Europe SGLT2 Inhibitors Market Share, Size, Trends, Industry Analysis Report: By Indication [Cardiovascular, Chronic Kidney Disease (CKD), Type 2 Diabetes, and Others], Drug, Distribution Channel, and Country (Germany, France, UK, Italy, Spain, Netherlands, Russia, and Rest of Europe) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5091

- Base Year: 2023

- Historical Data: 2019-2022

Europe SGLT2 Inhibitors Market Overview

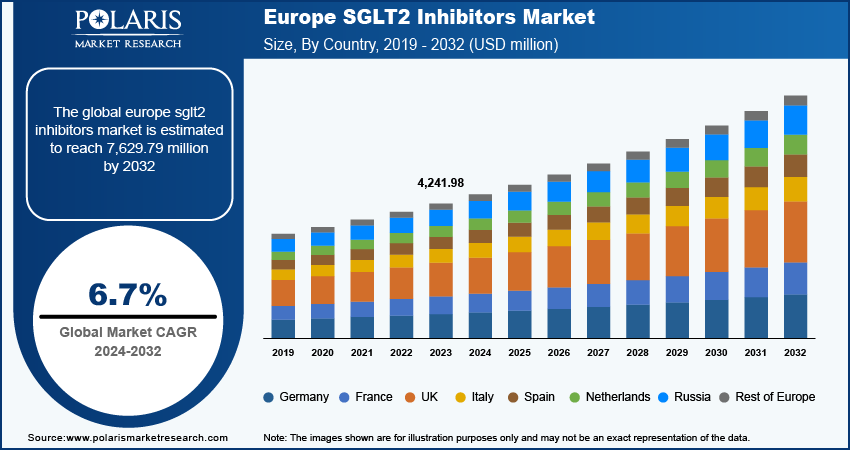

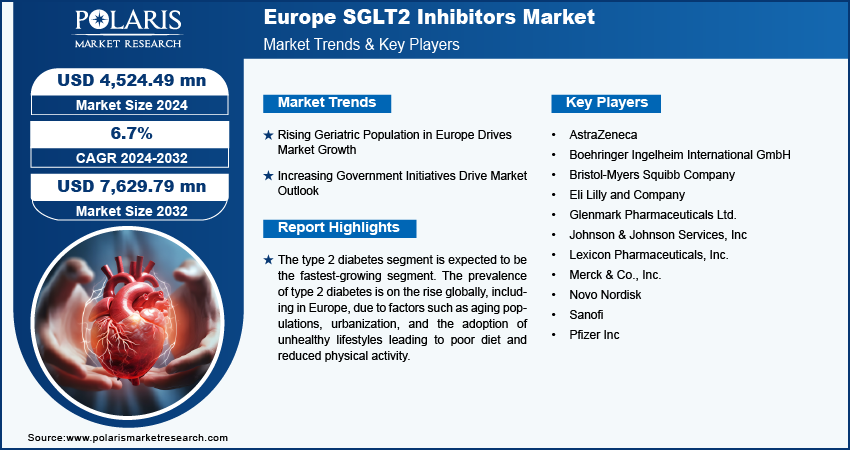

The Europe SGLT2 inhibitors market size was valued at USD 4,241.98 million in 2023. The market is projected to grow from USD 4,524.49 million in 2024 to USD 7,629.79 million by 2032, exhibiting a CAGR of 6.7% during 2024–2032.

The adoption of Western dietary patterns in Europe, indicated by high consumption of red and processed meats, refined grains, drinks containing high sugar content, and low intake of fruits and vegetables, has contributed to the increasing rates of obesity, diabetes, cardiovascular diseases, and other chronic diseases. Additionally, the rising consumption of alcohol among consumers across the region has led to a surge in side effects such as hypertension and diabetes. For instance, according to Office for National Statistics, the UK recorded 9,641 deaths (14.8 per 100,000 people) due to alcohol consumption-related causes in 2021; the number was at its highest recorded level. This number represented a 7.4% increase from 2020 and a 27.4% from 2019, highlighting the increasing burden of chronic diseases such as type 2 diabetes. Therefore, the increasing prevalence of diabetes led to a significant utilization of SGLT2 inhibitors for the treatment of type 2 diabetes, accounting for the largest SGLT2 inhibitors market share.

