Encryption as a Service Market Size, Share, Trends, Industry Analysis Report: By Service Type (Data Encryption as a Service, Management Encryption as a Service, Email Encryption as a Service, Application-Level Encryption as a Service, and Other), Organization Size, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM5385

- Base Year: 2024

- Historical Data: 2020-2023

Encryption as a Service Market Overview

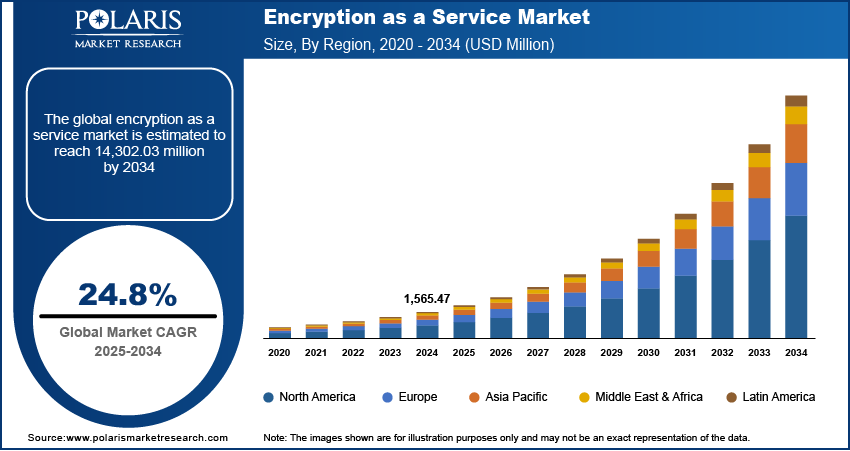

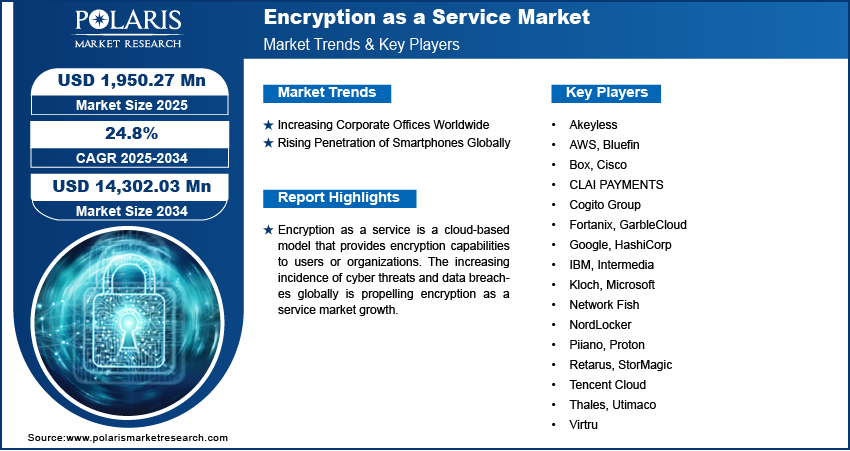

Encryption as a service market size was valued at USD 1,565.47 million in 2024. The market is projected to grow from USD 1,950.27 million in 2025 to USD 14,302.03 million by 2034, exhibiting a CAGR of 24.8 % during 2025-2034.

Encryption as a service (EaaS) is a cloud-based model that provides encryption capabilities to users or organizations. It allows them to encrypt their sensitive data and communications using cryptographic algorithms and techniques without managing the process themselves. EaaS offers easy accessibility via cloud-based platforms, so users encrypt and decrypt their data from anywhere using various devices as long as they have a secure connection to the service.

The increasing incidence of cyber threats and data breaches globally is propelling encryption as a service market growth. According to the Identity Theft Resource Center, in 2023, there were 3,122 publicly reported data breaches worldwide, representing a significant increase compared to previous years. Data breaches drive businesses and individuals to recognize the need to protect sensitive information from hackers, ransomware attacks, and unauthorized access. This encourages businesses to invest in encryption as a service to safeguard customer data, financial transactions, and intellectual property. Furthermore, strict data protection regulations, such as GDPR and CCPA, push companies to adopt encryption services to ensure compliance and avoid hefty fines.

