EV Connector Market Share, Size, Trends, Industry Analysis Report, By Component (Housing, Terminal, Lock, Other Components); By Voltage; By System type; By Propulsion; By Application; By Connection type; By Region; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4525

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

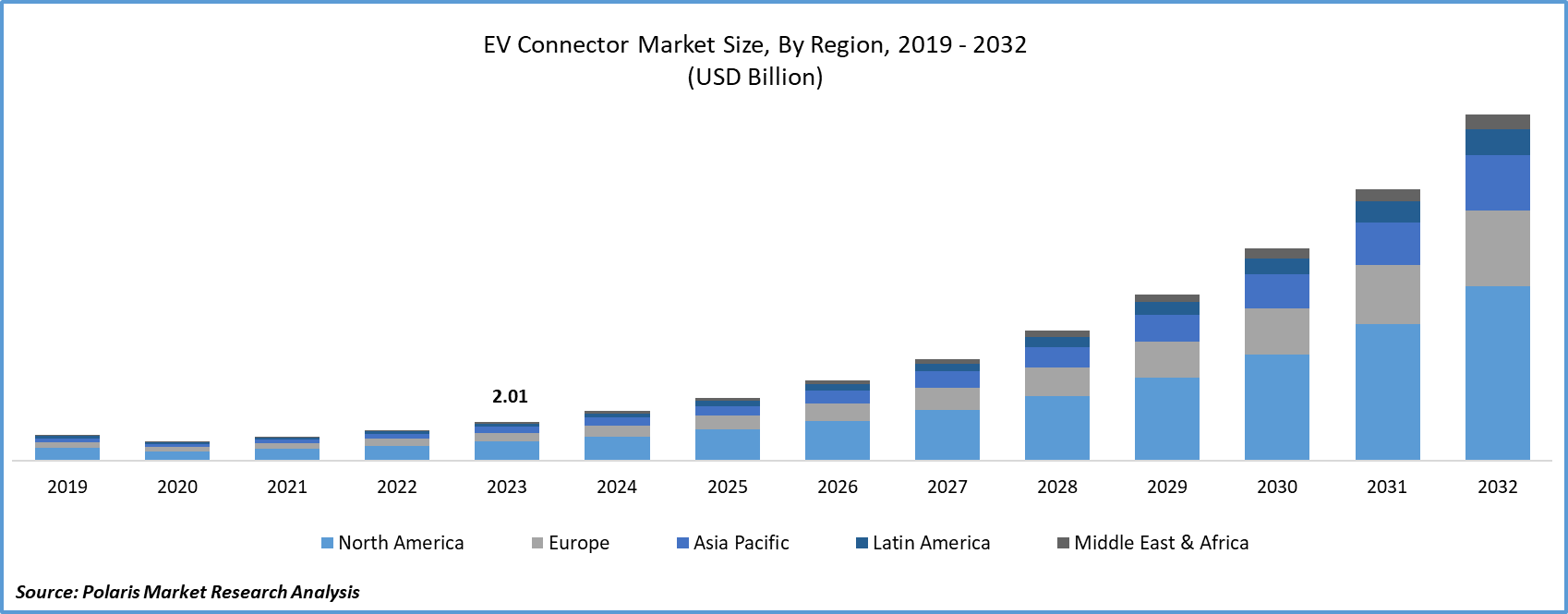

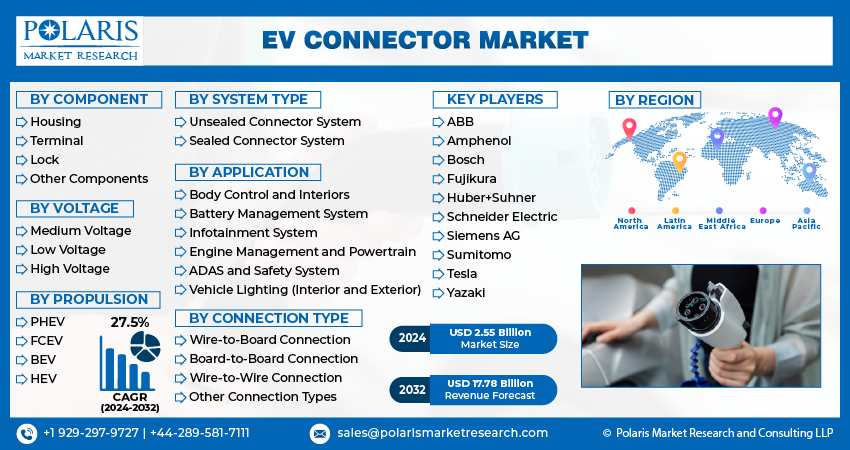

EV Connector Market size was valued at USD 2.01 billion in 2023. The market is anticipated to grow from USD 2.55 billion in 2024 to USD 17.78 billion by 2032, exhibiting the CAGR of 27.5% during the forecast period

EV Connector Market Overview

A connector is employed to deliver electrical energy from the charging station to the battery pack. The charging connector facilitates the flow of electricity from the charging station to the battery pack. In its structure, a charging connector shares similarities with a charging cable used for mobile phones, incorporating both a wall connector and a phone-side connector. Likewise, the charging connector for an electric vehicle's battery pack comprises a vehicle-side connector and a charger plug connector. The predominant type of electric vehicle charging stations globally is the Grid-to-Vehicle (G2V) variety, enabling charge transfer in a single direction.

The shift to electrification necessitates a fresh perspective on automotive design, underscoring the crucial role of high-quality automotive connectors in driving innovation. These connectors ensure the reliable distribution of power across various electrical systems, spanning from the battery and powertrain to dashboard electronics and specialized equipment. Moreover, they play a vital role in maintaining operational functionality in the event of faults, allowing systems to remain operational even in the case of isolated failures. The EV Charging Station can operate on either AC or DC power, and the classification of EV charging connectors is determined by the power source utilized.

Establishing an inclusive public charging infrastructure is crucial for achieving widespread adoption of electric vehicles (EVs). Public charging plays a vital role for EV owners residing in multi-unit complexes or without private driveways. Furthermore, for longer drives and the need to charge on the go, EV owners will rely on charging infrastructure along highways and driveways. Anticipated advancements in battery technology and increased investments from major stakeholders in charging networks are expected to drive growth in the global electric vehicle connectors market. Beyond government initiatives and incentives for installing EV charging stations, key players in the EV market are making substantial investments to develop charging networks in regions with high sales.

