Equine Healthcare Market Size, Share, Trends, Industry Analysis Report: By Product (Vaccines, Pharmaceuticals, Medicinal Feed Additives, Orthobiologics, Diagnostics, Software, and Others), Indication, Activity, Distribution Channel, and Region – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 116

- Format: PDF

- Report ID: PM5067

- Base Year: 2023

- Historical Data: 2019-2022

Equine Healthcare Market Outlook

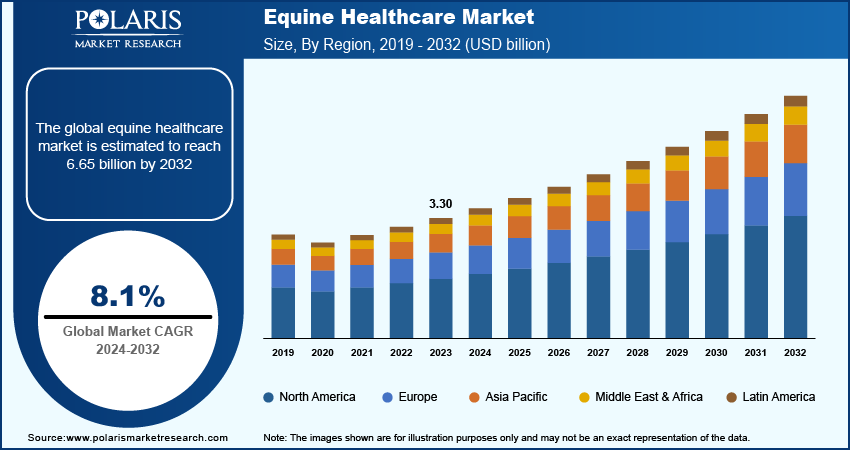

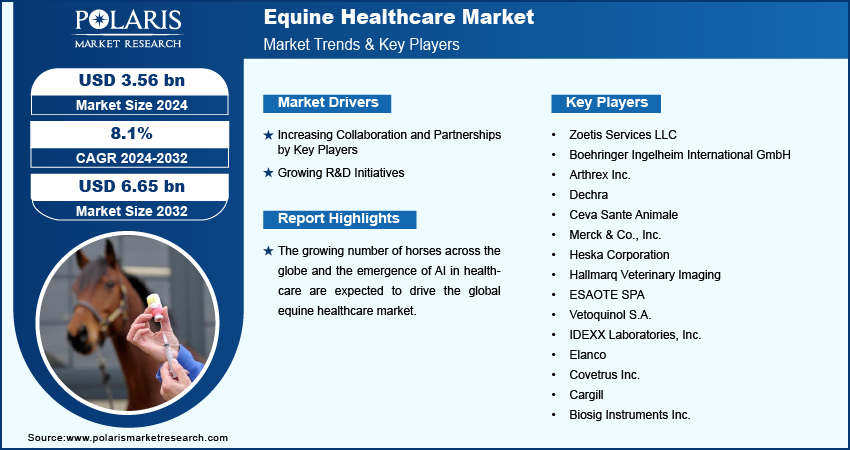

The equine healthcare market size was valued at USD 3.30 billion in 2023. The market is anticipated to grow from USD 3.56 billion in 2024 to USD 6.65 billion by 2032, exhibiting a CAGR of 8.1% during 2024–2032.

Equine Healthcare Market Overview

The equine healthcare market is driven by growing R&D initiatives. R&D often leads to the development of new treatments, therapies, and diagnostic tools for equine health. For instance, in September 2022, Vetoquinol USA introduced Phovia, a patented fluorescent light therapy for equine patients. Horse owners and veterinarians are likely to seek them out as these innovations become available, increasing demand for equine healthcare services.

The increasing collaboration and partnerships by key players facilitate the equine healthcare market growth. Collaborative efforts lead to the creation of new service models, such as telemedicine for equine care, mobile veterinary units, abuse care, and specialized referral networks. For instance, in September 2023, Ceva, a global animal health company, collaborated with EHPAD Equus, an association near Libourne (France) dedicated to the rescue and rehabilitation of horses. Such strategic initiatives make it easier for horse owners to access high-quality care.

