Europe Private 5G Network Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software & Services), By Operational Frequency, By Spectrum, By Vertical, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM3537

- Base Year: 2024

- Historical Data: 2020-2023

Overview

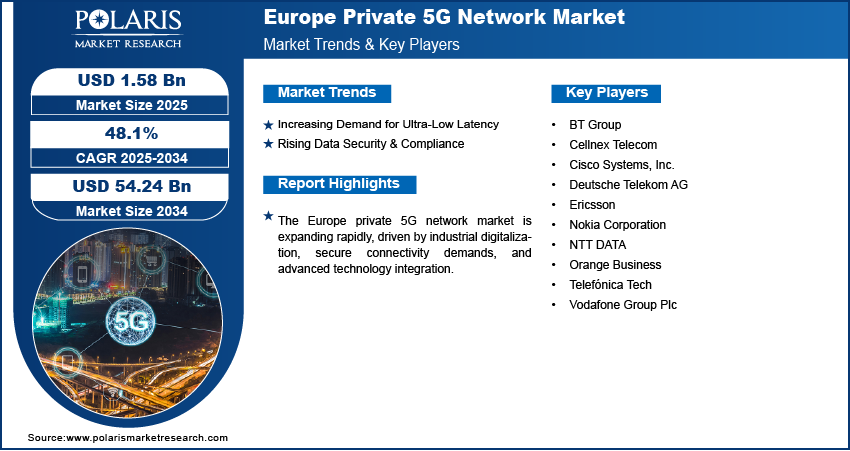

The Europe private 5G network market size was valued at USD 1.08 billion in 2024, growing at a CAGR of 48.1% from 2025 to 2034. Key factors driving demand include telecom-enterprise partnerships, edge AI integration, increasing demand for ultra-low latency, and rising data security and compliance.

Key Insights

- The hardware segment dominated with 73.33% revenue share in 2024, as private 5G deployments require extensive physical infrastructure such as base stations and edge devices to function effectively.

- The mmWave segment is expected to register a CAGR of 47.7% during 2025–2034, due to its ability to support ultra-fast speeds and near-instant response times for data-heavy applications.

- The unlicensed/shared spectrum segment held a 75.06% share in 2024, favored for its affordability and simpler setup compared to licensed alternatives.

- The healthcare segment is expected to record a CAGR of 48.9% during the forecast period, fueled by telemedicine, remote monitoring, and secure patient data transfer needs.

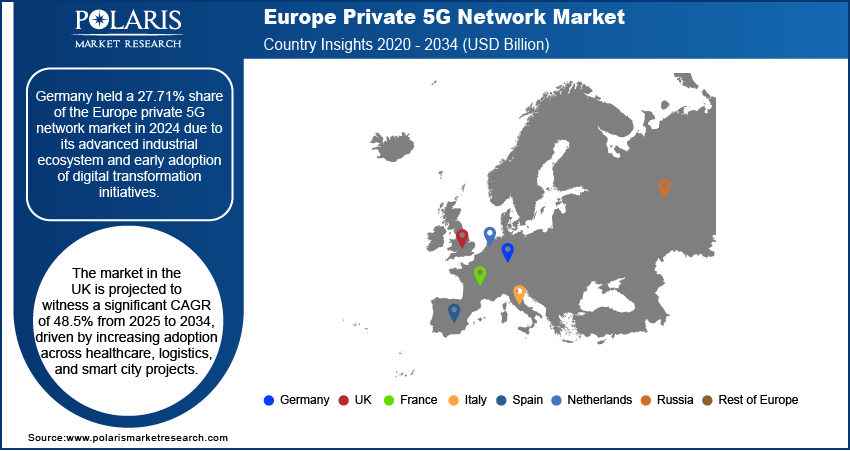

- Germany led the Europe market with 27.71% share in 2024, benefiting from its strong industrial base and early embrace of smart manufacturing technologies.

- The UK market will grow at 48.5% CAGR through 2034, driven by smart city initiatives, healthcare digitization, and logistics modernization.

