EV Composites Market Size, Share, Trends, Industry Analysis Report: By Fiber Type (Glass Fiber, Carbon Fiber, and Others), Resin Type, Type, Manufacturing Process, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 115

- Format: PDF

- Report ID: PM5168

- Base Year: 2024

- Historical Data: 2020-2023

EV Composites Market Overview

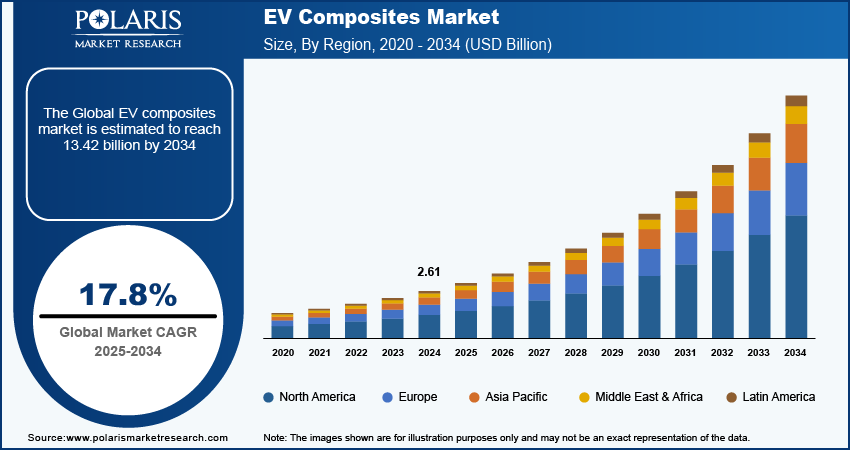

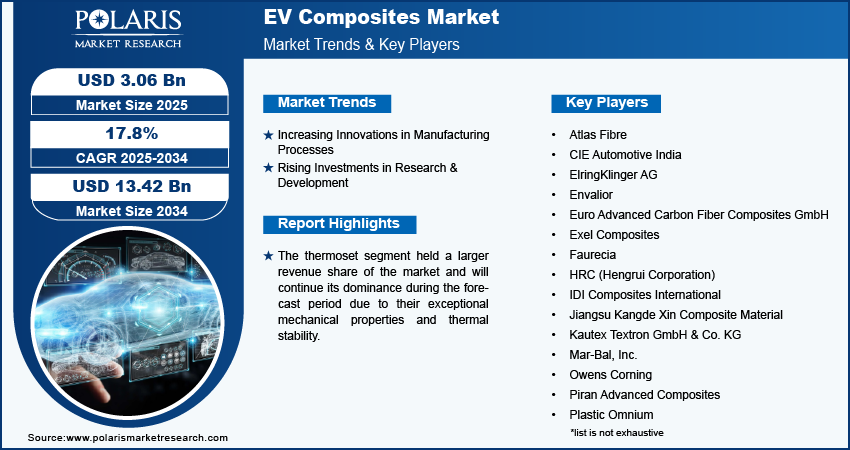

The EV composites market size was valued at USD 2.61 billion in 2024. The market is projected to grow from USD 3.06 billion in 2025 to USD 13.42 billion by 2034, exhibiting a CAGR of 17.8% during 2025–2034.

The EV composites market focuses on producing composite materials specifically designed for use in electric vehicles (EVs). These materials, which include combinations of fibers and resins, are crucial for enhancing the performance, efficiency, and safety of EVs.

The growing popularity of EVs is significantly driving the demand for composite materials. According to the International Energy Agency, electric car sales are expected to reach around 17 million units by the end of 2024, a notable increase from nearly 14 million in 2023. Consumers are increasingly opting for EVs due to environmental concerns and appealing incentives, leading to a heightened need for lightweight, high-performance components in these vehicles. Composites are essential for reducing vehicle weight and improving energy efficiency, making them vital for modern EV designs. As EV adoption continues to grow, the demand for composites in various vehicle parts is anticipated to rise in the coming years.

To Understand More About this Research: Request a Free Sample Report

EV manufacturers are increasingly turning to lightweight materials such as composites to boost energy efficiency and extend driving ranges. Composites have superior strength-to-weight ratios compared to traditional materials such as steel and aluminum. They are crucial for minimizing vehicle weight and improving overall performance. These benefits are driving market growth.

