Enterprise Networking Market Size, Share, Trends, Industry Analysis Report: By Equipment (Ethernet Switch, Enterprise Routers, WLAN, and Network Security); Infrastructure; Connection; Technology; End Users; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5120

- Base Year: 2023

- Historical Data: 2019-2022

Enterprise Networking Market Overview

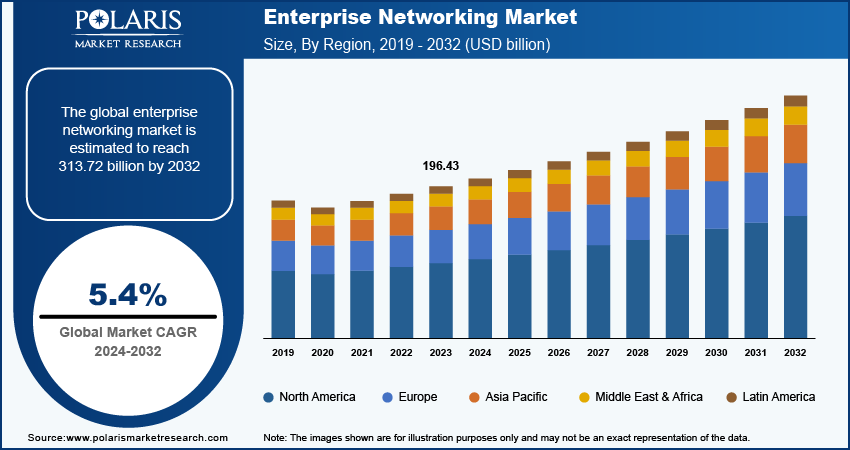

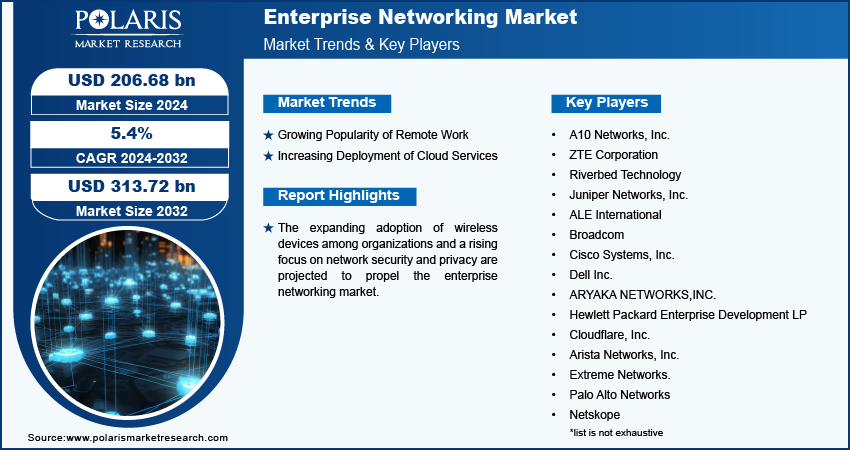

The enterprise networking market size was valued at USD 196.43 billion in 2023. The market is projected to grow from USD 206.68 billion in 2024 to USD 313.72 billion by 2032, exhibiting a CAGR of 5.4% during 2024–2032.

Enterprise networking refers to the complex IT infrastructure that organizations, particularly midsize and large enterprises, utilize to facilitate connectivity among users, devices, and applications. The primary objective of an enterprise network is to support the organization's goals by ensuring reliable and secure digital services for employees, partners, customers, and, increasingly, for Internet of Things (IoT) devices.

The expanding adoption of wireless devices among organizations is driving the enterprise networking market. Businesses require robust networks to handle the increased number of connections and ensure reliable connectivity as more wireless devices such as smartphones, tablets, and IoT devices are used in the workplace.

The rising focus on network security and privacy is projected to further propel the enterprise networking market. The growing emphasis on advanced security measures is leading businesses to upgrade their networking infrastructure by incorporating technologies such as firewalls, intrusion detection systems, and secure access protocols.