Market Dynamics

- The Europe private 5G market growth is fueled by industries needing instant data transfer for self-driving vehicles, smart factories, and remote surgeries, where delays risk safety and efficiency.

- Strict data rules are pushing companies to choose private 5G, as it keeps sensitive information safer than public networks by controlling all communications internally.

- Setting up private 5G is expensive; companies need to buy equipment and spectrum licenses, making it hard for smaller businesses to afford.

- Private 5G helps factories and hospitals run smarter by connecting machines and devices faster, boosting automation and efficiency.

Market Statistics

- 2024 Market Size: USD 1.08 billion

- 2034 Projected Market Size: USD 54.24 billion

- CAGR (2025-2034): 48.1%

- UK: Largest Market Share in 2024

AI Impact on Europe Private 5G Network Market

- AI optimizes 5G performance by adjusting bandwidth in real-time, reducing delays for factories and hospitals needing instant data.

- AI spots equipment issues early, preventing costly downtime in manufacturing plants using private 5G.

- AI detects cyber threats faster, keeping sensitive industrial data safe on private 5G networks.

- AI with 5G enables self-running robots and quality checks, boosting production speed and precision.

A private 5G network is a dedicated wireless communication system tailored for specific enterprises or organizations, offering enhanced security, reliability, and customization compared to public networks. In Europe, the private 5G network market is witnessing substantial growth, largely driven by the region’s strong focus on digital transformation and the increasing adoption of advanced connectivity solutions across industries. The rising demand for Europe-specific private 5G services is supported by favorable regulatory frameworks, the presence of leading telecom infrastructure providers, and a push towards Industry 4.0 adoption. This demand is further fueled by the need for high-performance connectivity in manufacturing, transportation, energy, and healthcare sectors, where mission-critical applications require ultra-low latency, robust security, and seamless device interoperability. For instance, in October 2022, Cisco partnered with Airspan Networks to include its Open RAN solutions in Cisco's Private 5G program, targeting enterprise applications requiring low-latency, high-availability connectivity for industrial automation and productivity enhancements. Additionally, the regional focus on boosting innovation, combined with investments in localized 5G infrastructure, positions Europe as a major hub for private network advancements.

The European private 5G network landscape is further driven by the integration of Edge AI, which enhances the capabilities of private 5G by enabling real-time data processing and intelligent decision-making at the network edge. This convergence allows enterprises to optimize operations, reduce latency, and improve responsiveness for applications such as predictive maintenance, autonomous systems, and smart city infrastructure. The connection between private 5G’s secure, high-speed connectivity and Edge AI’s computational intelligence creates a robust foundation for next-generation industrial automation and data-driven innovation. In Europe, this integration supports critical sectors such as manufacturing, logistics, and energy management, where instant analytics and rapid action are essential for operational efficiency and competitiveness. Enterprises unlock new opportunities for productivity, safety, and innovation within the evolving digital economy by merging network performance with advanced AI-driven insights.

Drivers & Opportunities

Increasing Demand for Ultra-Low Latency: The increasing demand for ultra-low latency is driving growth opportunities, as industries across the region require immediate data transmission to support mission-critical applications. In sectors such as autonomous transportation, advanced manufacturing, remote healthcare, and immersive AR/VR experiences, even minimal delays can disrupt operations or compromise safety. In December 2022, Porsche Engineering and Vodafone Business launched Europe's first 5G hybrid private network at Italy's Nardò Technical Center, enhancing connected vehicle testing with low-latency, high-bandwidth connectivity for automotive R&D. Private 5G networks deliver latency in the millisecond range, enabling seamless communication between machines, sensors, and control systems. This capability is essential for real-time decision-making, process automation, and enhancing productivity in high-precision environments. Moreover, the push for ultra-low latency connectivity aligns with Europe’s Industry 4.0 goals, boosting innovation and enabling enterprises to adopt technologies that demand uninterrupted, real-time performance.

