Environment Testing Market Size, Share, Trends, Industry Analysis Report: By Technology (Rapid and Conventional), Sample, Target Tested, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5528

- Base Year: 2024

- Historical Data: 2020-2023

Environment Testing Market Overview

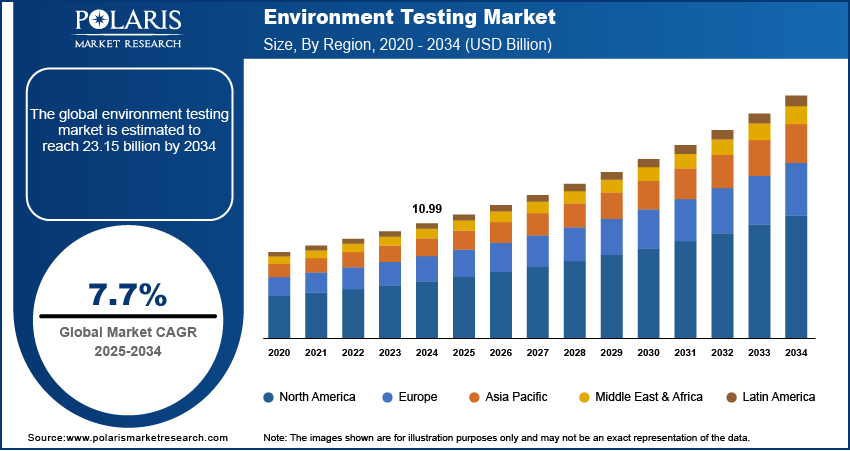

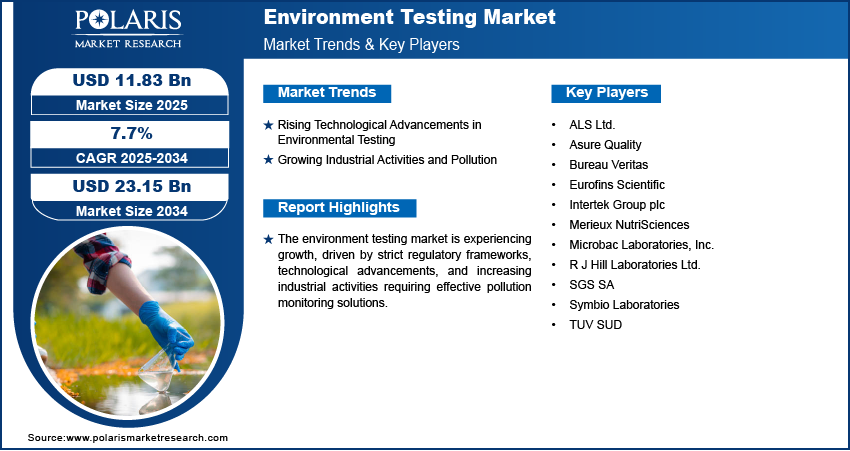

The global environment testing market was valued at USD 10.99 billion in 2024. It is expected to grow from USD 11.83 billion in 2025 to USD 23.15 billion by 2034, at a CAGR of 7.7% during the forecast period.

Environmental testing refers to the process of analyzing various environmental samples, such as air, water, soil, and waste, to assess pollutants and ensure compliance with regulatory standards. The environment testing market growth is driven by the increasing stringency of environmental regulations imposed by governments and international organizations. Regulatory bodies worldwide are implementing stricter pollution control measures, compelling industries to adopt rigorous testing protocols as industrialization and urbanization expand. For instance, in January 2024, India reaffirmed its climate goals, including 500 GW of non-fossil energy capacity, 50% renewable energy use, and 45% reduction in carbon intensity by 2030, aiming for net-zero emissions by 2070, as updated at COP27. Compliance with these regulations is essential for avoiding penalties and also for ensuring sustainable operations. Consequently, the demand for precise and efficient environmental testing solutions continues to rise as businesses strive to meet regulatory requirements.

To Understand More About this Research: Request a Free Sample Report

Another driver shaping the environment testing market growth is the growing public awareness of environmental issues. More individuals, communities, and advocacy groups are pushing industries and policymakers to take responsibility for the environment. This is happening as people become more concerned about climate change, pollution, and damage to nature. For instance, a March 2024 report by the UNDP stated that UNDP collaborated with educational institutions to integrate climate change topics into curricula. A workshop in Minsk highlighted the Climate Box toolkit, promoting climate education and recognizing Green Schools for their environmental efforts, fostering awareness and action among students and educators. This boosted awareness has led to increased demand for transparency in environmental practices and greater accountability for pollution control. As a result, industries are investing in advanced testing solutions to monitor and mitigate their environmental impact, aligning with consumer expectations and corporate sustainability goals. This growing consciousness continues to reinforce the market expansion, fostering innovation in environmental testing technologies.

