eSIM Market Share, Size, Trends, Industry Analysis Report, By Solution (Hardware, Connectivity Services); By Application (Consumer Electronics, M2M); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 111

- Format: PDF

- Report ID: PM2065

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

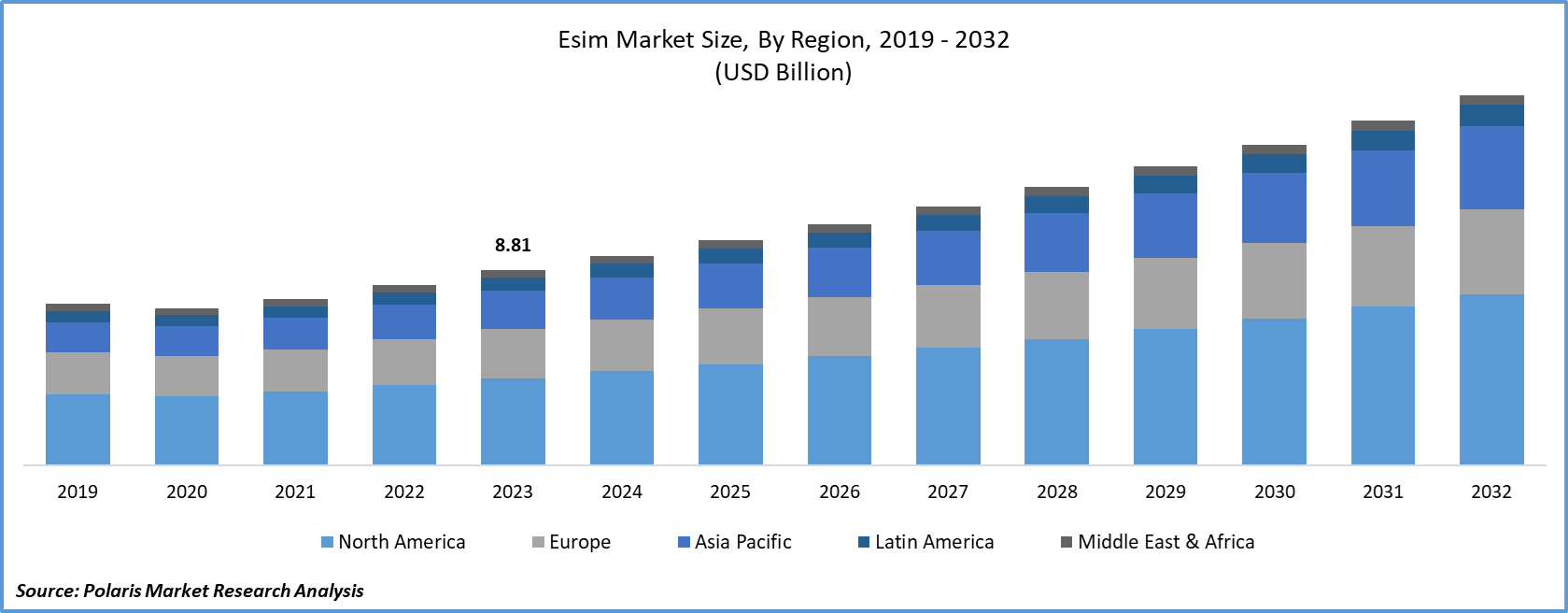

The global eSIM market size was valued at USD 8.81 billion in 2023. The market is anticipated to grow from USD 9.45 billion in 2024 to USD 16.69 billion by 2032, exhibiting the CAGR of 7.4% during the forecast period.

The growth of this market is driven by the continuous focus on remote SIM provisioning for M2M application to simplify the operational efficiency and secure environment, coupled with the growing government initiatives to support the adoption of IoT technology and M2M communication infrastructure. Additionally, the SIM technology has further led to innovations in the field of the connected ecosystem by allowing secure Machine-to-Machine (M2M) communication, which is further thrusting the market for eSIM on a global scale.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

During the inception of the COVID-19 pandemic, the global demand for the eSIM market was significantly reduced due to the weakened investments projects by government and private companies in consumer electronic manufacturing, which leads to cutbacks in such business lines. Thus, it can be defined as the recent outbreak of the novel COVID-19 diseases has considerably dropped the consumption of eSIM, thereby hampered the market growth considering the global scenario.

Industry Dynamics

Growth Drivers

The market demand for eSIM is rising gradually, which has created a significant growth opportunity for key players worldwide. eSIM offers secure, reliable, and economic connectivity for IoT/M2M applications. Thus, improved implementation of the wireless cellular-based solution has been observed, particularly eSIMs among different end-users.

Another integral advantage of the product is to provide physical security, as they are instantly linked to the device’s circuit. Therefore, the eSIM has observed a significant rise in adoption across electronic applications due to the improved requirement for supporting manifold mobile carriers all over the world.

