufacturing and infrastructure assets to unlock additional ethylene vinyl acetate (EVA) capacity at its Edmonton, Alberta facility.

- In October 2022, Hanwha Solutions, announced to invest a total of USD545.6 million into South Korea's solar energy industry as a preemptive response to the growing global solar market.

Report Coverage

The EVA solar films market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction across the world. Furthermore, it covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, region, and futuristic opportunities.

EVA Solar Films Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.77 billion |

|

Revenue Forecast in 2032 |

USD 7.52 billion |

|

CAGR |

9.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global EVA solar films market size was valued at USD 3.77 billion in 2023 and is projected to grow to USD 7.52 billion by 2032.

The global market is projected to grow at a CAGR of 9.0% during the forecast period

Asia Pacific accounted for the largest share of the global market in 2023

Celanese Corporation; Hangzhou First Applied; Mitsui Chemicals; 3M; KENGO Industrial Co., Ltd; Hanwha Solutions; Astenik Solar; Str Holdings, Inc.; Guangzhou Lushan New Materials Co. Ltd; and Bridgestone Corporation are among the key players in the market.

The anti-PID EVA solar films type segment is projected for significant growth in the global market during 2024–2032.

The crystalline solar cells segment dominated the market in 2023.