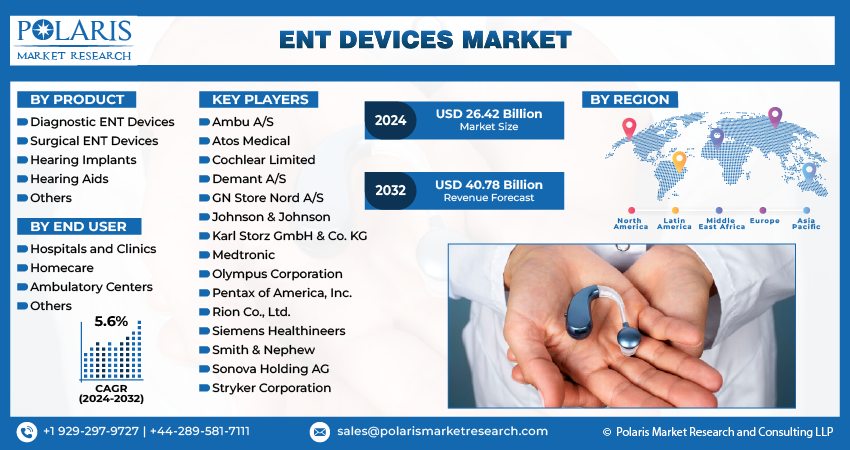

ENT Devices Market Share, Size, Trends, Industry Analysis Report, By Product (Diagnostic ENT Devices, Surgical ENT Devices, Hearing Implants, Hearing Aids, Others); By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4701

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

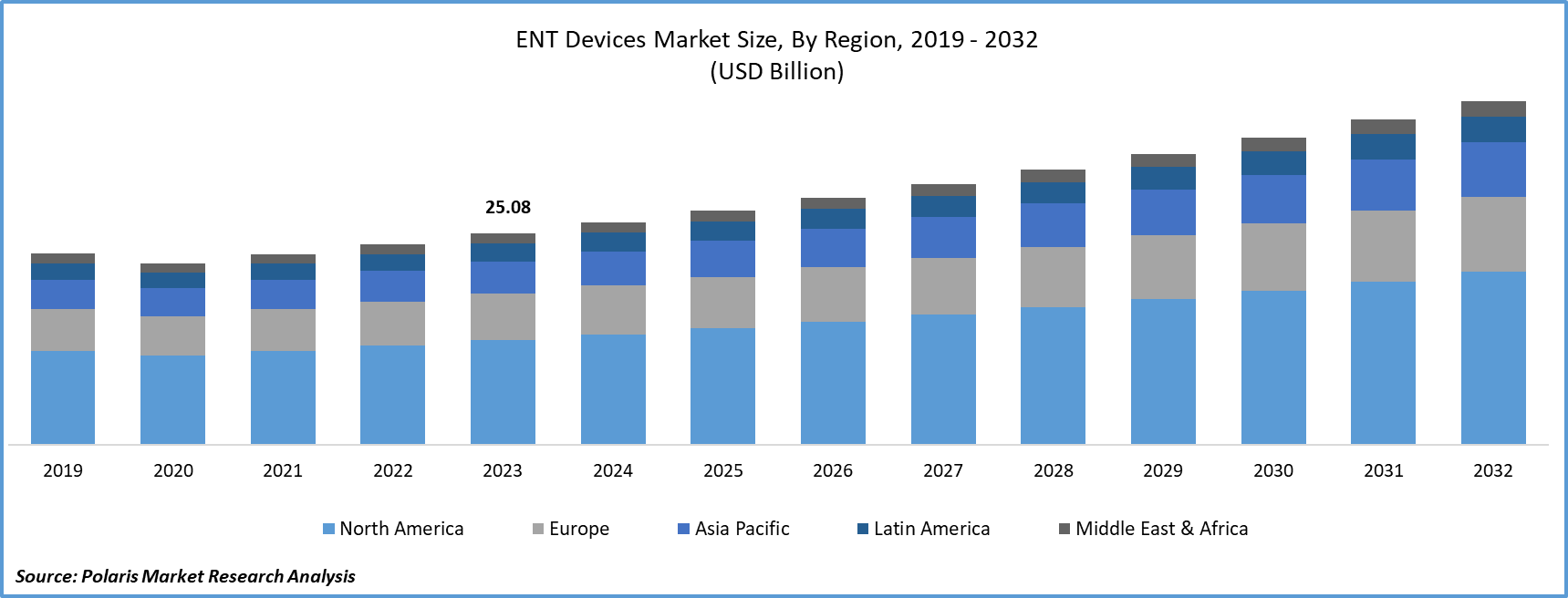

- Global ENT devices market size was valued at USD 25.08 billion in 2023.

