Europe Crop Protection Chemicals Market Size, Share, Trends, Industry Analysis Report: By Type (Herbicides, Insecticides, Fungicides & Bactericides, and Others), Origin, Form, Mode of Application, Crop Type, and Country (Germany, UK, France, Italy, Spain, Netherlands, Russia, and Rest of Europe) – Market Forecast, 2025 - 2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5322

- Base Year: 2024

- Historical Data: 2020-2023

Europe Crop Protection Chemicals Market Overview

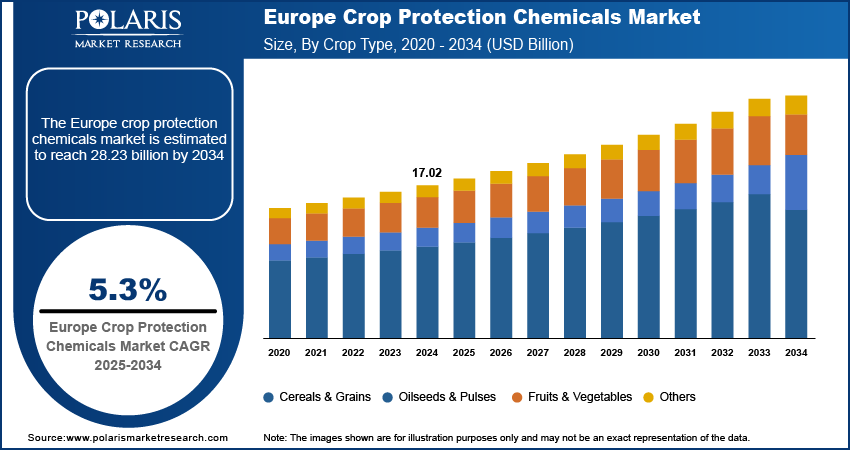

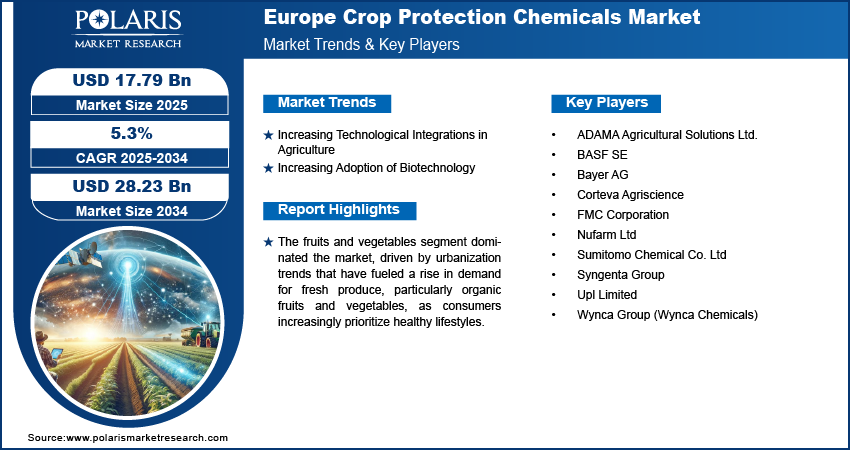

Europe crop protection chemicals market size was valued at USD 17.02 billion in 2024. The market is projected to grow from USD 17.79 billion in 2025 to USD 28.23 billion by 2034, exhibiting a CAGR of 5.3% during the forecast period.

The Europe crop protection chemicals market is experiencing growth due to the growing European population. It is driving the demand for more and different types of food, which in turn is increasing the need to boost crop yield and quality. This demand is also influenced by the rising preference for nutrient-dense and residue-free food products, which is a result of growing health awareness and socio-economic changes. As the population grows, the pressure on agricultural land increases, leading to a need for farmers to become more efficient and productive to meet the food demand. According to a report from the Food and Agriculture Organization of the UN, in December 2023, in order to meet the needs of an expected global population of 9.1 billion by 2050, food production will need to increase by 70%.

