Escalators and Moving Walkways Market Size, Share, Trends, Industry Analysis Report: By Product, Business (New Equipment, Maintenance, and Modernization), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5261

- Base Year: 2024

- Historical Data: 2020-2023

Escalators and Moving Walkways Market Overview

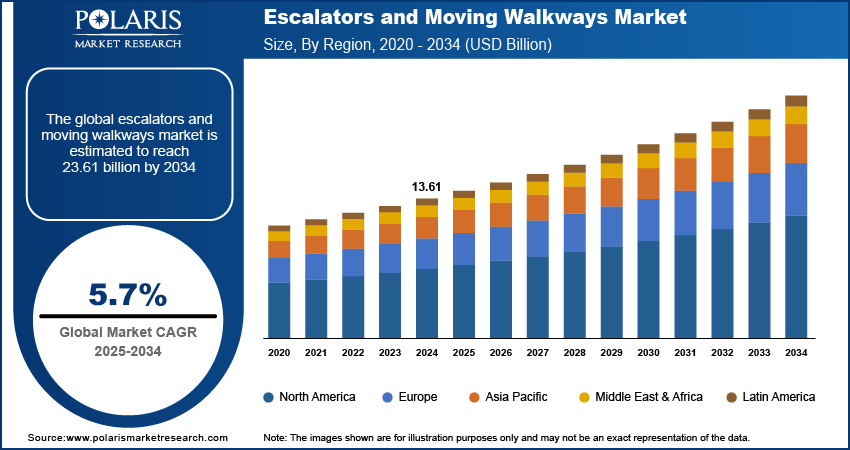

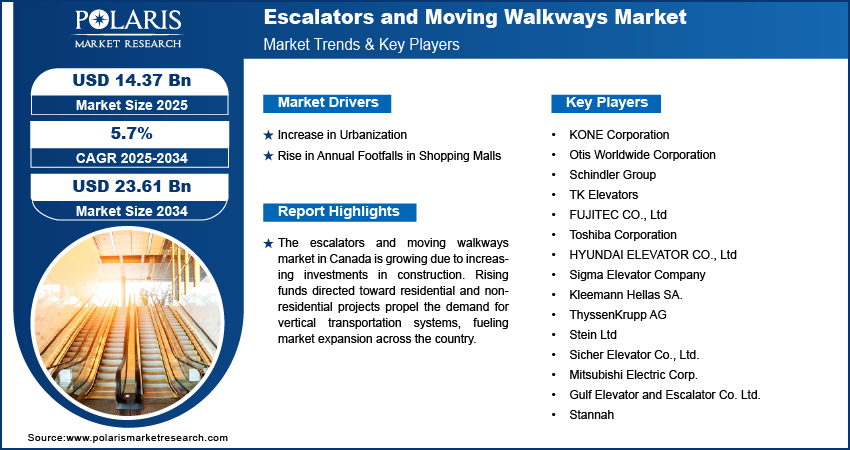

The escalators and moving walkways market size was valued at USD 13.61 billion in 2024. The market is projected to grow from USD 14.37 billion in 2025 to USD 23.61 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 5.7% during 2025–2034.

Escalators are installed in large commercial buildings to carry people up or down between different floors. On the other hand, moving walkways, flat, conveyor-belt-like surfaces, allow individuals to move more quickly across long distances in airports or train stations.

The increase in the number of air passengers due to tourism growth is driving the installation of escalators and moving walkways in airports. Moreover, with a surge in tourist traffic, airports are constantly upgrading their infrastructures for the efficient management of passenger flow and to move them quickly and comfortably between terminals, gates, and other facilities. According to the Airports Council International, in 2023, the total number of air passengers globally reached nearly 8.5 billion, which highlighted the growth of air passengers. Escalators and moving walkways help reduce congestion and waiting times, making air travel smoother. Therefore, the growing number of passengers creates a need for more installations and upgrades in airport infrastructure, thereby driving the escalator and moving walkway market growth.

