Enterprise Content Management Market Size, Share, Trends, Industry Analysis Report: By Offering (Solutions and Services); By Business Function; By Deployment Mode; By Organization Size; By End-Use; and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5088

- Base Year: 2023

- Historical Data: 2019-2022

Enterprise Content Management Market Overview

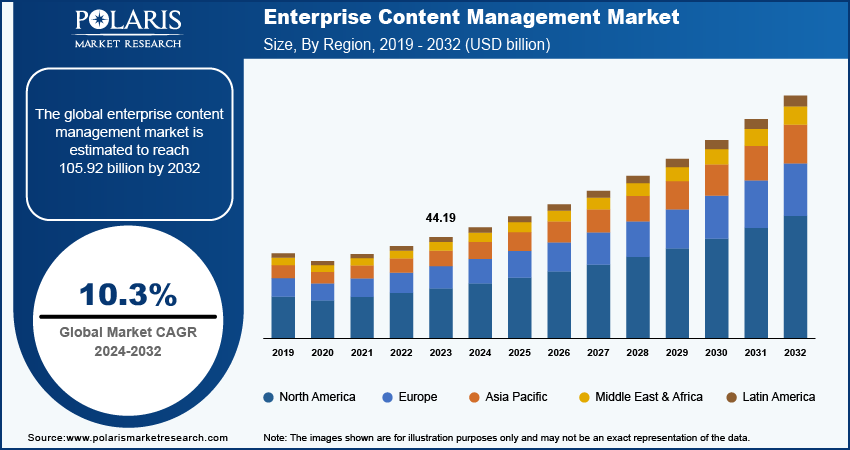

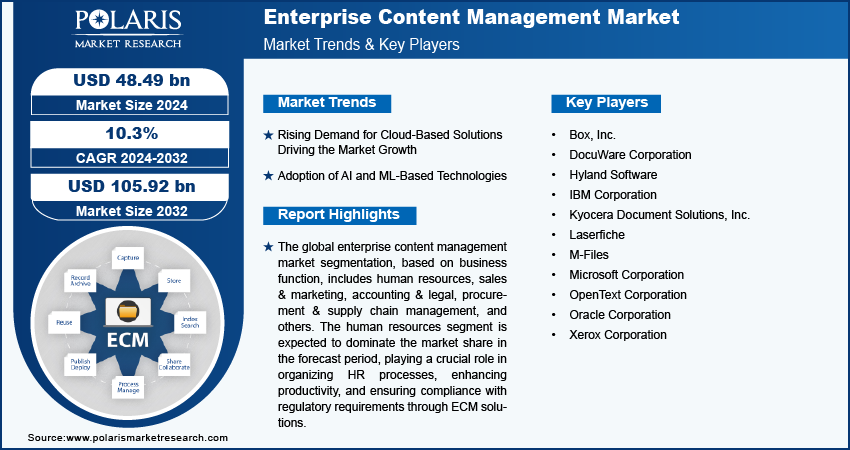

Global enterprise content management market size was valued at USD 44.19 billion in 2023. The industry is projected to grow from USD 48.49 billion in 2024 to USD 105.92 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.3% during the forecast period.

Enterprise content management (ECM) contains the strategies, techniques, and software solutions used for the acquisition, organization, storage, preservation, and dissemination of a diverse range of content and documents essential to organizational workflows.

The enterprise content management market is seeing significant growth due to the increasing demand for digital content, including documents, emails, multimedia files, and social media data. This poses a significant challenge for organizations to manage effectively. Enterprise content management (ECM) systems play a crucial role in addressing this challenge by providing robust solutions for storing, organizing, and retrieving vast amounts of digital content. These systems offer centralized repositories that enable seamless management across diverse formats and channels, ensuring easy access and efficient utilization of information assets. Market players are also taking initiatives to invest, collaborate, and launch new ECM solutions. For instance, in July 2023, KnowledgeLake's StreamLine Solutions introduced Intuitive AI to revolutionize enterprise content management, enhancing document processinga and workflow automation with cutting-edge capabilities. This integration of AI in ECM solutions drives the market.

Furthermore, the growing demand for enterprise content management solutions is driven by their ability to enhance operational efficiency and support regulatory compliance. ECM maintaining productivity, improving collaboration, and safeguarding critical information in a structured and accessible way for modern enterprises drives the enterprise content management market growth.