Rising Data Security & Compliance: Rising data security and compliance requirements are boosting the adoption of private 5G networks in Europe, as organizations aim to safeguard sensitive information while meeting strict regional regulations. Private 5G networks offer enhanced control over data traffic, allowing enterprises to manage and secure their communications within a dedicated infrastructure, reducing exposure to external threats. In October 2024, Boldyn Networks launched Private 5G as a Service, offering enterprise-grade connectivity without upfront costs. The company is investing USD 320 million to expand global adoption, focusing on security and operational efficiency enhancements. This advancement is particularly critical in sectors such as finance, healthcare, defense, and critical infrastructure, where regulatory frameworks such as GDPR and sector-specific compliance mandates demand robust data protection measures. These networks help organizations maintain compliance while ensuring operational resilience by providing end-to-end encryption, secure device authentication, and localized data processing. Thus, this focus on security and regulatory adherence is driving European enterprises to invest in private 5G as a strategic enabler of both technological advancement and regulatory risk mitigation.

Segmental Insights

Component Analysis

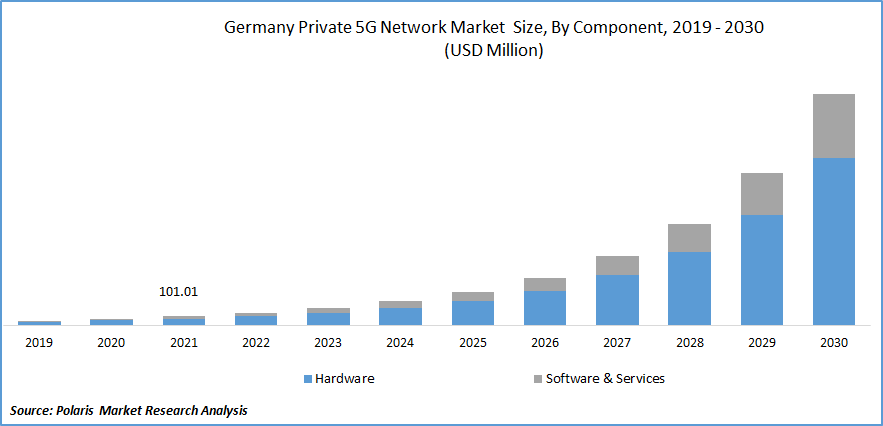

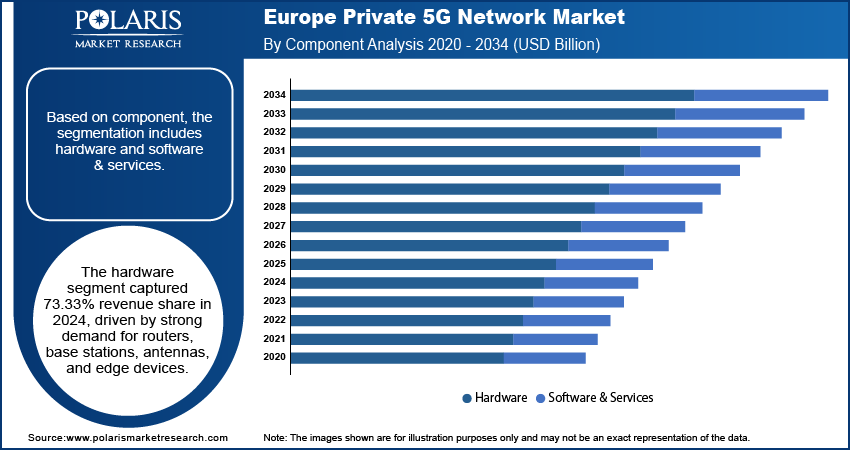

Based on component, the segmentation includes hardware, software & services. The hardware segment accounted for 73.33% revenue share in 2024 due to the high demand for physical network infrastructure, including routers, base stations, antennas, and edge devices, which form the backbone of private 5G deployments. Enterprises across manufacturing, transportation, and energy sectors are increasingly investing in dedicated hardware to ensure reliable connectivity, low latency, and enhanced network security. Additionally, the focus on building scalable and resilient network infrastructure in Europe has further reinforced the dominance of the hardware segment, as organizations prioritize long-term operational efficiency and network stability.

