Eubiotics Market Share, Size, Trends, Industry Analysis Report, By Form (Solid, Liquid); By Product; By End Use; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM1096

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

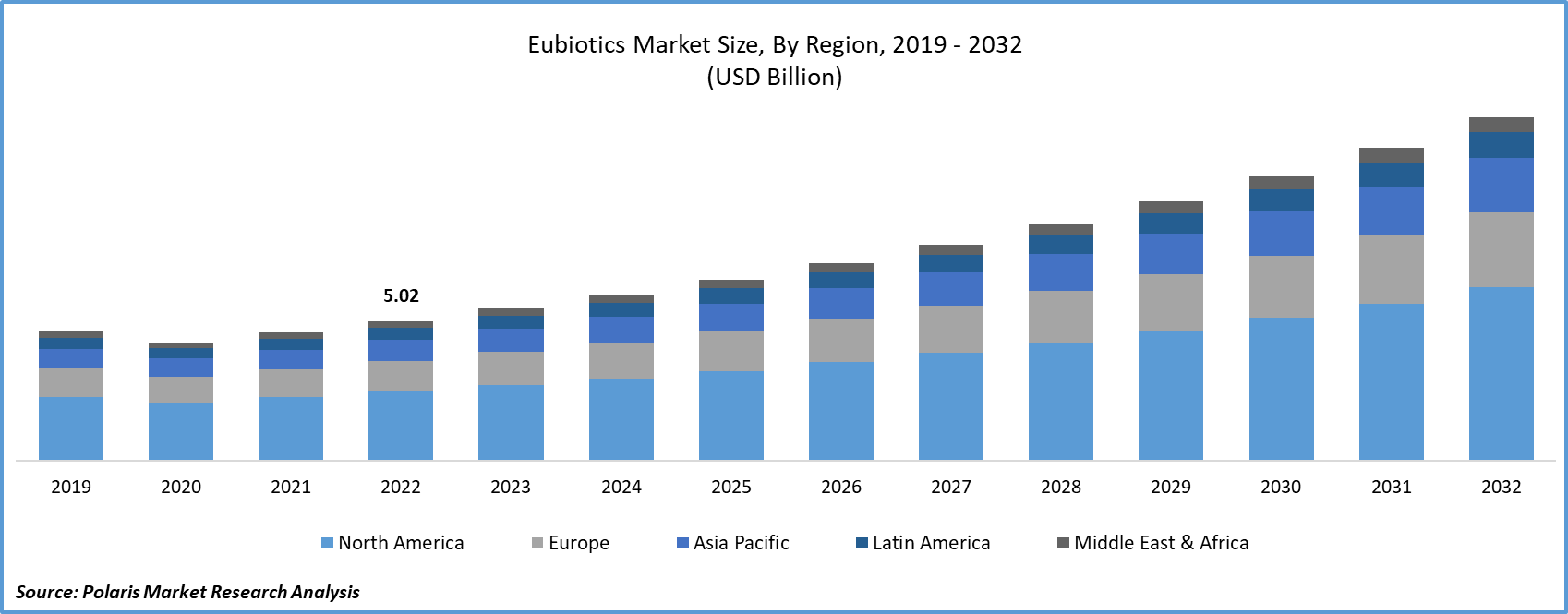

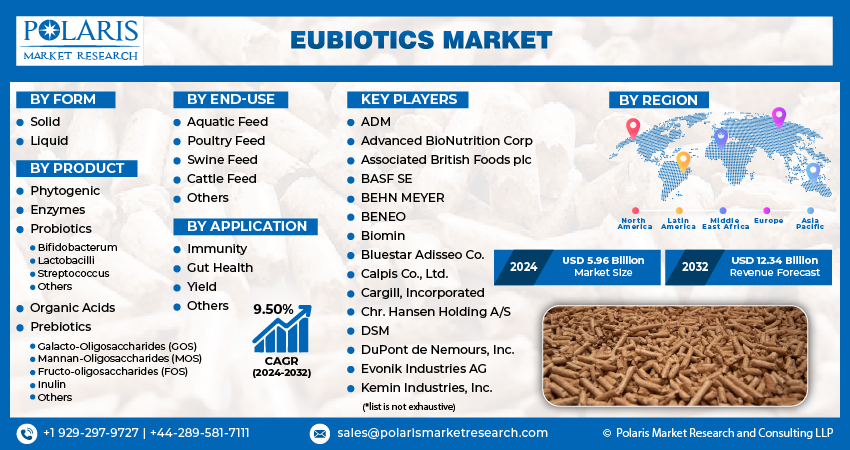

The global eubiotics market was valued at USD 5.47 billion in 2023 and is expected to grow at a CAGR of 9.50% during the forecast period.