Environment Testing Market Driver Dynamics

Rising Technological Advancements in Environmental Testing

Innovations such as sensor-based real-time monitoring, automation, and processed spectroscopy have revolutionized testing methodologies, enabling more precise identification of contaminants across various environmental matrices as they enhance the accuracy, efficiency, and speed of pollutant detection and analysis. According to a September 2024 report by the Ministry of Science & Technology, scientists developed a high-performance gas sensor using mixed spinel zinc ferrite nanostructures capable of detecting nitrogen oxides at ultra-low concentrations (down to 9 ppb) at room temperature. This innovation offers precise, cost-effective air quality monitoring for urban and industrial areas. These advancements streamline compliance with regulatory standards and also reduce the time and cost associated with traditional testing methods. Additionally, the integration of artificial intelligence and data analytics allows for predictive modeling and trend analysis, further strengthening environmental monitoring capabilities. Therefore, as industries and regulatory bodies seek more effective solutions, the adoption of advanced environmental testing technologies continues to grow, fueling the environment testing market expansion.

Growing Industrial Activities and Pollution

Rapid industrialization, particularly in emerging economies, has led to increased emissions, wastewater discharge, and soil contamination, necessitating strict environmental monitoring. Industries operating in sectors such as manufacturing, chemicals, and energy face mounting regulatory scrutiny to mitigate their environmental impact, leading to a heightened demand for comprehensive testing solutions. Furthermore, rising concerns over air and water quality due to industrial pollution have intensified the need for frequent and accurate environmental assessments. Alarming health statistics highlight this urgency. In June 2024, UNICEF reported air pollution as the second leading global risk factor for death, causing 8.1 million deaths in 2021. Over 700,000 children under five died due to air pollution, with 500,000 linked to household air pollution. The demand for robust environmental testing services is expected to grow as governments and businesses prioritize sustainable practices, reinforcing the market growth.

Environment Testing Market Segment Analysis

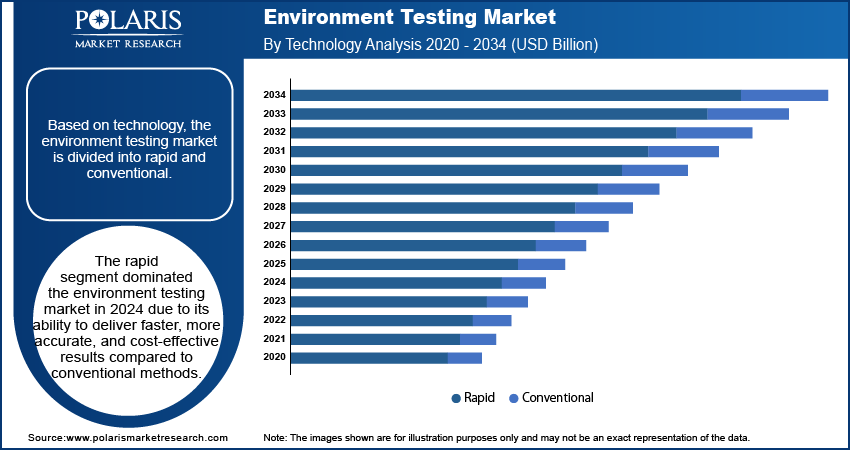

Environment Testing Market Assessment by Technology

The global environment testing market segmentation, based on technology, includes rapid and conventional. The rapid segment dominated the environment testing market share in 2024 due to its ability to deliver faster, more accurate, and cost-effective results compared to conventional methods. Rapid testing technologies, such as biosensors, immunoassays, and chromatography-based techniques, have gained considerable traction as they allow real-time monitoring and immediate decision-making. Industries and regulatory bodies increasingly prefer these methods to ensure timely compliance with strict environmental regulations. Additionally, advancements in automation and miniaturization have further improved the efficiency of rapid testing solutions, reducing labor-intensive processes. Therefore, as the demand for high-throughput and on-site environmental testing continues to rise, the adoption of rapid testing technologies boosts growth opportunities.

Environment Testing Market Evaluation by End Use

The global environment testing market segmentation, based on end use, includes government, industrial, environment testing laboratories, energy & utilities, agriculture, and others. The environment testing laboratories segment is expected to witness substantial environment testing market growth during the forecast period due to the rising need for specialized and accredited testing services. Businesses and government agencies rely on independent laboratories to ensure compliance with evolving environmental standards with increasing regulatory scrutiny and public concern over environmental pollution. These laboratories offer a wide range of advanced analytical techniques, ensuring precise detection of contaminants in air, water, soil, and waste samples. Additionally, the outsourcing trend among industries seeking cost-effective and highly accurate testing services has further fueled the expansion of this segment. Therefore, as environmental regulations become stricter, the role of dedicated testing laboratories in ensuring data integrity and regulatory adherence is expected to grow substantially.