EV Composites Market Driver Analysis

Increasing Innovations in Manufacturing Processes

The EV composites market is witnessing recent advancements in manufacturing processes, including automated fiber placement (AFP) and automated tape laying (ATL). These technologies significantly enhance the efficiency and precision of composite production, allowing for more accurate and consistent layering of materials, which, in turn, improves the overall quality and performance of the final products. As a result, composites are becoming increasingly viable for large-scale production.

The capabilities offered by AFP and ATL make composite materials more suitable for mass production in EVs. Owing to these innovations, manufacturers can more easily integrate composites into various vehicle components, resulting in lighter, more durable, and high-performance EVs. In May 2021, the National Composites Centre in Bristol launched a new AFP-ATL cell that combines Automated Fiber Placement and Automated Tape Laying technologies for advanced, high-precision composite manufacturing. Therefore, increasing innovations in manufacturing processes drive the EV composites market growth.

Rising Investments in Research & Development

Automotive companies and material producers are advancing composite technologies, enhancing performance and affordability. There are rising investments in improving properties such as strength, durability, and weight reduction, crucial for EVs. These R&D efforts push technological boundaries and explore innovative applications, accelerating the development of composites that offer better energy efficiency, safety, and overall vehicle performance.

The infusion of capital into R&D fosters collaboration and funding between automotive manufacturers, material scientists, and technology developers. For instance, in January 2024, the Department of Energy invested USD 131 million to advance EV battery R&D and infrastructure, including projects on sustainable, lightweight composite vehicle components.

The continuous advancement of composite technologies, fueled by these investments, is essential to meet the increasing need for advanced, lightweight, and high-performance materials in EVs. The expanded capabilities and reduced costs of new composite materials are significantly driving the growth of the EV composites market.

EV Composites Market Segment Insights

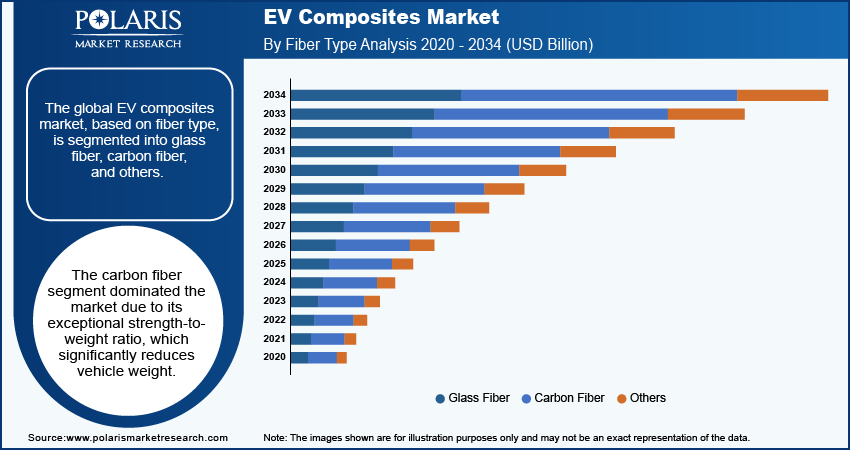

EV Composites Market Breakdown, by Fiber Type Insights

The global EV composites market, based on fiber type, is segmented into glass fiber, carbon fiber, and others. The carbon fiber segment dominated the market due to its exceptional strength-to-weight ratio, which significantly reduces vehicle weight. This reduction is crucial for enhancing energy efficiency and extending the driving range of EVs. Additionally, carbon fiber’s high strength and stiffness improve the structural integrity and safety of EVs, making it ideal for critical components such as chassis and body panels. In June 2024, Sinonus announced that it is advancing carbon fiber composites that double as structural batteries, promising weight reduction and enhanced efficiency for applications in aerospace, automotive, and IoT devices.

Carbon fiber composites offer design flexibility, allowing for innovative and aerodynamic shapes that further boost performance and efficiency. Further, advancements in manufacturing and economies of scale are gradually reducing costs, making carbon fiber a more accessible and appealing choice for EV manufacturers. This drives the EV composites market growth for the carbon fiber segment.