The software & services segment is expected to grow with a CAGR of 48.9% during the forecast period, driven by the rising need for network management solutions, automation, monitoring, and analytics. European enterprises are increasingly leveraging software-defined networking (SDN), network slicing, and AI-powered management tools to optimize private 5G operations. Additionally, services such as deployment, integration, maintenance, and consulting are becoming critical as companies adopt complex 5G architectures tailored to specific industry needs. This combination of advanced software capabilities and professional services is enabling organizations to extract maximum value from private 5G networks while reducing operational complexities.

Operational Frequency Analysis

In terms of operational frequency, the segmentation includes sub-6 GHz and mmWave. The sub-6 GHz segment dominated the market with 82.68% share in 2024 due to its superior coverage and ability to penetrate buildings and urban infrastructures, making it ideal for industrial campuses, corporate facilities, and public institutions. Its reliability and broad reach have made it the preferred choice for European enterprises aiming to ensure consistent connectivity across large operational areas without compromising on network performance.

The mmWave segment is projected to register a 47.7% CAGR during the forecast period owing to its capability to deliver extremely high data speeds and ultra-low latency. European industries requiring high-bandwidth applications, such as augmented and virtual reality, real-time data analytics, and automated robotics, are increasingly adopting mmWave frequencies. Despite its limited coverage compared to sub-6 GHz, mmWave is highly suitable for dense urban environments and localized industrial sites where maximum throughput is critical for operational efficiency.

Spectrum Analysis

In terms of spectrum, the segmentation includes licensed and unlicensed/shared. The unlicensed/shared segment accounted for a 75.06% share in 2024 owing to its cost-effectiveness and ease of deployment. Enterprises across various sectors are leveraging unlicensed spectrum to implement private networks quickly, reduce dependency on telecom operators, and support use cases that do not require extensive regulatory compliance. This flexibility has accelerated the adoption of private 5G networks in Europe, particularly among mid-sized enterprises and technology-driven organizations.

The licensed segment is expected to witness substantial growth during the forecast period, attributed to its ability to provide dedicated bandwidth, improved security, and guaranteed quality of service. European industries handling sensitive or mission-critical operations, such as defense, healthcare, and energy, prefer licensed spectrum to ensure uninterrupted connectivity, avoid interference, and meet regulatory requirements. The controlled nature of licensed spectrum makes it a strategic choice for organizations prioritizing network reliability and long-term performance.

Vertical Analysis

The segmentation, based on vertical, includes manufacturing, food & beverages, energy & utilities, transportation & logistics, aerospace & defense, government & public safety, corporates/enterprises, mining, healthcare, oil & gas, and others. The manufacturing segment held a 27.80% share in 2024, attributed to Europe’s strong industrial base and the adoption of Industry 4.0 technologies. Private 5G networks in manufacturing facilities enable real-time monitoring, automation, predictive maintenance, and seamless machine-to-machine communication, enhancing productivity and operational efficiency.

The healthcare segment is expected to witness the highest CAGR of 48.9% during the forecast period, driven by the increasing demand for connected medical devices, remote patient monitoring, telemedicine, and secure health data management. European healthcare institutions are adopting private 5G networks to improve patient care, enable real-time diagnostics, and ensure compliance with strict data protection regulations. The combination of low latency, high reliability, and secure communication offered by private 5G networks is transforming healthcare delivery across the region.

Country Analysis

Germany Private 5G Network Market Insights

Germany held 27.71% market share in the Europe private 5G network landscape in 2024 due to its advanced industrial ecosystem and early adoption of digital transformation initiatives. The country’s strong focus on Industry 4.0, particularly in manufacturing and automotive sectors, has driven demand for private 5G networks to enable automation, predictive maintenance, and real-time operational monitoring. Additionally, Germany’s well-established telecom infrastructure and supportive government policies have facilitated the deployment of secure and high-performance private networks across industrial and enterprise settings.

