Europe Pots & Pans for Residential End-Use Market Share, Size, Trends, Industry Analysis Report, By Sizes (Up to 16 cm, 16 to 20 cm, 20 to 24 cm, 24 to 28 cm, 28 to 32 cm, Above 32 cm); By Material; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 119

- Format: PDF

- Report ID: PM4939

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

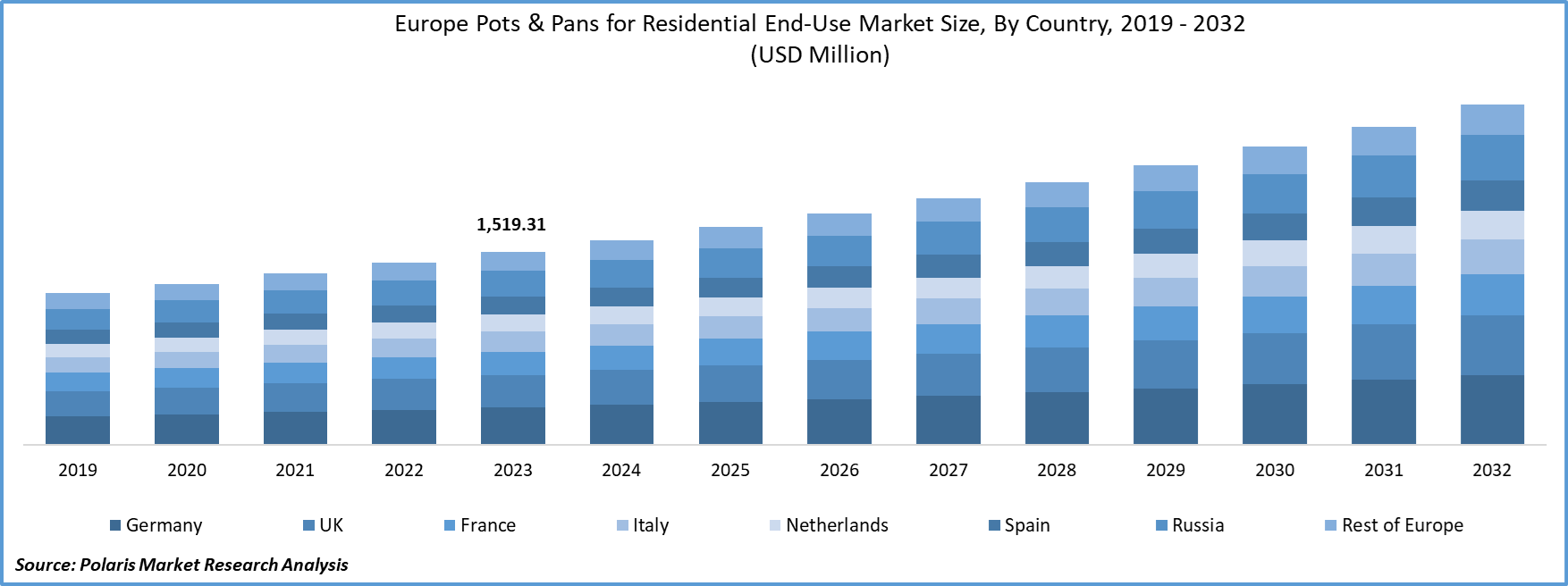

Europe pots & pans for residential end-use market size was valued at USD 1,519.31 million in 2023. The market is anticipated to grow from USD 1,612.53 million in 2024 to USD 2,676.80 million by 2032, exhibiting the CAGR of 6.5% during the forecast period.

Industry Trends

The European pots and pans for residential market places a significant emphasis on innovation and differentiation, employing various colors and custom collections to capture consumer attention. These cookware items come in diverse colors and patterns, though some may require extra care. A substantial portion of the market includes pressed aluminum pots and pans with riveted products, catering to a budget-friendly segment often sold in supermarkets, and distribution centers.

To Understand More About this Research:Request a Free Sample Report

European kitchens commonly feature a mix of materials, allowing for versatile cooking styles. Modern innovations, such as induction-compatible pots and pans, align with the growing popularity of induction stovetops in European homes. Renowned brands like Le Creuset, Tefal, and Fissler offer a wide array of choices, providing residents with options that suit their culinary preferences and kitchen aesthetics.

The pots and pans market in Europe is experiencing acceleration due to high consumer awareness of the importance of a healthy lifestyle. In the UK, there's a shift towards environmentally friendly and convenient nonstick products. The increasing number of television programs dedicated to food and recipes is also contributing to the market's growth. Individuals, especially those confined to their homes during lockdowns, are showing interest in experimenting with various dishes inspired by these shows.