EV Composites Market Breakdown, by Application Insights

Based on application, the global EV composites market is bifurcated into thermoplastics and thermoset. The thermoset segment held a larger revenue share of the market and will continue its dominance during the forecast period due to their exceptional mechanical properties and thermal stability. Unlike thermoplastics, thermoset resins cure into a rigid, solid state, providing superior strength, durability, and impact resistance, which are crucial in EV applications. These resins also exhibit excellent thermal stability, enabling them to withstand high temperatures generated by electrical and propulsion systems, and they offer robust chemical resistance, which is vital for handling battery electrolytes and other corrosive substances.

Thermoset resins facilitate complex, high-performance designs owing to their ability to be molded into intricate shapes while preserving high dimensional stability and minimal creep over time. Their well-established manufacturing processes and widespread use across various industries have created a reliable supply chain, further reinforcing their leading position in the EV composites market.

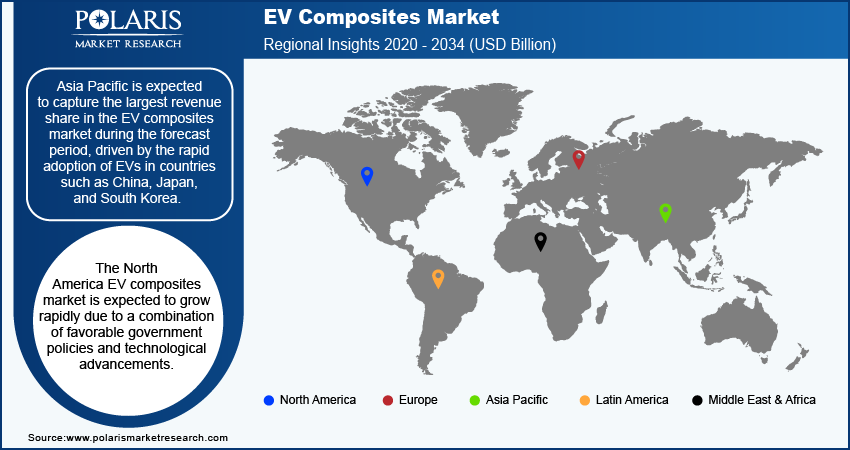

EV Composites Market – Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific Latin America, and the Middle East & Africa. Asia Pacific is expected to capture the largest revenue share in the EV composites market during the forecast period, driven by the rapid adoption of EVs in countries such as China, Japan, and South Korea. This growth is largely supported by government policies and incentives aimed at reducing emissions and improving air quality. These countries are leaders in EV adoption and the development of advanced materials and composites. According to the International Energy Agency (IEA), around 14 million EVs were sold globally in 2023, with China accounting for ∼59% of those sales.

The strong automotive industry of Asia Pacific, propelled by major manufacturers and suppliers, is heavily investing in EV technology and research and development. This has resulted in significant technological advancements, positioning Asia Pacific at the forefront of innovation in automotive materials, thereby driving the growth of the EV composites market in the region.

The North America EV composites market is expected to grow rapidly due to a combination of favorable government policies and technological advancements. Governments of the US and Canada are offering incentives and subsidies to promote EV adoption, which boosts demand for advanced materials. In Canada, the federal government provides incentives ranging from USD 2,500 to USD 5,000 for the purchase or lease of EVs. Additionally, many provinces offer incentives, which can be combined with federal rebates. For instance, Quebec residents can receive up to USD 7,000, and British Columbia offers up to USD 4,000 for eligible EVs.

Innovations in EV technology, such as improvements in battery efficiency and lightweight materials, drive the demand for high-performance composites that enhance vehicle range and performance.

EV Composites Market – Key Players and Competitive Insights

Key market players are making substantial investments in research and development to expand their product offerings, further driving growth of the EV composites market. Market participants are also undertaking a variety of strategic activities, including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations, to expand their global footprint. To expand and survive in a more competitive and rising market climate, the market players must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global EV composites industry to benefit clients and increase the market sector. In recent years, the EV composites industry has offered some technological advancements. A few major players in the EV composites market are Atlas Fibre; CIE Automotive India; ElringKlinger AG; Envalior; Euro Advanced Carbon Fiber Composites GmbH; Exel Composites; Faurecia, HRC (Hengrui Corporation); IDI Composites International; Jiangsu Kangde Xin Composite Material; Kautex Textron GmbH & Co. KG; Mar-Bal, Inc.; Owens Corning; Piran Advanced Composites; Plastic Omnium; POLYTEC HOLDING AG; Röchling SE & Co. KG; SGL Carbon; Syensqo; Teijin Limited; The Gund Company; Toray Industries, Inc.; TRB Lightweight Structures; and ZhongAo Carbon.

