Endoscopic Submucosal Dissection Market Size, Share, Trends, Industry Analysis Report: By Product (Gastroscopes and Colonoscopes, Knives, Injection Agents, Tissue Retractors, Graspers/Clips, and Others), Indication, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5570

- Base Year: 2024

- Historical Data: 2020-2023

Endoscopic Submucosal Dissection Market Overview

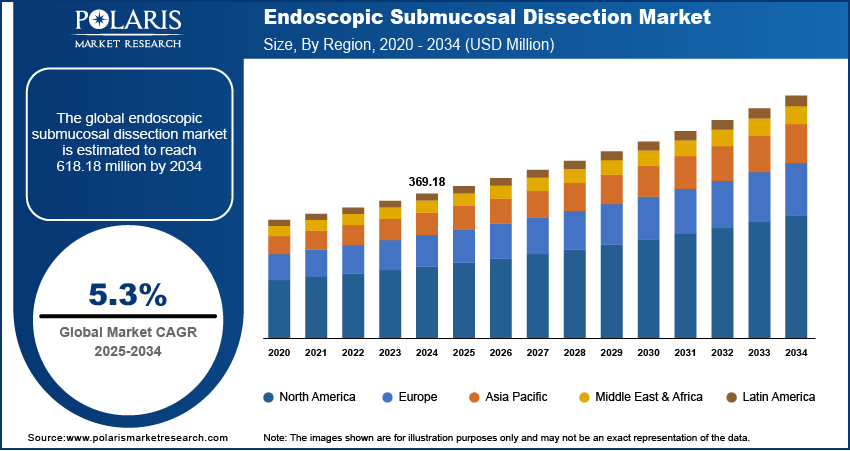

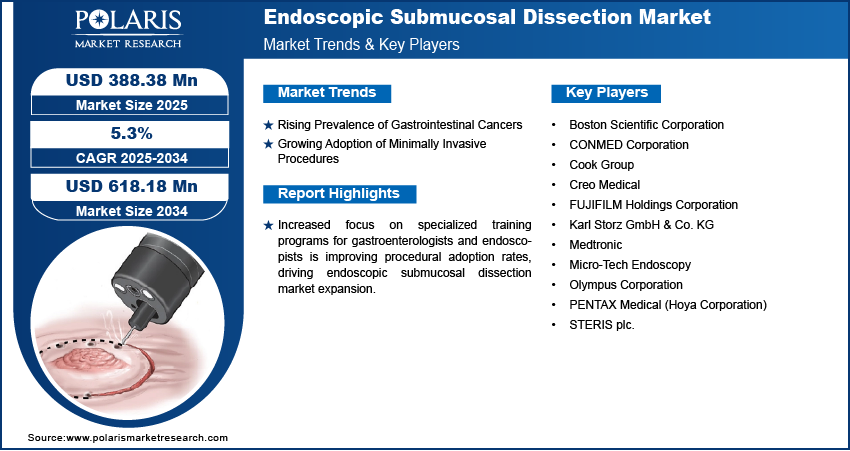

The global endoscopic submucosal dissection market size was valued at USD 369.18 million in 2024. The market is expected to grow from USD 388.38 million in 2025 to USD 618.18 million by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

The endoscopic submucosal dissection (ESD) market focuses on advanced endoscopic techniques used for the en-bloc resection of gastrointestinal tumors, particularly early-stage cancers in the esophagus, stomach, and colon. ESD is a minimally invasive procedure that allows for precise removal of lesions from the gastrointestinal (GI) tract while preserving organ integrity, reducing the need for more invasive surgical interventions.

The growing aging population faces a higher risk of digestive disorders and early-stage cancers, increasing the need for effective and less invasive treatments. This is driving the growth of the endoscopic submucosal dissection (ESD) market, especially in countries with advanced healthcare systems.

New technologies are also helping the market expand. High-definition endoscopes, improved electrosurgical knives, and real-time imaging systems make procedures more precise. These advancements help doctors perform ESD more accurately, leading to better patient outcomes and fewer complications. As medical technology continues to improve, more hospitals and clinics are adopting ESD as a preferred treatment option, further boosting market growth.

Increased focus on specialized training programs for gastroenterologists and endoscopists is improving procedural adoption rates, driving endoscopic submucosal dissection market expansion and ensuring the availability of skilled professionals. Furthermore, expanding regulatory approvals for endoscopic submucosal dissection devices and favorable reimbursement policies in key markets are improving accessibility and boosting market development, encouraging more hospitals and clinics to adopt this advanced endoscopic technique.

