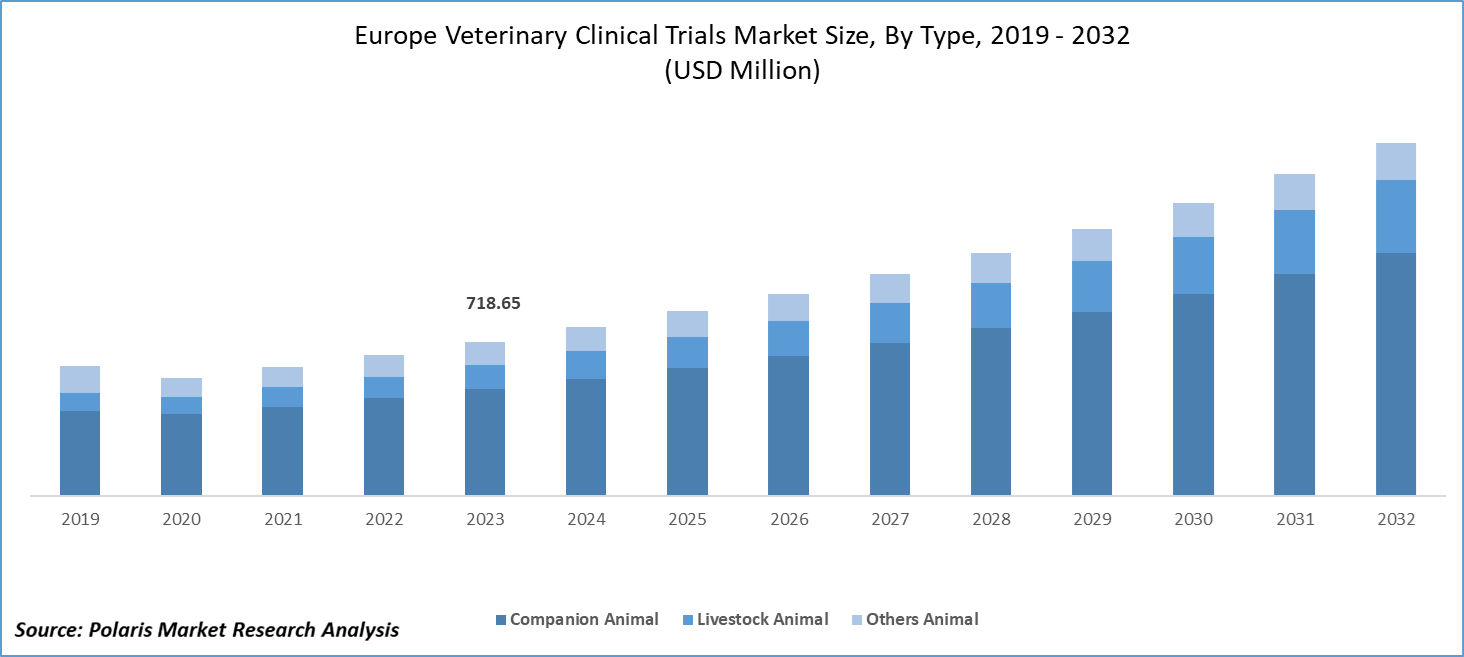

Europe Veterinary Clinical Trials Market Size, Share, Trends, Industry Analysis Report: Information By Animal Type (Livestock Animal, Companion Animal, Other Animals), By Intervention, By Indication, By End User, and By Country (Germany, France, UK, Italy, Spain, Netherlands, Russia, and the Rest of Europe) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 117

- Format: PDF

- Report ID: PM4997

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Europe veterinary clinical trials market size was valued at USD 718.65 million in 2023. The Europe veterinary clinical trials industry is projected to grow from USD 787.06 million in 2024 to USD 1,650.57 million by 2032, exhibiting a compound annual growth rate (CAGR) of 9.7% during the forecast period (2024 - 2032).

The Europe veterinary clinical trials market involves conducting research studies and trials to evaluate the safety, efficacy, and therapeutic benefits of veterinary medicines and treatments on animals. These trials are crucial for developing new medications, vaccines, diagnostic tools, and other animal healthcare products.

In Europe, the demand for veterinary clinical trials is driven by regulatory requirements, which increasingly mandate rigorous testing and documentation for veterinary products, necessitating clinical trials to meet these standards. Furthermore, ongoing advancements in veterinary science and technology fuel the need for clinical trials to validate and bring innovative treatments to the Europe veterinary clinical trials market.

