Europe Textile Chemicals Market Share, Size, Trends, Industry Analysis Report, By Product Type (Surfactants, Colorants, Finishing Agents, De-sizing Agents, Bleaching Agents, Others); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4466

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

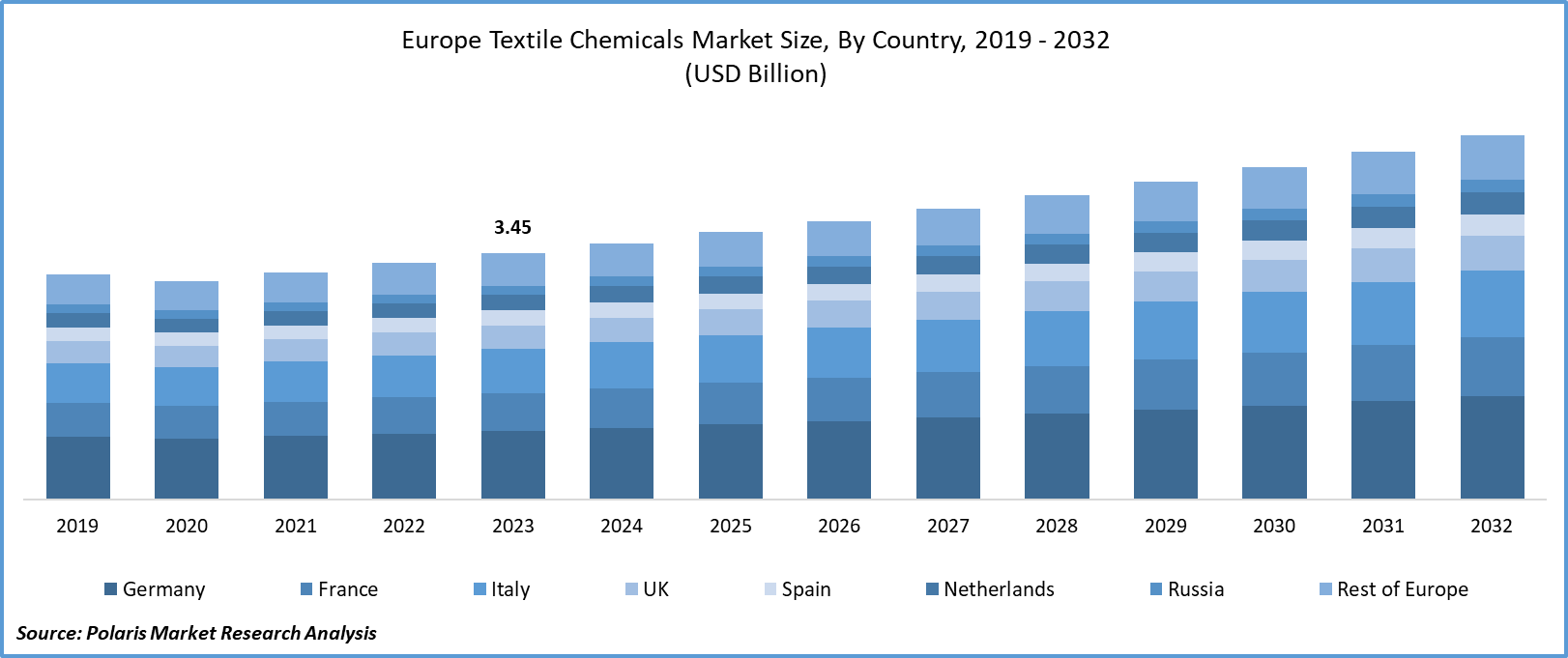

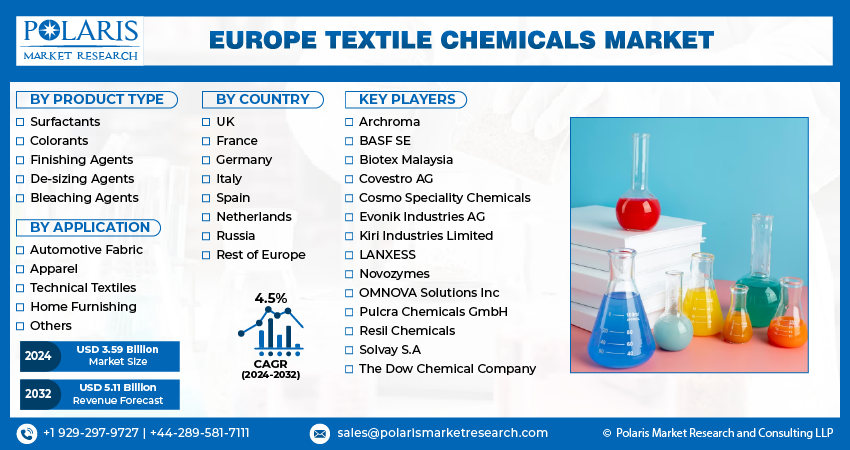

Europe Textile Chemicals Market size was valued at USD 3.45 billion in 2023. The market is anticipated to grow from USD 3.59 billion in 2024 to USD 5.11 billion by 2032, exhibiting the CAGR of 4.5% during the forecast period.

Industry Trends

The market is a significant sector that plays a crucial role in the production of high-quality textiles, which are used in various industries such as automotive, clothing, home furnishing, and industrial applications. The market is expected to grow at a substantial growth rate over the forecast period, driven by increasing demand for sustainable and eco-friendly textiles, growing awareness about environmental safety, and advancements in technologies that enhance the quality and durability of textiles.

- For instance, the production and consumption of textiles by the textile industry are being addressed by the EU's Strategy for Sustainable and Circular Textiles while recognizing the significance of the sector. This strategy meets the obligations of the Circular Economy Action Plan, the European Green Deal, and the European Industrial Strategy.

Similarly, with increasing concerns about environmental pollution and degradation, consumers, as well as governments, are becoming more conscious of their impact on the environment. This shift in consumer behavior has led to an increased demand for sustainable and eco-friendly textiles, which are made using eco-friendly materials and manufacturing processes. As a result, the demand for textile chemicals that meet these requirements is also on the rise.

To Understand More About this Research: Request a Free Sample Report

However, the market also faces some challenges, including stringent regulations, high cost of raw materials, and competition from substitutes. The use of certain textile chemicals is regulated by stringent laws and guidelines, such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and GOTS (Global Organic Textile Standard).

Key Takeaways

- Germany dominated the market and contributed over 22% of the share in 2023

- By product type category, the colorants segment accounted for the largest market share in 2023

- By application category, the apparel segment held the dominating revenue share in 2023

