Engineering Services Market Size, Share, Trends, Industry Analysis Report: By Engineering Services Type (Testing, Designing, Prototyping, System Integration), Engineering Discipline, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5318

- Base Year: 2024

- Historical Data: 2020-2023

Engineering Services Market Overview

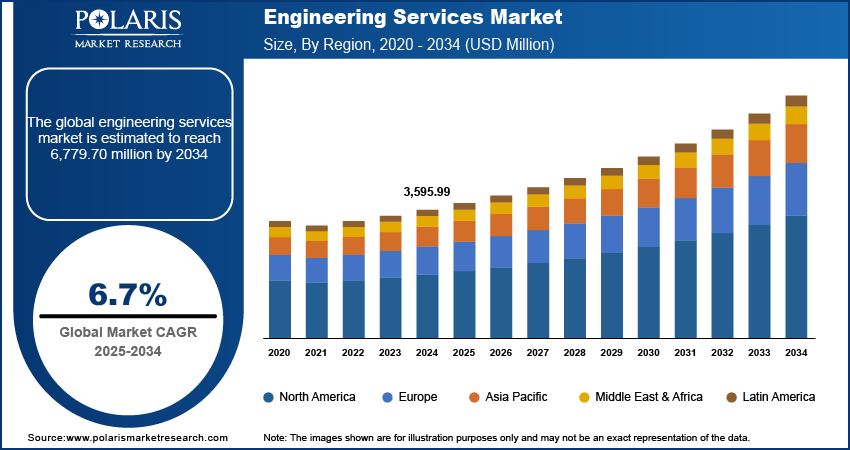

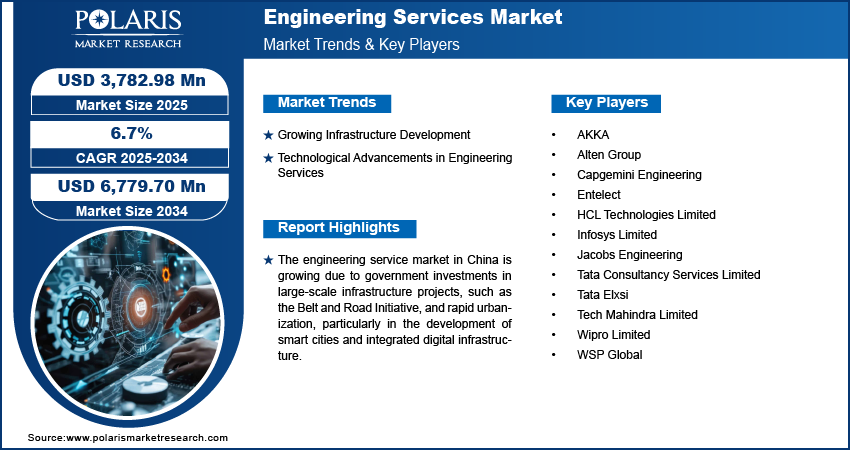

engineering services market size was valued at USD 3,595.99 million in 2024. The market is projected to grow from USD 3,782.98 million in 2025 to USD 6,779.70 million by 2034, exhibiting a CAGR of 6.7% from 2025 to 2034.

Engineering services apply engineering principles to design, develop, and manage systems, structures, and products. These services include consulting, design, analysis, project management, and maintenance across various engineering fields.

The engineering services market is growing due to partnerships between engineering service providers and original equipment manufacturers (OEMs). These collaborations have enabled OEMs to leverage the specialized expertise of engineering service providers, improving product design, development, and production processes. Additionally, these partnerships enable OEMs to focus on their core competencies while outsourcing complex engineering tasks, due to which the demand for engineering services is increasing. Therefore, growing partnerships between engineering service providers and original equipment manufacturers are driving the growth of the engineering service market.

To Understand More About this Research: Request a Free Sample Report

Engineering Services Market Drivers Analysis

Growing Infrastructure Development

The growing infrastructure development is driving the engineering services market. Cities and economies are expanding, creating a need for new infrastructure such as transportation systems, energy facilities, and smart cities. Engineering services are essential for planning, designing, and executing these large-scale projects, ensuring they are safe, efficient, and compliant with regulations, due to which the demand for engineering services is growing. Additionally, investments in infrastructure, both by governments and private companies, continue to rise globally. This growth increases the demand for expert engineering services to support construction, design, and project management, which is significantly fueling the engineering service market value.