To Understand More About this Research: Request a Free Sample Report

The encryption as a service market demand is driven by the rising adoption of mobile health applications and the growing digitalization of health records. Healthcare providers and app developers prioritize data security to protect sensitive patient information from cyber threats and unauthorized access, which drives them to adopt encryption as a service. Additionally, strict regulations such as GDPR require healthcare organizations to implement strong encryption measures to ensure compliance and prevent data breaches, owing to the growing digitalization of health records. This propels healthcare organizations to invest in encryption as a service to safeguard health records during transmission and storage.

Encryption as a Service Market Dynamics

Increasing Corporate Offices Worldwide

Companies operating across multiple locations need secure communication channels and data protection measures to prevent cyber threats and unauthorized access. Companies invest in encryption solutions, including encryption as a service to safeguard intellectual property, financial transactions, and confidential data as employees share sensitive information across global networks. Compliance with international data protection regulations, such as GDPR and CCPA, further pushes organizations to implement encryption services. The rise of remote work and cloud-based collaboration tools adds another layer of security concerns, prompting companies to adopt encryption as a service for seamless and scalable data protection, thereby contributing to encryption as a service market expansion. For instance, the World Economic Forum estimated that by 2030, global remote jobs to grow by around 25% to over 90 million roles.

Rising Penetration of Smartphones Globally

Smartphones lead to an increase in sensitive activities such as banking, online shopping, and communication, creating vulnerability to cyber threats. This drives smartphone owners to adopt encryption as a service to protect their sensitive data. This service scrambles the sensitive data so that only authorized parties with the correct decryption key can access it. The growing use of mobile payment systems and digital wallets further amplifies security concerns, prompting financial institutions to invest in encryption solutions, thereby supporting encryption as a service market growth. Thus, as smartphone usage continues to rise, the need for scalable, cloud-based encryption services grows. Groupe Spécial Mobile Association (GSMA) annual State of Mobile Internet Connectivity Report 2023 (SOMIC) stated that over 54%) of the global population or some 4.3 billion people own a smartphone.

Encryption as a Service Market Segment Insights

Encryption as a Service Market Evaluation by Service Type

Based on service type, the encryption as a service market is divided into data encryption as a service, management encryption as a service, email encryption as a service, application-level encryption as a service, and others. The data encryption as a service segment held the largest encryption as a service market share in 2024 due to the rising concerns over data breaches, stringent regulatory requirements, and the rapid adoption of cloud computing. Businesses across various industries prioritized data security to protect sensitive information, including customer records, financial transactions, and intellectual property. Government regulations such as GDPR, CCPA, and HIPAA pushed organizations to implement strong encryption protocols, further driving demand for data protection services. The increasing shift to hybrid and multi-cloud environments required enterprises to secure data both at rest and in transit, making data encryption a critical component of cybersecurity strategies. Financial institutions, healthcare providers, and e-commerce companies invested heavily in encryption technologies to maintain customer trust and comply with evolving security standards. Additionally, the rise in ransomware attacks and cyber activities propelled the need for advanced data encryption services, contributing to the dominance of the segment.