What are the market drivers driving the demand for Europe’s textile chemicals market?

Technological advancements in textile chemicals are driving market growth.

The development of innovative and sustainable chemicals has enabled manufacturers to produce high-quality fabrics with improved properties, such as wrinkle resistance, stain resistance, and UV protection. Also, the use of nanotechnology and biotechnology has led to the creation of specialized textile chemicals that provide enhanced performance and functionality to fabrics, such as water repellency, breathability, and antimicrobial properties.

These advanced chemicals have increased the demand for textile chemicals in various applications, including apparel, home furnishing, and industrial textiles. For instance, Novozymes, a chemical manufacturing company, has designed an advanced granulation technology along with the DeniSafe system to eliminate potential allergy hazards induced by airborne particles. These enzymes are used to improve worker safety in mills or laundries.

Overall, technological advancements in textile chemicals have transformed the industry, enabling manufacturers to produce high-performance fabrics that cater to the changing needs of consumers, thereby driving the growth of the market.

Which factor is restraining the demand for textile chemicals?

The stringent regulations, high cost of raw materials, and competition from substitutes are hindering market growth.

The European textile chemicals market is facing significant challenges due to stringent regulations, high costs of raw materials, and competition from substitutes. The regulatory framework in Europe is particularly strict, with laws such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the EU's Textile Regulation requiring manufacturers to meet rigorous standards for safety, sustainability, and environmental impact. This has resulted in increased compliance costs for companies, making it difficult for them to maintain profitability.

Along with this, the prices of raw materials used in textile production, such as cotton and polyester, have been rising steadily, further increasing the cost burden on manufacturers. Finally, the emergence of substitute products, such as synthetic fibers and natural fibers treated with eco-friendly chemicals, has reduced demand for traditional textile chemicals, posing a threat to the market's growth. These factors collectively constrain the Europe textile chemicals market, limiting its potential expansion and innovation.