SGL Carbon is a company in carbon-based products and materials, specializing in specialty graphites and composites, with around 4,800 employees across 29 sites worldwide. The company operates in four main business units: Graphite Solutions, Process Technology, Carbon Fibers, and Composite Solutions, serving diverse markets such as mobility, energy, digitalization, and industrial applications. In March 2023, SGL Carbon unveiled SIGRAFIL C T50-4.9/235, a new high-strength, high-elongation 50k carbon fiber for pressure vessels and other demanding applications at JEC World 2023.

Toray Industries, Inc., founded in 1926 and headquartered in Tokyo, Japan, is a multinational corporation specializing in advanced materials across various sectors, including textiles, chemicals, carbon fiber composites, and life sciences. Originally focused on rayon yarn production, Toray serves in business segments, which include fibers and textiles, performance chemicals, and environmental engineering. In April 2024, the company showcased its latest innovations in engineering plastics, fibers, and composites, including advancements in EV mobility, infrastructure, and green energy storage, at NPE 2024 in Orlando.

Key Companies in EV Composites Market

- Atlas Fibre

- CIE Automotive India

- ElringKlinger AG

- Envalior

- Euro Advanced Carbon Fiber Composites GmbH

- Exel Composites

- Faurecia

- HRC (Hengrui Corporation)

- IDI Composites International

- Jiangsu Kangde Xin Composite Material

- Kautex Textron GmbH & Co. KG

- Mar-Bal, Inc.

- Owens Corning

- Piran Advanced Composites

- Plastic Omnium

- POLYTEC HOLDING AG

- Röchling SE & Co. KG

- SGL Carbon

- Syensqo

- Teijin Limited

- The Gund Company

- Toray Industries, Inc.

- TRB Lightweight Structures

- ZhongAo Carbon

EV Composites Industry Developments

May 2024: Lotte Chemical unveiled flame-retardant PP resins that delay thermal runaway in EV batteries, withstanding temperatures above 1,000°C for over 600 seconds.

April 2024: UBE Corporation launched new composite products made with recycled carbon fiber to reduce greenhouse gas emissions and enhance environmental sustainability.

March 2024: Hexcel introduced HexTow IM9 24K carbon fiber, a lightweight, high-strength material with 12% improved tensile strength for advanced aerospace applications.

EV Composites Market Segmentation

By Fiber Type Outlook (Revenue – USD Billion, 2020–2034)

- Glass Fiber

- Carbon Fiber

- Others

By Resin Type Outlook (Revenue – USD Billion, 2020–2034)

- Thermoplastics

- Thermoset

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Ultra-Premium

- Premium

- Non-Premium

By Manufacturing Process Outlook (Revenue – USD Billion, 2020–2034)

- Compression Molding

- Injection Molding

- RTM

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Interior

- Exterior

- Battery Enclosure

- Powertrain & Chassis

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

EV Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.61 Billion |

|

Market Size Value in 2025 |

USD 3.06 Billion |

|

Revenue Forecast by 2034 |

USD 13.42 Billion |

|

CAGR |

17.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global EV composites market size was valued at USD 2.61 billion in 2024 and is anticipated to reach USD 13.42 billion by 2034

The global market is projected to register a CAGR of 17.8% during 2025–2034.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Atlas Fibre; CIE Automotive India; ElringKlinger AG; Envalior; Euro Advanced Carbon Fiber Composites GmbH; Exel Composites; Faurecia, HRC (Hengrui Corporation); IDI Composites International; Jiangsu Kangde Xin Composite Material; Kautex Textron GmbH & Co. KG; Mar-Bal, Inc.; Owens Corning; Piran Advanced Composites; Plastic Omnium; POLYTEC HOLDING AG; Röchling SE & Co. KG; SGL Carbon; Syensqo; Teijin Limited; The Gund Company; Toray Industries, Inc.; TRB Lightweight Structures; and ZhongAo Carbon.

The carbon fiber segment dominated the market in 2024.

The thermoset segment accounted for a larger share of the global market in 2024.