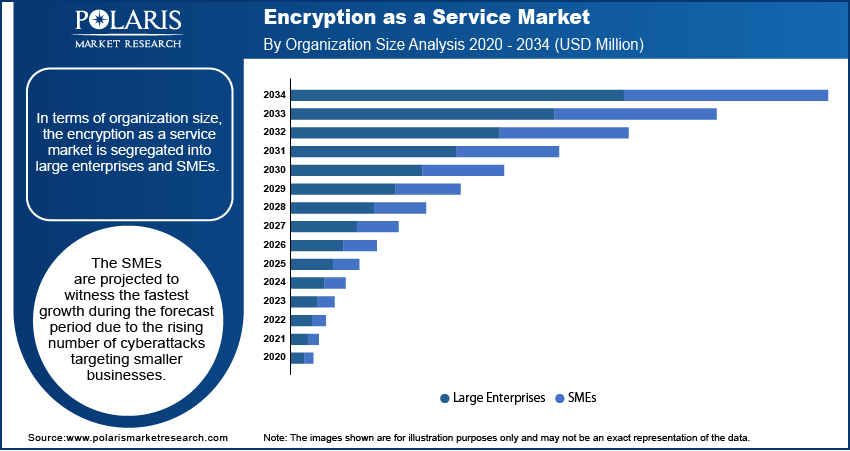

Encryption as a Service Market Assessment by Organization Size

In terms of organization size, the encryption as a service market is segregated into large enterprises and SMEs. The SMEs are projected to witness the fastest growth during the forecast period due to the rising number of cyberattacks targeting smaller businesses. Hackers increasingly exploit vulnerabilities in SME networks, prompting these organizations to adopt encryption services for safeguarding sensitive customer and financial data. Cloud adoption among smaller businesses continues to grow, driving the need for cost-effective security solutions that offer seamless integration with SaaS platforms and remote work environments. Government regulations and industry standards push SMEs to strengthen their cybersecurity, leading to higher demand for managed encryption services. Additionally, the increasing reliance on digital transactions and online customer interactions makes data protection a top priority in SMEs, thereby driving the segment.

Encryption as a Service Market Regional Analysis

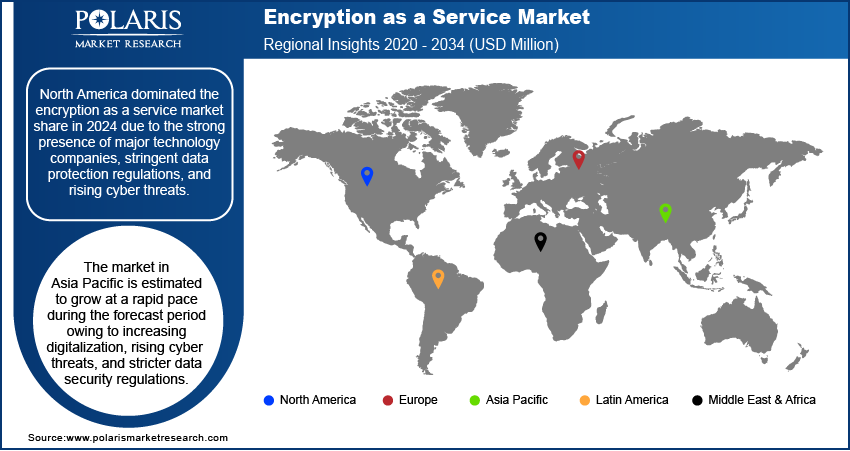

By region, the report provides encryption as a service market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market share in 2024 due to the strong presence of major technology companies, stringent data protection regulations, and rising cyber threats. The US leads the region, owing to its advanced cybersecurity infrastructure and high adoption of cloud computing across industries. Strict regulatory frameworks such as HIPAA, CCPA, and PCI-DSS compelled businesses to implement robust encryption solutions to protect sensitive data. Large enterprises and government agencies in the region prioritized cybersecurity investments to defend against ransomware attacks and data breaches. The rapid expansion of cloud-based services, IoT devices, and remote work environments further fueled demand for advanced encryption services in the region.

The encryption as a service market in Asia Pacific is estimated to grow at a rapid pace during the forecast period owing to increasing digitalization, rising cyber threats, and stricter data security regulations. Countries such as China, India, and Japan drive this expansion as businesses and governments focus on securing critical infrastructure and sensitive data. The rapid adoption of cloud computing, mobile banking, and e-governance platforms increases the need for encryption services. Governments across the region enforce stronger data protection laws, such as China’s Personal Information Protection Law (PIPL) and India’s Digital Personal Data Protection Act, compelling organizations to enhance their cybersecurity frameworks. The rise of e-commerce, fintech, and AI-driven technologies further boosts demand for encryption services as businesses seek to safeguard user data and financial transactions.

Encryption as a Service Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the encryption as a service industry grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Akeyless, AWS, Bluefin, Box, Cisco, CLAI PAYMENTS, Cogito Group, Fortanix, GarbleCloud, Google, HashiCorp, IBM, Intermedia, Kloch, Microsoft, Network Fish, NordLocker, Piiano, Proton, Retarus, StorMagic, Tencent Cloud, Thales, Utimaco, and Virtru.

