Europe Limestone Market Share, Size, Trends, Industry Analysis Report, By Application (Chemical Lime, Industry Lime, Construction Lime, Refractory Lime); By End-User; By Country; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM4055

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

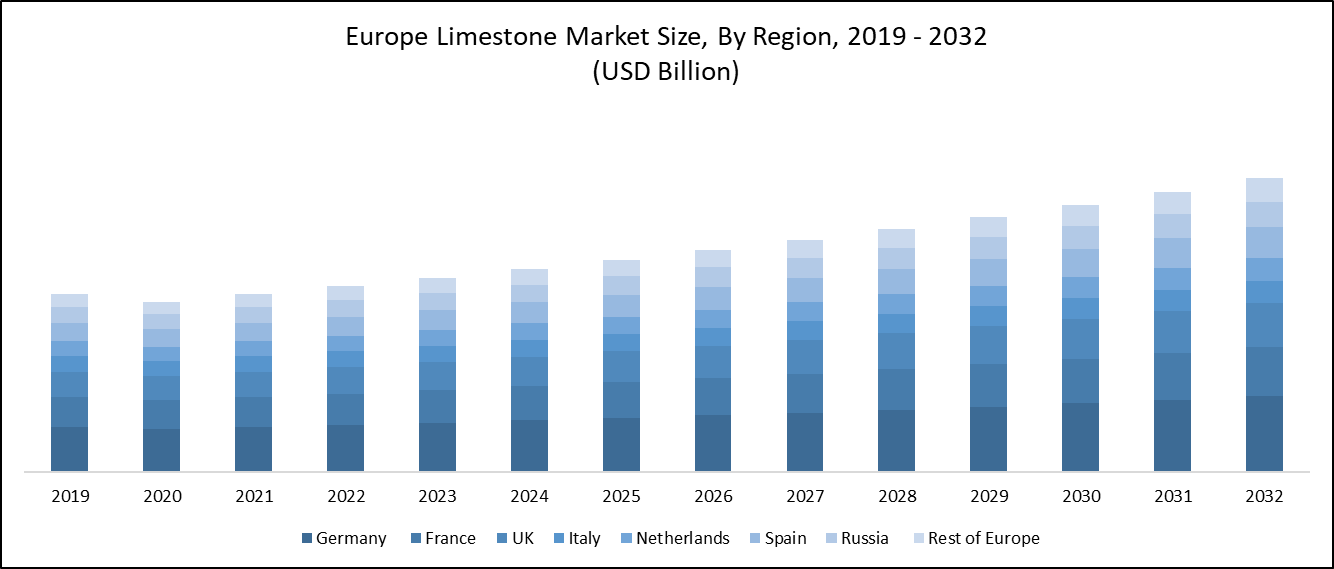

The europe limestone market was valued at USD 12.98 billion in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period.

The European limestone market, steeped in history yet poised for a sustainable future, reflects the enduring appeal of this versatile rock. As Europe pioneers green building practices and embraces modern agricultural techniques, limestone's significance will only grow. By navigating challenges and capitalizing on emerging opportunities, stakeholders in the European limestone market are poised to shape the continent's economic landscape for generations to come.

To Understand More About this Research: Request a Free Sample Report

The UK is embarking on ambitious infrastructure projects, including HS2 (High Speed 2) rail and Crossrail, which will drive demand for construction materials like limestone. Suppliers can play a pivotal role in providing high-quality limestone for these projects. The UK is rich in historical architecture, and there is a continuous need for limestone in restoration projects. This presents an opportunity for suppliers to cater to the preservation of heritage sites and monuments.

The UK government is actively promoting sustainable building practices. Suppliers offering eco-friendly and locally sourced limestone stand to benefit from this growing trend. Urban areas like London are witnessing extensive redevelopment projects. Limestone is a preferred material for modern urban spaces, providing an opportunity for suppliers to cater to this demand.

- For instance, in September 2022, CEMEX successfully obtained authorization to expand its quarry operations at the Serreta Larga quarry in Spain. This enables the company to extract and supply limestone at an annual capacity of 520,000 tons for an extended span of 30 years.

For Specific Research Requirements: Request for Customized Report

Both the UK and other European countries look to France for high-quality limestone. French suppliers have an opportunity to tap into these export markets and establish themselves as reliable sources of premium limestone. With an increasing emphasis on sustainability, there is an opportunity for suppliers to adopt and promote sustainable quarrying practices, which can be a key selling point for environmentally conscious customers. Suppliers can explore innovative products derived from limestone, such as specialized finishes or pre-fabricated elements. These value-added products can cater to specific needs in the construction and design industries.

Growth Drivers

- Increasing urbanization and infrastructure development is projected to spur the product demand.

The relentless pace of urbanization in Europe has led to a surge in construction activities. This has substantially heightened the demand for limestone, a fundamental component in cement and concrete production. Europe is at the forefront of sustainable construction practices, emphasizing the use of eco-friendly materials. Limestone, being abundant and recyclable, aligns perfectly with these green building initiatives. Its versatility allows it to be integrated seamlessly into sustainable construction projects, further driving europe limestone market growth.

