Epilepsy Treatment Devices Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Wearable Devices, Conventional Devices, and Implantable Devices), Technology, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 116

- Format: PDF

- Report ID: PM3177

- Base Year: 2024

- Historical Data: 2020-2023

Epilepsy Treatment Devices Market Overview

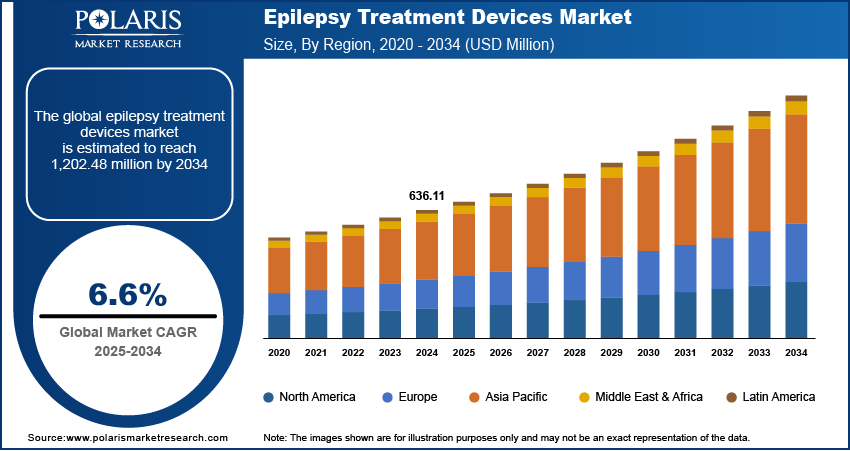

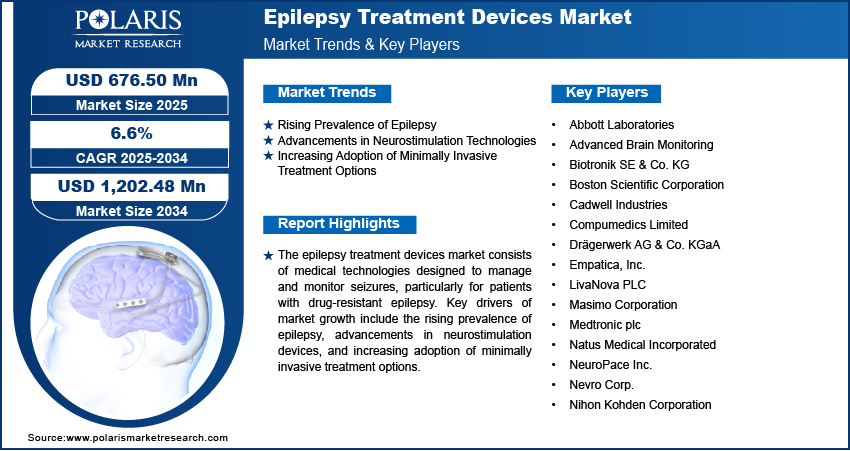

The epilepsy treatment devices market size was valued at USD 636.11 million in 2024. The market is projected to grow from USD 676.50 million in 2025 to USD 1,202.48 million by 2034, exhibiting a CAGR of 6.6% during 2025–2034.

The epilepsy treatment devices market encompasses medical devices designed to manage and treat epilepsy by monitoring brain activity, detecting seizures, and delivering therapeutic interventions.

Key drivers of epilepsy treatment devices market growth include the rising prevalence of epilepsy, advancements in neurostimulation devices, and increasing adoption of minimally invasive treatment options. According to a February 2024 report by the WHO, around 50 million people worldwide have epilepsy. Nearly 80% of those with epilepsy live in low- and middle-income countries. The growing demand for wearable and implantable devices, along with the integration of artificial intelligence for real-time seizure detection, are notable trends shaping the market. Additionally, government initiatives and favorable reimbursement policies are contributing to the expansion of epilepsy treatment device adoption worldwide.

To Understand More About this Research: Request a Free Sample Report

Epilepsy Treatment Devices Market Dynamics

Rising Prevalence of Epilepsy

Epilepsy affects approximately 50 million individuals worldwide, making it one of the most common neurological disorders. An April 2023 report by the NCBI indicated that in 2021, approximately 1.1% of US adults (about 2.865 million) reported having active epilepsy, while 0.6% (around 1.637 million) reported having inactive epilepsy. This high prevalence underscores the growing demand for effective epilepsy treatment devices. As the number of individuals diagnosed with epilepsy continues to rise, the need for advanced therapeutic solutions becomes increasingly critical.