To Understand More About this Research: Request a Free Sample Report

The enterprise networking market is driven by emerging technologies such as machine learning (ML), artificial intelligence (AI), 5G, and cloud computing. These technologies require robust networks to handle vast amounts of data in real time. Also, enterprises need networking solutions that support the high bandwidth and low latency necessary for processing and analyzing data quickly and efficiently. The rollout of 5G networks allows more devices to connect simultaneously with low latency. This boosts demand for enterprise networking solutions that manage the influx of connected devices and ensure reliable performance.

Enterprise Networking Market Drivers

Growing Popularity of Remote Work

The market CAGR for enterprise networking is being driven by the growing popularity of remote work. As per data published by Owl Lab State of Remote Work report, globally, 16% of companies are fully remotein 2022. Remote work necessitates reliable and secure connections for employees working from various locations. Additionally, enterprises need robust networking solutions to ensure seamless access to corporate resources and applications. With the rise of remote work, there’s a strong demand for secure networking solutions, such as virtual private networks (VPNs) and secure access service edge (SASE) models, to protect against cyber threats.

Increasing Deployment of Cloud Services

The increasing deployment of cloud services is projected to fuel the enterprise networking market. Many cloud applications, particularly those involving real-time data processing or collaboration tools, require low latency for optimal performance. This encourages businesses to invest in networking solutions that minimize latency to provide a seamless user experience.

Enterprise Networking Market Segment Insights

Enterprise Networking Market Breakdown by Equipment Insights

Based on equipment, the enterprise networking market is divided into ethernet switches, enterprise routers, WLAN, and network security. The ethernet switches segment accounted for a major market in 2023 due to their critical role in facilitating high-speed data transfer and reliable connectivity. Organizations increasingly rely on these switches to manage vast amounts of data traffic generated by cloud applications, IoT devices, and remote work solutions. The rise of data-intensive applications has pushed businesses to upgrade their infrastructure, leading to a surge in demand for advanced ethernet switches that support features such as Power over Ethernet (PoE) and Layer 3 capabilities. Moreover, the proliferation of 5G technology and the need for enhanced network performance further fuel the adoption of these switches as companies seek to optimize their networks for greater efficiency and scalability.

The WLAN segment is estimated to grow at a robust pace in the coming years, owing to the increasing adoption of mobile-first strategies and remote work among organizations. Advanced WLAN technologies, such as Wi-Fi 6 and the upcoming Wi-Fi 7, offer significant improvements in speed, capacity, and efficiency, making them essential for supporting a growing number of connected devices. Businesses recognize the need for seamless connectivity, particularly in environments where collaboration and real-time data access are crucial. The push for smart office initiatives and the integration of IoT devices within enterprises further drive the WLAN segment as organizations aim to create agile and responsive network environments.

Enterprise Networking Market Breakdown by Infrastructure Type Insights

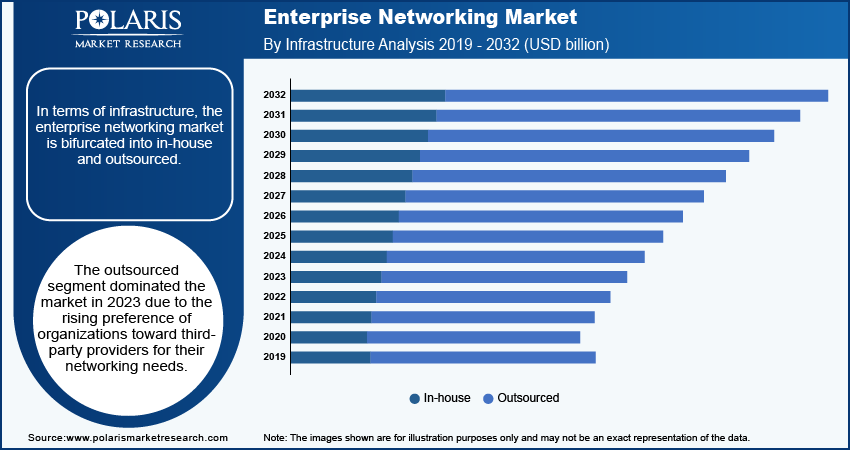

In terms of infrastructure, the enterprise networking market is bifurcated into in-house and outsourced. The outsourced segment dominated the market in 2023 due to the rising preference of organizations for third-party providers to meet their networking needs. Companies favor outsourcing due to its ability to reduce operational costs and streamline management, allowing them to focus on core business activities. Service providers offer specialized expertise, enabling organizations to benefit from the latest technologies without the burden of maintaining in-house teams. This trend has gained momentum as businesses adopt cloud-based solutions and seek to enhance their scalability and flexibility. Additionally, the rise of cybersecurity threats has prompted many firms to rely on outsourced services for robust security measures, further driving the growth of the segment.