To Understand More About this Research: Request a Free Sample Report

With the expansion of the electric vehicle (EV) market, there is a rising demand for vehicle-to-everything (V2X) charging connector solutions. The growing adoption of EVs underscores the significance of robust connectors capable of supporting EV charging, shaping the future automotive landscape, and contributing to grid and residential energy systems. Consequently, the escalating demand for V2X solutions is anticipated to enhance the applications and utilization of EV connectors across EV and related sectors, presenting an opportunity for the global electric vehicle connectors market.

EV Connector Market Dynamics

Market Drivers

Government support and initiatives are bolstering the growth of the EV connector market.

Electric vehicle connectors play a crucial role in ensuring the seamless power transfer and charging process between the vehicle and the charging station. The global market for electric vehicle (EV) connectors has experienced remarkable growth in recent years, propelled by factors such as robust government support and initiatives. The crucial role of government support and initiatives is evident in the significant boost provided to the global electric vehicle connectors market. Governments across the globe have implemented policies and incentives aimed at fostering electric vehicle adoption and bolstering the development of charging infrastructure.

For instance, the European Union (EU), has set ambitious targets to reduce carbon emissions, including the goal of achieving carbon neutrality by 2050. In alignment with this objective, the EU has introduced regulations and funding programs to expedite the deployment of EV charging infrastructure. As reported by the European Alternative Fuels Observatory (EAFO), the number of public EV charging points in the EU surged by 35% in 2020, surpassing 250,000. Such proactive government initiatives fuel the demand for electric vehicle connectors, meeting the expanding requirements of the growing charging infrastructure.

Market Restraints

Variations in the prices of raw materials are likely to hamper the growth of the market.

EV connectors are crafted from a blend of materials selected for their specific properties to fulfill the electrical and mechanical requisites of the connectors. The primary materials utilized in automotive connectors encompass metals, plastics, alloys, and coatings.