Crop protection chemicals play a crucial role in helping farmers achieve this by providing a cost-effective way to improve crop yield and quality. These chemicals help farmers manage pests and diseases effectively, ensuring that crops are healthy and productive, which is essential for meeting the growing food demand.

To Understand More About this Research: Request a Free Sample Report

The European crop protection chemicals market is shifting towards sustainable and technology-driven solutions driven by evolving consumer preferences and regulatory mandates. There is increasing emphasis on environmentally friendly crop protection methods, spurred by both consumer demand and stringent EU regulations. Biopesticides, derived from natural sources such as plants, bacteria, and fungi, are gaining traction as substitutes for synthetic pesticides within the European market.

Europe Crop Protection Chemicals Market Drivers and Trends

Increasing Technological Integrations in Agriculture

Technological integration in agriculture, particularly through digital innovations such as precision agriculture, drones, and data analytics, represents a significant leap forward in how crop protection chemicals are utilized and managed. Precision agriculture leverages technologies such as GPS, sensors, and mapping tools to monitor and manage crop conditions in real-time precisely. By using data-driven insights, farmers can make informed decisions regarding pesticide application, ensuring targeted treatments that maximize effectiveness while reducing environmental impact and operational costs. For instance, CropLife Europe's Digital agronomy enhanced farming efficiency through technologies including AI, drones, and digital sensors, optimizing pesticide and fertilizer use while maximizing crop yields and sustainability.

Drones have emerged as a valuable tool in modern agriculture by providing aerial imagery and data collection capabilities. Equipped with sensors, drones can monitor crop health, detect pest infestations, and assess field conditions with unprecedented detail and efficiency. This enables farmers to respond promptly to emerging threats, applying crop protection chemicals precisely where pests are detected, thereby preventing potential crop damage. Moreover, the integration of data analytics allows farmers to analyze vast amounts of data collected from various sources, including drones and field sensors, to gain actionable insights into crop health trends, pest dynamics, and environmental conditions.

Increasing Adoption of Biotechnology

The increasing adoption of biotechnology, particularly genetically modified (GM) crops, has reshaped agricultural practices worldwide. GM crops are engineered to possess desirable traits such as resistance to pests, diseases, or environmental stresses. However, these traits sometimes necessitate the use of complementary crop protection chemicals to manage specific pests or diseases effectively.

This synergy between biotechnology and crop protection chemicals has not only expanded agriculture but also offered farmers enhanced tools to address challenges including insect resistance and crop diseases, which can significantly boost demand for crop protection chemicals. Moreover, the adoption of biotechnology has spurred innovation in crop protection chemicals themselves, leading to formulations that are more specific, effective, and environmentally friendly. This dual approach of biotechnology and advanced crop protection chemicals supports farmers in producing higher yields with reduced environmental impact, contributing to global food security goals amidst evolving agricultural challenges.

Europe Crop Protection Chemicals Market Segment Insights

Europe Crop Protection Chemicals Market Breakdown by Crop Type Insights

The Europe crop protection chemicals market segmentation, based on crop type, includes cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The fruits and vegetables segment dominated the market, driven by urbanization trends that have fueled a rise in demand for fresh produce, particularly organic fruits and vegetables, as consumers increasingly prioritize healthy lifestyles. This shift towards organic options over conventional ones has spurred growers to adopt crop protection chemicals that comply with organic farming standards, thus boosting the market for organic-friendly pest management solutions and treatments. According to UNComtrade data from July 2023, Europe's robust market for fresh fruit and vegetables imported around 55 million tonnes annually, accounting for 40% of the global trade volume on average.

The prevalence of diseases affecting fruit and vegetable crops has heightened the urgency for effective crop protection measures. Farmers are turning towards advanced chemical solutions that safeguard crop yields while minimizing environmental impact. Simultaneously, the adoption of natural pest management solutions, especially in orchards, underscores a broader industry trend toward sustainable agriculture practices.

