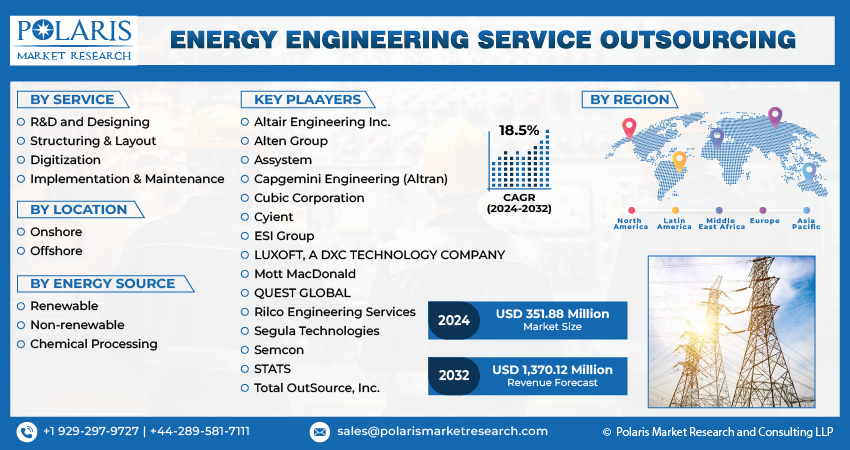

Energy Engineering Service Outsourcing (ESO) Market Share, Size, Trends, Industry Analysis Report, By Service (Structuring & Layout, Digitization, R&D & Designing, Implementation & Maintenance), By Location, By Energy Source, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4222

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

The global energy ESO market was valued at USD 301.81 million in 2023 and is expected to grow at a CAGR of 18.5% during the forecast period.

The increasing digitization within the energy sector is poised to contribute positively to market growth in the foreseeable future. Numerous Engineering Service Providers (ESPs) have introduced innovative technologies for various applications, including smart grid management, plant digitization, embedded product engineering, and virtual prototyping. These technological advancements are anticipated to play a crucial role in driving the digital transformation of the energy sector, enhancing the global impact of energy ESPs. Additionally, outsourcing services to engineering service providers offer Original Equipment Manufacturers (OEMs) the potential to reduce labor costs and other associated investment expenses significantly.

Market.png)

To Understand More About this Research: Request a Free Sample Report

Moreover, energy engineering service providers must engage in competitive pricing and showcase their domain expertise to be advantageous for energy-producing companies. ESPs prioritize offering services that tackle the challenges prevalent in the energy sector. For example, addressing power fluctuations, a significant concern in connecting wind farms to the power network, ESI Group provides virtual testing technology for windmill operations. Likewise, Altair Engineering, delivers IoT-based digital transformation services tailored for the energy outsourcing industry.

In recent years, the global slowdown caused by the COVID-19 pandemic has been unprecedented. This downturn has had a notable impact on the energy sector, leading to delays in the construction of new infrastructure and facilities primarily due to issues with the delivery of equipment. China, being one of the earliest countries affected by the pandemic, is a major producer of various types of clean energy equipment, including wind turbines and solar panels. The pandemic adversely affected the timely delivery and installation of energy-related equipment for companies in the renewable energy sector, leading to a decrease in demand for the services of engineering service providers.

Nonetheless, factors such as Intellectual Property (IP) concerns and security threats pose significant constraints to market growth. OEMs and service providers frequently share sensitive data related to project specifications, technologies, and equipment performance to facilitate collaboration in development, design, and support. Consequently, effective management of Intellectual Property and addressing data security issues have become increasingly paramount for businesses engaging in outsourcing services.

Industry Dynamics

Growth Drivers

Technological Advancements

Engineering service providers demonstrate the capability to implement effective strategies and complete projects efficiently, leveraging readily available teams of skilled and trained engineers. This proficiency is anticipated to attract the interest of end-use industries throughout the forecast period. Moreover, outsourcing firms capitalize on advanced engineering tools and technologies to cater to their clients, contributing to further energy engineering service outsourcing (ESO) market growth. Collaborating with service providers to expedite Research and Development (R&D) activities has become a commonplace practice in the energy sector.

Report Segmentation

The market is primarily segmented based on service, location, energy source, and region.

|

By Service |

By Location |

By Energy Source |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

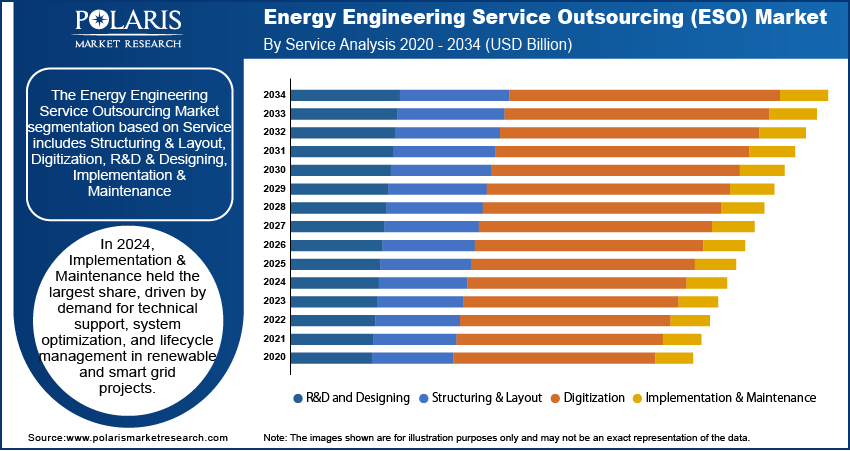

By Service Analysis

Structuring & layout segment held the largest share in 2023

The structuring segment held the largest share. This growth is a result of increasing concerns regarding the operational efficiency of energy plants. It encompasses activities such as construction & equipment procurement. ESO providers play a crucial role in delivering these services for significant infrastructure projects, spanning various sectors such as oil and gas, hydroelectric, mining, solar, & wind plants. This is anticipated to be a key driver for the growth of this segment throughout the forecast period.