The growing acceptance of e-commerce has facilitated the expansion of the online distribution segment. Manufacturers can now broaden their consumer base, improve communication, manage finances, and enhance brand awareness, all while benefiting from the cost-effectiveness of internet distribution. The rise of digitalization has provided numerous opportunities for the pots and pans business to expand and reach a dynamic customer base that prefers online shopping. This digital era has also altered societal trends, directly influenced consumer preferences, and purchased behavior.

Key Takeaways

- Germany dominated the market and contributed over 17% of the market share in 2023

- By sizes category, the 20 to 24 cm segment accounted for the largest Europe pots & pans for residential end-use market share in 2023

- By material category, the aluminum segment is anticipated to grow with a lucrative CAGR over the Europe pots & pans for residential end-use market forecast period

What are the market drivers driving the demand for market?

Increasing preference for modular kitchens, coupled with elevating living standards, is fueling the demand for pots and pans.

The demand for pots and pans is experiencing a surge due to the growing number of individuals who prefer cooking at home. In the current environment, marked by a focus on wellness and hygiene to shield against external germs and viruses, customers are opting for home-cooked meals. The rising popularity of cooking reality programs has further stimulated interest in honing culinary skills and exploring new cooking techniques and cuisines, positively impacting the sales of pots and pans. The influence of social media has unexpectedly played a significant role in fostering a keen interest in home cooking and experimenting with novel recipes.

This trend in favor of home-cooked meals, propelling the expansion of pots and pans products, is notably driven by millennials. The residential sector of the pots and pans market is witnessing trends such as a demand for more color, pieces that can adapt to smaller spaces, and items catering to consumers' specific needs. With an increase in disposable income and millennials settling towards metro cities, there has been an improvement in consumer living standards over time.

The surge in spending on home improvement projects and remodeling is also contributing to the increased demand for products, as consumers are increasingly inclined towards modular kitchens. Additionally, manufacturers are collaborating with contractors and builders to integrate suitable cookware products into kitchen designs during home construction.

Which factor is restraining the demand for market?

Regulatory Compliance and Safety Standards

Stringent regulations related to food safety and product materials may impact the manufacturing and marketing of pots and pans. Manufacturers may face challenges in meeting these standards, which could affect the supply chain and pricing.

Regulatory bodies often impose restrictions on the types of materials that can be used in pots and pans due to concerns about health risks. For example, restrictions on the use of certain chemicals or heavy metals may limit the materials available to manufacturers, affecting product design and production processes. Strict safety standards may lead to longer product development cycles as manufacturers invest time and resources in ensuring that their products meet all regulatory requirements. Delays in product launches can affect a company's competitiveness in the market.

Manufacturers may need to invest in educational efforts to ensure that consumers are aware of safety guidelines and understand the limitations of certain products. Also New companies may find it challenging to navigate the regulatory landscape and meet the required standards, hindering their ability to enter the market. Non-compliance with safety standards can lead to product recalls, damaging a company's reputation and finances. Manufacturers must be vigilant in ensuring ongoing compliance to avoid the potential costs and negative publicity associated with product recalls.

Report Segmentation

The market is primarily segmented based on sizes, material, and country.

|

By Sizes |

By Material |

By Country |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Sizes Insights

Based on sizes category analysis, the market has been segmented on the basis of Up to 16 cm, 16 to 20 cm, 20 to 24 cm, 24 to 28 cm, 28 to 32 cm, and Above 32 cm. The 20 to 24 cm segment accounted for the largest market share in 2023. The European pots market has witnessed a notable surge in demand, with the 20 to 24 cm size range emerging as a focal point for consumers seeking versatile and practical kitchen solutions. This segment caters to a wide array of cooking needs, striking a balance between accommodating substantial quantities of ingredients and maintaining a manageable size for everyday culinary tasks. The popularity of pots within this size range is reflective of the evolving preferences of European consumers, who prioritize efficiency and convenience in their kitchenware.

Similarly, the Europe pans market has witnessed a notable surge in the demand for cookware falling within the 20 to 24 cm range, reflecting a trend toward more versatile and space-efficient kitchen solutions. Pans of this size cater to a diverse range of cooking needs, striking a balance between accommodating various quantities of food and fitting conveniently on standard stovetops. This size range is particularly popular for European households where efficient use of kitchen space is paramount. Consumers appreciate the adaptability of these pans for everyday cooking tasks, from sautéing vegetables to searing meats.