Advancements in Neurostimulation Technologies

Recent technological innovations have significantly enhanced the efficacy and safety of neurostimulation devices for epilepsy treatment. For instance, in March 2024, McLean Hospital launched an accelerated TMS program for depression, reducing treatment time. This noninvasive therapy uses magnetic pulses to stimulate the prefrontal cortex, improving mood without anesthesia. Such advancements in neurostimulation technologies are propelling the development and adoption of sophisticated epilepsy treatment devices, thereby fueling the epilepsy treatment devices market development.

Epilepsy Treatment Devices Market Segment Insights

Epilepsy Treatment Devices Market Assessment – Product Type-Based Insights

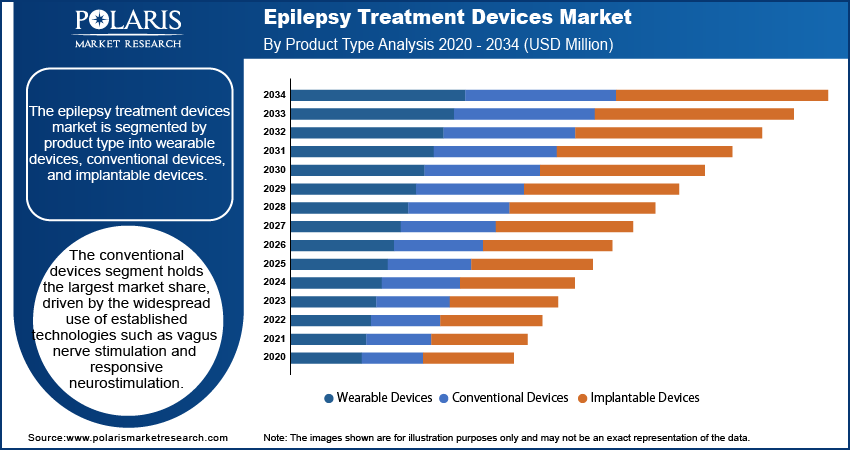

The epilepsy treatment devices market is segmented by product type into wearable devices, conventional devices, and implantable devices. The conventional devices segment holds the largest market share. This dominance is attributed to the widespread use of established technologies such as vagus nerve stimulation and responsive neurostimulation, which are highly effective in managing seizures and remain the preferred choice among healthcare providers. Additionally, the reliability and proven efficacy of these devices have solidified their position in clinical settings.

The wearable devices segment is experiencing the highest growth rate within the market. This surge is driven by the increasing demand for convenience and real-time monitoring solutions. Wearable devices, such as seizure-detection smartwatches, offer patients continuous tracking and instant alerts, enhancing patient autonomy and enabling proactive management of epilepsy. The integration of advanced technologies and the growing trend toward personalized healthcare further contribute to the rapid adoption and development of wearable epilepsy treatment devices.

Epilepsy Treatment Devices Market Evaluation – Technology-Based Insights

The epilepsy treatment devices market is segmented by technology into

The responsive neurostimulation segment is experiencing the highest growth rate. Responsive neurostimulation (RNS) offers personalized, on-demand brain stimulation tailored to individual patient needs, providing targeted seizure control. As technological advancements continue and clinical outcomes demonstrate their effectiveness, RNS is gaining popularity among healthcare providers and patients, contributing to its rapid market expansion.

Epilepsy Treatment Devices Market Outlook – End User-Based Insights

The ambulatory surgical centers segment is experiencing the highest growth rate. The increasing preference for outpatient procedures, driven by the demand for cost-effective and convenient treatment options, contributes to this growth. Ambulatory surgical centers offer epilepsy patients access to surgical interventions with reduced hospital stays, appealing to both patients and healthcare providers aiming to optimize resource utilization. The shift towards minimally invasive techniques and advancements in medical technology support the expansion of ASCs in the epilepsy treatment landscape.

