Ethylene Copolymers Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Hot Melt Adhesives, Asphalt Modifications, Thermo-Adhesive Films, and Others), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5311

- Base Year: 2024

- Historical Data: 2020-2023

Ethylene Copolymers Market Overview

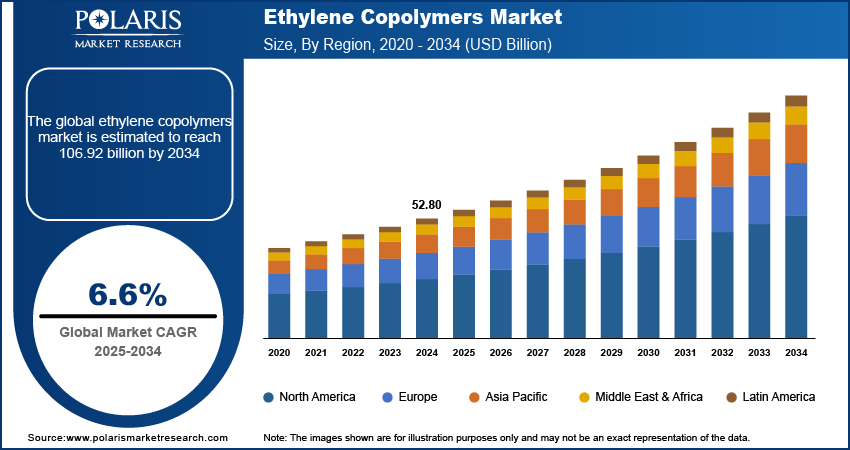

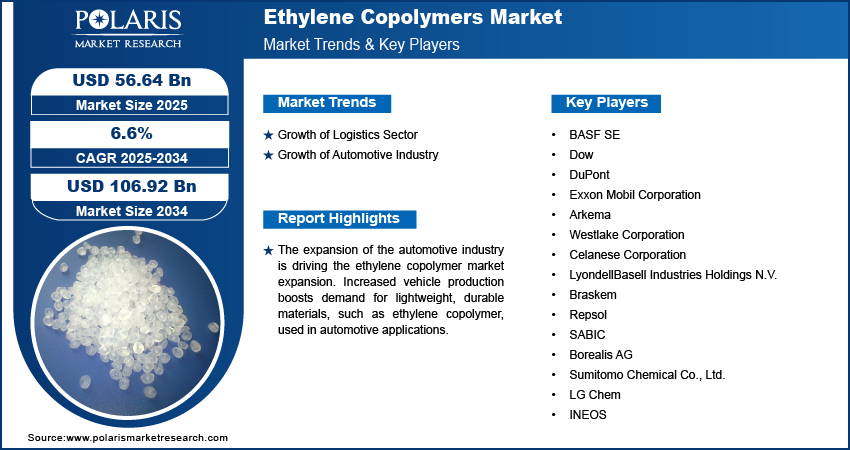

The ethylene copolymers market size was valued at USD 52.80 billion in 2024. The market is projected to grow from USD 56.64 billion in 2025 to USD 106.92 billion by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

Ethylene copolymers are polymers formed by combining ethylene with one or more other monomers, resulting in materials that exhibit a blend of properties from both. These copolymers are used in various applications for their flexibility, durability, and resistance to heat and chemicals.

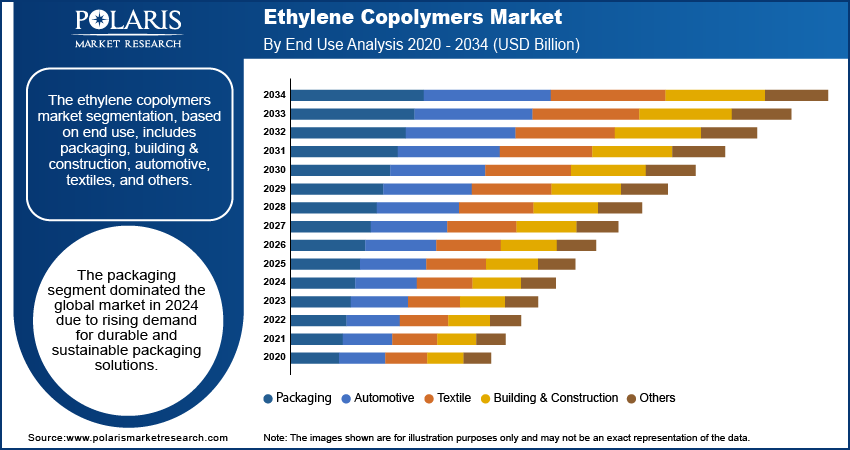

The ethylene copolymer market expansion is fueled by the growing demand for durable packaging solutions in industries such as food & beverages and e-commerce. With consumers seeking more convenient and dependable packaging, manufacturers are increasingly relying on ethylene copolymers due to their superior flexibility, moisture resistance, and durability. These materials help safeguard products during transportation and storage, maintaining their freshness and integrity. In the food & beverage sector, the need for reliable packaging solutions is rising, driven by stringent safety regulations aimed at preventing contamination and ensuring product quality. Similarly, the growing e-commerce industry relies on strong, lightweight materials, making ethylene copolymers an essential choice for modern packaging solutions. Therefore, the rising demand for durable packaging solutions boosts the ethylene copolymer market development.