To Understand More About this Research: Request a Free Sample Report

The growing urbanization has led to heightened exposure to stress, pollution, and decreased physical activity, which are contributing factors to chronic diseases. Certain professions also entail exposure to hazardous substances and high stress levels, thereby increasing the susceptibility to chronic conditions. However, advancements in healthcare systems and the development of improved diagnostic tools have resulted in enhanced detection and reporting of chronic diseases. Public health initiatives and heightened awareness have led to more individuals seeking medical advice and receiving diagnoses for chronic conditions such as type 2 diabetes. This has led to a significant increase in the utilization of SGLT2 inhibitors, consequently boosting the market growth of these inhibitors.

Europe SGLT2 Inhibitors Market Trends

Rising Geriatric Population in Europe Drives Market Growth

The population of England and Wales, with Census 2021, indicates a higher number of individuals in older age groups. Over 11 million people, accounting for 18.6% of the total population, were aged 65 years and above, compared to 16.4% in 2011. Additionally, there were over half a million individuals aged 90 and above. The average age has increased from 39 years in 2011 to 40 years in 2021, indicating the changing age composition of the population. As Europe is experiencing a significant rise in its aging population, there is an increased prevalence of various chronic diseases such as cardiovascular disease, diabetes, and cancer. This has resulted in a growing demand for SGLT2 inhibitors for the treatment of chronic conditions, including hypertension and type 2 diabetes. Therefore, the rising geriatric population across Europe is expected to boost the Europe SGLT2 inhibitors market growth during the forecast period.

Increasing Government Initiatives Drive Market Outlook

European governments are implementing various measures such as providing subsidies for diabetes medications, improving healthcare access, and emphasizing preventive care. These policies help enhance diabetes care and management, which would lead to the widespread adoption of SGLT2 inhibitors. For instance, in November 2023, IDF Europe conducted a targeted communications campaign for highlighting significant events for individuals affected by diabetes in Europe. In addition, IDF Europe organized blood glucose testing events at multiple EU institutions to raise awareness about diabetes and the importance of screening and early detection. This initiative has resulted in the early detection and treatment of type 2 diabetes, leading to increased demand for SGLT2 inhibitors.