Epilepsy Treatment Devices Market Regional Analysis

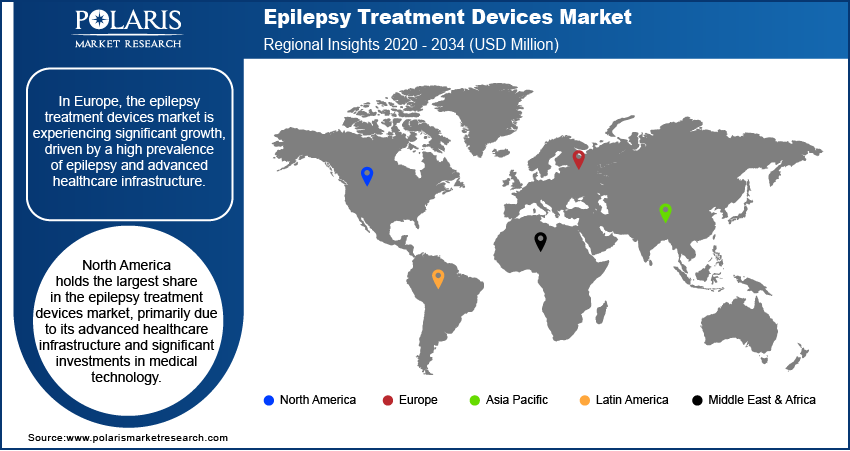

By region, the study provides the epilepsy treatment devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share in the epilepsy treatment devices market, primarily due to its advanced healthcare infrastructure and significant investments in medical technology. The region's early adoption of innovative treatment solutions, such as responsive neurostimulation and deep brain stimulation, has been facilitated by the presence of key industry players and favorable reimbursement policies. Additionally, the high prevalence of epilepsy in North America has driven the demand for effective treatment devices, further solidifying the regional market dominance.

The Europe epilepsy treatment devices market is experiencing significant growth, driven by a high prevalence of epilepsy and advanced healthcare infrastructure. The region's commitment to healthcare innovation is evident through the development of advanced neurostimulation devices, such as the Picostim implant by Amber Therapeutics, which has shown promising results in reducing seizure frequency. Additionally, supportive government initiatives and the presence of major manufacturers contribute to the regional market expansion, with a focus on enhancing patient care and quality of life.

Asia Pacific is witnessing the fastest growth in the epilepsy treatment devices market, attributed to the rising prevalence of epilepsy and increasing healthcare investments. Countries like China and India are making significant investments in healthcare infrastructure and medical research, aiming to improve epilepsy management and treatment outcomes. The growing awareness of epilepsy and the availability of advanced monitoring devices are further propelling market growth in this region. Moreover, strategic initiatives by key market players and government investments in epilepsy projects are enhancing the adoption of innovative treatment devices, thereby improving patient care and quality of life.

Epilepsy Treatment Devices Market – Key Players and Competitive Insights

The competitive landscape of the epilepsy treatment devices market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies. Competitive intelligence and pricing insights are critical for identifying growth opportunities. The market’s growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. A few key major players are Medtronic plc; Abbott Laboratories; Boston Scientific Corporation; LivaNova PLC; Natus Medical Incorporated; Empatica, Inc.; Compumedics Limited; Cadwell Industries; Masimo Corporation; Nihon Kohden Corporation; NeuroPace Inc.; Biotronik SE & Co. KG; Nevro Corp.; Advanced Brain Monitoring; and Drägerwerk AG & Co. KGaA

Medtronic plc is a medical technology company that offers innovative solutions for various health conditions, including epilepsy. In the realm of epilepsy treatment, Medtronic's Deep Brain Stimulation (DBS) system is a notable device. This system targets the anterior nucleus of the thalamus (ANT), a part of the brain involved in seizure generation and propagation. The Medtronic DBS System for Epilepsy is indicated as an adjunctive therapy for reducing the frequency of seizures in individuals aged 18 and older with epilepsy characterized by partial-onset seizures that are refractory to antiepileptic medications. The system includes implanted leads, lead extensions, a neurostimulator, and programming devices, allowing for personalized therapy tailored to each patient's needs. Unlike some surgical interventions, DBS is reversible and does not limit future treatment options. Clinical trials have shown that Medtronic's DBS therapy reduces seizure frequency, with sustained benefits over time. The Percept system, which includes BrainSense technology, further improves therapy personalization by capturing real-time brain signals. This technology allows for adjustments to therapy parameters based on individual patient needs, making it a valuable option for those seeking improved seizure control.

Abbott Laboratories is a healthcare company known for its diverse portfolio of medical devices and pharmaceuticals. Abbott's expertise in neuromodulation technologies, such as deep brain stimulation (DBS) systems for Parkinson's, highlights its capabilities in developing sophisticated neurostimulation devices. In the broader context of neurological treatments, Abbott's focus on innovative technologies such as the Infinity DBS system, which uses an

List of Key Companies in Epilepsy Treatment Devices Market

- Abbott Laboratories

- Advanced Brain Monitoring

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cadwell Industries

- Compumedics Limited

- Drägerwerk AG & Co. KGaA

- Empatica, Inc.

- LivaNova PLC

- Masimo Corporation

- Medtronic plc

- Natus Medical Incorporated

- NeuroPace Inc.

- Nevro Corp.