To Understand More About this Research: Request a Free Sample Report

Equine Healthcare Drivers

Increasing Horse Population

The population of horses is rising across the world. For instance, as per a report published by the World Animal Foundation, the number of horses worldwide is ∼60 million. Increased horse population leads to potential health issues, including diseases, injuries, and chronic conditions. This increases the need for diagnostic services, treatments, and specialized care, leading to a higher demand for equine healthcare professionals and facilities. Therefore, the growing number of horses across the globe is driving the global equine healthcare market.

Emergence of Artificial Intelligence (AI) in Equine Health

Artificial intelligence (AI) assists in creating personalized treatment plans based on a horse’s specific health data, including history, genetics, and current condition. This level of customization enhances treatment outcomes and drives demand for tailored healthcare solutions. For instance, in July 2024, Boehringer Ingelheim and Sleip leverage AI technology to diagnose lameness in equines. Therefore, the emergence of AI in equine health propels the equine healthcare market.

Equine Healthcare Market Restraint

High Cost Associated with Treatment

The high cost of treatment places a significant financial burden on horse owners, particularly for those with multiple horses or those who require ongoing care for chronic conditions. This financial strain encourages owners not to invest in more horses, thereby hindering the global equine healthcare market growth.

Equine Healthcare Market Segment Analysis

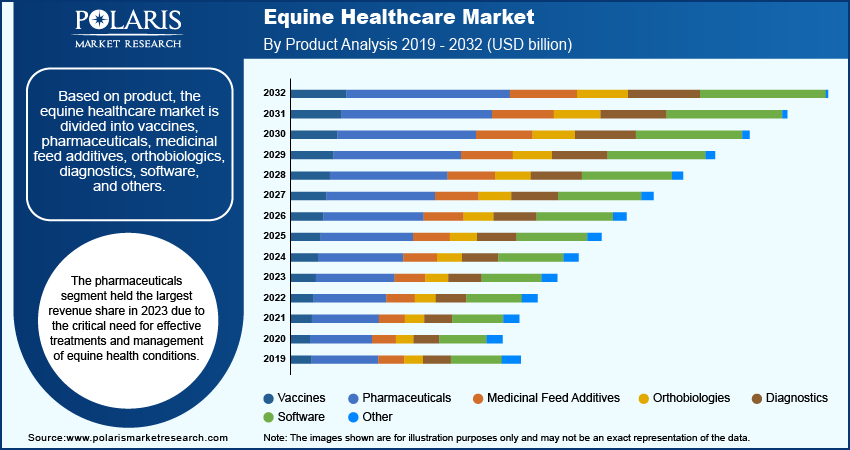

Equine Healthcare Market Breakdown – Product Analysis

Pharmaceuticals Segment Accounted for Largest Market Share in 2023

The pharmaceuticals segment held the largest revenue share in 2023 due to the critical need for effective treatments and management of equine health conditions. This segment offers a wide range of medications, including antibiotics, anti-inflammatory drugs, and analgesics, which are essential for treating infections, injuries, and chronic diseases in horses. The increasing prevalence of health issues among horses and the rising demand for innovative and effective drug therapies drive the equine healthcare market growth for the segment. Additionally, advancements in drug formulations and the development of new pharmaceutical products that target specific conditions boost the segment's dominance.

The software segment is expected to grow at a robust pace in the coming years, owing to the growing reliance on technology to streamline and enhance veterinary practices. Software solutions, including electronic health records (EHRs), practice management systems, and diagnostic software, offer significant improvements in data management, treatment planning, and overall efficiency. The integration of AI and machine learning into these tools further boosts their capabilities, allowing for more accurate diagnostics, better disease monitoring, and optimized treatment protocols. The software segment is expected to experience high growth as veterinary practices adopt these advanced technologies to improve care and operational efficiency.