Technological Advancements in Engineering Services

Technological advancements are driving significant growth in the engineering services market. Emerging technologies like automation, artificial intelligence (AI), the Internet of Things (IoT), and machine learning are transforming design, simulation, and analysis processes, enhancing efficiency and accuracy. Additionally, tools such as digital twins, augmented reality (AR), and virtual reality (VR) are reshaping how projects are visualized and executed, enabling more precise and immersive engineering solutions. These innovations not only boost productivity but also help reduce errors. The increasing adoption of these technologies across industries is fueling the demand for engineering services, leading to rapid market expansion.

Engineering Services Market Segment Analysis

Engineering Services Market Assesment by Engineering Services Type Outlook

The engineering services market segmentation, based on engineering services type, includes design and development, consulting, construction and project management, maintenance and support, specialized engineering services, and technology integration. The consulting segment dominated the engineering services market in 2024 due to their specialized expertise, cost-effectiveness, and efficient project management using advanced technologies. These services provide in-depth technical knowledge across various engineering fields, offering vital solutions for complex challenges in industries such as construction, manufacturing, and energy. Global consulting firms also offer valuable international experience and best practices tailored to local needs. Therefore, consulting segment dominated the engineering service market report.

Engineering Services Market Evaluation by Application Outlook

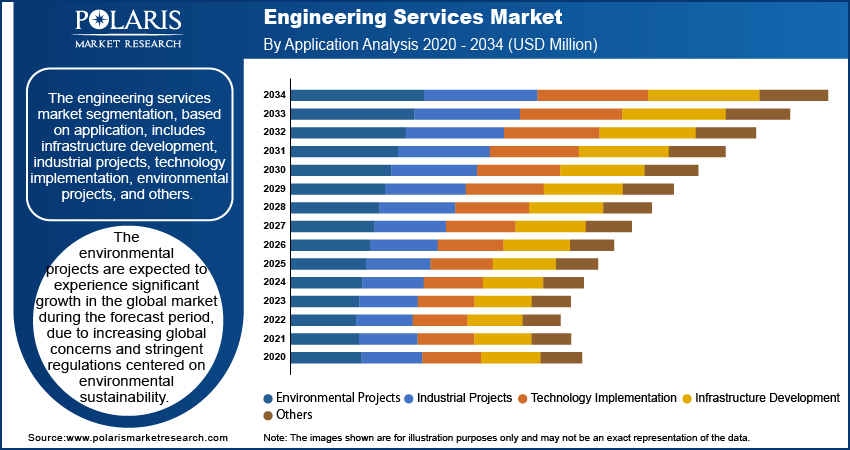

The engineering services market segmentation, based on application, includes infrastructure development, industrial projects, technology implementation, environmental projects, and others. The environmental projects are expected to experience significant growth in the global market during the forecast period, driven by increasing global concerns and stringent regulations centered on environmental sustainability. These projects encompass services aimed at tackling issues like pollution control, resource conservation, habitat restoration, and sustainable development. Additionally, the rising demand for environmental engineering is fueled by strict government regulations worldwide, particularly in areas such as emissions control, waste management, and environmental impact assessments, thereby driving the segmenatal growth in the global market.

For instance, in January 2024, India’s Ministry of Environment, Forest, and Climate Change (MoEF&CC) introduced the Environment (Protection) Amendment Rules, 2024. This amendment updated Schedule I, specifically revising the "Environmental Standards for Man-made Fibre Industry," further underscoring the increasing global emphasis on environmental sustainability and stricter pollution control measures.