Report Segmentation

The market is primarily segmented based on product type, application, and country.

|

By Product Type |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type analysis, the market is segmented on the basis of surfactants, colorants, finishing agents, de-sizing agents, bleaching agents, and others. The colorants segment accounted for the largest revenue share in the European market in 2023, owing to their extensive use in various applications such as dyeing, printing, and finishing of fabrics. Colorants are essential in imparting color, texture, and appearance to textiles. This is crucial for meeting the growing demand for high-quality and visually attractive clothing, automotive, technical, and home furnishing textiles.

Similarly, advancements in colorant technologies have led to the development of sustainable options, further boosting their adoption in the industry. Also, stringent regulations, such as the REACH and GOTS, regarding the use of harmful substances in textile production have resulted in a shift towards safer and more environmentally friendly alternatives, contributing to the growth of the colorants segment.

By Application Insights

Based on application analysis, the market has been segmented on the basis of automotive fabric, apparel, technical textiles, home furnishing, and others. In 2023, the apparel applications segment accounted for the largest share of the European textile chemicals market. This was due to the increasing demand for high-quality and unique textiles in the fashion industry, particularly in countries such as Germany, France, and Italy, where fashion is a significant contributor to the economy. The growing trend towards fast fashion and the rising number of online retail platforms further fueled the demand for textile chemicals used in apparel production, such as colorants, finishing agents, and de-sizing chemicals. In addition, the shift towards environmental consciousness led to an increased demand for eco-friendly textile chemicals, which also contributed to the growth of the apparel applications segment.

Country-wise Insights

Germany

Germany held the dominant revenue share in the European textile chemicals market owing to its strong and well-established textile industry, which is one of the largest in Europe. This provides a significant domestic market for textile chemicals, driving demand for products such as colorants, finishers, and auxiliaries.

For instance, according to the World Trade Organization's 2022 World Trade Statistical Review report, the largest importer of apparel and textiles globally is the European Union. As of 2021, the apparel and textile imports made by the EU accounted for 34.1% of the global market value. Germany was the top importer among all European nations.

In addition, Germany is home to many leading textile chemical manufacturers, such as BASF and Lanxess, who have a strong presence in the global market and contribute to the country's high revenue share. Also, Germany's strategic location in Central Europe allows for easy access to other major markets, enabling German companies to serve customers throughout the region effectively.

Competitive Landscape

The manufacturers in the market are focusing on product innovation and expansion of their product portfolios to cater to the changing demands of the textile industry. Many companies are investing heavily in research and development to develop sustainable and eco-friendly products that meet the stringent environmental regulations in Europe. In addition, companies like Archroma and Kiri Industries Ltd. are adopting various strategies such as mergers and acquisitions, collaborations, and partnerships to expand their presence in the market and strengthen their distribution networks.

Some of the major players operating in the European market include:

- Archroma

- BASF SE

- Biotex Malaysia

- Covestro AG

- Cosmo Speciality Chemicals

- Evonik Industries AG

- Kiri Industries Limited

- LANXESS

- Novozymes

- OMNOVA Solutions Inc

- Pulcra Chemicals GmbH

- Resil Chemicals

- Solvay S.A

- The Dow Chemical Company

- The DyStar Group

Recent Developments

- In February 2023, Archroma, an internationally recognized provider of sustainable specialty chemicals for industries such as paints, coatings, packaging & paper, and textiles, has recently acquired the Textile Effects business from Huntsman Corporation.

- In November 2021, Cosmo Speciality Chemicals, a subsidiary of Cosmo Films Limited, developed hydrophilic block silicone emulsions for use in the textile industry.

Report Coverage

The Europe textile chemicals market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, application, and their futuristic growth opportunities.

Textile Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.59 billion |

|

Revenue forecast in 2032 |

USD 5.11 billion |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Application, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

Browse Our Top Selling Reports

Medical Radiation Shielding Market Size, Share 2024 Research Report

Optical Imaging Systems Market Size, Share 2024 Research Report

Pharmaceutical Grade Lactose Market Size, Share 2024 Research Report

Garbage Truck Bodies Market Size, Share 2024 Research Report

Mushroom Cosmetics Market Size, Share 2024 Research Report

FAQ's

The Europe Textile Chemicals Market report covering key segments are product type, application, and country.

Europe Textile Chemicals Market Size Worth USD 5.11 Billion By 2032

Europe Textile Chemicals Market exhibiting the CAGR of 4.5% during the forecast period.

key driving factors in Europe Textile Chemicals Market are technological advancements in textile chemicals are driving market growth