- The market is anticipated to grow from USD 26.42 billion in 2024 to USD 40.78 billion by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Market Introduction

The ENT (Ear, Nose, and Throat) devices market is growing due to increased awareness and healthcare spending globally. A heightened understanding of ENT disorders prompts demand for advanced diagnostic and treatment solutions such as hearing aids and nasal implants. Improved access to healthcare services encourages early intervention, driving the adoption of ENT devices. Rising healthcare expenditure enhances infrastructure and accessibility to advanced medical technologies, including ENT devices. Governments allocate more resources to address ENT disorders, fostering research, development, and innovation. The prevalence of chronic ENT conditions, especially among aging populations, sustains market expansion. Continued investment in healthcare and awareness campaigns is expected to drive demand for ENT devices further, fostering growth.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

- For instance, in February 2024, Oticon unveiled a new hearing aid featuring 4D Sensor innovation, granting users complete immersion in the entire auditory landscape. This technology offers personalized adjustments based on the wearer's intentions, ensuring an optimized listening experience tailored to individual needs.

Technological advancements are revolutionizing the ENT devices market share, enhancing diagnosis, treatment, and management of ear, nose, and throat disorders. High-resolution imaging, including CT scans and MRI, improves diagnostic accuracy for conditions like sinusitis and hearing loss. Minimally invasive surgeries, aided by advanced endoscopic technology, enable precise visualization of ENT anatomy, reducing patient trauma and recovery times. Implantable devices such as cochlear implants offer life-changing solutions for severe hearing loss, while smaller, more discreet hearing aids with superior sound quality and connectivity are being developed. Digital health solutions and telemedicine expand access to ENT care, particularly in remote areas, offering improved patient outcomes and healthcare quality.

Industry Growth Drivers

Increasing prevalence of ENT disorders is projected to spur the product demand

The ENT disorders are increasing, driving demand for ENT devices. Aging populations, lifestyle changes, and environmental factors contribute to market growth. Advanced technologies offer minimally invasive procedures and improved diagnostics, with devices like endoscopes, hearing aids, and cochlear implants playing pivotal roles. Additionally, the COVID-19 pandemic has accelerated telehealth adoption in ENT care, enhancing accessibility. Greater awareness of early intervention further fuels demand. As the global population ages and environmental challenges persist, the ENT devices market growth is expected to grow, presenting opportunities for healthcare manufacturers and investors.

Growing aging population is expected to drive ENT devices market growth

The market is thriving due to the growing aging population globally. Age-related issues such as hearing loss and sinusitis drive demand for advanced diagnostic and therapeutic devices like hearing aids and nasal implants. Elderly individuals seek minimally invasive procedures and innovative technologies to maintain their quality of life, further boosting market growth. Government initiatives to improve healthcare infrastructure and raise awareness about ENT disorders among older adults contribute to this expansion. Manufacturers are investing in research and development to introduce tailored solutions, meeting the specific needs of elderly patients and driving global growth in the market.

Industry Challenges

High cost of ENT devices is likely to impede the market growth

The high prices of ENT devices present a significant barrier to market growth, limiting access to essential healthcare solutions for patients and healthcare facilities. Devices such as hearing aids and endoscopes often come with substantial costs due to advanced technologies and materials. This financial burden can discourage patients from seeking treatment or force them to settle for less effective options. Additionally, healthcare facilities may need help to afford these devices, impacting patient care. The high costs can also hinder innovation and market competitiveness.

Report Segmentation

The ENT devices market analysis is primarily segmented based on product, end user, and region.

|

By Product |

By End User |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Hearing aids segment held significant market revenue share in 2023

The hearing aids segment held a significant revenue share in 2023. The widespread prevalence of hearing loss, particularly among the aging population, drives substantial demand. Technological advancements, such as digital signal processing and wireless connectivity, enhance efficacy and appeal. Increased awareness and improved accessibility to hearing healthcare services contribute to growing consumer interest. Government subsidies and insurance coverage make hearing aids more affordable. Customization options tailored to individual needs and lifestyle preferences further enhance hearing aids market growth.

By End User Analysis

Hospitals and clinics segment held significant revenue share in 2023

The hospitals and clinics segment held a significant revenue share in 2023. They serve as key providers of diagnostic services, necessitating various devices such as endoscopes and imaging equipment. Additionally, these settings offer diverse treatment options, driving demand for specialized ENT devices. With specialized departments and experienced professionals, hospitals attract patients seeking comprehensive care, increasing device utilization. Referral networks from primary care physicians further contribute to patient volume and device usage. Providing both inpatient and outpatient services, they cater to diverse patient needs, requiring a range of ENT devices. Teaching hospitals and academic centers foster innovation, while insurance coverage makes ENT services more accessible, supporting ENT device market growth.