The prices of metals, particularly copper and aluminum, wield a significant influence on production costs. Escalating prices of these materials amplify the overall manufacturing expenses of EV connectors. Manufacturers may encounter challenges in preserving profit margins, especially if they are unable to pass on these heightened costs to customers, such as automotive OEMs. This volatility in material prices can precipitate disruptions in the supply chain as well. Surges in prices or shortages may disrupt the production timelines of connector manufacturers, leading to delays in delivering components to automotive OEMs. Consequently, this affects the overall manufacturing efficiency within the automotive industry.

Raw material prices exert an impact on the competitive landscape of the EV connector market. Global fluctuations in raw material and commodity prices diminish product competitiveness and have an adverse impact on profit margins. Manufacturers of automotive connectors rely on Tier II suppliers for raw materials like brass, copper, aluminum, and plastic connectors such as nylon 6 and Polybutylene Terephthalate (PBT). Moreover, any variance in the quality and price of raw materials impinges on profitability, posing a challenge for automotive connector manufacturers. Those adept at efficiently managing and mitigating the repercussions of material cost fluctuations may gain a competitive edge. Pricing strategies become pivotal, necessitating a delicate balance between competitive pricing and the imperative to cover production costs, especially during periods of volatile raw material prices. Consequently, an upswing in raw material prices directly constrains the profit margins of manufacturers, thereby impeding the EV connector market.

Report Segmentation

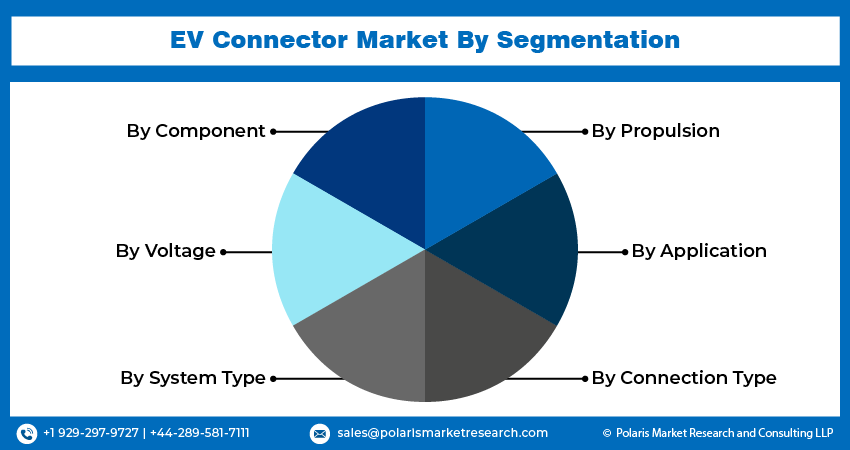

The market is primarily segmented based on component, voltage, system type, propulsion, application, connection type, and region.

|

By Component |

By Voltage |

By System Type |

By Propulsion |

By Application |

By Connection Type |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

EV Connector Market Segmental Analysis

By Application Analysis

- Battery management systems hold the largest share in 2023. These play a crucial role in ensuring optimal battery performance and extending its useful lifespan. They monitor key operational parameters, including current, voltage, and internal temperature, thereby alleviating stress on the battery by delivering the precise amount of power required by the electric vehicle's motor. Key functions of battery management systems encompass power optimization, damage minimization, and control over the battery's charging and discharging processes. In the context of Electric Vehicle (EV) connectors within the Battery Management System (BMS), they serve various critical functions such as cell monitoring, temperature sensing, voltage measurement, communication with vehicle control systems, and power distribution. EV connectors in the BMS link the monitoring circuitry of each cell to the BMS, facilitating the individual monitoring of voltage, temperature, and other parameters for each cell. Consequently, the growing production and sales of EVs are expected to drive the demand for EV connectors. Automotive Original Equipment Manufacturers (OEMs) globally are also directing their efforts toward increasing the production of electric vehicles.

For instance, in June 2023, Toyota Motor Corporation (Japan) revealed plans to globally launch next-generation Battery Electric Vehicles (BEVs) and achieve a full lineup by 2026. Connector manufacturers like Japan Aviation Electronics Industry, Ltd. (Japan), TE Connectivity (Switzerland), Hirose Electric Co., Ltd. (Japan), and Amphenol Corporation provide a range of high-voltage connectors and connector series utilized in battery management systems. These developments are anticipated to contribute to the revenue growth of the battery management systems segment within the EV connector market throughout the forecast period.

