Engineering Services Outsourcing Market Size, Share, Trends, Industry Analysis Report

By Application (Automotive, Energy, Network & Communications, Industrial Automation, Medical Technology), By Location, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1030

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The engineering services outsourcing market size was valued at USD 4.54 billion in 2024 and is expected to register a CAGR of 26.9% from 2025 to 2034. The rising demand for cost savings and access to global talent drives the industry growth. Companies in multiple industries, including automotive, aerospace, energy, telecommunications, and healthcare, are increasingly turning to engineering service outsourcing providers, thereby driving the growth of the market.

Key Insights

- In 2024, the industrial automation segment held the largest share. This is due to the rising adoption of automation in various end-use industries.

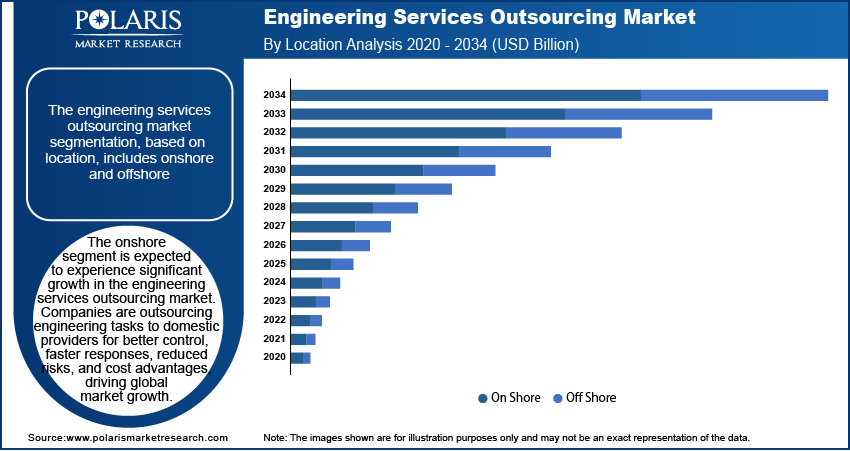

- The onshore segment is expected to experience significant growth during the forecast period. Companies are increasingly seeking to outsource engineering tasks to providers within their country to ensure better communication and higher control over projects.

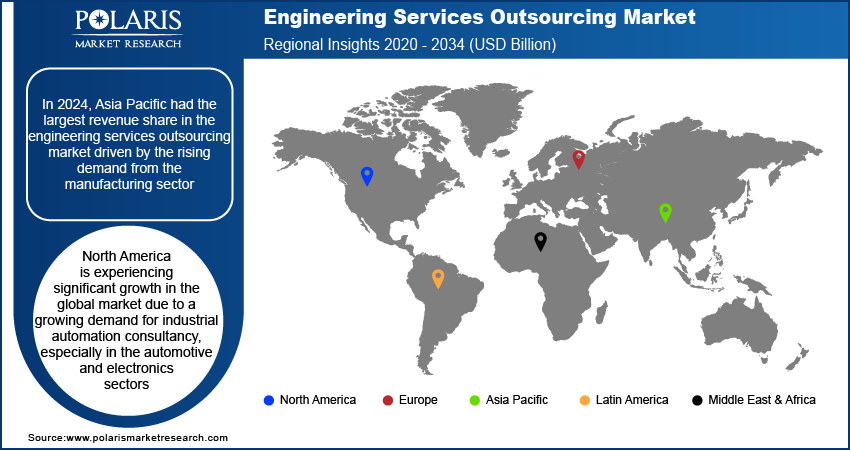

- In 2024, Asia Pacific accounted for the largest revenue share. The increasing demand from the manufacturing sector drives the regional industry expansion.

- The industry in North America is experiencing significant growth, due to a growing demand for industrial automation consultancy, especially in the automotive and electronics sectors.

Industry Dynamics

- Rising complexity of engineering projects creates the requirement for specialized expertise, which fuels the market growth.

- Increasing technological advancements in manufacturing processes propel the demand for engineering service outsourcing.

- Growing partnerships between OEM and ESP would drive the industry expansion in the coming years.