UK Private 5G Network Market Trends

The UK market is projected to witness a significant CAGR of 48.5% from 2025 to 2034, driven by increasing adoption across healthcare, logistics, and smart city projects. The country is investing heavily in digital infrastructure to support enterprise-grade connectivity and innovation, enabling real-time data analytics and automation. Growing awareness of data security and compliance, coupled with the need for ultra-reliable low-latency communication, is encouraging businesses to implement private 5G solutions. The UK’s focus on combining technological advancement with regulatory compliance is positioning it as a major market for private 5G expansion in Europe.

Key Players & Competitive Analysis

The European private 5G network market is witnessing intensified competition as vendor’s leverage technological advancements to address latent demand and opportunities across industrial verticals. Nokia, Ericsson, and Deutsche Telekom dominate in developed markets, offering end-to-end solutions for manufacturing and logistics, while Orange and Vodafone focus on sustainable value chains through energy-efficient deployments. Economic and geopolitical shifts, including EU digital sovereignty policies, are accelerating strategic investments in localized networks. Industry trends highlight the rise of edge AI integration and network slicing, with small and medium-sized businesses increasingly adopting cost-effective "as-a-service" models like Boldyn’s recent offering. Competitive intelligence and strategy reveal partnerships as critical to capturing high growth markets and emerging technologies in automotive and ports. However, supply chain disruptions in semiconductor components challenge vendors to innovate with Open RAN solutions.

A few major companies operating in the Europe private 5G network market include BT Group; Cellnex Telecom; Cisco Systems, Inc.; Deutsche Telekom AG; Ericsson; Nokia Corporation; NTT DATA; Orange Business; Telefónica Tech; and Vodafone Group Plc.

Key Players

- BT Group

- Cellnex Telecom

- Cisco Systems, Inc.

- Deutsche Telekom AG

- Ericsson

- Nokia Corporation

- NTT DATA

- Orange Business

- Telefónica Tech

- Vodafone Group Plc

Europe Private 5G Network Industry Developments

- June 2025: Istres collaborated with Ericsson, Spie, and Unitel to deploy a Private 5G Network, cutting surveillance camera costs by 83% per unit. The system enhances real-time coordination and paves the way for AI-driven smart city applications, serving as a scalable model for similar urban areas.

- October 2024: NEC Corporation partnered with Cisco to launch a Private 5G Network solution combining Cisco's 5G SA Core with NEC's radio expertise. The collaboration targets enterprise deployments in Europe and the Middle East, offering end-to-end implementation and support services.

Europe Private 5G Network Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Radio Access Network

- Core Network

- Backhaul & Transport Interconnecting

- Software & Services

- Installation & Integration

- Data Services

- Support & Maintenance

By Operational Frequency Outlook (Revenue, USD Billion, 2020–2034)

- Sub-6 GHz

- mmWave

By Spectrum Outlook (Revenue, USD Billion, 2020–2034)

- Licensed

- Unlicensed/Shared

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Food & Beverages

- Automotive

- Pharmaceuticals

- Electrical & Electronics

- Heavy Machinery

- Clothing & Accessories

- Other Manufacturing Verticals

- Energy & Utilities

- Transportation & Logistics

- Aerospace & Defense

- Government & Public Safety

- Corporates/Enterprises

- Mining

- Healthcare

- Oil & Gas

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Private 5G Network Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.08 Billion |

|

Market Size in 2025 |

USD 1.58 Billion |

|

Revenue Forecast by 2034 |

USD 54.24 Billion |

|

CAGR |

48.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.08 billion in 2024 and is projected to grow to USD 54.24 billion by 2034.

The market is projected to register a CAGR of 48.1% during the forecast period.

Germany held 27.71% share in Europe private 5G network landscape in 2024.

A few of the key players in the market are BT Group; Cellnex Telecom; Cisco Systems, Inc.; Deutsche Telekom AG; Ericsson; Nokia Corporation; NTT DATA; Orange Business; Telefónica Tech; and Vodafone Group Plc.

The hardware segment accounted for 73.33% revenue share in 2024

The mmWave segment is projected to register the highest CAGR of 47.7% during the forecast period.