To Understand More About this Research: Request a Free Sample Report

With increasing cyber threats, organizations prioritize data security as a paramount concern. Enterprise content management (ECM) systems play a critical role by integrating robust security measures like encryption, role-based access control (RBAC), and data loss prevention (DLP) mechanisms. These systems ensure the protection of sensitive information across its lifecycle, from creation to storage and sharing. By implementing stringent security protocols, ECM solutions help mitigate risks associated with unauthorized access, data breaches, and compliance violations, thereby safeguarding organizational integrity and maintaining trust with stakeholders.

Enterprise Content Management Market Trends

Rising Demand for Cloud-Based Solutions Driving the Market Growth

The enterprise content management market witnessed a significant surge in demand for cloud-based solutions, largely driven by the advantages of scalability, cost-effectiveness, and ease of deployment offered by cloud computing. For instance, in January 2024, Newgen Software introduced its Cloud Content Management Accelerator on the Guidewire Marketplace, designed to enhance document management efficiency and user experience for insurers utilizing Guidewire's ClaimCenter and PolicyCenter. This solution exemplifies the cloud ECM options, offering scalability and reducing the need for significant upfront investments in hardware or infrastructure, which drives the growth of the market.

ECM scalability is particularly beneficial for businesses experiencing fluctuating demands or rapid growth, allowing them to efficiently manage digital content without concerns about storage limitations or performance constraints. Cloud ECM solutions also enhance data accessibility and security by centralizing content storage and implementing robust security measures such as encryption and secure access controls.

Adoption of AI and ML-Based Technologies

The integration of artificial intelligence (AI) and machine learning (ML) into ECM systems represents a significant advancement in content management capabilities. AI and ML technologies empower ECM platforms to automate complex tasks such as content classification, where documents and data are categorized based on their content and context automatically. For instance, in March 2024, Zscaler's latest report revealed a nearly 600% increase in enterprise adoption of AI/ML tools over the past year, underscoring substantial growth amidst rising security concerns. Moreover, predictive analytics powered by AI in ECM systems can forecast trends and patterns from historical data, providing valuable insights that aid in strategic decision-making and resource allocation.

Furthermore, AI-driven intelligent search functionalities enhance user productivity by enabling faster and more accurate retrieval of information. ECM systems equipped with AI can understand user queries and contextually search through vast repositories of documents and data, delivering relevant results promptly. This capability is particularly beneficial in organizations dealing with large volumes of data across diverse formats and sources, as it streamlines information access and supports informed decision-making at various levels driving the enterprise content management market revenue.

Enterprise Content Management Market Segment Insights

Enterprise Content Management Offerings Insights

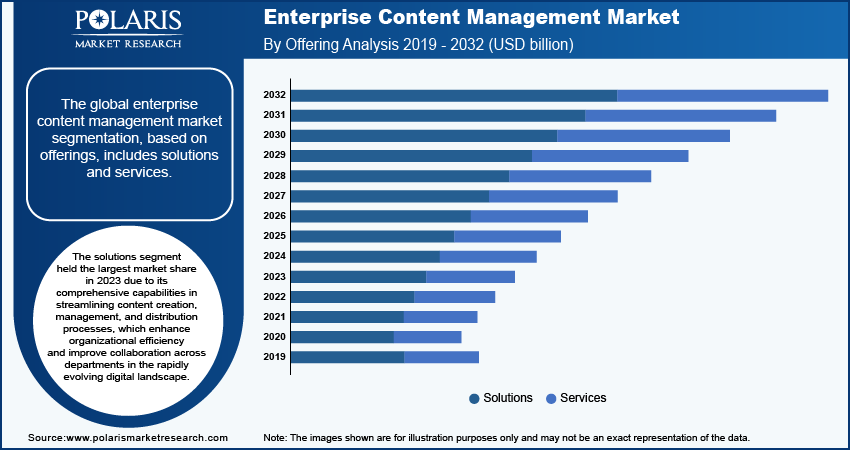

The global enterprise content management market segmentation, based on offerings, includes solutions and services. The solutions segment held the largest market share in 2023 due to its comprehensive capabilities in streamlining content creation, management, and distribution processes, which enhance organizational efficiency and improve collaboration across departments in the rapidly evolving digital landscape. Further, the segment solution is further sub-segmented into document management, case management, record management, imaging & capturing, web & mobile content management, digital asset management, collaborative content management, eDiscovery, and others. The web and mobile content management segment is poised to dominate the enterprise content management market as it offers essential tools for organizations to distribute content across various online and mobile platforms and also serves as centralized hubs for creating, editing, and publishing diverse content types like text, images, videos, and interactive elements drives the segment growth in the market.

