Epoxy Resin Market Size, Share, Trends, Industry Analysis Report: By Type (DGBEA, DGBEF, Novolac, Aliphatic, Glycidylamine, and Hardener), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 128

- Format: PDF

- Report ID: PM1503

- Base Year: 2024

- Historical Data: 2020-2023

Epoxy Resin Market Overview

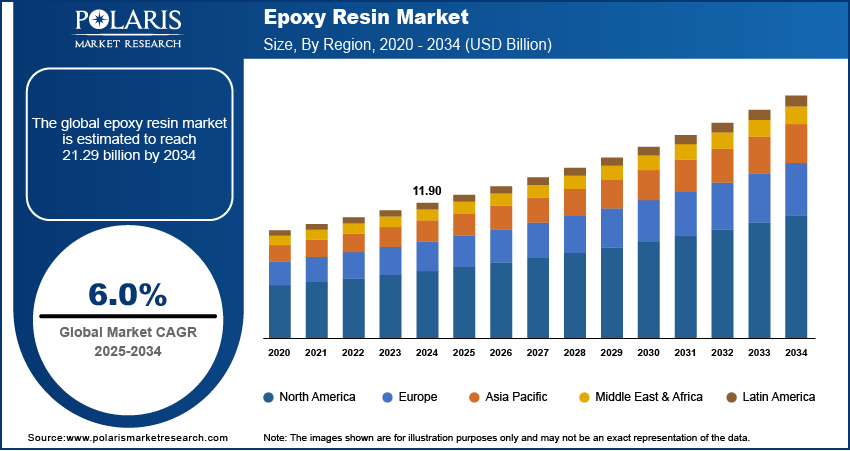

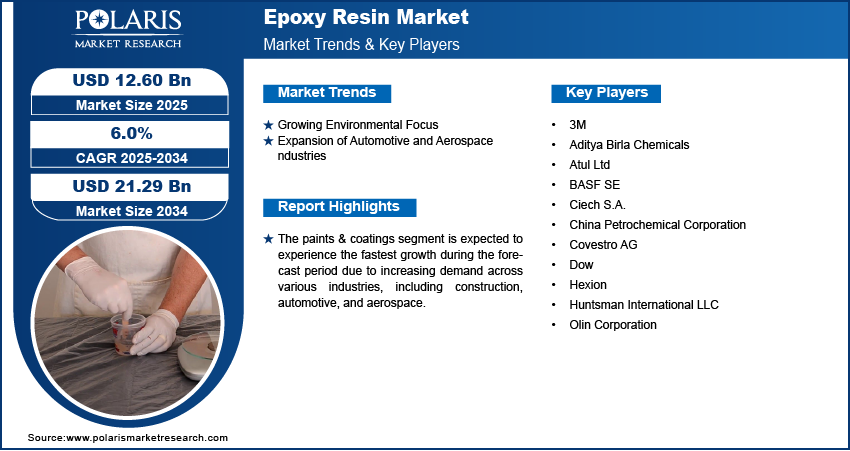

The epoxy resin market size was valued at USD 11.90 billion in 2024. The market is projected to grow from USD 12.60 billion in 2025 to USD 21.29 billion by 2034, exhibiting a CAGR of 6.0% during 2025–2034.

The epoxy resin market refers to the global industry involved in the manufacturing, distribution, and uses of epoxy resins. Epoxy resins are thermosetting polymers widely used for their exceptional mechanical properties, chemical resistance, and strong adhesive qualities. They are versatile materials that are key components in various industries such as construction, automotive, electronics, aerospace, wind energy, and marine.

The epoxy resin market demand is driven by increasing construction activities, particularly in emerging economies, where urbanization and infrastructure development are growing rapidly. The rising demand for high-performance adhesives, coatings, and composites in residential and commercial projects further boosts market growth. Additionally, the global shift toward renewable energy sources has improved the adoption of wind energy solutions, where epoxy resins are essential in manufacturing lightweight and durable wind turbine blades. This growing demand for sustainable and efficient energy solutions is significantly contributing to the epoxy resins market development.

