Epoxy Coating Market Size, Share, Trends, Industry Analysis Report: By Product (Solvent Borne Epoxy, Waterborne Epoxy, and Solid Epoxy), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 128

- Format: PDF

- Report ID: PM5380

- Base Year: 2024

- Historical Data: 2020-2023

Epoxy Coating Market Overview

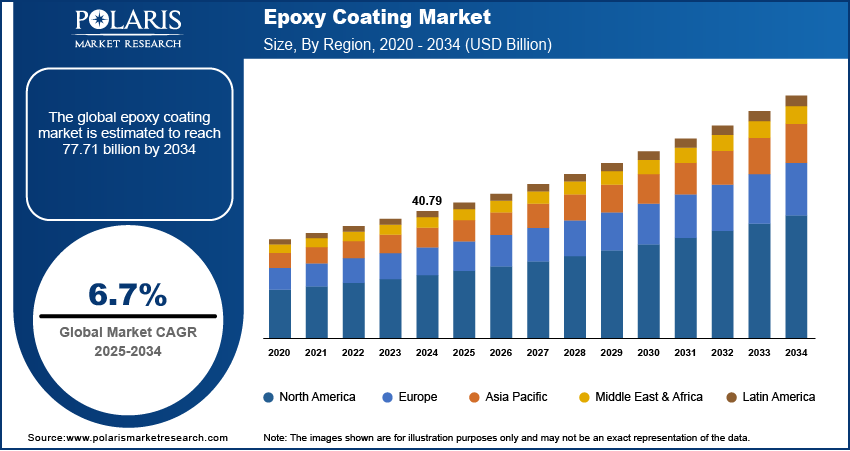

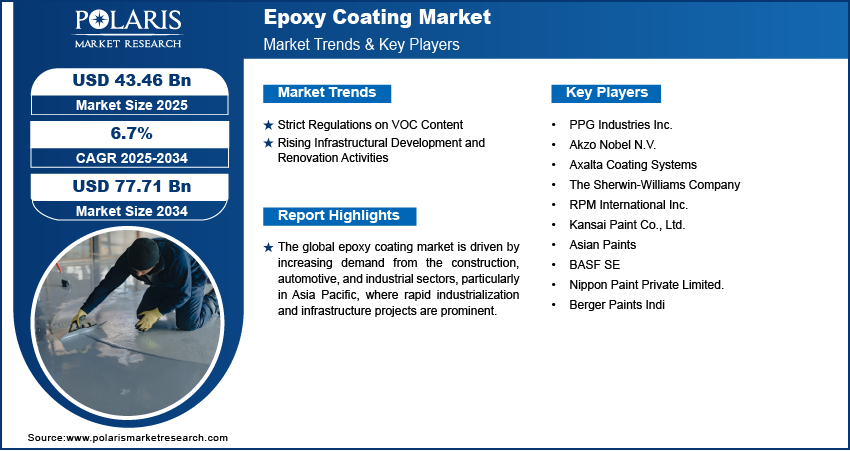

The global epoxy coating market size was valued at USD 40.79 billion In 2024. The market is projected to grow from USD 43.46 billion in 2025 to USD 77.71 billion by 2034, exhibiting a CAGR of 6.7% from 2025 to 2034.

Epoxy coating is a durable and protective finish manufactured from a mixture of epoxy resin and hardener. These coatings are known for their excellent adhesion, chemical resistance, and mechanical properties. They are widely used in applications such as industrial floors, protective coatings for steel structures, and automotive finishes due to their ability to withstand harsh environments.

The epoxy coating market is experiencing significant growth, fueled by the increasing demand for durable and protective finishes across various industries. The expansion of infrastructure projects and the rise in renovation activities, particularly in the construction and industrial sectors, are further boosting market demand. In addition, advancements in epoxy formulations are leading to the development of low-volatile organic compounds (VOCs) and eco-friendly products in response to strict environmental regulations.

The growing preference for efficient, long-lasting solutions is increasing the adoption of epoxy coatings, which is expected to strengthen their market presence. The epoxy coating market is poised for further growth in the coming years with continued regulatory pressures, technological innovations, and rising investments in infrastructure.

To Understand More About this Research: Request a Free Sample Report

Epoxy Coating Market Dynamics

Strict Regulations on VOC Content

Governments worldwide are enforcing stringent environmental standards, resulting in increased demand for low-VOC epoxy coatings. For instance, the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation has enforced strict limits on VOC levels in paints and coatings to reduce air pollution and health risks. These regulations have prompted companies to develop formulations that comply with low VOC requirements and adhere to guidelines for air quality and health safety. Low-VOC epoxy coatings offer benefits such as reduced odors and improved indoor air quality, making them increasingly appealing for use in various sectors. Thus, the focus on meeting regulatory requirements is significantly boosting the adoption of sustainable and low-emission solutions in the epoxy coatings market.