Equine Healthcare Market Breakdown – Indication Analysis

Parasitic Infection Segment Dominated Market Share in 2023

The parasitic infection segment dominated the market share in 2023 due to the widespread impact of parasites on horse health. Parasites such as worms, lice, and bots cause a range of issues, including digestive problems, skin infections, and overall poor health. Advances in parasite control, including the development of broad-spectrum dewormers and targeted therapies, have contributed to this segment's growth. Additionally, increased awareness among horse owners and veterinarians about the importance of regular parasite management drives the segment dominance.

The equine herpes virus (EHV) segment is estimated to register a significant CAGR during the forecast period owing to its significant impact on horse health, including respiratory disease, reproductive issues, and neurological disorders. Advances in vaccine development and diagnostic tools, aimed at improving prevention and early detection of the virus, are driving the segment.

Equine Healthcare Market Breakdown – Distribution Channel Analysis

Veterinary Hospitals & Clinics Segment Held Largest Market Share in 2023

The veterinary hospitals & clinic segment held the largest market share in 2023 due to their essential role in delivering comprehensive care for horses. These facilities provide a wide range of services, including routine check-ups, emergency care, diagnostics, and advanced treatments, which are crucial for maintaining the health of equines. The extensive infrastructure, specialized staff, and advanced equipment available at these institutions make them the primary choice for horse owners seeking professional veterinary care. The growing number of veterinary practices and their focus on offering high-quality and specialized services contribute to this segment’s dominant market share.

The e-commerce segment is projected to grow at a considerable pace during the forecast period owing to the rising adoption of online platforms for purchasing equine health products and medications. E-commerce offers horse owners easy access to a variety of products, including pharmaceuticals, supplements, and diagnostic tools, without the need to visit physical stores. The growth of this segment is further driven by the increasing preference for online shopping, the availability to compare products and prices, and the convenience of home delivery. The e-commerce sector is set to capture a larger share of the market as more companies develop robust online sales channels and expand their digital presence.

Regional Insights

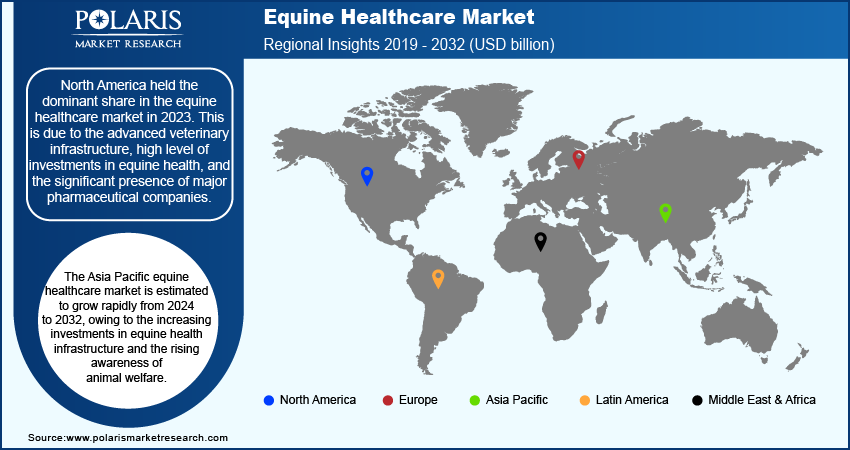

North America Held Largest Share of Global Market in 2023

North America held the dominant share in the equine healthcare market in 2023 due to the advanced veterinary infrastructure, high level of investments in equine healthcare, and the significant presence of major pharmaceutical and biotechnology companies. The US, in particular, dominated the regional market with its well-established network of veterinary clinics, hospitals, and research institutions that focus on equine care. The wide number of horse owners and the prevalence of competitive equine sports contribute to the high demand for comprehensive veterinary services and products. Additionally, strong regulatory frameworks and substantial spending on advanced treatments and diagnostics drive the market's expansion in this region.