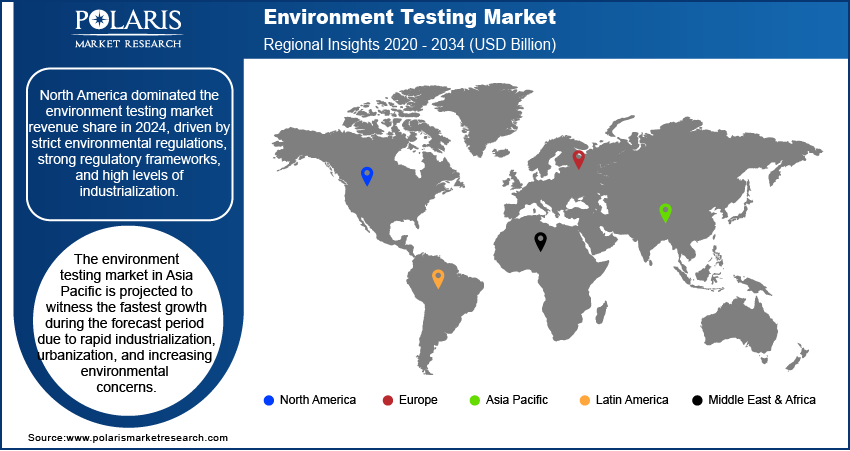

Environment Testing Market Regional Insights

By region, the report provides the environment testing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the environment testing market revenue share in 2024, driven by strict environmental regulations, strong regulatory frameworks, and high levels of industrialization. Government agencies such as the US Environmental Protection Agency (EPA) and Environment Canada have established strict environmental standards, compelling industries to invest in advanced testing solutions to maintain compliance. For instance, in April 2024, Eurofins Environment Testing US collaborated with EarthSoft/EQuIS to advance digitalization in environmental testing. The collaboration aimed to streamline data workflows, improve data security, and enhance decision-making through standardized processes and electronic data deliverables. Additionally, the region has a well-established infrastructure for environmental monitoring, with vast adoption of advanced testing technologies. The presence of leading market players, combined with growing concerns over air and water pollution, has further strengthened North America's leadership position.

The environment testing market in Asia Pacific is projected to witness the fastest growth during the forecast period due to rapid industrialization, urbanization, and increasing environmental concerns. Countries such as China, India, and Japan are experiencing amplified regulatory enforcement to address rising pollution levels and ensure environmental sustainability. Additionally, government initiatives aimed at strengthening environmental monitoring infrastructure and improving public health standards are driving the adoption of advanced testing technologies. The expanding manufacturing and energy sectors further contribute to the demand for reliable environmental testing services. As Asia Pacific continues to prioritize environmental protection and regulatory compliance, the region is expected to see accelerated market expansion, making it the fastest growing market for environmental testing.

Environment Testing Key Market Players & Competitive Analysis Report

The competitive landscape features global leaders and regional players competing for environment testing market share through innovation, strategic alliances, and regional expansion. Global players utilize strong R&D capabilities, technological advancements, and extensive distribution networks to deliver advanced solutions, meeting the growing demand for disruptive technologies and sustainable value chains. Environment testing market trends highlight rising demand for emerging technologies, digitalization, and business transformation driven by economic growth, geopolitical shifts, and macroeconomic trends. Global players focus on strategic investments, mergers and acquisitions, and joint ventures to strengthen their market position. Post-merger integration and strategic alliances are key strategies to improve competitive positioning and expand regional footprints. Regional companies, meanwhile, address localized needs by offering cost-effective solutions and leveraging economic landscapes.

Competitive benchmarking includes market entry assessments, expansion opportunities, and partnership ecosystems to meet the demand for innovative products and future-ready solutions. The market is experiencing technological advancements, such as disruptive technologies and digital transformation, reshaping industry ecosystems. Companies are investing in supply chain management, procurement strategies, and sustainability transformations to align with environment testing market demand, trends, and future development strategies. Pricing insights, revenue growth analysis, and competitive intelligence are critical for identifying opportunities and driving long-term profitability. In conclusion, the environment testing industry growth is driven by technological innovation, market adaptability, and regional investments. Major players focus on strategic developments, market penetration, and competitive benchmarking to address economic and geopolitical shifts, assuring sustained growth in a hypercompetitive global market. A few key major players are SGA SA; Eurofins Scientific; Intertek Group plc; Bureau Veritas; ALS Ltd.; TUV SUD; Asure Quality; Merieux NutriSciences; Microbac Laboratories, Inc.; R J Hill Laboratories Ltd.; Symbio Laboratories.