To Understand More About this Research: Request a Free Sample Report

The rising investments in key end-use industries, particularly packaging and construction, drive the ethylene copolymer market growth. These sectors are increasingly adopting advanced materials such as ethylene copolymers due to their exceptional flexibility, strength, and resistance to environmental factors. The influx of capital into these industries is enabling the acquisition of cutting-edge materials that improve operational efficiency and product performance. In packaging, ethylene copolymers are used to create robust, protective solutions. In construction, they are essential for waterproofing and sealing applications. This increase in investments is directly fueling the ethylene copolymer market growth.

Ethylene Copolymers Market Drivers

Growth of Logistics Sector

The logistics industry across the world is growing rapidly. Logistics UK reports that the logistics sector in the UK employs 1.25 million people, reflecting the industry's significant growth. As the industry continues to thrive, demand for reliable and innovative packaging solutions rises. The industry prefers ethylene copolymers for their durability and flexibility. Therefore, the expansion of the logistics sector is driving the ethylene copolymer market demand.

Growth of Automotive Industry

Rising vehicle production boosts the demand for lightweight and durable materials such as ethylene copolymers. According to the International Organization of Motor Vehicle Manufacturers, in 2023, vehicle sales rose by 12% compared to 2022, highlighting this industry's expansion. This boost in car production creates a higher demand for ethylene copolymer for various automotive applications, such as interior parts and exterior coatings. Overall, the expanding automotive industry significantly increases the demand for ethylene copolymer, positively impacting the ethylene copolymer market expansion.

Ethylene Copolymers Market Segment Insights

Ethylene Copolymers Market Assessment by Application Outlook

The ethylene copolymers market segmentation, based on application, includes hot melt adhesives, asphalt modifications, thermo-adhesive films, and others. The hot melt adhesive segment is expected to experience the highest CAGR in the global market during the forecast period. This growth is attributed to the increasing use of hot melt adhesives in the automotive industry due to their high color stability and excellent bonding properties. Automotive manufacturers seek materials that enhance durability and aesthetics. Therefore, the demand for ethylene copolymer-based hot melt adhesives is expected to rise during the forecast period.

Ethylene Copolymers Market Evaluation by End Use Outlook

The ethylene copolymers market segmentation, based on end use, includes packaging, building & construction, automotive, textiles, and others. The packaging segment is expected to dominate the ethylene copolymers market share during the forecast period. This growth is driven by the rising demand for durable and sustainable packaging solutions. More companies focus on eco-friendly materials; therefore, ethylene copolymers have become a popular choice for producing strong and lightweight packaging. This shift is expected to continue as consumers and businesses prioritize sustainability in their packaging options.

Ethylene Copolymers Market Regional Outlook

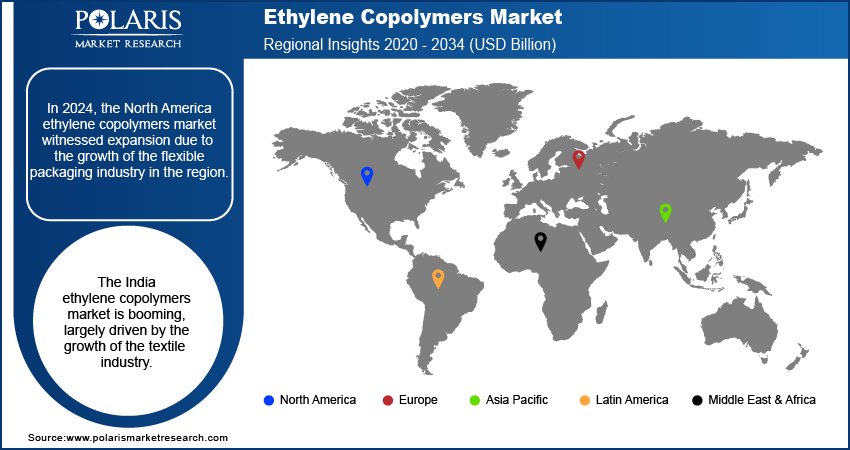

By region, the study provides the ethylene copolymers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the ethylene copolymers market revenue. The growth of the flexible packaging industry is driving the demand for ethylene copolymers in the region as manufacturers seek flexible, sustainable, and durable packaging solutions. According to the Flexible Packaging Association, in 2022, the US flexible packaging industry generated sales of USD 41.5 billion, which shows the growth of the flexible packaging industry in North America. Additionally, as the flexible packaging industry continues to grow, the demand for ethylene copolymers is expected to rise, leading to increased production and innovation in this material during the forecast period.