Content authoring, version control, and workflow automation features streamline the content creation and publishing processes, while responsive design ensures optimal display across different devices and screen sizes. Additionally, web and mobile CMS incorporate analytics tools to gauge user engagement and behavior, enabling organizations to refine their content strategies for enhanced user experiences.

Enterprise Content Management Business Function Insights

The global enterprise content management market segmentation, based on business function, includes human resources, sales & marketing, accounting & legal, procurement & supply chain management, and others. The human resources segment is expected to dominate the market share in the forecast period, playing a crucial role in organizing HR processes, enhancing productivity, and ensuring compliance with regulatory requirements through ECM solutions. These systems enable HR departments to manage the entire lifecycle of documents, including resumes, applications, contracts, performance evaluations, and training materials. By providing reliable repositories for HR documentation, ECM simplifies document management by granting HR professionals quick and accurate access to essential information. For instance, in October 2023, GRM Information Management introduced QuickPack, a streamlined HR packet onboarding solution, enhancing efficiency and document management for new employee onboarding processes.

ECM also automates workflow management tasks such as employee onboarding, performance assessments, and training, reducing manual efforts. Furthermore, ECM solutions streamline HR functions by securely storing sensitive employee data, enforcing retention policies, and maintaining audit trails for document access and revisions.

Enterprise Content Management Regional Insights

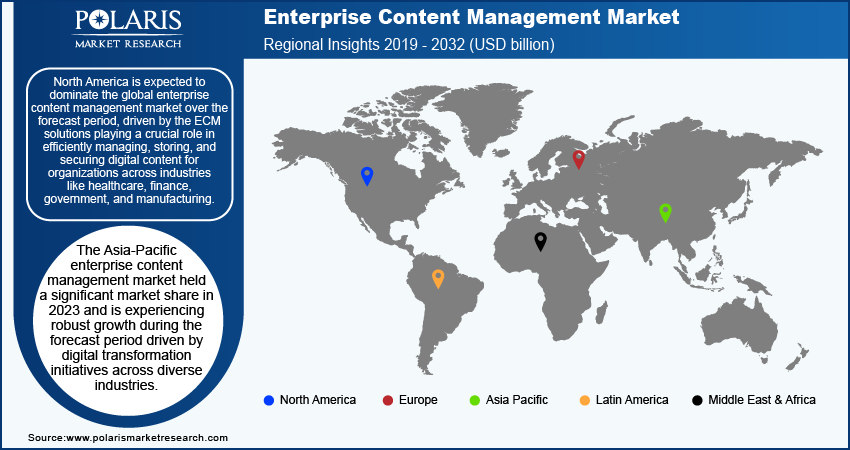

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America is expected to dominate the global enterprise content management market over the forecast period, driven by the ECM solutions playing a crucial role in efficiently managing, storing, and securing digital content for organizations across industries like healthcare, finance, government, and manufacturing. The region's ECM sector benefits from increasing digital content volumes, facilitating streamlined content management, regulatory compliance, and enhanced collaboration and productivity.

Competition in North America's ECM market is fierce and characterized by technological advancement. Major players such as IBM Corporation, OpenText Corporation, Microsoft Corporation, and Oracle Corporation offer a range of ECM solutions, including document management, record management, digital asset management, and workflow automation.

Furthermore, cloud-based ECM solutions are also gaining traction due to their scalability, flexibility, and cost-efficiency. At the same time the integration of AI and ML technologies continues to drive innovation by automating content processes and extracting valuable insights from data.

The Asia-Pacific enterprise content management market held a significant market share in 2023 and is experiencing robust growth during the forecast period driven by digital transformation initiatives across diverse industries. Organizations are increasingly adopting cloud-based ECM solutions to enhance scalability, flexibility, and cost-effectiveness in document management and collaboration. Strict regulatory requirements in sectors like finance, healthcare, and government are also fueling ECM adoption, ensuring secure document storage and compliance with data protection laws. Moreover, the demand for ECM solutions with advanced collaboration tools and AI-driven automation is rising, supporting remote work dynamics and improving operational efficiency across the region.