Europe Crop Protection Chemicals Market Breakdown by Form Insights

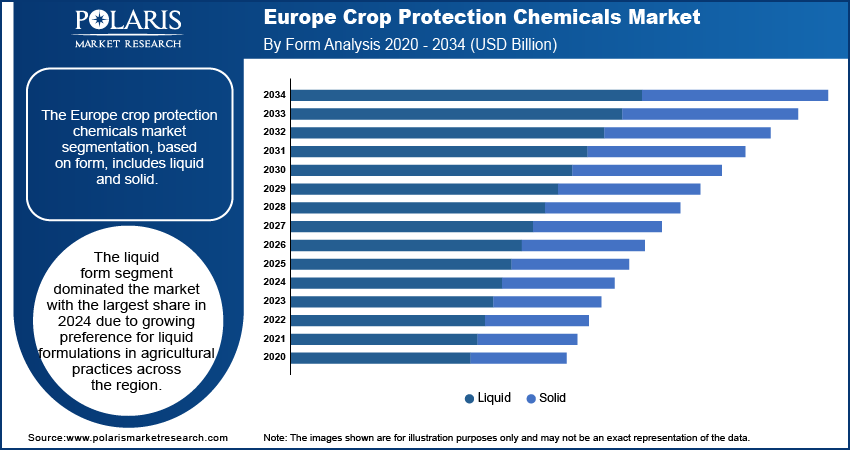

The Europe crop protection chemicals market segmentation, based on form, includes liquid and solid. The liquid form segment dominated the market with the largest share in 2024. Liquid formulations are favored for their ease of application, ensuring uniform coverage across crops. They are also noted for their superior performance and extended effectiveness, lasting up to 6 months compared to dry formulations, which typically last up to 3 months. Advancements in spraying technologies further enhance the appeal of liquid formulations, making them more efficient and precise in their application.

Liquid formulations are perceived as safer to handle and apply due to their reduced likelihood of generating dust, which poses inhalation risks associated with dry formulations. This safety aspect is particularly valued among European farmers, contributing significantly to the growing preference for liquid formulations in agricultural practices across the region.

Europe Crop Protection Chemicals Market Breakdown by Country Insights

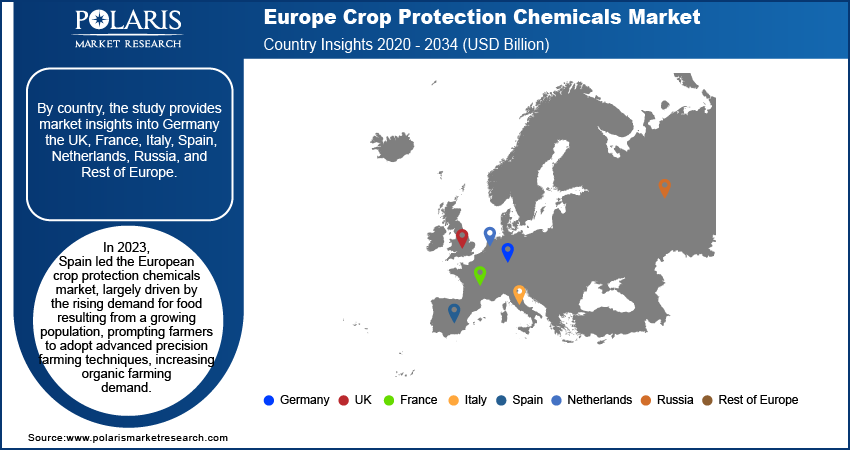

By country, the study provides market insights into Germany, the UK, France, Italy, Spain, Netherlands, Russia, and Rest of Europe. In 2023, Spain led the European crop protection chemicals market, largely driven by the rising demand for food resulting from a growing population, prompting farmers to adopt advanced precision farming techniques, increasing organic farming demand. This approach optimizes the use of crop protection chemicals, enhancing efficiency and yield. According to the Union of Small Farmers and Ranchers (UPA) and the Spanish Society of Organic Agriculture and Agroecology (SEAE) report a growth in the area devoted to organic farming in Spain reached over 2.67 million hectares in 2022 (almost 11% of total agriculture).