Engineering Services Market Share by Region Outlook

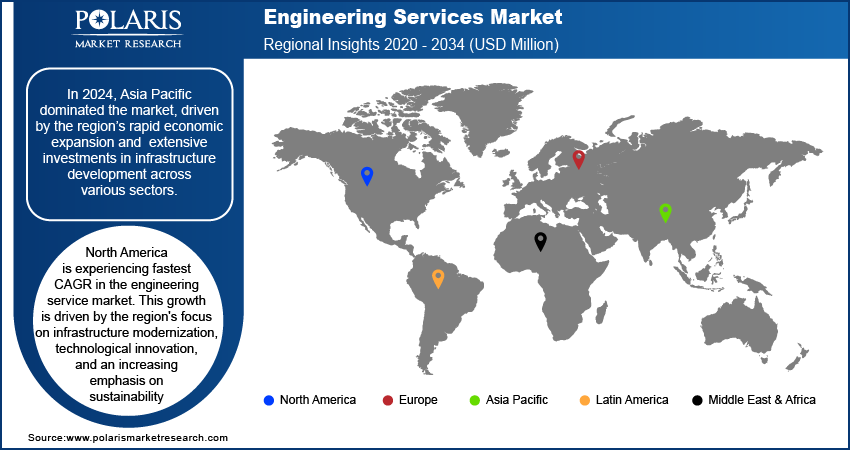

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market, driven by several factors contributing to its substantial growth and influence. The region’s rapid economic expansion has led to extensive investments in infrastructure development across sectors such as transportation, energy, telecommunications, and urban planning, due to which the demand for engineering services for planning, consulting, and technology is rising, thereby driving the engineering service market growth in the Asia Pacific region.

The engineering service market in China is experiencg significant growth, driven by government investments and large-scale infrastructure projects. Notably, initiatives like the Belt and Road Initiative (BRI) are increasing the demand for engineering expertise in planning, design, and execution. Additionally, rapid urbanization and the development of smart cities with integrated digital infrastructure are further driving the engineering service demand. For instance, in August 2022, China announced a USD 1 trillion infrastructure investment aimed at boosting the construction sector and fostering growth across related industries, showcasing an increase in government investment in infrastructure. Thus, growing government investment in the infrastructure is driving the growth of the engineering service market in China.

North America is experiencing fastest CAGR in the engineering service market. This growth is driven by several factors, including the region's focus on infrastructure modernization, technological innovation, and an increasing emphasis on sustainability. Initiatives related to green buildings, renewable energy, and sustainable urban planning are helping to fuel market expansion. Additionally, North America's robust industrial base and the presence of public-private partnerships are further contributing to the region's growth trajectory. Additionally, key players in the region are actively engaging in mergers, acquisitions, and collaborations to strengthen their market presence and deliver enhanced offerings during the forecast period, positively impacting the growth of the engineering service market growth.

Engineering Services Market Key Players & Competitive Analysis Report

The engineering service market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their service offerings and expand into new markets.

New companies are impacting the industry by introducing innovative services to meeting the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the engineering service market, includes AKKA, Alten Group, Capgemini Engineering, Infosys Limited, Tata Elxsi, Tata Consultancy Services Limited, Wipro Limited, Entelect, HCL Technologies Limited, and Tech Mahindra Limited.

Infosys Limited is an Indian multinational technology company established in 1981, with its headquarters in Bengaluru, Karnataka. It specializes in providing digital services and consulting to help organizations undergo digital transformation across various sectors, including finance, healthcare, and manufacturing. The company employs over 343,000 people and operates in more than 50 countries. Infosys offers a wide range of services and products to address the needs of its clients. Its consulting services cover areas such as digital experience, cloud solutions, data analytics, artificial intelligence (AI), engineering, and sustainability. In addition to consulting, Infosys provides business process outsourcing through its subsidiary, Infosys BPM, which encompasses functions like finance, procurement, customer service, and human resources. The company has developed several digital products aimed at enhancing operational efficiency. Key offerings include Finacle, a banking solution for financial institutions; Panaya, which facilitates application delivery; Infosys Equinox, a platform for digital commerce; and EdgeVerve Systems, focusing on enterprise software. In terms of geographical presence, Infosys generates a significant portion of its revenue from North America, which accounts for approximately 61%. Europe contributes around 25%, while other regions including India (3%), the Middle East, Australia, and Japan (11%).