Advancements in the electronics and electrical sectors are driving significant epoxy resins market growth, as these industries increasingly require high-performance insulating materials to meet the demand for durable, efficient, and miniaturized components. Furthermore, the need for durable and biocompatible materials in medical devices and equipment has led to increased adoption of epoxy resins.

To Understand More About this Research: Request a Free Sample Report

Epoxy Resin Market Dynamics

Growing Environmental Focus

The growing environmental consciousness among consumers and regulatory authorities significantly boosts the development of eco-friendly and low-VOC (volatile organic compounds) formulations. For instance, in the US, the Environmental Protection Agency (EPA) regulates the outdoor emissions of volatile organic compounds (VOCs) primarily to mitigate the formation of tropospheric ozone, a key component of photochemical smog. These regulations are critical for air quality management and environmental protection efforts aimed at reducing ozone pollution and its associated health risks. Industries across the world face stricter environmental regulations; thus, there is a rising demand for sustainable materials that minimize environmental impact while maintaining high performance. Epoxy resins, traditionally associated with chemical-intensive production processes, are now being innovatively reformulated to reduce harmful emissions and enhance biodegradability. Manufacturers are focusing on incorporating renewable raw materials, such as bio-based epoxies derived from plant oils or lignin, to meet this market demand. These advancements support environmental sustainability goals and expand epoxy resin market opportunities, particularly in sectors such as construction, automotive, and coatings.

Expansion of Automotive and Aerospace Industries

The automotive and aerospace industries are experiencing significant growth, driven by an increasing importance on lightweight and fuel-efficient designs to meet stringent environmental regulations and rising consumer expectations. Epoxy resins are used in structural components, panels, and adhesives, reducing vehicle weight while maintaining safety and performance standards in the automotive industry, thereby enhancing fuel efficiency and contributing to the epoxy resins market expansion. Similarly, in aerospace, epoxy resin composites are extensively applied in aircraft fuselages, wings, and interior components, where their lightweight properties contribute to improved aerodynamics and reduced fuel consumption.

Epoxy Resin Market Segment Insights

Epoxy Resin Market Assessment by Type Outlook

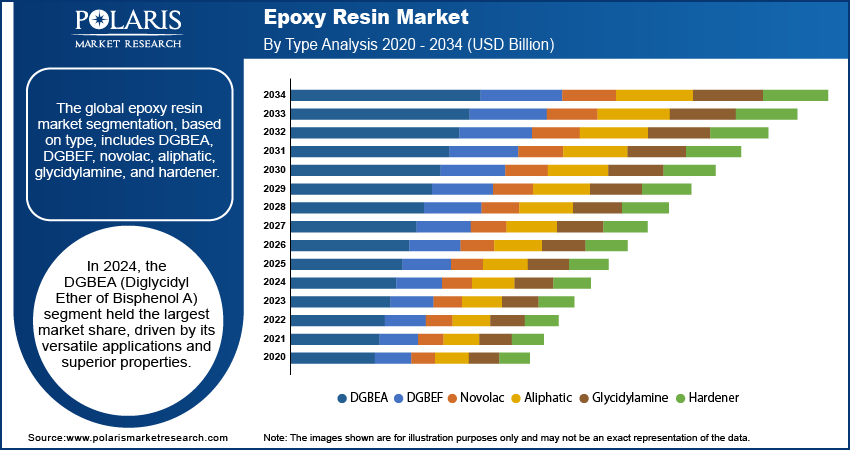

The global epoxy resin market segmentation, based on type, includes DGBEA, DGBEF, novolac, aliphatic, glycidylamine, and hardener. In 2024, the DGBEA (Diglycidyl Ether of Bisphenol A) segment held the largest market share of the epoxy resin market revenue, driven by its versatile applications and superior properties. DGBEA-based epoxy resins are widely recognized for their excellent mechanical strength, chemical resistance, and adhesive capabilities, making them a preferred choice across multiple industries. Their extensive use in coatings, adhesives, and composites for construction, automotive, and aerospace applications has significantly contributed to their market dominance. Additionally, the growing demand for high-performance materials in the electrical and electronics sectors, where DGBEA resins are used for insulation and encapsulation, has further boosted the market demand.

