Environmental Monitoring Market Share, Size, Trends, Industry Analysis Report, By Application; By Component; By Product Type (Environmental Monitors, Environmental Monitoring Sensors, Wearable Environmental Monitors); By End-User; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 118

- Format: PDF

- Report ID: PM2375

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

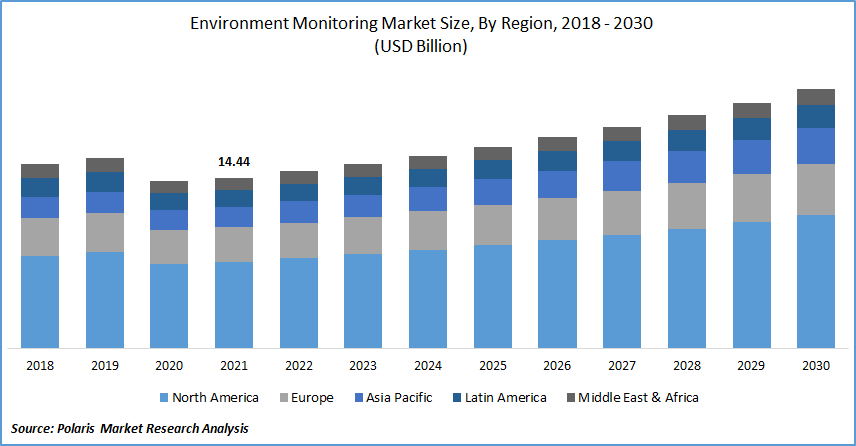

The global environmental monitoring market was valued at USD 14.44 billion in 2021 and is expected to grow at a CAGR of 4.9% during the forecast period. Factors such as technological advancements in environment checking devices, rising government funding, policies and initiatives, and supportive rules and regulations for diminishing environmental pollution boost environmental monitoring market growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Traditional ecological checking devices were time-consuming and inaccurate, emphasizing the need for more specific products that can effectively identify environmental toxicity. Sensor and component technological advances have led to high checking systems and digital sensors.

Real-time ecological monitoring systems have been introduced due to technological advancements combined with data science. These systems integrate modern real-time sensor networks, the Sensor Observation Service (SOS), Geographic Information Systems (GIS), telemetry systems, artificial intelligence techniques, the Internet of Things, predictive analytics, and other innovations to collect and statistically analyze ecological information in real. This real-time data is used to generate forecasts and inform time-critical ecological decisions.

Further, the Ministry of Environment and Forests focuses on applying policies and programs to conserve the available natural resources, such as lakes and rivers, biodiversity, forests, wildlife, animal health, and pollution prevention and management. The "Policy Statement for Pollution Abatement, 1992" and the "National Conservation Strategy and the Policy Statement on Environment and Development, 1992" emphasize pollution control and the advancement of cleaner technologies to reduce industrial pollutants.

Also, the environmental monitoring market is primarily driven by increased government support for ecological sustainability, the development of policies and interventions to minimize ecological pollution, the increased installation of ecological monitoring sites, and the expanding importance of ecological monitoring solutions in public-private partnerships. However, some of the main factors restricting market growth are high product prices, slow execution of pollution control policy changes in emerging markets, and side effects associated with monitoring products.

Industry Dynamics

Growth Drivers

IoT's environmental monitoring applications include ecological protection, severe weather monitoring, water quality, endangered species protection, and agricultural production. Sensors accurately detect any ecological transformation in these applications. Furthermore, nanotechnology deals with material with dimensions ranging from 1 to 100 nm. Nanotechnology-enabled sensors and alternatives have increased sensitivity in detecting and identifying chemical or biological agents in the air and soil.

In addition to nan sensors, the internet of things (IoT) in monitoring systems is the most recent technology. IoT requires online monitoring of water quality, air pollutant concentration levels indoors and outdoors, snowfall, and any other ecological parameter that affects people's safety and the environment. Its use of IoT for real-time data gathering and the systematic collection of large amounts of data to analyze it further makes ecological monitoring more feasible, resulting in the growth of the environmental monitoring market.

Further, the rise in deaths due to rising levels of pollution has led to various health issues, prompting an increase in the use of ecological monitoring systems worldwide. Furthermore, as the human population has increased, so has industrial development, and as a result, pollution production is unpreventable. As a result, there has been a growing adoption of ecological nursing solutions in developing countries.

Besides, natural resource management is used for major natural resources such as land, water, air, fisheries, and wild flora and fauna. Most economies depend on natural resources to generate revenue, including material resources such as fossil fuels, metals, nonmetallic minerals and water, and land. Thus, these factors are propelling the market growth of the environmental monitoring market.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on application, component, product type, end-user, and region.

|

By Application |

By Product Type |

By Component |

By End-User |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Application

Air pollution monitoring segment is expected to be the most significant revenue contributor in the global market. This is due to rising levels of air pollution in major markets, growing recognition and requirement for sensor-based air quality nursing systems, surging health concerns, and strictly regulated air pollution control legislation enacted by several governments.

Rapidly expanding industrial and manufacturing sectors and growth in residential and commercial vehicles are expected to emerge as key segment market growth drivers. Furthermore, increasing air quality monitoring solutions by large organizations and Small and Medium-Sized Enterprises (SMEs) are expected to drive the environmental monitoring market during the forecast period.

Geographic Overview

In terms of geography, North America had the largest regional market share. The regional market is expected to be driven by the United States Environmental Protection Agency's stringent pollution checking and control regulations and rising global warming and ecological pollution concerns. The region's massive proportion of smart city initiatives and the presence of several progressive industrial manufacturing groups are expected to drive the market for environmental checking systems.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market throughout the forecast period. This is primarily due to increased government support for the emergence of environmental checking stations, stricter regulations that encourage the increased adoption of pollution checking technologies, and technological advances in the field of environmental sensors. Furthermore, the implementation and expansion of pollution monitoring systems by small and medium-sized enterprises in emerging economies such as China and India are expected to drive the market during the forecast period.

Competitive Insight

Major market players operating in the global market include 3M Company, AMS AG, Danaher Corporation, E.S.I. Environmental Sensors Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., HORIBA, Ltd., Powelectrics Limited, Raritan Inc., Raytheon Technologies Corporation, Siemens AG, Spectris plc, TE Connectivity Ltd., Teledyne Technologies Incorporated, Texas Instruments Inc., and Thermo Fisher Scientific Inc.

Environmental Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 14.44 Billion |

|

Revenue forecast in 2030 |

USD 22.02 Billion |

|

CAGR |

4.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Component, By Product Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M Company, AMS AG, Danaher Corporation, E.S.I. Environmental Sensors Inc., Emerson Electric Co., General Electric Company, Honeywell International Inc., HORIBA, Ltd., Powelectrics Limited, Raritan Inc., Raytheon Technologies Corporation, Siemens AG, Spectris plc, TE Connectivity Ltd., Teledyne Technologies Incorporated, Texas Instruments Inc., and Thermo Fisher Scientific Inc. |