SGS SA is a global testing, inspection, and certification company that offers wide environmental testing services. SGS provides a vast network for environmental analysis, ensuring compliance with regulatory standards across multiple continents with more than 125 environmental laboratories worldwide. Their facilities are equipped with state-of-the-art equipment, allowing the analysis of various matrices such as air, soil, water, and waste. SGS conducts routine testing for volatile organics, semi-volatile organics, metals, and wet chemistry applications using advanced techniques such as Gas Chromatography/Mass Spectrometry (GC/MS) and Inductively Coupled Plasma (ICP). SGS also specializes in contaminants of emerging concern (CECs), developing rigorous analytical methods to detect and quantify these substances in various matrices. Their testing methods can detect CECs in the nanogram to pictogram range, utilizing sophisticated instrumentation such as GC HRMS and LCMS/MS. Additionally, SGS provides environmental site assessments, which include Phase I, II, and III evaluations to identify environmental liabilities and guide cleanup operations. These assessments are crucial for businesses to understand the true value of a site and make informed decisions during mergers and acquisitions. Overall, SGS's environmental testing services are designed to ensure regulatory compliance, protect human health, and safeguard ecosystems globally.

Eurofins Scientific is a global testing and laboratory analysis company headquartered in Luxembourg. Founded in 1987, it has grown into a provider of services across various sectors, such as pharmaceuticals, food, environmental testing, and more. Eurofins operates an extensive network of over 900 laboratories in 62 countries. The company's environmental testing services are a key part of its offerings, focusing on assessing the quality and impact of water, air, soil, waste, and other products on health and the environment. Eurofin's environmental testing capabilities are improved by its strategic acquisitions, such as TestAmerica Environmental Services, which added substantial capacity to its environmental testing network. The company prides itself on its technological capabilities, service quality, and geographical reach, making it a global leader in environmental testing. Eurofins also provides consulting services to industrial companies, supporting them in maintaining compliance with environmental regulations and promoting sustainability.

Key Companies in Environment Testing Market

- ALS Ltd.

- Asure Quality

- Bureau Veritas

- Eurofins Scientific

- Intertek Group plc

- Merieux NutriSciences

- Microbac Laboratories, Inc.

- R J Hill Laboratories Ltd.

- SGS SA

- Symbio Laboratories

- TUV SUD

Environment Testing Market Developments

January 2025: SGS acquired RTI Laboratories, a Detroit-based environmental and materials testing provider, enhancing its PFAS analysis and material testing capabilities. The acquisition adds 30 employees and strengthens SGS’s Midwest presence, supporting Strategy 27 and expanding client services.

April 2024: NOAA’s GOES-U, the final satellite in the GOES-R series, completed rigorous environmental testing, including thermal vacuum tests, to ensure it withstands extreme space conditions. It is set for launch from Cape Canaveral Space Force Station.

August 2024: Envisys Technologies Pvt Ltd opened its Environmental Test Lab VISTARA LABS. The lab offers expanded testing capabilities with advanced equipment and experienced professionals.

Environment Testing Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Rapid

- Conventional

By Sample Outlook (Revenue, USD Billion, 2020 - 2034)

- Wastewater/Effluent

- Soil

- Water

- Air

- Noise

- Others

By Target Tested Outlook (Revenue, USD Billion, 2020 - 2034)

- Chemical

- Biological

- Temperature

- Particulate Matter

- Moisture

- Noise

By End Use Outlook (Revenue, USD Billion, 2020 - 2034)

- Government

- Industrial

- Environment Testing Laboratories

- Energy & Utilities

- Agriculture

- Others

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Environment Testing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.99 billion |

|

Market Size Value in 2025 |

USD 11.83 billion |

|

Revenue Forecast in 2034 |

USD 23.15 billion |

|

CAGR |

7.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global environment testing market size was valued at USD 10.99 billion in 2024 and is projected to grow to USD 23.15 billion by 2034.

The global market is projected to register a CAGR of 7.7% during the forecast period.

North America dominated the environment testing market revenue share in 2024.

Some of the key players in the market are SGA SA; Eurofins Scientific; Intertek Group plc; Bureau Veritas; ALS Ltd.; TUV SUD; Asure Quality; Merieux NutriSciences; Microbac Laboratories, Inc.; R J Hill Laboratories Ltd.; and Symbio Laboratories.

The rapid segment dominated the environment testing market in 2024.

The environment testing laboratories segment is expected to witness substantial environment testing market growth during the forecast period.