- High initial investments hinder the market demand.

Market Statistics

2024 Market Size: USD 4.54 billion

2034 Projected Market Size: USD 49.05 billion

CAGR (2025–2034): 26.9%

Asia Pacific: Largest market in 2024

AI Impact on Engineering Services Outsourcing Market

- Artificial Intelligence (AI) technology is transforming the engineering services outsourcing (ESO) market landscape.

- AI and machine learning technology are used to automate complex engineering tasks, as they provide advanced analytics capabilities.

- AI tools analyze vast data, identify patterns, and offer insights that help make effective decisions.

- The ESO industry uses AI and ML for quality control and predictive maintenance. Using these technologies, engineering service providers can deliver more efficient and innovative solutions.

Market.png)

To Understand More About this Research: Request a Free Sample Report

Engineering service outsourcing involves hiring external companies or teams to handle specific engineering tasks or projects, such as design, development, or testing, instead of performing them in-house. This allows businesses to reduce costs, access specialized expertise, and focus on core operations.

Engineering service outsourcing has gained significant traction in recent years due to the increasing complexity of engineering projects, the increase in cost, and the need for specialized expertise. Engineering service outsourcing providers support overall cost reduction in engineering projects as they boast the required resources for engineering projects, due to which companies in multiple industries, such as automotive, aerospace, energy, telecommunications, and healthcare, are increasingly turning to engineering service outsourcing providers, thereby driving the growth of the engineering service outsourcing market growth.

The engineering services outsourcing market growth is driven by the demand for cost savings and access to global talent. Outsourcing engineering tasks to countries such as India, China, and Eastern Europe supports companies with cost reduction. This allows businesses to focus internal resources on strategic goals while benefiting from specialized expertise at a reduced cost. Engineering services outsourcing also provides access to a wider range of skills and the latest technological advancements. Providers bring fresh perspectives, innovative solutions, and specialized knowledge to help companies solve complex engineering problems, accelerate product development, improve quality, and maintain competitiveness in an evolving market.

Market Dynamics

Technological Advancement in Manufacturing Process

New technologies such as automation, artificial intelligence, and robotics are revolutionizing the way products are designed, produced, and tested. These innovations require specialized skills that may not be available in-house, making outsourcing an attractive solution. Companies leverage the expertise of external engineering firms to integrate advanced technologies into their processes, which improve efficiency and reduce costs. Additionally, outsourcing supports businesses to stay ahead of competitors by quickly adopting new manufacturing techniques. Therefore, technological advancement is driving the engineering services outsourcing market growth.

Growing Partnership between OEM and ESP

The engineering services outsourcing market demand is largely driven by increasing collaborations between original equipment manufacturers (OEM) and engineering services providers (ESP). These partnerships enable OEMs to access specialized skills, reduce operational costs, and focus on their core competencies while outsourcing complex engineering tasks. ESPs, in turn, gain opportunities to expand their customer base and provide innovative solutions. For instance, Faurecia, an OEM, partnered with ESP for consulting automotive digital cockpit designing. Such collaborations support OEMs to accelerate product development and improve efficiency. This mutual benefit strengthens the outsourcing trend, thereby driving the market.

Segment Analysis

Market Assessment by Application Outlook

The engineering services outsourcing market segmentation, based on application, includes automotive, energy, network & communications, industrial automation, medical technology, industrial electronics & automated embedded service, consumer electronics, semiconductors, construction, and aerospace. The industrial automation segment accounted for the largest share in 2024. This is due to the growing adoption of automation in various industries. Companies are increasingly integrating automation technologies to improve efficiency, reduce operational costs, and improve production quality. This trend has fueled the demand for outsourcing engineering services as businesses seek specialized expertise to implement complex automation systems such as building automation system. Industries such as manufacturing, automotive, and electronics are particularly focused on automating processes to stay competitive. The rise of smart factories and Industry 4.0 further accelerates the need for advanced automation solutions, driving segmental growth in the engineering services outsourcing market report.