- Nihon Kohden Corporation

Epilepsy Treatment Devices Industry Developments

- January 2025: Boston Scientific Corporation announced the acquisition of Bolt Medical, a company specializing in neurostimulation technologies. This strategic move aims to expand Boston Scientific's portfolio in neuromodulation therapies, potentially enhancing treatment options for neurological disorders, including epilepsy.

- February 2023: LivaNova PLC introduced the SenTiva DUO, an implantable pulse generator designed to provide VNS Therapy for treating drug-resistant epilepsy. This device features a dual-pin header, allowing patients with legacy dual-pin systems to upgrade without requiring lead revision surgery.

Epilepsy Treatment Devices Market Segmentation

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Wearable Devices

- Conventional Devices

- Implantable Devices

By Technology Outlook (Revenue – USD Million, 2020–2034)

- Vagus Nerve Stimulator

- Responsive Neurostimulation

- Deep Brain Stimulation

- Accelerometry

By End User Outlook (Revenue – USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers

- Neurology Centers

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Epilepsy Treatment Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 636.11 million |

|

Market Size Value in 2025 |

USD 676.50 million |

|

Revenue Forecast by 2034 |

USD 1,202.48 million |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The epilepsy treatment devices market has been segmented into detailed segments of product type, technology, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the epilepsy treatment devices market focuses on technological advancements, strategic partnerships, and expanding accessibility. Companies invest in research and development to enhance neurostimulation, wearable monitoring, and implantable devices. Collaborations with healthcare providers, research institutions, and government agencies drive product innovation and regulatory approvals. Market players also emphasize patient awareness programs and digital marketing to improve adoption rates. Expansion into emerging markets, where epilepsy treatment options remain limited, is another key focus area to increase market penetration.

FAQ's

The epilepsy treatment devices market size was valued at USD 636.11 million in 2024 and is projected to grow to USD 1,202.48 million by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period.

North America had the largest share of the market in 2024.

Medtronic plc; Abbott Laboratories; Boston Scientific Corporation; LivaNova PLC; Natus Medical Incorporated; Empatica, Inc.; Compumedics Limited; Cadwell Industries; Masimo Corporation; Nihon Kohden Corporation; NeuroPace Inc.; Biotronik SE & Co. KG; Nevro Corp.; Advanced Brain Monitoring; and Drägerwerk AG & Co. KgaA.

The conventional devices segment accounted for the largest share of the market in 2024.

The deep brain stimulation segment accounted for the held the largest share of the market in 2024.

Epilepsy treatment devices are medical technologies designed to help manage seizures in individuals with epilepsy, particularly those who do not respond adequately to medication. These devices include implantable neurostimulation systems, wearable seizure monitoring devices, and conventional electroencephalography (EEG) systems used for diagnosis and management. Neurostimulation devices, such as vagus nerve stimulators (VNS), responsive neurostimulation (RNS) systems, and deep brain stimulation (DBS) implants, work by delivering electrical impulses to specific areas of the brain to reduce seizure activity. Wearable devices and accelerometry-based systems detect and track seizure patterns in real-time, providing valuable data for treatment adjustments. These technologies enhance patient care by offering alternative treatment options for drug-resistant epilepsy and improving seizure monitoring accuracy.

A few key trends in the market are described below: Increasing Adoption of Neurostimulation Devices – Growing preference for vagus nerve stimulation (VNS), responsive neurostimulation (RNS), and deep brain stimulation (DBS) due to their effectiveness in drug-resistant epilepsy. Advancements in Wearable Seizure Monitoring Devices – Development of AI-integrated and sensor-based wearable devices for real-time seizure detection and monitoring. Integration of AI and Machine Learning – AI-driven algorithms are enhancing seizure prediction, treatment personalization, and remote patient monitoring. Growing Focus on Noninvasive and Minimally Invasive Solutions – Development of advanced non-surgical and minimally invasive treatment options to improve patient outcomes and reduce procedure-related risks

A new company entering the epilepsy treatment devices market could focus on noninvasive and AI-driven seizure monitoring technologies, addressing the demand for more accessible and cost-effective solutions. Developing advanced wearable devices with real-time seizure detection and prediction capabilities can provide a competitive edge. Integration of AI and machine learning for personalized treatment approaches can enhance patient outcomes and differentiate new entrants. Strategic partnerships with research institutions and healthcare providers can accelerate product development and regulatory approvals. Additionally, expanding into emerging markets with affordable and innovative solutions can help capture unmet demand and establish a strong market presence.

Companies manufacturing, distributing, or purchasing epilepsy treatment devices and related products, and other consulting firms must buy the report.