Anticipated growth in product demand is expected to result from favorable regulatory conditions prohibiting antibiotic usage and the increasing global consumption of meat.

The market is marked by fierce competition, wherein well-established, longstanding players command substantial market shares. Companies are making substantial investments in research and development to create sustainable technologies for the cost-effective production of affordable products. In several countries, particularly in the Middle East, a scarcity of players presents abundant opportunities for new entrants to establish a robust presence in the market.

To Understand More About this Research: Request a Free Sample Report

Eubiotics are produced and distributed through various channels, including feed mills, pre-mixers, and specialized distributors. Companies engaged in eubiotic manufacturing either directly sell their products to consumers or supply them to integrated feed producers, ensuring that the eubiotic products ultimately reach livestock producers. Eubiotics, such as organic acids, are typically manufactured through processes like fermentation and chemical synthesis. In animal feed applications like silage and feed additives, chemical synthesis is predominantly favored.

The pricing of eubiotics is primarily influenced by factors such as raw material availability, agro-climatic conditions, and regional regulations. Manufacturers engage in competitive pricing strategies due to the presence of price-sensitive buyers. To gain a competitive edge, manufacturers emphasize process innovation and efficient procurement of low-cost raw materials. Additionally, the expanding use of eubiotics in applications like feed and pharmaceuticals, coupled with the growing production of eubiotics to address supply-demand imbalances, is expected to impact prices during the forecast period moderately.

For Specific Research Requirements: Request for Customized Report

In the nutraceuticals industry, eubiotic products like prebiotics and probiotics play a crucial role in the value chain. Emerging economies, exemplified by India and China, hold a favorable position in the eubiotics market due to technological advancements, cost-effective labor, and ample access to raw materials resulting from increased production. Key players in these developing economies are strategically establishing optimized processes and robust supply chains to manufacture products cost-effectively, consequently providing their offerings at more competitive prices.

Industry Dynamics

Growth Drivers

Advancement of the Poultry Industry

Over the last decade, significant transformations have occurred in the livestock industry, particularly in response to the growing demand for commercial cattle farming and its associated value chains. The practice of animal husbandry has undergone considerable diversification, particularly in regions such as Japan, China, and India. This evolution emphasizes the implementation of scientific management practices for farm animals, aiming to increase output while reducing expenses.

As per the World Bank, the transition to industrialized meat production is progressing at a rate six times swifter than traditional meat production. As industrial meat production expands, there is a growing interest in the concept of landless meat production facilities. The intensification of livestock farming raises concerns about potential soil and water pollution. Animal feces, containing 60-90% of the nitrogen and phosphorus consumed by the animals, contribute to these environmental challenges.

Addressing the environmental impact of intensive livestock farming, the use of Eubiotics becomes crucial. Eubiotics play a primary role in enhancing feed digestibility, enabling animals to absorb nutrients and produce less waste more efficiently. With the increasing industrialization of livestock farming, it is anticipated that Eubiotics will be employed more frequently to enhance the body mass of meat animals and mitigate the environmental footprint associated with this agricultural practice.

Report Segmentation

The market is primarily segmented based on form, product, end-use, application, and region.

|

By Form |

By Product |

By End-Use |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Probiotics Segment Held the Largest Revenue Share in 2022

The increased awareness of probiotic use in animal feed, continuous research, and development efforts to create more effective products, and the extensive range of offerings from key industry players contribute to this phenomenon. Additionally, the multiple applications in animal contexts, such as enhancing immunity and maintaining gut health, are anticipated to influence market demand positively.