HCL Technologies Ltd., established in 1991, specializes in the global IT services sector, renowned for its diverse offerings in engineering and R&D services. Headquartered in Noida, India, HCL has expanded its operations across 59 countries, employing over 218,000 professionals dedicated to driving innovation and technological advancement. The company provides a comprehensive suite of services that includes IT infrastructure management, digital process operations, cybersecurity solutions, and cloud-native services, catering to a wide array of industries such as financial services, healthcare, manufacturing, and telecommunications. The engineering and R&D services (ERS) segment is particularly significant for HCL, enabling clients to enhance product development cycles and optimize their return on innovation. This division focuses on delivering high quality engineering solutions that accelerate time-to-market for products while ensuring compliance with industry standards. HCL's commitment to innovation is clear in its extensive portfolio of over 2,000 patents and the establishment of more than 60 innovation labs worldwide. These labs facilitate research and development efforts aimed at integrating cutting-edge technologies such as AI, IoT, and automation into client solutions. Moreover, HCL's strategic partnerships with leading technology vendors bolster its capabilities in delivering tailored solutions that meet the evolving needs of businesses. The company has achieved remarkable milestones, including surpassing USD 10 billion in revenue and being recognized as one of the world's best employers. It remains well-positioned to influence the future landscape of IT and engineering solutions globally as HCL Technologies continues to expand its engineering services and embrace emerging technologies.

List of Key Companies in Engineering Services Market

- AKKA

- Alten Group

- Capgemini Engineering

- Entelect

- HCL Technologies Limited

- Infosys Limited

- Jacobs Engineering

- Tata Consultancy Services Limited

- Tata Elxsi

- Tech Mahindra Limited

- Wipro Limited

- WSP Global

Engineering Services Market Developments

June 2024: Capgemini enhanced its automotive systems engineering capabilities in Germany with the acquisition of Lösch & Partner, a Munich-based firm renowned for its expertise in application lifecycle management and systems engineering for the automotive sector. This strategic move strengthens Capgemini's position in driving intelligent industry solutions for global automotive manufacturers.

Feb 2024: Capgemini announced the acquisition of Unity's Digital Twin Professional Services arm to accelerate enterprises’ digital transformation through advanced real-time 3D (RT3D) technology. This move enhances Capgemini's capacity to offer immersive experiences across automotive, consumer products, energy, aerospace, healthcare, and industrial sectors, driving innovation in intelligent industry solutions globally.

Jun 2024: Tata Consultancy Services (TCS) launched AI Wisdom Next™, a platform integrating multiple Generative AI (GenAI) services. It aims to accelerate AI adoption at scale, simplify business solution development, and ensure regulatory compliance. TCS has already implemented this platform successfully across industries like outdoor advertising, insurance, and banking, enhancing operational efficiency and customer experiences through innovative AI applications.

April 2024: WSP Global Inc. announced the acquisition of 1A Ingenieros, a Spanish consulting firm with 250 employees. This strategic move strengthens WSP's capabilities in Spain's Power & Energy sector and diversifies its portfolio across core markets, including Transportation & Infrastructure and Earth and Environment services.

Engineering Services Market Segmentation

By Engineering Services Type Outlook (Revenue USD Million, 2020–2034)

- Design and Development

- Consulting

- Construction and Project Management

- Maintenance and Support

- Specialized Engineering Services

- Technology Integration

By Engnieering Discipline Outlook (Revenue USD Million, 2020–2034)

- Civil

- Mechanical

- Electrical

- Piping and Structural

By Application Outlook (Revenue USD Million, 2020–2034)

- Infrastructure Development

- Industrial Projects

- Technology Implementation

- Environmental Projects

- Others

By End Use Outlook (Revenue USD Million, 2020–2034)

- Construction

- Manufacturing

- Energy and Utilities

- Transportation

- Healthcare

- Telecommunications

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Engineering Services Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,595.99 million |

|

Market Size Value in 2025 |

USD 3,782.98 million |

|

Revenue Forecast in 2034 |

USD 6,779.70 million |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The engineering services market size was valued at USD 3,595.99 million in 2024 and is projected to grow to USD 6,779.70 million by 2034.

The market is projected to register a CAGR of 6.7% from 2025 to 2034.

Asia Pacific had the largest share of the market.

The key players in the market are AKKA, Alten Group, Capgemini Engineering, Infosys Limited, Tata Elxsi, Tata Consultancy Services Limited, Wipro Limited, Entelect, HCL Technologies Limited, and Tech Mahindra Limited.

The consulting services segment dominated the market in 2024, due to rising demand for experts consulting in technology and products.

The environmental projects are expected to experience significant growth in the global market during the forecast period, driven by increasing global concerns and stringent regulations centered on environmental sustainability.