The in-house segment is expected to register a significant CAGR from 2024 to 2032, owing to the importance of data privacy and control among enterprises. This trend is particularly evident in industries with stringent regulatory requirements, where firms prioritize direct oversight of their network infrastructure. Advances in technology, such as the development of software-defined networking (SDN) and automation tools, empower businesses to manage their in-house infrastructure effectively and efficiently. Moreover, the increasing demand for customized solutions tailored to specific business needs encourages companies to invest in their networking capabilities, creating a dynamic environment that supports the growth of the in-house segment.

Enterprise Networking Market Breakdown by Regional Insights

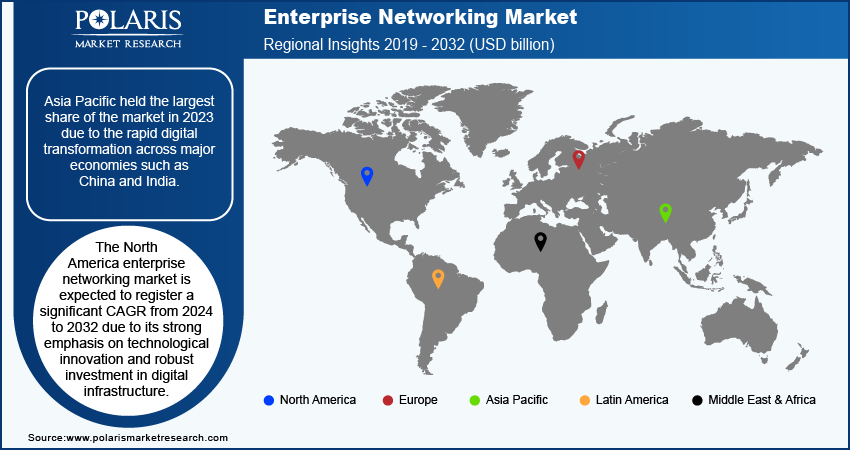

By region, the study provides enterprise networking market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share of the market in 2023 due to the rapid digital transformation across major economies such as China and India. These countries are experiencing significant investments in technology, propelled by the increasing adoption of cloud services, IoT devices, and 5G networks. The region's vast population and expanding middle class have also created a booming demand for reliable connectivity, pushing businesses to upgrade their network infrastructures. Additionally, government initiatives aimed at fostering innovation and enhancing digital capabilities further stimulate growth.

North America enterprise networking market is expected to register a significant CAGR over the forecast period due to its strong emphasis on technological innovation and robust investment in digital infrastructure. The demand for advanced networking solutions is set to rise as companies in North America focus on enhancing their cybersecurity measures and optimizing their networks for remote work and collaboration. Furthermore, the ongoing shift towards hybrid work environments encourages businesses to seek flexible, high-performance networking options.

Enterprise Networking Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the enterprise networking market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the enterprise networking market must offer innovative solutions.

The enterprise networking market is fragmented, with the presence of numerous global and regional market players. Major players in the enterprise networking market include A10 Networks, Inc.; ZTE Corporation; Riverbed Technology; Juniper Networks, Inc.; ALE International; Broadcom; Cisco Systems, Inc.; Dell Inc.; ARYAKA NETWORKS, INC.; Hewlett Packard Enterprise Development LP; Cloudflare, Inc.; Arista Networks, Inc.; Extreme Networks.; Palo Alto Networks; Netskope; STL Tech; Check Point Software Technologies Ltd.; F5, Inc.; and Lavelle Networks.