The Asia Pacific equine healthcare market is estimated to grow rapidly during the forecast period, owing to the increasing investments in equine health infrastructure, rising awareness of animal welfare, and the expanding equestrian industry in countries such as China and Australia. The growing number of horse owners and the development of competitive and recreational equestrian activities in Asia Pacific contribute to the surge in demand for equine health products and services. Furthermore, improvements in veterinary care standards and increasing access to advanced treatments and diagnostics are driving market expansion in this region.

Key Market Players and Competitive Insights

Key market players are investing heavily in research and development to expand their offerings, which will fuel the equine healthcare market growth. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the equine healthcare market are Zoetis Services LLC, Elanco, Ceva Sante Animale, Heska Corporation, Esaote SPA, and Covetrus Inc.

List of Key Companies in Equine Healthcare Market

- Zoetis Services LLC

- Boehringer Ingelheim International GmbH

- Arthrex Inc.

- Dechra

- Ceva Sante Animale

- Merck & Co., Inc.

- Heska Corporation

- Hallmarq Veterinary Imaging

- ESAOTE SPA

- Vetoquinol S.A.

- IDEXX Laboratories, Inc.

- Elanco

- Covetrus Inc.

- Cargill

- Biosig Instruments Inc.

Recent Developments in Industry

- In November 2021, Biosig Instruments Inc., a global player in heart rate technology since 1975, launched the Insta-Pulse Equine heart rate monitor, the model 109. The company claims that this unique device delivers ease of use, continuous monitoring of the heart of the horse, and automatic start.

- In September 2021, Dechra announced the acquisition of the veterinary marketing and distribution firm Hassinger Biomedical to enhance its product portfolio for equine healthcare significantly.

Report Coverage

The equine healthcare market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, it covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, indication, activity, distribution channel, region, and futuristic growth opportunities.

Report Segmentation

The market is primarily segmented on the basis of product, indication, activity, distribution channel, and region.

By Product Outlook (Revenue, USD Billion, 2019–2032)

- Vaccines

- Pharmaceuticals

- Parasiticides

- Anti-infectives

- Anti-inflammatory & Analgesics

- Other Pharmaceuticals

- Medicinal Feed Additives

- Orthobiologics

- Diagnostics

- Diagnostic Test Kits

- Diagnostic Equipment

- Software

- Practice Management Software

- Imaging Software

- Telehealth Software

- Other Software

- Other

By Indication Outlook (Revenue, USD Billion, 2019–2032)

- Musculoskeletal Disorders

- Parasitic Infections

- Equine Herpes Virus

- Equine Viral Arteritis (EVA)

- Equine Influenza

- West Nile Virus

- Tetanus

- Other

By Activity Outlook (Revenue, USD Billion, 2019–2032)

- Sports/Racing

- Recreation

- Other

By Distribution Channel Outlook (Revenue, USD Billion, 2019–2032)

- Veterinary Hospitals & Clinics

- E-commerce

- Equestrian Facilities

- Other

By Regional Outlook (Revenue, USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Equine Healthcare Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.56 billion |

|

Revenue Forecast by 2032 |

USD 6.65 billion |

|

CAGR |

8.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Equine Healthcare Industry Trend Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global equine healthcare market size was valued at USD 3.30 billion in 2023 and is projected to grow to USD 6.65 billion by 2032.

The global market is projected to register a CAGR of 8.1 % during the forecast period.

North America had the largest share of the global market in 2023.

Key players in the market are Zoetis Services LLC; Arthrex Inc.; Dechra; Ceva Sante Animale; Merck & Co., Inc.; Heska Corporation; Hallmarq Veterinary Imaging; ESAOTE SPA; Vetoquinol S.A.; IDEXX Laboratories, Inc.; Elanco; Covetrus Inc.; Cargill; and Biosig Instruments Inc.

The equine herpes virus (EHV) product segment is projected for significant growth in the global market during 2024–2032.

The veterinary hospitals & clinic segment dominated the equine healthcare market in 2023.