Implementation and maintenance services encompass post-construction activities, including equipment diagnostics, maintenance, operational support, and upgrade services. Engineering service providers extend implementation and maintenance services to OEMs to address operational issues or accommodate changes in project requirements. The availability of these services is increasingly becoming a crucial distinguishing factor among engineering service providers. Consequently, ESPs are placing a significant emphasis on delivering continuous support services to OEMs.

The digitization segment is projected to grow at the fastest rate. In their pursuit of enhancing energy efficiency and cutting operational costs, organizations and industries are increasingly adopting digital solutions to optimize energy consumption. Digitization facilitates real-time monitoring, data analytics, and advanced control mechanisms, enabling the identification of energy waste, inefficiencies, and opportunities for optimization.

By Energy Source Analysis

Non-renewable segment registered the largest market share in 2023

The non-renewable segment accounted for the largest share. Fossil fuels, which include natural gas, coal, and petroleum, primarily constitute most non-renewable energy sources. Over the forecast period, the production of natural gas is anticipated to outpace other fossil fuels. This trend is attributed to the abundant availability of natural gas resources, encompassing shale gas, tight gas, and coalbed methane.

The renewable energy source segment witnessed a substantial growth rate. This can be attributed to the increasing awareness and concerns regarding environmental protection. As the global economy grows and rapid industrialization continues, there will be a substantial increase in the demand for energy in the coming years. Amid the challenges of meeting this rising energy demand and mitigating greenhouse gas emissions, the importance of cleaner energy sources for environmental protection has become paramount. Consequently, there is a notable rise in the demand for renewable energy sources.

By Location Analysis

On-shore segment held the significant market revenue share in 2022

The onshore segment held the largest share. OEMs prefer onshore outsourcing services due to considerations related to information security and privacy. Onshore services encompass the offerings delivered to an OEM by an Engineering Service Outsourcing (ESO) vendor operating within its home country. Factors such as language, communication, and working within the same time zone are anticipated to be significant contributors to the continued dominance of the onshore segment throughout the forecast period.

The offshore segment will grow at a rapid pace. Offshore engineering services pertain to the services provided by the ESPs located in international locations. One of the primary drivers for offshore outsourcing is its cost-effectiveness. Additionally, companies extending beyond the conventional practice of outsourcing non-core functions are increasingly inclined to transition core processes offshore. This shift is anticipated to be another significant factor driving the growth of the offshore segment over the forecast period.

Regional Insights

APAC held the largest share of the global market in 2022

APAC dominated the market. The presence of favorable government regulations in countries, along with a skilled talent pool and cost-effective labor, renders these nations conducive to outsourcing activities. Additionally, the region's growing investments in clean energy sources are anticipated to be a significant driver for the expansion of the market.

North America is projected to grow at a rapid pace. The escalating investments in renewable energy sources primarily propel the region's growth. Based on data from the U.S. Energy Information Administration (EIA), electricity production from clean sources increased to 20% in 2020, up from 17% in 2019. Additionally, the region's early adoption of advanced technologies in the energy sector is poised to be a significant driver for the region's growth.

Key Market Players & Competitive Insights

In recent years, ESPs have transformed, transitioning from delivering ESO services solely from their headquarters to establishing crucial operations and excellence centers in developing countries. Most prominent ESPs offer a spectrum of services, including embedded product engineering, mechanical designs, plant layout designs, and digital manufacturing solutions. These companies primarily function as engineering, procurement, and construction management entities with a widespread global presence.

For instance, in April 2022, the British government unveiled its intentions to create a system operator in the region, National Grid. This initiative is designed to assist the country in reaching its zero emissions target by 2050.

Some of the major players operating in the global market include:

- Altair Engineering Inc.

- Alten Group

- Assystem

- Capgemini Engineering (Altran)

- Cubic Corporation

- Cyient

- ESI Group

- LUXOFT, A DXC TECHNOLOGY COMPANY

- Mott MacDonald

- QUEST GLOBAL

- Rilco Engineering Services

- Segula Technologies

- Semcon

- STATS

- Total OutSource, Inc.

Recent Developments

- In February 2023, SolarEdge Technologies introduced its first "battery virtual power plant" created to assist the National Grid ESO Demand Flexibility Service (DFS) in the United Kingdom.

Energy ESO Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 351.88 million |

|

Revenue forecast in 2032 |

USD 1,370.12 million |

|

CAGR |

18.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Service, By Location, Energy Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Energy Engineering Service Outsourcing (ESO) Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Energy Engineering Service Outsourcing (ESO) Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Minibar Refrigerators Market Size, Share 2024 Research Report

Research Grade Proteins Market Size, Share 2024 Research Report

Insect Repellent Market Size, Share 2024 Research Report

FAQ's

Altair Engineering, Alten Group, Assystem, Capgemini Engineering are the key companies in Energy Engineering Service Outsourcing (ESO) Market.

The global energy ESO market is expected to grow at a CAGR of 18.5% during the forecast period.

Service, location, energy source, and region are the key segments covered.

Technological Advancements are the key driving factors in Energy Engineering Service Outsourcing (ESO) Market.

The global energy engineering service outsourcing (ESO) market size is expected to reach USD 1.37 billion by 2032