Major enterprise content management market players offer comprehensive suites that encompass document management, records management, and information governance. Meanwhile, regional and local ECM providers are emerging to cater to specific industry needs and regulatory landscapes, further diversifying the market and driving innovation in ECM solutions tailored to local requirements. China, India, and Southeast Asian countries like Singapore, Malaysia, Indonesia, and Thailand are key growth areas within the Asia Pacific enterprise content management market, each driven by rapid digitization, sector-specific demands, and stringent regulatory frameworks.

Enterprise Content Management Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the enterprise content management market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the enterprise content management industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global enterprise content management industry to benefit clients and increase the market sector. In recent years, the enterprise content management industry has offered some technological advancements. Major players in the enterprise content management market, including Box, Inc., DocuWare Corporation, Hyland Software, IBM Corporation, Kyocera Document Solutions, Inc., Laserfiche, M-Files, Microsoft Corporation, OpenText Corporation, Oracle Corporation, Xerox Corporation.

Microsoft is a multinational technology company headquartered in Redmond, Washington. Microsoft offers various products and services, including operating systems, productivity software, gaming consoles, and cloud-based solutions. Its flagship product, Microsoft Windows, is the world's most widely used operating system. Other popular products include Microsoft Office, Skype, and the Xbox gaming console. In February 2024, Microsoft introduced a new Content Management hub, integrating diverse solutions within Microsoft 365 to enhance community collaboration and engagement.

IBM is a provider of hybrid cloud solutions, AI technologies, and consulting services, catering to clients in more than 175 countries. The company enables organizations to harness their data for valuable insights, optimize operations, reduce expenses, and gain competitive advantages in their industries. Trusted by over 4,000 government and corporate entities across critical sectors such as finance, telecommunications, and healthcare, IBM's hybrid cloud platform, complemented by Red Hat OpenShift, supports swift, efficient, and secure digital evolutions. In May 2023, IBM launched IBM Hybrid Cloud Mesh, a SaaS solution enhancing hybrid multi-cloud management with application-centric connectivity and automation capabilities.

Key Companies in the Enterprise Content Management market include

- Box, Inc.

- DocuWare Corporation

- Hyland Software

- IBM Corporation

- Kyocera Document Solutions, Inc.

- Laserfiche

- M-Files

- Microsoft Corporation

- OpenText Corporation

- Oracle Corporation

- Xerox Corporation

Enterprise Content Management Industry Developments

April 2024: OpenText expanded its GenAI capabilities to enhance enterprise content management and IoT data processing.

April 2024, Hyland launched Hyland Experience Automate to enhance intelligent content automation and streamline workflows for organizations.

January 2024: Box, Inc. acquired Crooze to enhance enterprise content management through AI and metadata-powered applications on the Box Platform.

Enterprise Content Management Market Segmentation

Enterprise Content Management Offering Outlook

- Solution

- Document Management

- Case Management

- Record Management

- Imaging & Capturing

- Web & Mobile Content Management

- Digital Asset Management

- Collaborative Content Management

- eDiscovery

- Others

- Services

- Professional Services

- Deployment & Integration

- Training & Consulting

- Support & Maintenance

- Managed Services

- Content Analytics & Reporting

- Managed Print & Output Services

- Content Migration Services

- Professional Services

Enterprise Content Management Business Function Outlook

- Human Resources

- Sales & Marketing

- Accounting & Legal

- Procurement & Supply Chain Management

- Others

Enterprise Content Management, Deployment Mode Outlook

- Cloud

- On-premises

Enterprise Content Management Organization Size Outlook

- Large Enterprises

- SMEs

Enterprise Content Management End-Use Outlook

- BFSI

- Retail & Consumer Goods

- IT & ITeS

- Telecommunications

- Healthcare & Life Sciences

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Government & Public Sector

- Others

Enterprise Content Management Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Enterprise Content Management Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 44.19 billion |

|

Market size value in 2024 |

USD 48.49 billion |

|

Revenue Forecast in 2032 |

USD 105.92 billion |

|

CAGR |

10.3% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global enterprise content management market size was valued at USD 44.19 billion in 2023 and is anticipated to reach USD 105.92 billion in 2032.

The global market is projected to grow at a CAGR of 10.3% during the forecast period, 2024-2032.

North America had the largest share of the global market in 2023.

The key players in the market are Box, Inc., DocuWare Corporation, Hyland Software, IBM Corporation, Kyocera Document Solutions, Inc., Laserfiche, M-Files, Microsoft Corporation, OpenText Corporation, Oracle Corporation, and Xerox Corporation.

The solution category dominated the market in 2023.

The human resources had the largest share in the global market.