Energy Drinks Market Share, Size, Trends, & Industry Analysis Report By Product (Non-alcoholic, Alcoholic); By Type; By Distribution; By Region, Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM1606

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

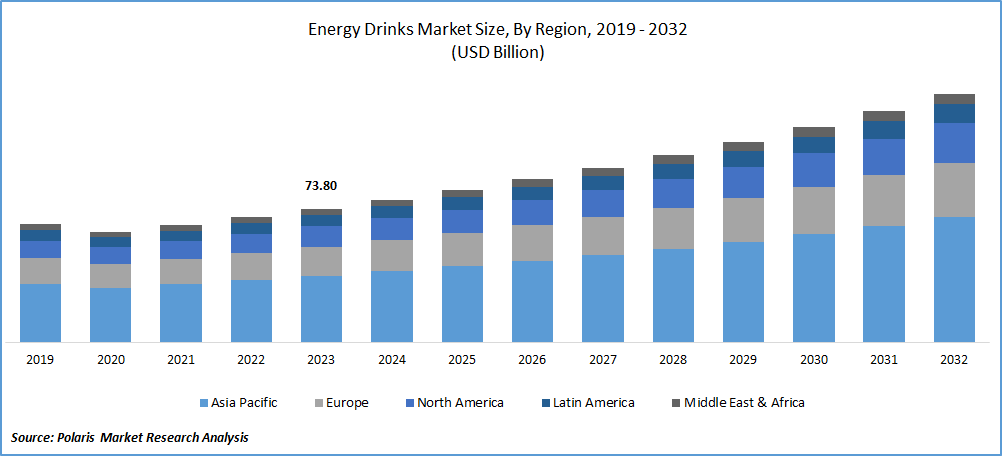

The global energy drinks market was valued at USD 73.80 Billion in 2023 and is anticipated to grow at a CAGR of 7.2% during the forecast period.

Energy drinks, characterized by ingredients such as caffeine, taurine, vitamins, and sugar, are positioned as products that provide a quick energy boost and enhance alertness. This market has expanded globally, serving a diverse consumer base that includes athletes, students, and professionals seeking a convenient and effective energy source.

The energy drinks market is the growing trend of a fast-paced lifestyle, where individuals often face high levels of stress and fatigue. Energy drinks, with their stimulating ingredients, appeal to consumers looking for a quick and efficient way to fight tiredness and maintain mental alertness. Also, the marketing strategies employed by major players in the industry, including endorsements by athletes and celebrities, have contributed to the popularity and widespread adoption of energy drinks.

To Understand More About this Research: Request a Free Sample Report

Factors influencing demand for the product are shifting consumer lifestyles and an increase in the market for alcohol mixes. The drink’s functional aspects are another factor that is driving demand for a variety of applications. Product sales are increasing in terms of volume as well, and this growth is mostly driven by the growing emphasis on convenient packaging and eye-catching designs to draw in customers.

As of right now, China and Japan lead the world market, but the United States, Brazil, and India are the rapidly growing economies. These products compete directly with other non-alcoholic beverages like soda and brewed coffee, making up 16% to 18% of all non-alcoholic beverages. The most popular non-alcoholic beverages are ready-to-drink tea and soda, which are fierce competitors because they are high in caffeine and rich in antioxidants. Given their high demand in the UK and the US, energy shots are one of the most recently adopted product trends in several newly emerging nations.

Despite the market's growth, several restraining factors pose challenges to its continued expansion, such as the increasing scrutiny and criticism regarding the health implications of energy drinks. High levels of caffeine and sugar content have raised health-related concerns, including links to cardiovascular issues, obesity, and adverse effects on mental health.

Industry Dynamics

Growth Drivers

Sports Industry Driving the Sales of Energy Drinks

Energy drinks, known for their caffeine content and other stimulating ingredients, have found a natural fit within the sports and fitness industry. Athletes, fitness enthusiasts, and individuals engaged in various physical activities often turn to energy drinks to enhance their performance and increase alertness and stamina. The caffeine in these beverages is known to improve endurance and cognitive functions, making them popular choices for pre-workout and during exercise consumption.

Along with this, major sports events, teams, and athletes often form partnerships with energy drink brands, leveraging their global appeal and creating a strong marketing presence. This strategic alignment not only boosts the market growth of energy drinks but also establishes them as a go-to beverage brand for consumers aspiring to achieve peak physical performance.

Report Segmentation

The market is primarily segmented based on product, type, distribution channel, and region.

|

By Product |

By Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Non-alcoholic Energy Drinks Dominated the Market in Terms of Revenue Share in 2023

In 2023, non-alcoholic energy drinks showed their dominance in the market, securing a significant revenue share due to several key factors, such as changing consumer preferences and lifestyle trends. Non-alcoholic energy drinks are perceived as functional beverages, offering a quick and convenient solution for consumers seeking an energy boost without the effects of alcohol. The active ingredients in these beverages, such as caffeine, taurine, B vitamins, and other energy-boosting compounds, attract a broad consumer base, including students, professionals, athletes, and individuals with active lifestyles. The market dominance of non-alcoholic energy drinks is because of their versatility as performance enhancers.