Moreover, there has been notable growth in the demand and consumption of propionic acid compared to other organic acids. A significant portion of the produced propionic acid serves as a preservative in both human and animal food. Its most effective application lies in serving as a feed additive and growth promoter, particularly in food animals such as poultry and pigs.

By Form Analysis

The Solid Segment Accounted for the Highest Market Share During the Forecast Period

This significant share is credited to its benefits, such as heightened protection against exposure to light and moisture. Solid forms encompass flakes, beadlets, and cross-linked beadlets. The utilization of beadle technology consistently shields the active ingredients from both mechanical and heat stress, enhancing their stability and bioavailability in feed production.

Feed formulators are increasingly favoring the liquid form due to its ability to significantly contribute to the animal's good health and enhanced performance, surpassing the advantages of solid forms while also presenting a more economical option. Moreover, the preference for the liquid form of these feed additives is driven by their capability to lower enteric pathogens and gastric pH, making them a cost-effective choice.

By Application Analysis

The Gut Health Segment Accounted for the Highest Market Share During the Forecast Period

Its significant market share can be attributed to the prevalent gut health issues among animals and a growing preference for preventive healthcare. Eubiotic products play a crucial role in fostering the production of microbiota in the animal's gastrointestinal tract, thereby enhancing digestion and the immune system. Probiotics, prebiotics, organic acids, essential oils, and other such products contribute effectively to maintaining gut integrity. These items can be utilized individually or in combination for optimal results.

Eubiotics are employed to enhance both the performance and the overall health status of domesticated animals. The product's efficacy relies on its antimicrobial effects and its capacity to influence the gut flora. Notable gut health enhancers encompass fructo-oligosaccharide, beta-glucan, probiotics, mannan-oligosaccharide, and prebiotics.

Eubiotics play a crucial role in enhancing the immune system of animals. Although the immune system represents a relatively minor component of the animal's total nutritional requirements, its activation presents a notable challenge and exerts a profound influence on the nutritional status. Insufficient immunity levels can render animals susceptible to various infections and diseases, including parasitic, viral, and bacterial infections, ultimately leading to fatal outcomes. Therefore, it is imperative to boost and develop immunity levels, particularly in growing and newborn animals.

Regional Insights

Europe Dominated the Market in 2022

Europe dominated the market due to the growing consumption of processed meat and the rise in livestock production. Countries like Italy, France, and Germany have witnessed a significant upswing in meat consumption in recent years. This surge has prompted producers to seek out high-quality and disease-free animal products.

The Asia Pacific region is rapidly emerging as one of the fastest-growing markets globally. The increased consumption of meat and meat products has underscored the importance of prioritizing animal health and hygiene, leading to a heightened demand for feed additives. The surge in beef and pork consumption in countries such as China, India, Japan, and South Korea is a key factor propelling the demand for animal feed and additives in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ADM

- Advanced BioNutrition Corp

- Associated British Foods plc

- BASF SE

- BEHN MEYER

- BENEO

- Biomin

- Bluestar Adisseo Co.

- Calpis Co., Ltd.

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- DSM

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Kemin Industries, Inc.

- Lallemand, Inc.

- Lesaffre Group

- Novozymes

- Novus International, Inc.

- UAS Laboratories

Recent Developments

- In January 2023, Cargill and BASF have announced the expansion of their partnership in feed enzyme distribution and development to encompass the United States. The goal is to create a collaborative innovation pipeline to support the animal protein producers in the region who are grappling with the increasing demand for animal protein.

- In August 2022, Koninklijke DSM NV, a Dutch multinational corporation, has unveiled Symphiome, a eubiotic feed additive designed to promote optimal gut health, growth, welfare, and sustainability in poultry.

Eubiotics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.96 billion |

|

Revenue forecast in 2032 |

USD 12.34 billion |

|

CAGR |

9.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Form, By Product, By End Use, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global eubiotics market size is expected to reach USD 12.34 billion by 2032

Key players in the market are ADM, Advanced BioNutrition Corp, Associated British Foods plc, BASF SE, BEHN MEYER, BENEO, Biomin

Europe contribute notably towards the global eubiotics market

The global eubiotics market is expected to grow at a CAGR of 9.5% during the forecast period.

The eubiotics market report covering key segments are form, product, end-use, application, and region.