Rising Infrastructural Development and Renovation Activities

Rising infrastructure development and renovation activities are driving the epoxy coating market expansion, particularly in the construction sector, where there is an increasing demand for durable coatings. For instance, according to a report by Invest India in March 2023, the Indian government prioritized infrastructure development through various initiatives, including the National Infrastructure Pipeline (NIP) and the PM GatiShakti Master Plan. These initiatives aim to improve logistics networks and urban projects. Similarly, the 2023–2024 budget significantly increased infrastructure spending to 3.3% of GDP, allocating USD 8,920,425 for 100 critical multimodal logistics projects. Epoxy coatings offer excellent resistance to corrosion, chemicals, and scraping, making them ideal for high-traffic areas such as floors and industrial equipment. The growth in commercial and residential construction projects, particularly in emerging economies, is boosting demand for these coatings. Thus, as governments and private sectors continue to invest in modernizing infrastructure, the use of epoxy coatings is expected to rise significantly.

Epoxy Coating Market Segment Insights

Epoxy Coating Market Assessment by Product Outlook

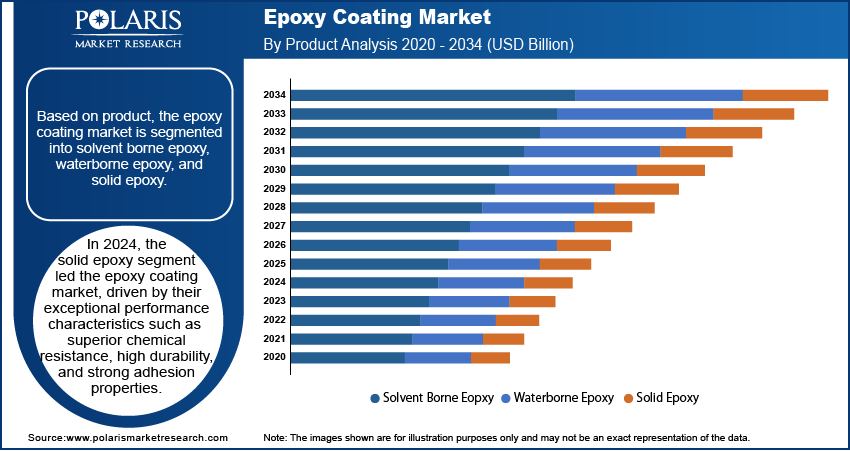

The global epoxy coating market segmentation, based on product, includes solvent borne epoxy, waterborne epoxy, and solid epoxy. In 2024, the solid epoxy segment dominated the market due to their exceptional performance characteristics, such as superior chemical resistance, high durability, and strong adhesion properties. These characteristics make solid epoxy ideal for industrial applications such as concrete floor coatings and protective coatings for steel structures, where long-term protection is essential. Additionally, solid epoxy coatings are preferred in environments where VOC emissions need to be minimized, as they are solvent-free and have low environmental impact.

Epoxy Coating Market Evaluation by Application Outlook

The global epoxy coating market segmentation, based on application, includes construction, industrial, transportation, and others. The industrial segment is anticipated to experience significant growth during the forecast period due to the increasing demand for protective coatings in manufacturing and heavy industries. The superior performance characteristics of epoxy coatings, such as excellent adhesion and chemical resistance, make them ideal for harsh industrial settings. The rise in infrastructural projects and the need for durable coatings in industrial environments are further driving the segment’s growth in the global market.

Epoxy Coating Market Regional Analysis

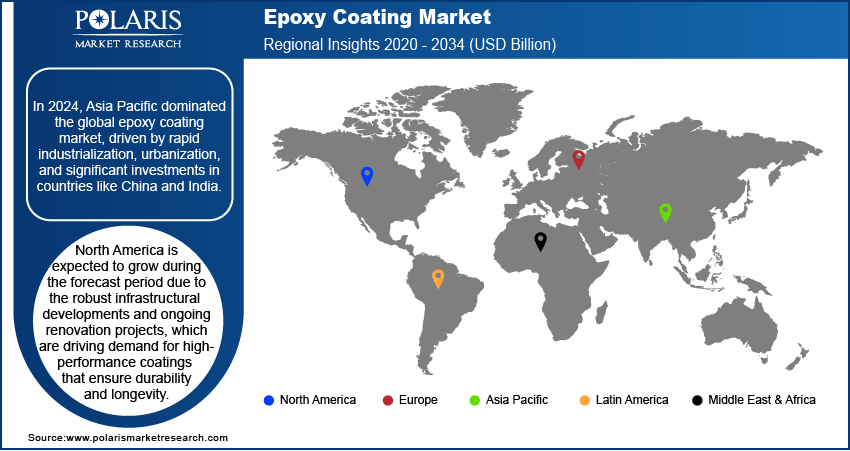

By region, the study provides the epoxy coatings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the epoxy coating market in 2024, primarily due to rapid industrialization and urbanization in countries such as China and India. Additionally, the increasing investments in infrastructure projects, including automotive, construction, and defense sectors, are driving demand for paints and coatings. For instance, in September 2024, the Indian Navy received a patent for a solvent-free anticorrosive epoxy resin composition. This innovation addresses the persistent challenge of corrosion in marine environments, providing a durable solution for safeguarding naval vessels and equipment.