Spain boasts substantial organic farmland and a rising consumer preference for organic food, bolstering the demand for organic crop protection solutions. Moreover, supportive government policies favoring biological crop protection chemicals further contribute to Spain's prominent position in the European market, ensuring sustainable agricultural practices aligning with environmental and health considerations.

Europe Crop Protection Chemicals Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the crop protection chemicals market grow even more. Market participants are also undertaking a variety of strategic activities to expand their European footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Europe crop protection chemicals industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the market to benefit clients and increase the market sector. In recent years, Europe crop protection chemicals market has offered some technological advancements. Major players in the Europe crop protection chemicals market include ADAMA Agricultural Solutions Ltd.; BASF SE; Bayer AG; Corteva Agriscience; FMC Corporation; Nufarm Ltd; Sumitomo Chemical Co. Ltd; Syngenta Group; Upl Limited; and Wynca Group (Wynca Chemicals).

BASF SE is a European chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In October 2023, BASF invested in a new fermentation plant at its Ludwigshafen site to produce biological and biotechnology-based crop protection products, including Inscalis. Commissioning is scheduled for the second half of 2025.

Bayer AG is a multinational conglomerate with core competencies in Life Sciences, encompassing healthcare and agriculture. The company has evolved into a global powerhouse with a diverse portfolio of products and solutions to improve lives and address some of the world's most pressing challenges. Bayer is advancing medical science and enhancing patient well-being in the healthcare sector. In September 2023, Bayer invested approximately $236 million to establish a new research and development facility in Germany aimed at advancing sustainable crop protection products and supporting regenerative agriculture efforts.

Key Companies in Europe Crop Protection Chemicals Market

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- Upl Limited

- Wynca Group (Wynca Chemicals)

Europe Crop Protection Chemicals Industry Developments

July 2024: Corteva Agriscience launched ProClova in Germany, a new herbicide effective for weed control in grasslands while preserving clover species, available from July 2024 and expanding to Austria by early 2025.

April 2024, Bayer secured exclusive rights launched the first bioinsecticide for arable crops through a partnership with UK-based AlphaBio Control. The product is expected to be available in 2028.

January 2024: ADAMA launched five new cereal fungicide products in Europe, featuring innovative Asorbital Formulation Technology for enhanced efficacy and addressing diverse farmer needs across crop stages and disease types.

Europe Crop Protection Chemicals Market Segmentation

By Type Outlook

- Herbicides

- Insecticides

- Fungicides & Bactericides

- Other

By Origin Outlook

- Synthetic

- Biopesticides

By Form Outlook

- Liquid

- Solid

By Application Outlook

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Other

By Crop Type Outlook

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Country Outlook

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Crop Protection Chemicals Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 17.02 billion |

|

Market Size Value in 2025 |

USD 17.79 billion |

|

Revenue Forecast in 2034 |

USD 28.23 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Europe crop protection chemicals market size was valued at USD 17.02 billion in 2024 and is projected to hold USD 28.23 billion in 2034.

The Europe crop protection chemicals market exhibits at a CAGR of 5.3% during the forecast period, 2025-2034

Spain had the largest share in the Europe market.

The key players in the market are ADAMA Agricultural Solutions Ltd.; BASF SE; Bayer AG; Corteva Agriscience; FMC Corporation; Nufarm Ltd; Sumitomo Chemical Co. Ltd; Syngenta Group; Upl Limited; and Wynca Group (Wynca Chemicals).

The fruits and vegetables category dominated the market in 2024.

The liquid form had the largest share in the market.