Epoxy Resin Market Evaluation by Application Outlook

The global epoxy resin market segmentation, based on application, includes paints & coatings, wind turbine, composites, construction, electrical & electronics, adhesives, and others. The paints & coatings segment is expected to experience the fastest growth during the forecast period due to increasing demand across various industries, including construction, automotive, and aerospace. The segment's growth is fueled by the superior properties of epoxy resin-based coatings, such as high durability, corrosion resistance, and excellent adhesion, which make them ideal for protecting surfaces in harsh environments. Additionally, the rising trend of sustainable construction and infrastructure projects, and advancements in paint formulations for enhanced performance and aesthetics, further supports market expansion. The growing adoption of protective coatings in industrial and marine applications also contributes to the rapid growth of paints & coatings segment in the forecast period.

Epoxy Resin Market Regional Analysis

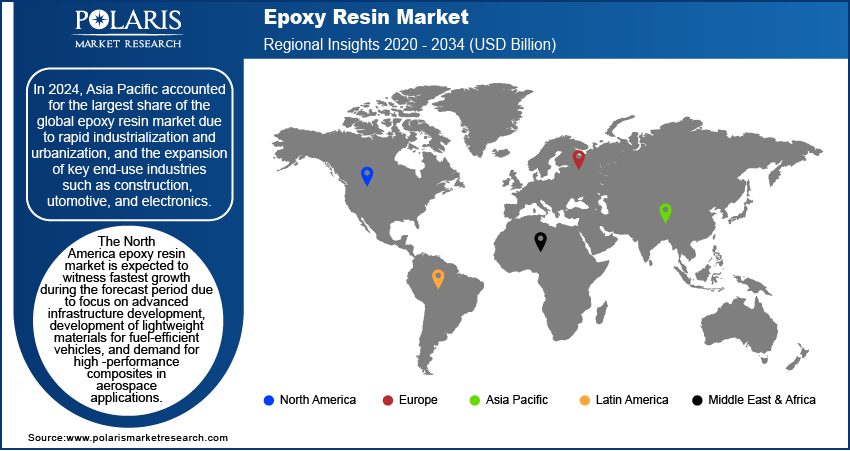

By region, the study provides epoxy resin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest epoxy resin market share due to rapid industrialization, urbanization, and the expansion of key end-use industries such as construction, automotive, and electronics. For instance, according to the India Brand Equity Foundation, in April 2024, the production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles totaled ∼2.36 million units. In FY23, India exported around 4.76 million vehicles, with the automotive sector's GDP contribution increasing from 2.77% in FY 1992–1993 to about 7.1% in FY 2024. The region's growing infrastructure projects and increasing investments in renewable energy, particularly in wind energy installations, have significantly boosted the demand for epoxy resin-based materials. Additionally, the robust manufacturing base for electronics and electrical equipment in countries such as China, Japan, and South Korea amplifies demand for epoxy resins. Favorable government policies supporting industrial growth and sustainable practices, along with the availability of cost-effective raw materials and labor, have solidified Asia Pacific's position as the largest contributor to the market expansion.

The North America epoxy resin market is expected to witness fastest growth during the forecast period due to the rising focus on advanced infrastructure development, development of lightweight materials for fuel-efficient vehicles, and increasing demand for high-performance composites in aerospace applications. Additionally, the growing adoption of sustainable and eco-friendly epoxy resin formulations, supported by stringent environmental regulations and green building initiatives, further accelerates the regional market growth. Innovation in the electronics sector, particularly in insulation and circuit board applications, also plays a key role in boosting epoxy resin market demand in North America.

Epoxy Resin Market – Key Players and Competitive Analysis Report

The competitive landscape of the epoxy resin market is characterized by the presence of numerous global and regional players striving to gain market share through innovation, strategic collaborations, and expansion into emerging markets. Key players, including BASF SE, Huntsman Corporation, Olin Corporation, Dow Chemical Company, and Kukdo Chemical Co., Ltd., are focused on developing advanced epoxy resin formulations to meet the growing demand for high-performance materials in various end-use industries.