To Understand More About this Research: Request a Free Sample Report

Furthermore, various companies across Europe are actively conducting numerous veterinary clinical trials for animal healthcare products. This trend underscores the increasing demand and necessity for veterinary clinical trials in the region.

For instance, ONDAX Scientific has extensive experience operating multiple veterinary clinical trials across a wide spectrum of animal diseases. Many veterinary products have achieved successful registration and authorization in Europe through centralized procedures, decentralized procedures, mutual recognition, and other regulatory pathways. This track contributes to making ONDAX Scientific a major European company specializing in the design and execution of clinical trials for animal health products. The majority of ONDAX Scientific's veterinary clinical trials adhere to Good Clinical Practice (VICH-GCP) guidelines aimed at securing registration for new pharmaceutical molecules, vaccines, or product claims. This research and development effort by European companies significantly boosts the demand for the Europe veterinary clinical trials market.

Europe Veterinary Clinical Trials Market Trends

Increasing Pet Ownership is Driving Market Growth

The Europe veterinary clinical trials market is growing with the rising pet ownership rates across Europe, alongside increasing awareness about pet health. As more households include pets in their lives, the need for advanced veterinary healthcare solutions correspondingly increases. Pet owners today are more invested in securing the health and well-being of their animals, often seeking out innovative treatments and therapies that contribute to an increase in the demand in the Europe veterinary clinical trials market.

According to a report from FEDIAF European Pet Food, pet ownership in Europe is experiencing healthy growth, with 91 million European households (46%) owning one or more of Europe’s 340 million pets. Cats (127 million) are the most popular pet in Europe, found in 26% of households, closely followed by dogs (104 million) in 25% of households.

This rising demand necessitates access to effective treatments that can address a wide range of health issues pets may face, from chronic conditions to acute illnesses. Consequently, the increasing rates of pet ownership and heightened awareness about pet health are key drivers of growth in the Europe veterinary clinical trials market.

Rising Regulatory Support

The increasing regulatory support drives the Europe veterinary clinical trials market. The European Medicines Agency (EMA) and other regulatory bodies have developed harmonized guidelines for veterinary clinical trials, making the approval and compliance process across Europe more efficient than ever.

Also, governments and regulatory bodies offer funding, grants, and tax incentives to promote research and development in veterinary medicine, encouraging companies to invest in clinical trials. Recognizing the importance of animal health in public health, regulatory bodies support initiatives aimed at controlling zoonotic diseases and ensuring food safety, driving the need for effective veterinary clinical trials.

Further, various key players are actively engaged in the research and development of veterinary products, which are gaining approval from regulatory bodies. This trend indicates the growth of the Europe veterinary clinical trials market.

For instance, in January 2024, Merck Animal Health announced that the European Commission (EC) approved BRAVECTO (fluralaner) 150 mg/ml powder and solvent for suspension for injection for dogs. The product is approved for the persistent and immediate killing of fleas (Ctenocephalides felis and Ctenocephalides canis) and for the continued killing of ticks from 3 days to 12 months after treatment. This approval indicates the rising innovation by companies, driving the Europe veterinary clinical trials market revenue.

Europe Veterinary Clinical Trials Market Segment Insights

Veterinary Clinical Trials Intervention Insights:

The Europe veterinary clinical trials market segmentation, based on intervention, includes medicines, medical devices, and others. In 2023, the medicines segment accounted for the largest market share. With increasing pet ownership rates and rising awareness about animal health, there is a growing demand for effective veterinary medicines to treat a wide range of conditions, ranging from chronic diseases to acute illnesses.

In addition, continuous innovation and development of new pharmaceutical products by companies have led to an increase in the number of clinical trials being conducted to test these medicines. This ensures that new and improved treatments are regularly introduced to the market.

Further, regulations passed by regulatory bodies becoming law indicate that companies are conducting extensive research into veterinary medicines. This rigorous research and development process is essential for meeting regulatory standards, and it subsequently drives the need for clinical trials to ensure the safety and efficacy of new veterinary medicines.

For instance, according to the Organisation for Professionals in Regulatory Affairs Ltd., the European Union’s (EU) Veterinary Medicines Regulation became law in January 2019, introducing many significant changes. These changes signify the rising research in veterinary medicines, which contributes to the increased demand for the Europe veterinary clinical trials market.