Additionally, the rise in the application of consumer electronics in developed and developing has been expanding significantly. Therefore, several companies are extremely involved in using eSIM by replacing traditional sim cards as it provides seamless and upfront mobile connections for all sorts of connected devices.

For instance, as per the Indian Brand Equity Foundation, the Indian consumer electronics market reached USD 10.9 billion in 2019 and is expected to grow to USD 21.1 billion by 2025. Thus, the global manufacturers are looking forward to integrating eSIM and playing a crucial role in changing the market outlook of the global market during the forecast period.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Esim Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Report Segmentation

The market is primarily segmented on the basis of solution, application, and region.

|

By Solution |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Solution

On the basis of the solution segment, the connectivity services segment is expected to account for the largest market share in the global market over the forthcoming period. This is due to connectivity services consisting of the services offered by the Mobile Network Operators (MNOs) for remotely and securely handling the cellular subscriptions of the end-users.

Further, the implementation of eSIM for M2M connections optimistically concerning the network operators for offering subscription services, thereby offering connectivity services, has ensued in additional revenue generation for the network operators. This, in turn, is expected to contribute to the market demand for connectivity services in the global market.

Meanwhile, the hardware segment accounted for a significant eSIM market share and is expected to be the fastest CAGR by 2028, and hence, is witnessing considerable growth throughout the world. This can be recognized by factors, such as the growing proliferation of consumer electronics manufacturers. For instance, the surging trend among smartphone manufacturers to incorporate eSIM in the device intending to save space is projected to thrust the demand and contribute to the segment growth in the forecasting years.

Insight by Application

The consumer electronic segment is expected to witness a larger revenue share in the global market, owing to the extensive implementation of the eSIM in smartphones and other electronic devices on account of the rising internet penetration. Further, the consumer electronics application remains one of the prominent forces shaping innovation, disruption, and growth across several technology industries. Also, eSIM is projected to be a game-changer in the consumer electronics market. Improved connectivity, reliability, and safety are some of the integral features strengthening the adoption of eSIM in the consumer electronic segment.

On the flip side, the M2M segment is expected to pave a significant market share in terms of revenue over the study period, owing to the remarkable benefits offered via adoption of eSIM in M2M devices with enhanced security and reliability and sleek design. In addition, eSIM facilitates seamless connectivity and effective management of M2M devices that are remotely sited and often hermetically sealed, which is further projected to impel the segment growth over the foreseen period.

Geographic Overview

Geographically, North America is the prominent region in the global market in 2020 and is projected for the largest share in terms of revenue due to the rising inclination towards eSIM along with the rapid rise in technological advancements in the region. Additionally, the rise in the presence of network operators delivers the prospect for such a product to support multiple mobile carriers, making subscription management simpler for the device end-user. This, in turn, is expected to expand the market growth at a rapid pace considering the global scenario.

Region estimated to register the high proliferation of advanced technologies, such as machine learning and AI, coupled with the increased number of strategic initiatives like product launches and partnership agreements by international players across these countries. As a result, in April 2021, Samsung’s commenced the rolling out of eSIM to Galaxy phones in the United States, which is expected to bolster the region’s growth.

Moreover, Asia-Pacific is expected to witness a high CAGR over the study period. The demand for eSIM in the region is attributed to an increase over the forecast period, owing to the rising development of advanced technologies and the escalating demand for embedded connectivity in vehicles from the consumers.

According to the CAICT’s latest assessment released in December 2020, it is assessed that China’s IoT connections represent almost 30% of the global total. While the country also accounted for three-quarters of cellular IoT connections worldwide in 2020. Moreover, the surge in adoption of consumer electronics, such as smartphones and laptops, is further expected to create significant demand for eSIM, which, in turn, the market is gaining significant prominence worldwide.

Competitive Landscape

Some of the major players operating in the global AT&T, ARM Holdings, Deutsche Telekom AG, Etisalat, Gemalto NV, Giesecke+Devrient Mobile Security GmbH, Infineon Technologies AG, KORE Wireless Group Inc, NTT Docomo, NXP Semiconductors N.V, Orange, Sierra Wireless, Sinch, Singtel, STMicroelectronics, Telenor Connexion, Telit, Vi™.

eSIM Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.45 billion |

|

Revenue forecast in 2032 |

USD 16.69 billion |

|

CAGR |

7.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Solution, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AT&T, ARM Holdings, Deutsche Telekom AG, Etisalat, Gemalto NV, Giesecke+Devrient Mobile Security GmbH, Infineon Technologies AG, KORE Wireless Group Inc, NTT Docomo, NXP Semiconductors N.V, Orange, Sierra Wireless, Sinch, Singtel, STMicroelectronics, Telenor Connexion, Telit, Vi™ |

Navigate through the intricacies of the 2021 Esim Market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2028. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.