Cisco Systems, Inc. is a multinational technology conglomerate headquartered in San Jose, California. Founded in December 1984 by Stanford University computer scientists Leonard Bosack and Sandy Lerner, Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment, and other high-technology services and products. Cisco specializes in specific tech sectors, including the Internet of Things (IoT), domain security, videoconferencing, and energy management, offering products such as Webex, OpenDNS, Jabber, Duo Security, Silicon One, and Jasper. The company provides encryption services through its secure email encryption service, which works alongside Cisco Secure Email Gateways and Cisco Encryption appliances to provide on-premises content scanning, policy enforcement, and encryption.

Microsoft is a US-based multinational technology conglomerate headquartered in Redmond, Washington. Founded in 1975 by Bill Gates and Paul Allen. Microsoft develops, licenses, and supports a wide array of software products, services, and hardware devices. The company provides a broad range of services, including cloud-based solutions, solution support, and consulting services. Microsoft's key projects include Microsoft 365, LinkedIn, and Dynamics 3654. Its best-known software products are the Windows line of operating systems and the Microsoft Office suite. Microsoft employs encryption to secure customer data within its cloud services, protecting data both at rest and in transit.

Key Companies in Encryption as a Service Market

- Akeyless

- AWS

- Bluefin

- Box

- Cisco

- CLAI PAYMENTS

- Cogito Group

- Fortanix

- GarbleCloud

- HashiCorp

- IBM

- Intermedia

- Kloch

- Microsoft

- Network Fish

- NordLocker

- Piiano

- Proton

- Retarus

- StorMagic

- Tencent Cloud

- Thales

- Utimaco

- Virtru

Encryption as a Service Market Developments

June 2024: Arqit Quantum Inc., a major player in quantum-safe encryption, announced the launch of an encryption intelligence service that assists organizations in identifying network risks and developing mitigation plans to enhance their security posture against current and evolving cybersecurity threats.

November 2023: Utimaco, a global provider of IT security solutions, announced the launch of its new, easy-to-use file encryption as-a-service management solution, u.trust LAN Crypt Cloud, which protects sensitive and business-critical data against unauthorized access.

November 2023: Retarus launched a new service to reduce administrative efforts for email encryption. The service is an integral component of Retarus’ Email Encryption solution and enables IT security managers to automate numerous tasks, saving time and money.

December 2020: IBM Security introduced next-generation encryption technology services package that allows companies to experiment with an emerging technology to secure data even while it's being processed or analyzed in the cloud or third-party environments.

Encryption as a Service Market Segmentation

By Service Type Outlook (Revenue, USD Million, 2020-2034)

- Data Encryption as a Service

- Management Encryption as a Service

- Email Encryption as a Service

- Application-level Encryption as a Service

- Other

By Organization Size Outlook (Revenue, USD Million, 2020-2034)

- Large Enterprises

- SMEs

By Industry Vertical Outlook (Revenue, USD Million, 2020-2034)

- BFSI

- Aerospace & Defense

- Government & Public Utilities

- IT & Telecommunications

- Healthcare

- Retail

- Other

By Regional Outlook (Revenue, USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Encryption as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,565.47 million |

|

Revenue Forecast in 2025 |

USD 1,950.27 million |

|

Revenue Forecast in 2034 |

USD 14,302.03 million |

|

CAGR |

24.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global encryption as a service market size was valued at USD 1,565.47 million in 2024 and is projected to grow to USD 14,302.03 million by 2034.

• The global market is projected to register a CAGR of 24.8% during the forecast period.

• North America had the largest share of the global market in 2024.

• Some of the key players in the market are Akeyless, AWS, Bluefin, Box, Cisco, CLAI PAYMENTS, Cogito Group, Fortanix, GarbleCloud, Google, HashiCorp, IBM, Intermedia, Kloch, Microsoft, Network Fish, NordLocker, Piiano, Proton, Retarus, StorMagic, Tencent Cloud, Thales, Utimaco, and Virtru.

• The data encryption as a service segment dominated the encryption as a service market in 2024.