To Understand More About this Research: Request a Free Sample Report

Endoscopic Submucosal Dissection Market Dynamics

Rising Prevalence of Gastrointestinal Cancers

The increasing incidence of early-stage gastrointestinal (GI) cancers, including esophageal, gastric, and colorectal cancers, is significantly contributing to the endoscopic submucosal dissection market growth. For instance, the American Cancer Society estimates stomach cancer to account for roughly 30,300 new cases and approximately 10,780 deaths in the US in 2025, representing about 1.5% of all new cancer diagnoses. This rise in GI cancer cases has led to a heightened demand for advanced, minimally invasive treatment options like ESD, which offers precise tumor removal while preserving organ function. As a result, the market is growing as more healthcare providers use ESD to improve patient care. The rising number of GI cancer cases is increasing the demand for ESD, leading more hospitals and clinics to invest in advanced equipment and specialist training. This shows how the ESD market is changing to meet the growing need for effective treatments for GI cancers.

Growing Adoption of Minimally Invasive Procedures

Healthcare providers are increasingly favoring advanced techniques like ESD over conventional surgeries. For instance, according to the American Society of Plastic Surgeons, minimally invasive procedures grew 7 percent in 2023. The demand for ESD is rising due to its ability to achieve precise tumor resection with reduced complications, faster recovery times, and minimal hospital stays. The rising investments by hospitals and specialized clinics in cutting-edge endoscopic technologies are also fueling the adoption of ESD. Additionally, the increasing preference for outpatient procedures is driving market expansion, as ESD allows for effective treatment without the need for major surgical interventions. With more healthcare systems recognizing the benefits of minimally invasive techniques, the endoscopic submucosal dissection market demand is projected to rise, accelerating the adoption of this advanced endoscopic approach in gastrointestinal cancer treatment.

Endoscopic Submucosal Dissection Market Segment Insights

Endoscopic Submucosal Dissection Market Assessment by Product Outlook

The global endoscopic submucosal dissection market segmentation is based on product includes gastroscopes and colonoscopes, knives, injection agents, tissue retractors, graspers/clips, and others. In 2024, the knives segment accounted for the largest market share due to the increasing reliance on high-precision electrosurgical knives for complex gastrointestinal procedures. Innovations in dual-knife, insulated-tip, and hook-knife technologies have enhanced procedural efficiency, enabling controlled dissection with minimal tissue damage. The rising adoption of advanced knives with improved cutting accuracy in both clinical and research settings, along with the growing preference for single-use ESD knives to mitigate cross-contamination risks and enhance procedural safety and coagulation properties, contributes to the segment’s dominant position in the market.

Endoscopic Submucosal Dissection Market Evaluation by End Use Outlook

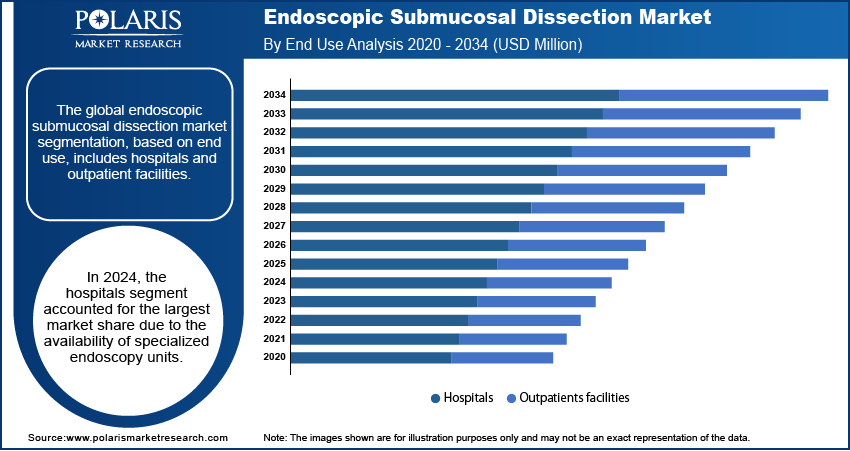

The global endoscopic submucosal dissection market segmentation, based on end use, includes hospitals and outpatient facilities. The hospitals segment held the largest market share in 2024 due to the availability of specialized endoscopy units, advanced imaging technologies, and multidisciplinary expertise required for complex gastrointestinal procedures. Hospitals are increasingly integrating state-of-the-art ESD systems, supported by a rise in government funding and healthcare infrastructure investments. The increasing burden of gastrointestinal cancers and early-stage lesions is driving the demand for ESD, prompting hospitals to expand their minimally invasive treatment offerings. The adoption of robotic-assisted ESD procedures and AI-powered endoscopic imaging is further enhancing procedural success rates, solidifying the hospital segment's dominance in the global market.