Asia Pacific is projected to register a substantial CAGR during the forecast period due to rising mergers and strategic collaborations in the region. These activities are helping companies expand their reach in various industries such as textiles and construction. This growth creates more opportunities across different sectors, leading to the ethylene copolymer market growth in Asia Pacific.

The ethylene copolymers market demand in India is set for substantial growth, driven by the growth of the textile industry. According to the Asia Garment Hub, the textile industry in India employs 45 million people, which highlights the growth of the industry. As the demand for textiles increases, the need for advanced materials such as ethylene copolymers also rises. These materials are used in various textile applications, improving durability and performance. With a growing population and rising consumer spending, the textile industry's expansion is expected to boost the ethylene copolymer demand in India.

Ethylene Copolymers Market – Key Players and Competitive Insights

The ethylene copolymers market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative manufacturing techniques to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the ethylene copolymers market are BASF SE; Dow; DuPont; Exxon Mobil Corporation; Arkema; Westlake Corporation; Celanese Corporation; LyondellBasell Industries Holdings N.V.; Braskem; Repsol; SABIC; Borealis AG; Sumitomo Chemical Co., Ltd.; LG Chem; INEOS.

Exxon Mobil Corporation, also known as ExxonMobil, is an American multinational oil and gas company based in Spring, Texas. The company was established in 1999 following the merger of Exxon and Mobil, both of which were descendants of John D. Rockefeller's Standard Oil. ExxonMobil is among the largest integrated energy companies globally, engaging in all aspects of the oil & gas industry, including exploration, production, refining, and marketing. The company operates in various segments—Upstream, which focuses on oil and gas exploration and extraction; Downstream, which encompasses the refining and marketing of petroleum products; and Chemical, which produces petrochemicals and specialty products. With a workforce of around 88,300 employees, the company’s operations span over 200 countries.

BASF SE is a global chemical corporation with seven distinct business segments—chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, the surface technologies segment provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

List of Key Companies in Ethylene Copolymers Market

- BASF SE

- Dow

- DuPont

- Exxon Mobil Corporation

- Arkema

- Westlake Corporation

- Celanese Corporation

- LyondellBasell Industries Holdings N.V.

- Braskem

- Repsol

- SABIC

- Borealis AG

- Sumitomo Chemical Co., Ltd.

- LG Chem

- INEOS

Ethylene Copolymers Industry Developments

September 2025: Mitsui & Dow Polychemicals announced the launch of biomass ethylene vinyl acetate copolymer and biomass low-density polyethylene, certified by ISCC PLUS.

November 2024: SKFP announced the launch of LOTRYL 40MA05T, a new ethylene-acrylate copolymer with 40% methyl acrylate. Developed for flexible cables and impact modification, it offers high polarity and flexibility, providing a cost-effective alternative to EVA and enhancing various applications.

Ethylene Copolymers Market Segmentation

By Type Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- Ethylene-Vinyl Acetate

- Ethylene Ethyl Acrylate

- Ethylene Butyl Acrylate

- Ethylene Propylene

- Others

By Application Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- Hot Melt Adhesives

- Asphalt Modifications

- Thermo-Adhesive Films

- Others

By End Use Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- Packaging

- Building & Construction

- Automotive

- Textiles

- Others

By Regional Outlook (Volume, Kilotons; Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ethylene Copolymers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 52.80 Billion |

|

Market Size Value in 2025 |

USD 56.64 Billion |

|

Revenue Forecast by 2034 |

USD 106.92 Billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 52.80 billion in 2024 and is projected to grow to USD 106.92 billion by 2034.

The global market is projected to register a CAGR of 6.6% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are BASF SE; Dow; DuPont; Exxon Mobil Corporation; Arkema; Westlake Corporation; Celanese Corporation; LyondellBasell Industries Holdings N.V.; Braskem; Repsol; SABIC; Borealis AG; Sumitomo Chemical Co., Ltd.; LG Chem; and INEOS.

The hot melt adhesive segment is expected to experience the highest CAGR in the global market due to increasing application in the automotive industry.

The packaging segment dominated the market in 2024 due to the rising demand for durable and sustainable packaging solutions.