Modern agricultural practices, especially in regions like France, where limestone-rich soils are prevalent, have spurred an increased demand for limestone. It serves as an essential soil amendment, optimizing pH levels for optimal crop growth and maximizing agricultural productivity. Moreover, Europe is home to a wealth of historical and architectural treasures, many of which are constructed or adorned with limestone. The ongoing need for restoration and preservation of these sites ensures a steady demand for high-quality limestone, especially in countries like Italy and Greece.

Report Segmentation

The market is primarily segmented based on application end-user, and country.

|

By Application |

By End-User |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

- Chemical Lime segment is expected to witness highest growth during forecast period

The chemical lime segment within the European limestone market has experienced remarkable growth, driven by its integral role in various industries and applications.

One of the primary applications of chemical lime is in the production of calcium oxide (quicklime) and calcium hydroxide. These compounds find extensive usage in metallurgical processes, where they serve as fluxes to facilitate the removal of impurities during the refining of metals. Another critical application is in water treatment, where chemical lime is used to adjust the pH of water, neutralize acidity, and aid in the coagulation and precipitation of impurities. As Europe continues to prioritize clean and safe water supplies, the demand for chemical lime in the water treatment sector remains high.

In the pharmaceutical industry, chemical lime plays a role in various processes, including the manufacture of medications, where it is used as a reagent. This sector's growth has spurred the demand for high-quality chemical lime in Europe. Overall, the chemical lime segment in the European limestone market is thriving, primarily due to its versatility in serving industries such as metallurgy, water treatment, and pharmaceuticals. Its multifaceted applications align with the evolving needs of Europe's industrial landscape, further emphasizing its pivotal role in the region's economic development.

By End-User Analysis

- Agriculture segment held a considerable market share in 2022

The agriculture segment within the European limestone market has experienced substantial growth, showcasing the vital role limestone plays in enhancing agricultural productivity and sustainability. Limestone is an indispensable soil amendment in European agriculture. Its ability to neutralize acidic soils by raising pH levels is crucial for creating optimal conditions for plant growth. This ensures that crops receive the necessary nutrients for healthy development. In regions like France and Spain, where agriculture is a cornerstone of the economy, the demand for limestone in agriculture remains consistently high.

Moreover, limestone aids in improving the structure and water-holding capacity of soils. It enhances soil aeration and promotes the beneficial activities of soil microorganisms, creating a more fertile and conducive environment for plant roots. In addition, the use of limestone as a component in livestock feed supplements further drives its demand in the agriculture sector. It provides essential minerals like calcium that are vital for the health and development of animals.

As European agriculture increasingly adopts modern and sustainable practices, the demand for limestone is expected to continue its upward trajectory. The emphasis on soil health and environmental stewardship aligns with limestone's role in optimizing agricultural outcomes. Overall, the agriculture segment in the European limestone market is poised for sustained growth, ensuring the continued prosperity of the agricultural industry in the region.

Country Insights

- Germany dominated the European market in 2022

Germany's limestone market is characterized by robust demand across various industries. The construction sector stands as a major consumer, relying on limestone for cement and concrete production. This essential ingredient ensures structural integrity and durability in building projects. Germany's manufacturing industry, encompassing steel production and chemical processes, further drives the demand for limestone.

Additionally, agriculture benefits from limestone's role in soil stabilization and pH level adjustment, optimizing conditions for crop growth. The emphasis on sustainability in construction and agriculture aligns with limestone's eco-friendly properties, solidifying its position in the market. Germany's strategic location in Europe positions it as a key player, not only in catering to domestic demand but also in contributing to the wider European limestone industry. With its well-developed industrial base and commitment to green practices, Germany's limestone market is poised for sustained growth.

Key Market Players & Competitive Insights

The European limestone market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the European market include:

- Buechel Stone Corp.

- Carmeuse Group S.A.

- CRH plc

- Eurocement Group

- HeidelbergCement AG

- Independent Limestone Company, LLC

- Lhoist Group

- Mississippi Lime Company

- Mitsubishi Materials Corporation

- NALC LLC

- Nittetsu Mining Co., Ltd.

- Omya AG

- SCHAEFER KALK GmbH & Co. KG

- United States Lime & Minerals, Inc.

- Vulcan Materials Company

Recent Developments

- In January 2023, The European Commission's recently introduced Common Agricultural Policy aims to bolster European farmers in their shift towards a more sustainable and robust agricultural sector, while also safeguarding the vitality of rural communities. These comprehensive strategies are set to assist lemon growers in rural areas in enhancing their production capabilities.

Europe Limestone Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 13.57 billion |

|

Revenue forecast in 2032 |

USD 20.54 billion |

|

CAGR |

4.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By End-User, By Country |

|

Customization |

Report customization as per your requirements with respect to countries, and segmentation. |