Endoscopic Submucosal Dissection Market Regional Analysis

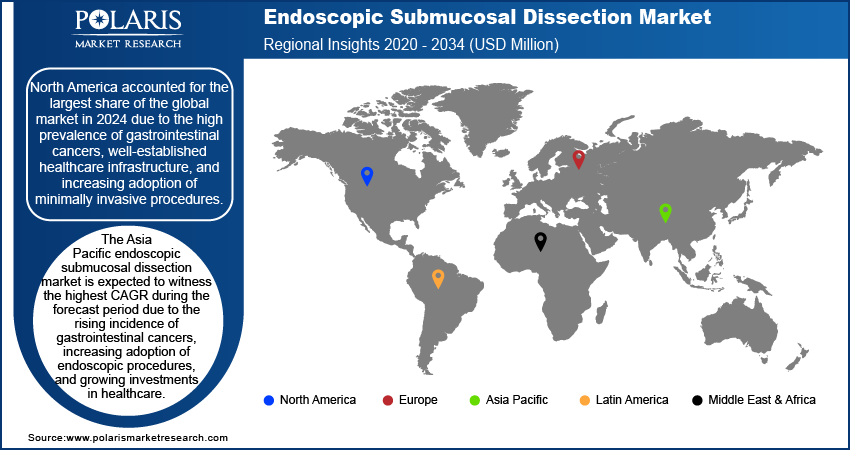

By region, the study provides the endoscopic submucosal dissection market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the high prevalence of gastrointestinal cancers, well-established healthcare infrastructure, and increasing adoption of minimally invasive procedures. The presence of leading medical device manufacturers, advanced endoscopy training programs, and robust reimbursement frameworks has accelerated market expansion. The growing adoption of AI-assisted endoscopic technologies and robotic-assisted ESD systems also contributes to the regional market demand. Strong investments in oncology research, favorable regulatory approvals, and rising patient awareness regarding early cancer detection are solidifying North America's position as the leading region in the global market.

The Asia Pacific endoscopic submucosal dissection market is expected to witness the highest CAGR during the forecast period due to the rising incidence of gastrointestinal cancers, increasing adoption of endoscopic procedures, and growing investments in healthcare infrastructure. Countries like Japan, South Korea, and China are at the forefront, with well-established endoscopic training programs and high procedural volumes. Government initiatives promoting early cancer screening and the expansion of advanced endoscopy centers are contributing to the regional market growth. For instance, the World Health Organization (WHO) introduced the “Guide to Cancer Early Diagnosis” to assist policymakers and program managers in enabling timely cancer detection and enhancing access to treatment for all patients. Additionally, technological advancements in electrosurgical knives, AI-driven endoscopic imaging, and cost-effective ESD devices are accelerating market demand and adoption. The presence of key medical device manufacturers and an increasing geriatric population further positions Asia Pacific as a leading region in the global market.

Endoscopic Submucosal Dissection Market – Key Players and Competitive Insights

The endoscopic submucosal dissection market is highly competitive, with leading medical device manufacturers, specialized endoscopy equipment providers, and emerging players continuously innovating to enhance procedural efficiency and clinical outcomes. Key market participants are focusing on technological advancements in ESD knives, high-frequency electrosurgical devices, and AI-assisted endoscopic imaging systems to strengthen their market position. Companies are also investing in strategic collaborations with healthcare institutions and research organizations to advance training programs and expand their product portfolios. Regulatory approvals and product launches play a crucial role in market expansion as firms seek to introduce next-generation electrosurgical knives, endoscopic injectors, and hemostatic devices with improved precision and safety features. Additionally, the increasing adoption of robotic-assisted ESD procedures and AI-driven diagnostic tools is reshaping market dynamics, leading to intensified competition among established players. Emerging companies are focusing on cost-effective solutions and regional market penetration strategies to compete with global leaders.