The North America epoxy coating market is expected to grow during the forecast period due to robust infrastructural developments and ongoing renovation projects, which are driving demand for high-performance coatings that ensure durability and longevity. Additionally, strict environmental regulations are encouraging the adoption of low-VOC and eco-friendly coating solutions, aligning with consumer preferences for sustainable products. Furthermore, advancements in technology are leading to innovative product offerings, improving performance characteristics and expanding application areas.

Epoxy Coating Market – Key Players and Competitive Insights

The competitive landscape of the epoxy coating market is characterized by a mix of global leaders and regional players competing for market share through innovation, strategic collaborations, and regional expansion. Major companies in the market, such as PPG, Akzo Nobel B.V., and Asian Paints, leverage their robust R&D capabilities and extensive distribution networks to deliver advanced epoxy solutions that cater to applications across sectors such as construction, automotive, aerospace, and industrial manufacturing. These leading players focus on product innovation, improving durability, chemical resistance, and sustainability to meet the growing demands for high-performance coatings.

Smaller regional firms are emerging with specialized epoxy products tailored to specific local markets, offering unique solutions and customized applications. Competitive strategies in this market include mergers and acquisitions, partnerships with technology firms, and expanding product portfolios to improve market presence in key geographic regions. A few key major players are PPG Industries Inc.; Akzo Nobel N.V.; Axalta Coating Systems; The Sherwin-Williams Company; RPM International Inc.; Kansai Paint Co., Ltd.; Asian Paints; BASF SE; Nippon Paint Private Limited.; and Berger Paints India.

Sherwin-Williams is a US-based company that focuses on the manufacturing, development, distribution, and sale of paints, coatings, and related products for a variety of customers, including professionals, industries, and retailers. The company is known for its strong brand portfolio, featuring names such as Sherwin-Williams, Valspar, and Krylon, among others. In 2024, Sherwin-Williams introduced Textured Epoxy Coating (TEC) for rebar, a new category of functional coating designed to amplify corrosion protection and durability while improving bond strength with concrete. This innovation aims to promote sustainability in construction, extend asset longevity, and reduce costs.

PPG Industries Inc. is a leading manufacturer and supplier of paints, coatings, optical products, and specialty materials, catering to various sectors, including industrial, transportation, consumer products, and construction. The company’s extensive product range serves numerous industries, such as food and beverage, cosmetics, civil infrastructure, petrochemical, and marine. In September 2024, PPG launched PPG STEELGUARD 951 epoxy intumescent fire protection coating, specifically designed for advanced manufacturing environments, including semiconductor and electric vehicle battery facilities, as well as data centers.

List of Key Companies in Epoxy Coating Market

- PPG Industries Inc.

- Akzo Nobel N.V.

- Axalta Coating Systems

- The Sherwin-Williams Company

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Asian Paints

- BASF SE

- Nippon Paint Private Limited.

- Berger Paints India

Epoxy Coating Industry Developments

In March 2023, Westlake Corporation launched the AZURES product line under Westlake Epoxy at the European Coatings Show. The AZURES series consists of newly formulated epoxy resins, modifiers, and curing agents designed without SVHC- and CMR-labelled substances, making them safer alternatives for sustainable use. These products aim to offer eco-friendly solutions for applications in coatings, civil engineering, and adhesives while maintaining the same high-performance standards as traditional technologies.

In April 2024, Evonik launched Ancamine 2880, a modified cycloaliphatic epoxy curing agent. The product addresses existing performance gaps by offering a fast cure speed, resistance to carbamation, water-spotting, and chemicals. Its excellent aesthetics and safety profile make it ideal for topcoat flooring applications.

Epoxy Coating Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Solvent Borne Epoxy

- Waterborne Epoxy

- Solid Epoxy

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Construction

- Industrial

- Transportation

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Epoxy Coating Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 40.79 billion |

|

Market Size Value in 2025 |

USD 43.46 billion |

|

Revenue Forecast by 2034 |

USD 77.71 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global epoxy coating market size was valued at USD 40.79 billion in 2024 and is projected to grow to USD 77.71 billion by 2034.

• The global market is projected to register a CAGR of 6.7% during the forecast period.

• In 2024, Asia Pacific dominated the global market, driven by rapid industrialization, urbanization, and significant investments in countries like China and India.

• A few key players in the market are PPG Industries Inc.; Akzo Nobel N.V.; Axalta Coating Systems; The Sherwin-Williams Company; RPM International Inc.; Kansai Paint Co., Ltd.; Asian Paints; BASF SE; Nippon Paint Private Limited.; and Berger Paints India.

• In 2024, the solid epoxy segment dominated the epoxy coating market due to their exceptional performance characteristics, such as superior chemical resistance, high durability, and strong adhesion properties.

• The industrial segment is anticipated to experience significant growth during the forecast period due to the increasing demand for protective coatings in manufacturing and heavy industries.