By Propulsion Analysis

- The Battery Electric Vehicle (BEV) segment is anticipated to dominate a larger share of the EV connector market throughout the forecast period. BEVs necessitate a greater quantity of EV connectors compared to traditional gasoline vehicles, propelled by the intricate electrical systems inherent in BEVs, which encompass electric motors, high-voltage batteries, and various actuators and sensors. EV connectors play a pivotal role in facilitating the seamless transmission of power and data among diverse components in the BEV, ensuring reliable and efficient operation. The increasing popularity of electric vehicles (EVs) in the automotive industry has led to a heightened demand for robust battery management systems (BMS) aimed at monitoring battery cell conditions and optimizing their potential. According to the International Energy Agency (IEA), BEV car sales surged from 4.6 million units in 2021 to 7.3 million units in 2022. This upward trajectory in BEV prevalence aligns directly with the escalating demand for EV connectors, contributing to the market's expansion.

EV Connector Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

Asia Pacific stands at the forefront of the global EV market, notably with China contributing to over half of the global EV sales. The region's swift adoption of electric vehicles, propelled by government incentives, escalating fuel prices, and a heightened environmental consciousness, is a driving force behind the escalating demand for EV-specific connectors. Prominent automotive manufacturers in the Asia Pacific, including Toyota Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), and Hyundai Motor Company (South Korea), are capitalizing on the burgeoning growth of EVs in the region. Toyota, for instance, plans to introduce ten new battery electric vehicle models by 2026 as of April 2023. In the realm of electric vehicles, EV connectors play a pivotal role in facilitating safe, efficient, and reliable operation by executing functions like power transmission, data communication, and safety measures. Consequently, the increasing prevalence of EVs in the Asia Pacific region is expected to bolster the market growth for EV connectors.

North America is anticipated to witness substantial growth opportunities in the EV connector market. The region boasts key Tier I suppliers of EV connectors, including Molex (US), TE Connectivity Ltd. (Switzerland), and Amphenol (US), among others. Consequently, the prevalence of leading EV connector manufacturers positions the region as a catalyst for the continued expansion of the EV connector market.

Competitive Landscape

The EV Connector market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB

- Amphenol

- Bosch

- Fujikura

- Huber+Suhner

- Schneider Electric

- Siemens AG

- Sumitomo

- Tesla

- Yazaki

Recent Developments

- In November 2023, Japan Aviation Electronics Industry, Ltd. unveiled the MX81 Series, a compact connector designed for in-vehicle electronic devices, including ECUs, lighting, sensors, and various other in-vehicle applications, featuring a non-waterproof design.

- In September 2023, Yazaki Corporation (Yazaki) declared that Yazaki Egypt had acquired a 67,000-square-meter area in the Fayoum investment-free zone to enhance the manufacturing capacity for wire harnesses and electrical systems.

- In August 2023, Sumitomo Electric Wiring Systems disclosed an investment of around USD 10.0 million in the production of harnesses, marking its status as the inaugural Tier 1 automotive company to establish operations in Tabasco, Mexico.

Report Coverage

The EV Connector market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, voltage, system type, propulsion, application, connection type, and their futuristic growth opportunities.

EV Connector Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.55 billion |

|

Revenue forecast in 2032 |

USD 17.78 billion |

|

CAGR |

27.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Voltage, By System type, By Propulsion, By Application, By Connection type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Uncover the dynamics of the EV Connector sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Scooters Market Size, Share 2024 Research Report

Trim Tabs Market Size, Share 2024 Research Report

Universal Remote Controls Market Size, Share 2024 Research Report

Seed Cracker Market Size, Share 2024 Research Report

Subcutaneous Immunoglobulin Market Size, Share 2024 Research Report

FAQ's

The EV Connector Market report covering key segments are component, voltage, system type, propulsion, application, connection type, and region.

EV Connector Market Size Worth $17.78 Billion By 2032

EV Connector Market exhibiting the CAGR of 27.5% during the forecast period

Asia Pacific is leading the global market

key driving factors in EV Connector Market are Government support and initiatives are bolstering the growth of the intumescent coatings market