Europe SGLT2 Inhibitors Market Segment Insights

Europe SGLT2 Inhibitors Market: Drug-Based Insights

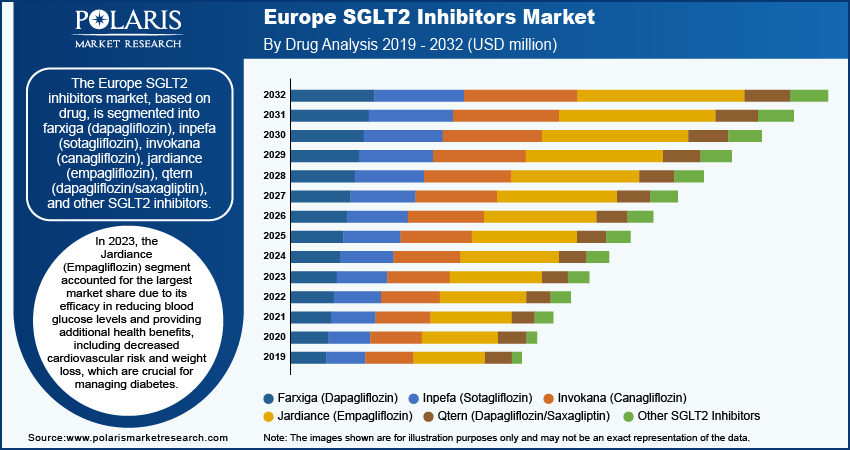

The Europe SGLT2 inhibitors market, based on drug, is segmented into farxiga (dapagliflozin), inpefa (sotagliflozin), invokana (canagliflozin), jardiance (empagliflozin), qtern (dapagliflozin/saxagliptin), and other SGLT2 inhibitors. In 2023, the Jardiance (Empagliflozin) segment accounted for the largest market share due to its efficacy in reducing blood glucose levels and providing additional health benefits, including decreased cardiovascular risk and weight loss, which are crucial for managing diabetes. Boehringer Ingelheim and Eli Lilly's strong marketing efforts and established presence have significantly boosted Jardiance's market penetration and acceptance among healthcare providers and patients. Additionally, Jardiance has garnered broad regulatory approval and favorable guidelines from major health authorities and professional organizations, boosting its credibility and trust within the medical community. For instance, Jardiance (empagliflozin) has been approved by the European Commission to treat adults suffering from chronic kidney disease, containing the potential to advance the standard of care for over 47 million people affected by the disease in Europe. This approval also has the potential to reduce the burden on healthcare systems by reducing the risk of all-cause hospitalization for individuals suffering from chronic kidney disease. As a result, Jardiance emerged as the primary SGLT2 inhibitor in the European market, holding the largest market share in 2023.

Europe SGLT2 Inhibitors Market: Indication-Based Insights

The Europe SGLT2 inhibitors market, based on indication, is segmented into cardiovascular, chronic kidney disease (CKD), type 2 diabetes, and others. The type 2 diabetes segment is expected to be the fastest-growing segment. The prevalence of type 2 diabetes is on the rise globally, including in Europe, due to factors such as aging populations, urbanization, and the adoption of unhealthy lifestyles leading to poor diet and reduced physical activity. According to the World Health Organization (WHO), Europe has one of the highest prevalence of diabetes, with ∼60 million people affected, constituting about 10.3% of men and 9.6% of women aged 25 years and above. This number is projected to reach 71 million by 2040. The rising prevalence of type 2 diabetes is expected to drive the growth of the SGLT2 inhibitors market during the forecast period, as SGLT2 inhibitors are used in disease management.

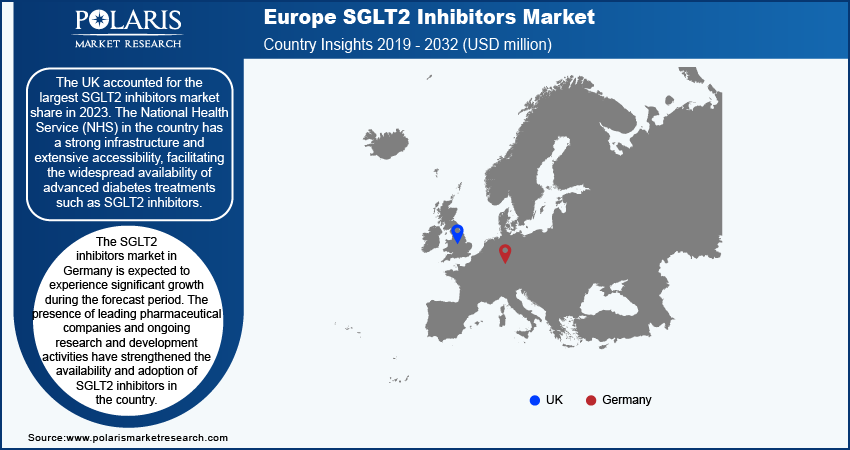

Europe SGLT2 Inhibitors Market: Country-Based Insights

By country, the study provides market insights into Germany, France, the UK, Italy, Spain, the Netherlands, Russia, and the Rest of Europe. The UK accounted for the largest SGLT2 inhibitors market share in 2023. The National Health Service (NHS) in the country has a strong infrastructure and extensive accessibility, facilitating the widespread availability of advanced diabetes treatments such as SGLT2 inhibitors. The UK government and healthcare organizations have introduced multiple initiatives aimed at enhancing diabetes care, including early detection and preventative measures. These efforts have led to an increased demand for effective treatments, consequently fueling the growth of the UK SGLT2 inhibitors market.