Also, the widespread adoption of non-alcoholic energy drinks is influenced by health-conscious consumer behaviors, as these beverages are often marketed as low-calorie or sugar-free options. The emphasis on wellness and the demand for functional beverages align with the positioning of non-alcoholic energy drinks as a healthier alternative to traditional caffeinated beverages or sugary soft drinks.

By Distribution Channel Analysis,

The Off-Trade Segment is Expected to Hold the Largest Revenue Share over the Forecasted Period

The off-trade segment is anticipated to dominate the revenue share in the energy drinks market because consumer preferences are evolving, with an increasing inclination towards convenience and accessibility. The off-trade segment, which includes supermarkets, hypermarkets, convenience stores, and online platforms, offers a convenient and one-stop shopping experience for consumers, allowing them to easily purchase energy drinks along with their regular groceries or through online channels.

Along with this, the off-trade segment often provides attractive promotional offers, discounts, and bulk purchase options, further attracting consumers to choose these channels for buying energy drinks. The widespread presence of off-trade outlets, both physical and online, enhances product availability, contributing to higher sales volumes. As a result, the off-trade segment is poised to generate the largest revenue share in the energy drinks market.

Regional Insights

The Asia-Pacific Region Dominated the Market in 2023

The Asia-Pacific region emerged as the dominant region in the market because it witnessed a surge in urbanization and a rapidly growing young and dynamic population. With changing lifestyles, there was an increasing demand for energy-boosting beverages to meet the demands of busy schedules and hectic work routines. Energy drinks, known for their energetic properties, gained popularity among the youth and working professionals, driving significant consumption. Also, the Asia-Pacific region experienced a rise in disposable incomes, allowing consumers to spend on non-essential products such as energy drinks. As economies in the region continued to grow, there was a similar increase in consumer purchasing power, contributing to the expansion of the energy drinks market.

North America is expected to have the fastest growth rate in the energy drinks market because there has been a noticeable shift in awareness towards health and wellness, with an increasing number of consumers seeking functional beverages that not only provide an energy boost but also align with healthier lifestyle choices. Energy drink manufacturers in North America have responded to this trend by introducing products with natural ingredients such as yerba mate, lower sugar content, and added functional benefits, which have resembled health-conscious consumers well, fostering market growth.

Key Market Players & Competitive Insights

The beverage industry's energy drink segment is still in its early stages, and the major players in the market are still attempting to break through and discover new markets across multiple countries. Key players hold the majority of the market share. These producers are using a range of strategies, such as mergers and acquisitions, portfolio expansion, and the introduction of new products.

Some of the major players operating in the global energy drinks market include:

- Amway

- AriZona Beverages USA

- Coca-Cola

- GCMMF

- Goldwin Healthcare

- GSK

- Heinz

- Living Essentials LLC

- Lucozade

- Monster Energy

- NourishCo.

- PepsiCo. Inc.

- Power Horse

- Red Bull

- Taisho Pharmaceutical Co. Ltd.

- The Coca-Cola Company

- Xyience Energy

Recent Developments

- December 2022: Old Tom Gin, a beverage manufacturer based in Scotland, and Fresh Del Monte jointly introduced a line of energy drinks. Each can have 12–15 calories per can and contains four B-group vitamins in addition to caffeine.

- January 2023: PRIME Energy Drinks was introduced by GNC, a global health and wellness company that offers customers high-quality, scientifically based products and solutions.

- September 2023: With the introduction of Say Never Energy Drink, consumer products company Tata Consumer Products (TCP) made a bold entry into the rapidly expanding energy drink market. The Energy Drink comes in two vibrant flavors, Red and Blue, both of which are intended to give an energy boost.

- March 2024: Red Bull GmbH, introduced its 250 ml can of Summer Edition Curuba Elderflower. This new offering, made with elderflower and curuba, is available in a variety of forms, including sugar-free versions.

- April 2024: GURU Organic Energy Corp., Canada's organic energy drink brand, introduced Peach Mango Punch in the country. This new beverage, which is high in natural ingredients and low in calories, is designed to improve brain function and focus.

Energy Drink Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2024 |

USD 78.79 billion |

|

Revenue Forecast in 2032 |

USD 137.52 billion |

|

CAGR |

7.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Type, By Distribution Channel, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

Explore the market dynamics of the 2024 Energy Drink Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Energy Drink Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

G-Protein Coupled Receptors Market Size, Share Research Report

Conveying Equipment Market Size, Share Research Report

Chromium Market Size, Share Research Report

FAQ's

include Amway, AriZona Beverages USA, Coca-Cola, GCMMF, Goldwin Healthcare, GSK, Heinz are the key companies in Energy Drink Market

The global energy drinks market is anticipated to grow at a CAGR of 7.2% during the forecast period.

The Energy Drink Market report covering key segments are product, type, distribution channel, and region

Sports Industry driving the sales of energy drinks are the key driving factors in Energy Drink Market

The global energy drinks market size is expected to reach USD 137.52 Billion by 2032