Veterinary Clinical Trials End User Insights

The Europe veterinary clinical trials market segmentation, based on end user, includes academics and research centers, pharmaceutical and biopharmaceutical companies, and others. The academics and research centers segment is expected to witness a significant CAGR in the Europe veterinary clinical trials market over the forecast period. This growth is a testament to the increasing focus of research centers and academic institutions on emerging and re-emerging diseases in animals. Their work, which is crucial in identifying new pathogens, understanding disease mechanisms, and developing new vaccines and treatments, is driving the industry forward. Also, universities and research institutions are also playing a pivotal role in education and training, producing skilled professionals who can contribute to the veterinary clinical trials market.

Moreover, there is a growing trend of collaborations between academic institutions, research centers, and pharmaceutical companies. These partnerships facilitate the sharing of resources, expertise, and technology, thereby boosting the efficiency and scope of clinical trials.

For instance, according to FECAVA, the European Medicines Agency (EMA) has launched the "EU Veterinary Big Data Workplan to 2025" in collaboration with the Heads of Medicines Agencies (HMA). This groundbreaking initiative is set to revolutionize the European Medicines Regulatory Network by leveraging scientific knowledge and data-driven practices. Through this work, the agencies aim to significantly improve regulatory efficiency and robustness in veterinary medicines across the European Union (EU).

Additionally, 12-13 September 2023 was marked as the EMA Veterinary Awareness Day. The innovative event offered a comprehensive overview of the EMA’s efforts in veterinary medicine science and regulation within the EU. Such events and partnerships highlight the increasing focus on veterinary medicine research and its impact on driving the Europe veterinary clinical trials industry.

Veterinary Clinical Trials Country Insights

By country, the study provides market insights into Germany, France, the UK, Italy, Spain, Netherlands, Russia, and the Rest of Europe. The German veterinary clinical trials market is expected to witness a significant CAGR during the forecast period. The region’s robust growth is due to continuous advancements in veterinary medicine, including innovative treatments, vaccines, and diagnostic tools that necessitate rigorous clinical testing. This drives the need for clinical trials to evaluate the safety, efficacy, and potential side effects of these new products.

Germany, as part of the European Union, adheres to stringent regulatory standards for veterinary medicines. The regulatory framework ensures that products meet high safety and efficacy standards before they can be marketed. This regulatory support encourages pharmaceutical companies and research institutions to conduct extensive clinical trials to meet these requirements.

For instance, in January 2022, a new EU Act was introduced in Germany to regulate the marketing and implementation of veterinary medicinal products. This Act ensures the safe trade of the products and aims to guarantee their quality, effectiveness, and safety. It enhances animal health, welfare, environmental protection, and public health standards. The Act aligns with EU regulations and covers production, distribution, labeling, packaging, clinical trials, residue testing, authorization, manufacturing licenses, wholesale distribution permits, public information, and quality control. These measures promote extensive research and clinical trials in veterinary medicine, thereby driving growth in the Europe veterinary clinical trials market.

The UK veterinary clinical trials market accounted for the largest share in 2023. The UK has well-established veterinary healthcare services and research institutions. These institutions often collaborate with pharmaceutical companies to conduct clinical trials, fostering innovation and growth in the Europe veterinary clinical trials market. High rates of pet ownership in the UK drive demand for veterinary healthcare products and services. This demand stimulates investment in research and development, including clinical trials, to meet the healthcare needs of companion animals.

According to the Royal Veterinary College, the Shih Tzu ranks as the most ordinary dog species in the UK, with an estimated population exceeding 300,000 dogs, constituting about 3% of all dogs in the UK. In January 2024, a study from the RVC identified the most prevalent diseases in Shih Tzu dogs in the UK, which include anal sac impaction, periodontal disease, and ear infections. Despite these predispositions, the overall health profile of Shih Tzus appears to differ and improve compared to many other popular flat-faced breeds.

Additionally, in July 2024, a study from the Royal Veterinary College highlighted that delaying spaying in female dogs until between seven and 18 months could reduce the risk of early-onset urinary incontinence by 20% to spaying at an earlier age of 3 to 6 months. This research underscores the growing importance of veterinary research in the UK, which contributes to advancing the field and stimulating growth in the Europe veterinary clinical trials market.

Veterinary Clinical Trials Key Market Players & Competitive Insights

Leading market players drive innovation and competitiveness in the Europe veterinary clinical trials market through their reveal of a dynamic landscape shaped by technological advancements, strategic collaborations, and regulatory market developments.