ZTE Corporation, a prominent China-based technology company founded in 1985, has established itself as a key player in the telecommunications sector, specializing in a wide array of products and services that cater to both consumer and enterprise networking needs. The company’s core business encompasses wireless communication systems, optical transmission, data telecommunications equipment, and telecommunications software, alongside a range of mobile devices. ZTE operates under its brand while also functioning as an original equipment manufacturer (OEM) for various clients globally. In November 2023, ZTE Corporation released a 5G-based industrial field network whitepaper to empower critical industrial productions.

Palo Alto Networks, founded in 2005 and headquartered in Santa Clara, California, has emerged as a major player in the cybersecurity landscape, particularly known for its innovative approach to enterprise networking. The company specializes in providing next-generation firewalls and advanced security solutions that protect organizations from a wide array of cyber threats. Palo Alto Networks has positioned itself as a crucial partner for enterprises seeking to secure their networks, applications, and data against evolving threats with the increasing complexity of digital environments. In September 2024, Palo Alto Networks announced that it had completed the acquisition of IBM's QRadar Software as a Service (SaaS) assets to secure customers with best-in-class threat prevention, addressing ever-expanding attack surfaces with the complete platform approach that is required to simplify security operations.

List of Key Companies in Enterprise Networking Market

- A10 Networks, Inc.

- ZTE Corporation

- Riverbed Technology

- Juniper Networks, Inc.

- ALE International

- Broadcom

- Cisco Systems, Inc.

- Dell Inc.

- ARYAKA NETWORKS,INC.

- Hewlett Packard Enterprise Development LP

- Cloudflare, Inc.

- Arista Networks, Inc.

- Extreme Networks.

- Palo Alto Networks

- Netskope

- STL Tech

- Check Point Software Technologies Ltd.

- F5, Inc.

- Lavelle Networks

Enterprise Networking Market Developments

March 2024: Aryaka, a telecommunications company that provides cloud-based software-defined networking (SD-WAN) and security services, announced the launch of Unified SASE as a Service to transform global secure networking.

November 2023: Netskope, a global player in secure access service edge (SASE), announced the launch of the Next Gen SASE Branch for optimized enterprise networking.

October 2023: STL, a leading optical and digital solutions company, announced the expansion of its Enterprise Networking Solutions portfolio with the launch of Estevan. Estevan, an end-to-end solution in fiber and copper cable connectivity, enables enterprises to modernize and digitize their large-scale network infrastructure.

Enterprise Networking Market Segmentation

By Equipment Outlook

- Ethernet Switch

- Enterprise Routers

- WLAN

- Network Security

By Infrastructure Outlook

- In-house

- Outsourced

By Connection Outlook

- Wired

- Wireless

By Technology Outlook

- Software Defined Networking (SDN)

- Network Function Virtualization (NFV)

- Software Defined Wide Area Network (SD-WAN)

- Secure Acess Service Edge (SASE)

- Wi-Fi

- Intenet-based Networking (IBN)

- Other

By End Users Outlook

- Cloud Service Providers

- Telecom Service Providers

- BFSI

- Manufacturing

- IT & ITes

- Healthcare & Life Sciences

- Retail & E-commerce

- Transportation

- Government

- Other

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Enterprise Networking Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 196.43 billion |

|

Market Size Value in 2024 |

USD 206.68 billion |

|

Revenue Forecast in 2032 |

USD 313.72 billion |

|

CAGR |

5.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019-2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The enterprise networking market size was valued at USD 196.43 billion in 2023 and is projected to grow to USD 206.68 billion by 2032.

The market is projected to grow at a CAGR of 5.4% during 2024–2032

Asia Pacific held the largest share of the market in 2023.

The key players in the market are A10 Networks, Inc.; ZTE Corporation; Riverbed Technology; Juniper Networks, Inc.; ALE International; Broadcom; Cisco Systems, Inc.; Dell Inc.; ARYAKA NETWORKS, INC.; Hewlett Packard Enterprise Development LP; Cloudflare, Inc.; Arista Networks, Inc.; Extreme Networks.; Palo Alto Networks; Netskope; STL Tech; Check Point Software Technologies Ltd.; F5, Inc.; and Lavelle Networks

The WLAN segment is projected for significant growth in the market.

The outsourced segment dominated the enterprise networking market in 2023.