The SGLT2 inhibitors market in Germany is expected to experience significant growth during the forecast period. The presence of leading pharmaceutical companies and ongoing research and development activities have strengthened the availability and adoption of SGLT2 inhibitors in the country.

Europe SGLT2 Inhibitors Market: Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which drives the Europe SGLT2 inhibitors market growth. Market participants are also undertaking a variety of strategic activities to expand their footprint across the region, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaborations with other organizations. To expand and survive in a more competitive and rising market climate, the Europe SGLT2 inhibitors industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Europe SGLT2 inhibitors industry to benefit clients and boost the market. In recent years, the Europe SGLT2 inhibitors industry has offered some technological advancements. AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Novo Nordisk; Sanofi; and Pfizer Inc. are among the major market players.

Boehringer Ingelheim, established in 1885, operates in the human pharmaceutical and animal health sectors. The human pharmaceutical division focuses on therapeutic areas such as heart diseases, metabolic diseases, chronic kidney diseases, cancer, lung diseases, skin and inflammatory diseases, mental disorders, and retinal diseases. In April 2024, Boehringer Ingelheim received approval from the European Commission for the use of Jardiance (empagliflozin) 10mg and 25mg tablets for the management of insufficiently controlled type 2 diabetes mellitus in children aged 10 years and above.

AstraZeneca PLC is a biopharmaceutical company that researches, develops, manufactures, and sells prescription drugs. The company's products include tagrisso, lynparza, imfinzi, calquence, orpathys, truqap, enhertu, zoladex, and others. In December 2022, Forxiga (dapagliflozin) received approval in the European Union for an expanded indication to include heart failure (HF) patients with a broad range of left ventricular ejection fraction (LVEF), encompassing HF with mildly reduced and preserved ejection fraction, in addition to HF with reduced ejection fraction (HFrEF).

Key Companies in Europe SGLT2 Inhibitors Market

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Glenmark Pharmaceuticals Ltd.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- Lexicon Pharmaceuticals, Inc.

- Merck & Co., Inc.

- Novo Nordisk

- Sanofi

- Pfizer Inc.

Europe SGLT2 Inhibitors Industry Developments

- In May 2024, Lexicon announced its plans to resubmit its New Drug Application (NDA) for Zynquista to the FDA by mid-2024, after an unsuccessful attempt to gain approval for type 1 diabetes in 2019.

- In March 2024, Novo Nordisk announced its plan to seek regulatory approval for expanded Ozempic label in the US and EU in 2024.

Europe SGLT2 Inhibitors Market Segmentation

By Indication Outlook

- Cardiovascular

- Chronic Kidney Disease (CKD)

- Type 2 Diabetes

- Others

By Drug Outlook

- Farxiga (Dapagliflozin)

- Inpefa (Sotagliflozin)

- Invokana (Canagliflozin)

- Jardiance (Empagliflozin)

- Qtern (Dapagliflozin/Saxagliptin)

- Other SGLT2 Inhibitors

By Distribution Channel Outlook

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Country Outlook

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe SGLT2 Inhibitors Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 4,241.98 million |

|

Market Size Value in 2024 |

USD 4,524.49 million |

|

Revenue Forecast in 2032 |

USD 7,629.79 million |

|

CAGR |

6.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4,241.98 million in 2023 and is projected to grow to USD 7,629.79 million by 2032.

The market is projected to register a CAGR of 6.7% during 2024–2032

The UK held the largest share in 2023 due to a strong infrastructure and extensive accessibility, facilitating the widespread availability of advanced diabetes treatments .

AstraZeneca; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Eli Lilly and Company; Glenmark Pharmaceuticals Ltd.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); Lexicon Pharmaceuticals, Inc.; Merck & Co., Inc.; Novo Nordisk; Sanofi; and Pfizer Inc. are among the key players in the market.

The jardiance (empagliflozin) segment dominated the market in 2023 due to its efficacy in reducing blood glucose levels.

The type 2 diabetes is expected to be the fastest-growing segment in the forecast period due to the rising prevalence of type 2 diabetes.