To Understand More About this Research: Request a Free Sample Report

Recent technological advancements are improving the safety, efficiency, and maintenance of escalators and moving walkways. Innovations such as energy-efficient motor design, optimized operational smoothness, and sophisticated safety protocols have made these systems increasingly desirable for building owners and developers. These advancements are reducing the operational costs and extending the equipment's lifespan. As a result, there's a growing trend among buildings and public spaces to incorporate escalators and moving walkways, thereby propelling the escalator and moving walkways market expansion.

Escalators and Moving Walkways Market Driver Analysis

Increase in Urbanization

The rising population in urban areas is creating the demand for large buildings and structures such as malls, airports, and offices for accommodation. For instance, according to the World Bank Group, 56% of the world's population lives in urban areas. The large multi-story buildings require escalators and moving walkways to provide easy access between floors. The expansion of cities and the construction of new high-rise buildings fuel the demand for these transportation solutions. Therefore, increasing urbanization is driving the escalator and moving walkways market development.

Rise in Annual Footfalls in Shopping Malls

More people are visiting malls for shopping, entertainment, and dining, which requires efficient management for large crowds. According to the Gulf Business, in 2023, Emaar Malls recorded a 19% increase in footfall from 2022, with over 20 million people visiting the mall in the first two months of 2023. The rising number of visitors in malls is creating a higher demand for the installation of escalators and moving walkways. Therefore, an increase in annual footfall in shopping malls is driving the escalator and moving walkways market growth.

Escalators and Moving Walkways Market Segment Analysis

Escalators and Moving Walkways Market Assessment by Business

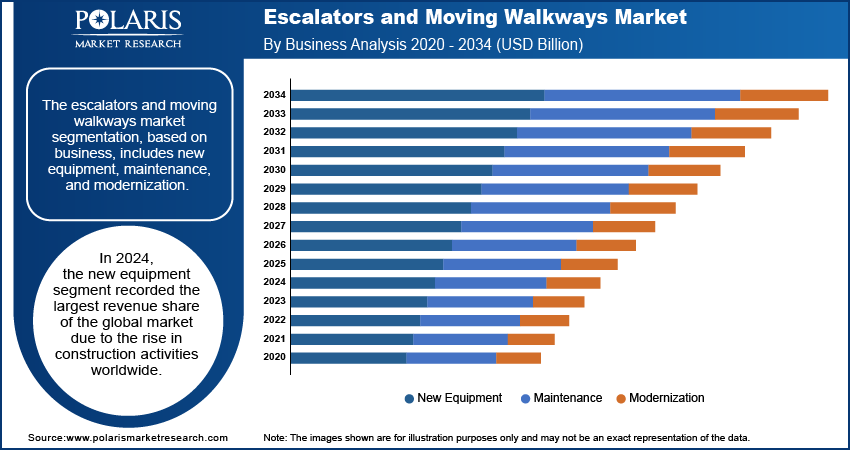

The escalators and moving walkways market segmentation, based on business, includes new equipment, maintenance, and modernization. In 2024, the new equipment segment recorded the largest market revenue share due rise in construction activity worldwide. More buildings are being constructed, including commercial and residential. Thus, the demand for new escalators and moving walkways has increased across the world.

Escalators and Moving Walkways Market Evaluation by End Use

The escalators and moving walkways market segmentation, based on end use, includes public transit, airports, retail, institutional, and others. The public transit segment dominated the market in 2024 due to the increasing need for passenger movement tools in transportation hubs such as airports, train stations, and subway stations. These locations experience high foot traffic, and escalators and moving walkways are essential to help passengers navigate large, multi-level spaces quickly and safely. The growing demand for smoother, faster travel within public transit areas is driving the segmental dominance.