By Material Insights

Based on material category analysis, the market has been segmented on the basis of stainless steel, aluminum, cast iron, glass, and others. The aluminum segment is anticipated to grow with a lucrative CAGR over the forecast period. The use of aluminum in the production of pots has brought about a paradigm shift in the industry, introducing a range of benefits that cater to the evolving needs of consumers and businesses alike. Aluminum, known for its lightweight yet sturdy nature, has become a preferred choice for pot manufacturers in Europe. This material offers a unique combination of durability and easy handling, making aluminum pots well-suited for both domestic and commercial applications. The lightweight characteristic of aluminum pots ensures ease of use in the kitchen, enhancing the overall cooking experience for consumers. Additionally, the sturdiness of aluminum makes these pots resilient to wear and tear, contributing to their long lifespan and cost-effectiveness.

Similarly, aluminum pans are highly conductive metal and offer several advantages due to their lightweight properties, making them easy to handle and maneuver in the kitchen. Aluminum pans have excellent heat conductivity and distribute heat evenly across the cooking surface. It ensures that food is cooked uniformly and is often more budget-friendly compared to other materials like stainless steel or copper. Induction cooking requires pans with a magnetic base, and aluminum itself is not magnetic. To make aluminum pans compatible with induction, manufacturers often add a coating layer with magnetic properties to the bottom of the pan. This added layer allows the pan to efficiently generate heat when placed on an induction cooktop.

Country-wise Insights

Germany

Germany leads the pots & pans for residential end-use market in Europe because the country has a rich culinary culture, and cooking is considered an important part of daily life. Traditional cooking methods influence the market, but there is also a growing interest in international cuisines and modern cooking techniques. This diversity contributes to the demand for a variety of pots and pans suitable for different cooking styles. Consumers often prioritize quality and durability when purchasing cookware. Manufacturers in the market are expected to meet high standards to satisfy the discerning tastes of consumers. Pots and pans made from durable materials and featuring innovative designs are likely to find favor among German consumers. There is an increasing awareness of health and environmental considerations among German consumers. It has led to a demand for cookware with non-toxic coatings and environmentally friendly materials. Products that align with health and sustainability trends are likely to be well-received.

Competitive Landscape

Companies often adopt diverse sourcing strategies, indluding global sourcing, dual sourcing, and sole sourcing, to optimize costs and mitigate risks. In the European pots and pans market, brands focus on innovation, sustainable materials, and appealing designs to meet consumer preferences. Intense competition and evolving consumer trends drive continual advancements in product offerings. Companies are trying to advance their products by partnering with other key players. For instance, Outokumpu and Fissler partner for sustainable cookware, using low carbon stainless steel, aligning with Fissler's durability and recyclability focus.

Some of the major players operating in the European market include:

- Carl Schmidt Sohn

- Cuisinart

- Fissler GmbH

- Groupe SEB

- Illa S.p.A.

- Le Creuset UK Limited.

- Meyer Corporation

- Sardel

- SCANPAN

- Tramontina

- Wilh. Werhahn KG.

Recent Developments

- In September 2023, Outokumpu and Fissler collaborated to introduce low-carbon stainless steel for sustainable cookware, aligning with Fissler's to produce durable, long-lasting premium products. Fissler emphasizes sustainability, incorporating 100% recyclable stainless steel in their cookware, and plans to use Outokumpu Circle Green for an upcoming anniversary edition.

- In August 2023, Cuisinart, a renowned cookware and home appliance brand, has unveiled a limited-edition Caskata Collection in collaboration with the New England-based company. The six-item collection showcases Caskata's intricate patterns in chic blue and white colors, bringing both style and functionality to the kitchen.

- In June 2023, Tefal introduced RENEW, a groundbreaking cookware line featuring 100% recycled aluminum and Inoceramic non-stick coating, enhancing healthy cooking without added fats.

- In July 2019, Sardel introduced its Italian-made, 5-ply stainless steel cookware collection with ergonomic handles, a unique honeycomb non-stick surface, oven-safety, and affordability.

Report Coverage

The Europe pots & pans for residential end-use market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, sizes, material, and their futuristic growth opportunities.

Europe Pots & Pans for Residential End-Use Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,612.53 million |

|

Revenue forecast in 2032 |

USD 2,676.80 million |

|

CAGR |

6.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Sizes, By Material, By Country |

|

Country scope |

Germany, UK, France, Italy, Netherlands, Spain, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Europe Pots & Pans For Residential End-Use Market report covering key segments are sizes, material, and country.

Europe Pots & Pans for Residential End-Use Market Size Worth USD 2,676.80 Million by 2032.

Europe pots & pans for residential end-use market exhibiting the CAGR of 6.5% during the forecast period

The key driving factors in Europe Pots & Pans for Residential End-Use Market are 1. Increasing preference for modular kitchens, coupled with elevating living standards, is fueling the demand for pots and pans