Companies are investing heavily in research and development to introduce eco-friendly and low-VOC epoxy resins, aligning with the increasing environmental regulations and sustainability trends. Strategic partnerships, and mergers and acquisitions are also prominent, enabling firms to strengthen their product portfolios and geographical reach. Additionally, the expansion of production capacities and adoption of digital technologies to enhance operational efficiency further define the competitive strategies in this market.

A few key major players are 3M, Aditya Birla Chemicals, Atul Ltd (India), BASF SE, Ciech S.A., China Petrochemical Corporation, Covestro AG, Dow, Hexion, Huntsman International LLC, and Olin Corporation.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments—chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector. 3M offers high-performance epoxy resins with strong adhesion, durability, chemical resistance, and versatility for automotive, aerospace, electronics, and industrial applications.

3M company is a global technology services provider with operations across the US and international markets. 3M is organized into four main segments—transportation and electronics, safety and industrial, health care, and consumer. The company offers a diverse array of products and solutions. The transportation and electronics segment focuses on ceramic solutions, tapes, films, and products for temperature management in transportation vehicles, as well as graphic films for advertising. 3M also provides interconnection and packaging solutions, and reflective signage for safety applications. 3M’s Safety and Industrial segment includes epoxy resin-based adhesives, coatings, and materials designed for high-performance applications across industries such as automotive, construction, and manufacturing. These epoxy resins are used in a variety of products, including coatings for metal and composite parts, surface protection, and durable bonding solutions.

List of Key Companies in Epoxy Resin Market

- 3M

- Aditya Birla Chemicals

- Atul Ltd

- BASF SE

- Ciech S.A.

- China Petrochemical Corporation

- Covestro AG

- Dow

- Hexion

- Huntsman International LLC

- Olin Corporation

Epoxy Resin Industry Developments

In February 2024, DCM Shriram launched a new greenfield epoxy resins plant, backed by a USD 120.6 million investment to enhance production capabilities and innovation in advanced epoxy technology.

In May 2023, Mitsui Chemicals, Inc. acquired certification for their epoxy resins, specifically those derived from the biomass phenol chain. This certification was granted under the International Sustainability and Carbon Certification (ISCC) PLUS system, which verifies and certifies sustainable products.

In February 2022, Westlake Chemical Corporation acquired the global epoxy business of Hexion Inc. for ∼USD 1.2 billion in an all cash deal. This transaction marks a significant expansion for Westlake as it integrates Hexion's leading downstream portfolio of coatings and composite products into its business operations.

Epoxy Resin Market Segmentation

By Type Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- DGBEA

- DGBEF

- Novolac

- Aliphatic

- Glycidylamine

- Hardener

By Application Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- Paints & Coatings

- Wind Turbine

- Composites

- Construction

- Electrical & Electronics

- Adhesives

- Others

By Regional Outlook (Revenue, USD Billion; Volume, Kilotons; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Epoxy Resin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.90 billion |

|

Market Size Value in 2025 |

USD 12.60 billion |

|

Revenue Forecast by 2034 |

USD 21.29 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion; Volume in Kilotons; 2020–2034 and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global epoxy resin market size was valued at USD 11.90 billion in 2024 and is projected to grow to USD 21.29 billion by 2034.

The global market is projected to register a CAGR of 6.0% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to rapid industrialization and urbanization, and the expansion of key end-use industries such as construction, automotive, and electronics.

A few key players in the market are 3M, Aditya Birla Chemicals, Atul Ltd (India), BASF SE, Ciech S.A., China Petrochemical Corporation, Covestro AG, Dow, Hexion, Huntsman International LLC, and Olin Corporation.

In 2024, the DGBEA (Diglycidyl Ether of Bisphenol A) segment held the largest market share, driven by its versatile applications and superior properties.

The paints & coatings segment is expected to experience the fastest growth during the forecast period due to increasing demand across various industries, including construction, automotive, and aerospace.