Market Evaluation by Location Outlook

The engineering services outsourcing market segmentation, based on location, includes onshore and offshore. The onshore segment is expected to experience significant growth in the market. Companies are increasingly seeking to outsource engineering tasks to providers within their own country to ensure better communication, higher control over projects, and quicker turnaround times. This trend is driven by a need for faster response times, reduced risks related to offshore outsourcing, and stronger regulatory compliance. Additionally, the ongoing demand for quality and innovation has encouraged businesses to choose onshore providers who can offer local expertise while maintaining competitive cost advantages, thereby driving segmental growth in the global market.

Regional Insights

By region, the study provides the engineering services outsourcing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific had the largest engineering services outsourcing market revenue share driven by the rising demand from the manufacturing sector. Countries such as China, India, and Japan are seeing a surge in manufacturing activities, which has increased the demand for specialized engineering services to improve productivity and reduce costs. For instance, Japan’s manufacturing output is 6.5% of global manufacturing output, showcasing an increase in manufacturing activities. Outsourcing engineering tasks such as product design, development, and prototyping help manufacturers stay competitive by accessing expert knowledge and technology. This trend is driving regional growth in the market.

North America is experiencing significant growth in the global market due to a growing demand for industrial automation consultancy, especially in the automotive and electronics sectors. Companies in these industries are focusing on enhancing production efficiency and lowering costs by adopting advanced automation technologies. Outsourcing provides access to specialized expertise in areas such as robotics, control systems, and process optimization. The increasing need for customized automation solutions in these sectors is driving the growth of the engineering services outsourcing market in North America.

Key Players & Competitive Analysis Report

The engineering services outsourcing market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the engineering services outsourcing industry include Accenture Plc; ALPEN; Altair Engineering, Inc.; Alten; Altran; Amazon Web Services (AWS); ASAP Holding GmbH; AVL List GmbH; Boston Engineering Corporation; Capgemini SE; Cybage Software Pvt. Ltd.; EPAM Systems Inc.; HCL Technologies Limited; Infosys Limited; International Business Machines Corporation; Microsoft Azure; QuEST Global Services Pte. Ltd.; Sonata Software Limited; Tata Consultancy Services Limited; Tech Mahindra Limited (Mahindra Group) and Wipro Limited.

Accenture is a global professional services company that provides consulting, technology, and outsourcing services to various industries worldwide. The company operates in five segments, which include media & technology, communications, financial services, health & public service, products, and resources. Artificial intelligence (AI) is one of the key focus areas for Accenture. The company offers various AI solutions to help clients optimize their operations, improve customer experiences, and drive business growth. These solutions include AI-powered automation, machine learning, natural language processing, and predictive analytics. Accenture has invested heavily in building a strong ecosystem of AI partners, including technology giants such as Google, Microsoft, and Amazon Web Services, as well as niche AI startups. The company's AI solutions are designed to integrate seamlessly with existing technology systems and processes, enabling clients to derive maximum value from their investments. Accenture is a leading partner for cloud professional services. The company serves over 34,000 cloud projects in nearly every industry to build secured cloud solutions. The company has a network of about 400 innovation centers, studios, and centers worldwide and has offices in more than 200 cities in 50 countries. Accenture offers engineering services outsourcing (ESO) solutions, including product design, digital manufacturing, AI-driven automation, IoT technology, Industry 4.0, cloud engineering, cybersecurity, and sustainability, helping businesses accelerate innovation, reduce costs, and enhance efficiency.