Escalators and Moving Walkways Market Regional Outlook

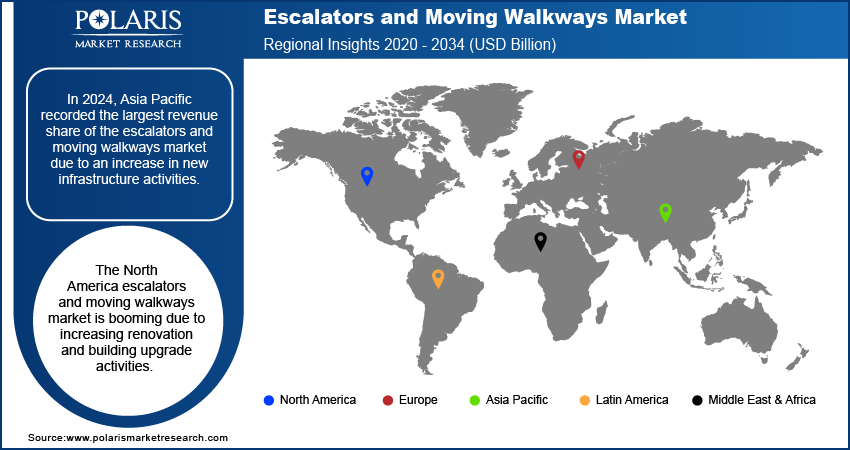

By region, the study provides the escalators and moving walkways market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific held the largest market share due to an increase in infrastructure activities. Rapid urbanization, along with increasing infrastructure projects such as shopping malls, office buildings, and transportation hubs, is driving the demand for escalators and moving walkways. According to the Indian Department of Economics Affairs, in 2024, Indian economy recorded USD 818.67 billion worth of new infrastructure projects by public-private partnerships. Moreover, since multi-story structures are being built, the demand for escalators and moving walkways is growing, boosting the Asia Pacific escalators and moving walkways market revenue growth.

The North America escalator and moving walkways market is experiencing significant growth due to increasing renovation and building upgrade activities. Many old commercial and public buildings are being modernized to improve accessibility and meet higher safety standards. Installing or upgrading escalators and moving walkways is a key part of these renovation projects, allowing building management to handle more foot traffic and provide better mobility. Thus, increasing renovation and building upgrade activities are driving the elevators & escalators or escalators and moving walkway market growth in North America.

The escalators and moving walkways market in Canada is experiencing substantial growth due to an increase in investments in construction projects. More funds are being directed toward building new residential and nonresidential projects, due to which the demand for vertical transportation systems is rising. According to Statistics Canada, in August 2024, investment in building construction was USD 21.0 billion. This growing investment in construction projects across cities fuels the need for more escalator and moving walkway installations, contributing to the Canada escalator and moving walkway market expansion.

Escalators and Moving Walkways Market – Key Players and Competitive Analysis Report

The escalators and moving walkways market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the escalators and moving walkways industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the escalators and moving walkways market are KONE Corporation; Otis Worldwide Corporation; Schindler Group; TK Elevators; FUJITEC CO., Ltd; Toshiba Corporation; HYUNDAI ELEVATOR CO., Ltd; Sigma Elevator Company; Kleemann Hellas SA.; ThyssenKrupp AG; Stein Ltd; Sicher Elevator Co., Ltd.; Mitsubishi Electric Corp.; Gulf Elevator and Escalator Co. Ltd.; and Stannah.

Toshiba manufactures and distributes electronic devices, energy systems, social infrastructure, and digital solutions. It operates in electronic devices and storage solutions, retail and printing solutions, battery business, energy and infrastructure systems and solutions, building solutions, and digital solutions. The energy systems and solutions division provides power generation systems for nuclear and thermal power plants and transmission, generation, and distribution systems for renewable energy. Additionally, they offer escalators, elevators, ventilation, and lighting solutions for buildings and facilities. The retail and printing solutions segment offers barcode printers, inkjet heads, peripherals, and retail solutions. The battery company specializes in creating rechargeable lithium-ion battery cells and industrial battery packs and modules. The electronic devices and storage solutions segment provides high-capacity HDDs for data centers, automotive and industrial semiconductors, equipment, and related materials and devices. The digital solutions segment focuses on AI, IoT, and quantum-related technologies.