Strategic acquisitions and partnerships between endoscopic technology companies and hospitals are also influencing market demand, as institutions prioritize advanced ESD systems to improve patient outcomes. Furthermore, the growing emphasis on training programs and skill development in minimally invasive endoscopic procedures is leading to collaborations between industry leaders and academic medical centers.

Medtronic is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into four segments: cardiovascular portfolio, medical surgical portfolio, neuroscience portfolio, and diabetes operating unit. The medical surgical portfolio segment provides a range of surgical products, including vessel sealing instruments, surgical stapling devices, wound closure and electrosurgery products, hernia mechanical devices, surgical artificial intelligence and robotic-assisted surgery products, mesh implants, lung products, gynecology, and various therapies to treat diseases. Medtronic offers advanced electrosurgical knives, hemostatic devices, and high-definition imaging systems to support precise and effective endoscopic submucosal dissection procedures.

Boston Scientific Corporation (BSC), an American biotechnology and biomedical engineering firm founded in 1979, is a multinational manufacturer of medical devices used in various interventional medical specialties. Headquartered in Marlborough, Massachusetts, BSC has a history of developing and marketing minimally invasive medical devices. The company's products are used in interventional radiology, cardiology, neuromodulation, neurovascular intervention, electrophysiology, cardiac and vascular surgery, endoscopy, oncology, urology, and gynecology. BSC is known for its focus on innovation, market expansion, and organizational efficiency. One area of focus for Boston Scientific is urology, with offerings for treating Benign Prostatic Hyperplasia (BPH). Boston Scientific offers several surgical treatments for BPH, such as the GreenLight XPS laser therapy system, which uses laser energy to remove excess prostate tissue, and the Rezūm system. This minimally invasive procedure uses radiofrequency energy to deliver targeted water vapor ablation to reduce the size of the prostate.

List of Key Companies in Endoscopic Submucosal Dissection Market

- Boston Scientific Corporation

- CONMED Corporation

- Cook Group

- Creo Medical

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co. KG

- Medtronic

- Micro-Tech Endoscopy

- Olympus Corporation

- PENTAX Medical (Hoya Corporation)

- STERIS plc.

Endoscopic Submucosal Dissection Industry Developments

In April 2025, Fujifilm introduced Tracmotion, an advanced endoscopic submucosal dissection (ESD) device designed to improve precision in removing gastrointestinal lesions. It enhances control and safety, streamlining complex procedures for clinicians.

In May 2023, Olympus received FDA clearance for its EVIS X1 endoscopy system, along with two compatible gastrointestinal endoscopes: the GIF-1100 for upper digestive tract procedures and the CF-HQ1100DL/I for lower digestive tract applications. The company stated that the new system is aimed at enhancing diagnostic and therapeutic capabilities in gastroenterology.

In January 2023, FUJIFILM India expanded its endoscopy solutions portfolio to enhance therapeutic gastrointestinal applications, strengthening its offerings in advanced diagnostic and interventional procedures.

Endoscopic Submucosal Dissection Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Gastroscopes and Colonoscopes

- Knives

- Injection Agents

- Tissue Retractors

- Graspers/ Clips

- Others

By Indication Outlook (Revenue, USD Million, 2020–2034)

- Stomach Cancer

- Colon Cancer

- Esophageal Cancer

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Outpatients Facilities

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Endoscopic Submucosal Dissection Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 369.18 million |

|

Market Size Value in 2025 |

USD 388.38 million |

|

Revenue Forecast in 2034 |

USD 618.18 million |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global endoscopic submucosal dissection market size was valued at USD 369.18 million in 2024 and is projected to grow to USD 618.18 million by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

In 2024, North America accounted for the largest market share due to the high prevalence of gastrointestinal cancers, well-established healthcare infrastructure, and increasing adoption of minimally invasive procedures.

Some of the key players in the market are Boston Scientific Corporation; CONMED Corporation; Cook Group; Creo Medical; FUJIFILM Holdings Corporation; Karl Storz GmbH & Co. KG; Medtronic; Micro-Tech Endoscopy; Olympus Corporation; PENTAX Medical (Hoya Corporation); and STERIS plc.

In 2024, the knives segment accounted for the largest market share due to the increasing reliance on high-precision electrosurgical knives.

The hospitals segment accounted for the largest market share in 2024 due to the availability of specialized endoscopy units, advanced imaging technologies, and multidisciplinary expertise required for complex gastrointestinal procedures.