Infosys Limited is an Indian multinational technology company established in 1981, with its headquarters in Bengaluru, Karnataka. It specializes in providing digital services and consulting to help organizations undergo digital transformation across various sectors, including finance, healthcare, and manufacturing. Infosys offers a wide range of services and products to address the needs of its clients. Its consulting services cover areas such as digital experience, cloud solutions, data analytics, artificial intelligence (AI), engineering, and sustainability. In addition to consulting, Infosys provides business process outsourcing through its subsidiary, Infosys BPM, which encompasses functions such as finance, procurement, customer service, and human resources. The company has developed several digital products aimed at enhancing operational efficiency. Key offerings include Finacle, a banking solution for financial institutions; Panaya, which facilitates application delivery; Infosys Equinox, a platform for digital commerce; and EdgeVerve Systems, focusing on enterprise software. In terms of geographical presence, Infosys generates a significant portion of its revenue from North America, which accounts for approximately 61%. Europe contributes around 25%, while other regions include India (3%), the Middle East, Australia, and Japan (11%). Infosys Limited offers engineering services outsourcing (ESO) solutions, including product design, digital twin, IoT engineering, AI-driven automation, Industry 4.0, manufacturing optimization, and sustainability engineering, enabling cost-effective innovation and accelerated product development.

List Of Key Companies

- Accenture Plc

- ALPEN

- Altair Engineering, Inc.

- Alten

- Altran

- Amazon Web Services (AWS)

- ASAP Holding GmbH

- AVL List GmbH

- Boston Engineering Corporation

- Capgemini SE

- Cybage Software Pvt. Ltd.

- EPAM Systems Inc.

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Microsoft Azure

- QuEST Global Services Pte. Ltd.

- Sonata Software Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited (Mahindra Group)

- Wipro Limited

Engineering Services Outsourcing Industry Developments

- In December 2024, ALTEN Group announced the successful acquisition of the Worldgrid business unit from Atos SE. Worldgrid is known for delivering specialized consulting and engineering solutions to the energy and utilities sector, with operations primarily focused in France, Germany, and Spain.

- In December 2024, HCLTech disclosed the acquisition of select assets from HPE’s Communications Technology Group. This move aims to broaden HCL’s service portfolio across areas such as Business Support Systems (BSS) and network applications, while also embedding cutting-edge technologies like artificial intelligence (AI) and Internet of Things (IoT) into its offerings.

-

February 2024: MGS' Global Engineering Services Group was launched, uniting over 200 toolmakers and 85 engineers worldwide. This initiative expanded the company's engineering capabilities and enhanced global production for healthcare innovators.

-

March 2023: Deloitte acquired the assets of Optimal Design Co., a prominent product engineering services company focused on smart connected products and IoT devices. The collaboration between Deloitte and Optimal Design will enable clients to drive innovation and accomplish their digital transformation objectives by combining their respective expertise.

Engineering Services Outsourcing Market Segmentation

By Application Outlook (Revenue USD Billion, 2020–2034)

- Automotive

- Energy

- Network & Communications

- Industrial Automation

- Medical Technology

- Industrial Electronics & Automated Embedded Service

- Consumer Electronics

- Semiconductors

- Construction

- Aerospace

By Location Outlook (Revenue USD Billion, 2020–2034)

- Onshore

- Offshore

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Engineering Services Outsourcing Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.54 billion |

|

Market Size Value in 2025 |

USD 5.73 billion |

|

Revenue Forecast in 2034 |

USD 49.05 billion |

|

CAGR |

26.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The engineering services outsourcing market size was valued at USD 4.54 billion in 2024 and is projected to grow to USD 49.05 billion by 2034.

• The global market is projected to grow at a CAGR of 26.9% during the forecast period, 2025-2034.

• North America had the largest share in the global market in 2024.

• The key players in the market are Accenture Plc; ALPEN; Altair Engineering, Inc.; Alten; Altran; Amazon Web Services (AWS); ASAP Holding GmbH; AVL List GmbH; Boston Engineering Corporation; Capgemini SE; Cybage Software Pvt. Ltd.; EPAM Systems Inc.; HCL Technologies Limited; Infosys Limited; International Business Machines Corporation; Microsoft Azure; QuEST Global Services Pte. Ltd.; Sonata Software Limited; Tata Consultancy Services Limited; Tech Mahindra Limited (Mahindra Group) and Wipro Limited

• The industrial automation segment accounted for the largest share in 2024 due to the growing adoption of automation in various industries

• The onshore segment is expected to experience significant growth in the engineering services outsourcing market. Companies are outsourcing engineering tasks to domestic providers for better control, faster responses, reduced risks, and cost advantages, driving global market growth.