Pharmaceutical companies, biotechnology firms, and academic institutions are leveraging collaborative partnerships to enhance research capabilities and drive innovation in areas such as cancer treatments and disease prevention, which collectively increase the demand for the Europe veterinary clinical trials industry.

Major players in the Europe veterinary clinical trials market include Argenta, Veyx-Pharma GmbH, Central VetPharma Consultancy, KLIFOVET GmbH, Boehringer Ingelheim International GmbH, Ondax Scientific, Vivesto AB, Labcorp Drug Development, Merck & Co., Inc., and knoell.

Merck & Co., Inc. is a major research-driven biopharmaceutical company pioneering health solutions that advance disease prevention and treatment for both humans and animals. The company offers a wide range of products tailored for companion animals, equines, swine, poultry, ruminants, and aquaculture. In 2024, Merck Animal Health received approval for BRAVECTO injection for dogs, providing immediate and sustained protection against fleas and ticks.

Vivesto is a research and development company specializing in creating new treatment options for patients with challenging cancers. The company focuses on projects that promise innovative treatments for cancer patients with critical medical needs. Vivesto possesses the expertise and capability to advance drugs from early preclinical stages through clinical trials. Currently, Vivesto is developing the cancer therapies Cantrixil and Docetaxel micellar, along with Paccal Vet (paclitaxel micellar) for veterinary oncology. Pascal Vet aims to treat malignant melanoma and hemangiosarcoma in dogs. In December 2023, Vivesto AB, an oncology-immersed research and development corporation, announced that the US Veterinary Review Board Clinical Studies Committee approved its scheduled Paccal Vet open-label pilot clinical study in dogs with splenic hemangiosarcoma post-splenectomy.

Key companies in the Europe veterinary clinical trials market include

- Argenta

- Boehringer Ingelheim International GmbH

- Central VetPharma Consultancy

- KLIFOVET GmbH

- knoell

- Labcorp Drug Development

- Merck & Co., Inc.

- Ondax Scientific

- Veyx-Pharma GmbH

- Vivesto AB

Veterinary Clinical Trials Industry Developments

October 2023: Coalition for Epidemic Preparedness Innovations (CEPI) extended its collaboration with WBVR (Wageningen Bioveterinary Research) to advance WBVR's vaccine candidate against RVF via a multi-site Phase I/IIa clinical trial.

September 2021: Argenta acquired Klifovet, a major Contract Research Organization (CRO) and Regulatory Affairs consultancy in Europe. This merger will create a global, full-value strategic partner that fosters innovation and supports large and small animal health and nutrition companies.

February 2021: The Royal Veterinary College (RVC), in collaboration with The Kennel Club, identified dental disease, obesity, and ear infections as the most common health problems in dogs. These findings will encourage pet owners to develop early habits in caring for their dogs' teeth, ears, and body weight, promoting happier and healthier lives for their pets.

Europe Veterinary Clinical Trials Market Segmentation

Europe Veterinary Clinical Trials Animal Type Outlook

- Livestock Animal

- Companion Animal

- Other Animals

Europe Veterinary Clinical Trials Intervention Outlook

- Medicines

- Medical Device

- Others

Europe Veterinary Clinical Trials Indication Outlook

- Orthopedics

- Oncology

- Cardiology

- Ophthalmology

- Neurology

- Dermatology

- Internal Medicine

- Other Indication

Europe Veterinary Clinical Trials End User Outlook

- Academics And Research Centers

- Pharmaceutical And Biopharmaceutical Companies

- Others

Europe Veterinary Clinical Trials Country Outlook

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Veterinary Clinical Trials Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 718.65 million |

|

Market Size Value in 2024 |

USD 787.06 million |

|

Revenue Forecast in 2032 |

USD 1,650.57 million |

|

CAGR |

9.7% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, country, and segmentation. |

FAQ's

The Europe veterinary clinical trials market size was valued at USD 718.65 million in 2023 and is expected to grow to USD 1,650.57 million in 2032.

The Europe market is projected to grow at a CAGR of 9.7% during the forecast period.

The UK veterinary clinical trials market held the largest market share in 2023.

The key players in the market are Argenta, Veyx-Pharma GmbH, Central VetPharma Consultancy, KLIFOVET GmbH, Boehringer Ingelheim International GmbH, Ondax Scientific, Vivesto AB, Labcorp Drug Development, Merck & Co., Inc., and knoell.

In 2023, the medicines segment accounted for the largest market share.

The academics and research centers segment is expected to witness a significant CAGR in the Europe veterinary clinical trials market during the forecast period.