Regional Insights

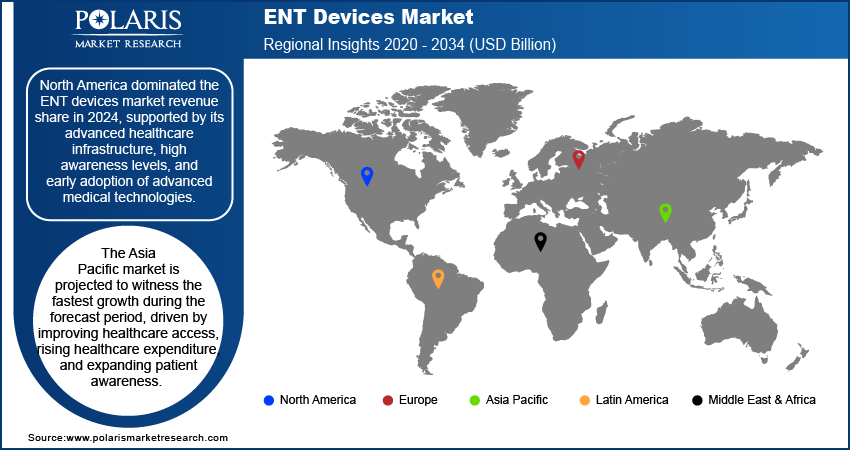

North America region accounted for a significant market share in 2023

In 2023, the North American region accounted for a significant market share due to its advanced healthcare infrastructure, technological leadership, and high prevalence of ENT disorders such as hearing loss. The region's aging population contributes to the demand for devices such as hearing aids and implants. Well-established healthcare policies and insurance coverage ensure accessibility to ENT services, while strong economic conditions allow for greater affordability of advanced devices. Investment in research and development, along with the presence of leading academic institutions, drives innovation and market competitiveness.

Asia-Pacific is expected to experience significant growth during the forecast period. Rising healthcare spending, propelled by economic growth and government initiatives, improves access to ENT devices and services. Technological advancements in medical devices enhance diagnostic and treatment options. Urbanization and lifestyle changes contribute to a higher prevalence of ENT disorders. Increasing awareness and education about ENT conditions, along with government initiatives and reimbursement policies, further stimulate market growth. Additionally, emerging economies in the region present untapped opportunities, with rising middle-class populations and increased disposable incomes driving market expansion.

Key Market Players & Competitive Insights

The ENT devices market players consists of various participants, and the anticipated arrival of new competitors is set to heighten competitive pressures. Key players in the sector consistently upgrade their technologies, aiming to sustain a competitive edge through efficiency, dependability, and safety. These entities prioritize strategic initiatives, such as forging partnerships, refining product ranges, and engaging in cooperative ventures. Their objective is to surpass rivals in the sector, securing a notable ENT devices market share.

Some of the major players operating in the global ENT devices market include:

- Ambu A/S

- Atos Medical

- Cochlear Limited

- Demant A/S

- GN Store Nord A/S

- Johnson & Johnson

- Karl Storz GmbH & Co. KG

- Medtronic

- Olympus Corporation

- Pentax of America, Inc.

- Rion Co., Ltd.

- Siemens Healthineers

- Smith & Nephew

- Sonova Holding AG

- Stryker Corporation

Recent Developments

- In February 2023, Innovia Medical introduced its Summit Medical ENT series in the UK market. This product lineup showcases a range of high-quality essentials, including Rhino Rocket, Grommets and Ventilation Tubes, AbsorbENT Nasal and Sinus Packs, and Denver Splint.

- In October 2022, Sony Electronics revealed the launch of its over-the-counter (OTC) hearing aids for the U.S. market. Created in collaboration with WS Audiology, the two inaugural products from this partnership are the CRE-C10 and the CRE-E10 self-adjusting OTC hearing aids.

- In September 2021, Acclarent, Inc. unveiled its inaugural AI-driven ENT technology in the United States, aimed at streamlining surgical preparation and offering immediate guidance during ENT navigation procedures. This novel software suite, comprising TruSeg and TruPath, is compatible with the TruDi Navigation System. It harnesses a machine learning algorithm to offer dependable and precise image-guided preoperative planning and navigation for ENT procedures.

Report Coverage

The ENT devices market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, end users, and their futuristic growth opportunities.

ENT Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.42 billion |

|

Revenue forecast in 2032 |

USD 40.78 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global ENT Devices market size is expected to reach USD 40.78 billion by 2032

Key players in the market are Cochlear Limited, Demant A/S, Johnson & Johnson, Karl Storz GmbH & Co. KG

North America contribute notably towards the global ENT Devices Market

ENT Devices Market exhibiting the CAGR of 5.6% during the forecast period.

The ENT Devices Market report covering key segments are product, end user, and region.