Mitsubishi Electric Corp. (Mitsubishi Electric) creates, produces, and sells electrical and electronic goods. The business produces and operates in turbine generators, nuclear power plants, and power electronics equipment, as well as motors, transformers, circuit breakers, gas-insulated switchgear, switch control, and display devices. In addition, it provides transmission and distribution systems, electrical equipment for locomotives and rolling stock, escalators, elevators, building security and management systems, and more. The business offers a variety of services, including logistics, finance, real estate, and advertising.

Mitsubishi Electric provides services to information processing and communications, satellite communications, consumer electronics, industrial technology, construction equipment, energy, and transportation industries. It engages in business in the following sectors, including energy and electric systems, industrial automation systems, information and communication systems, electronic devices, home appliances, and others. The energy and electric systems segment focuses on elevators, escalators, and supervisory control systems. The industrial automation systems category includes measurement and control systems, automotive and electrical goods, and automobile multimedia systems. The information and communication systems category comprises antennas; radars; closed-circuit television; and satellite, space, and wireless communication technologies. The electronic devices category offers liquid crystal displays, high frequency, and optical devices. The home appliances category includes systems for generating electricity from solar and wind energy, as well as televisions, recorders, and players. The others section includes financial services, real estate, advertising, and logistics for acquiring materials.

Key Companies in Escalators and Moving Walkways Market

- KONE Corporation

- Otis Worldwide Corporation

- Schindler Group

- TK Elevators

- FUJITEC CO., Ltd

- Toshiba Corporation

- HYUNDAI ELEVATOR CO., Ltd

- Sigma Elevator Company

- Kleemann Hellas SA.

- ThyssenKrupp AG

- Stein Ltd

- Sicher Elevator Co., Ltd.

- Mitsubishi Electric Corp.

- Gulf Elevator and Escalator Co. Ltd.

- Stannah

Escalators and Moving Walkways Market Developments

November 2021: TK Elevator launched a multi-purpose facility in Chakan, Pune, for locally manufactured escalators, including the Velino, Tugela, and Victoria series. The initiative, aligned with the “Make in India” campaign, aims to meet India’s demand for high-quality mobility solutions.

December 2020: Mitsubishi Electric Corporation announced the launch of its new u series escalators, featuring enhanced safety, comfort, and energy savings. The escalators were designed for markets in ASEAN, the Middle East, Latin America, and India, with annual sales targeted at 500 units.

Escalators and Moving Walkways Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Escalators

- Parallel

- Multi-Parallel

- Others

- Moving Walkways

By Business Outlook (Revenue USD Billion, 2020–2034)

- New Equipment

- Maintenance

- Modernization

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Public Transit

- Airports

- Retail

- Institutional

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Escalators and Moving Walkways Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 13.61 billion |

|

Market Size Value in 2025 |

USD 14.37 billion |

|

Revenue Forecast by 2034 |

USD 23.61 billion |

|

CAGR |

5.7% from 2025–2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The escalators and moving walkways market value reached USD 13.61 billion in 2024 and is projected to grow to USD 23.61 billion by 2034.

The global market is projected to register a CAGR of 5.7% during 2025–2034.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are KONE Corporation; Otis Worldwide Corporation; Schindler Group; TK Elevators; FUJITEC CO., Ltd; Toshiba Corporation; HYUNDAI ELEVATOR CO., Ltd; Sigma Elevator Company; Kleemann Hellas SA.; ThyssenKrupp AG; Stein Ltd; Sicher Elevator Co., Ltd.; Mitsubishi Electric Corp.; Gulf Elevator and Escalator Co. Ltd.; and Stannah.

The new equipment segment recorded the largest revenue share of the global market in 2024 due to a rise in construction activity worldwide.

The public transit segment dominated the market in 2024 due to the increasing need for passenger movement tools in transportation hubs such as airports, train stations, and subway systems.