Emulsifiers Market Size, Share, Trends, Industry Analysis Report: By Source (Bio-Based Emulsifiers and Synthetic Emulsifiers), Product Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5414

- Base Year: 2024

- Historical Data: 2020-2023

Emulsifiers Market Overview

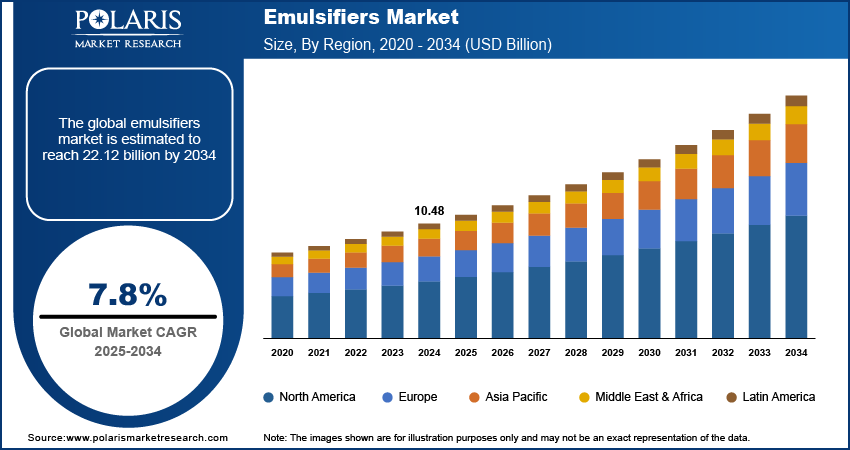

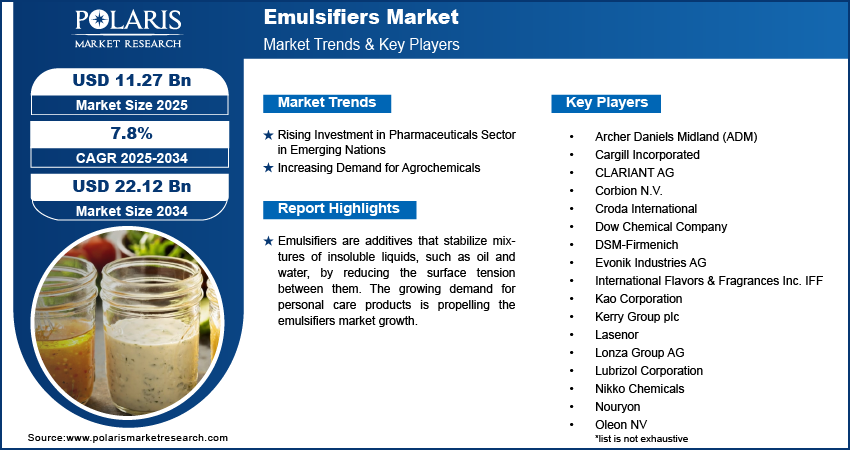

The global emulsifiers market size was valued at USD 10.48 billion in 2024. The emulsifiers market is projected to grow from USD 11.27 billion in 2025 to USD 22.12 billion by 2034, exhibiting a CAGR of 7.8% during 2025–2034.

Emulsifiers are additives that stabilize mixtures of insoluble liquids, such as oil and water, by reducing the surface tension between them. These additives have both hydrophilic and lipophilic properties, enabling them to create stable dispersions where one liquid is uniformly distributed within the other. They are widely used in various industries, particularly in food production, where they enhance texture, improve shelf life, and maintain product consistency in products such as mayonnaise, ice cream, and baked goods.

The growing demand for personal care products is propelling the emulsifiers market growth. Emulsifiers help blend oil and water-based components, which are incompatible, into smooth homogeneous personal care products such as lotions, creams, and serums. Manufacturers of personal care products are increasingly relying on emulsifiers to ensure product consistency, texture, and shelf stability. In addition, the growing working women population globally is fueling the demand for personal care products, which drives the adoption of emulsifiers as these substances are critical elements in personal care products. For instance, International Labor Organizations published a report stating that women represent over 40% of the global labor force, with approximately 70% of women in developed countries and 60% in developing countries. The rise of natural and organic personal care products is further driving demand for specialized emulsifiers that meet clean-label standards.

The emulsifiers market demand is driven by the rising adoption of processed and convenience food. Processed or packaged food manufacturers rely on emulsifiers to improve texture, extend shelf life, and maintain product stability as consumers seek quick, ready-to-eat meals. Emulsifiers help create smooth, appealing textures and prevent ingredients from separating, which becomes essential for packaged or convenience foods that need to stay fresh during transportation and storage. Furthermore, processed food companies are using emulsifiers to enhance low-fat and plant-based products, responding to health-conscious and vegan consumer trends.

Emulsifiers Market Dynamics

Rising Investments in Pharmaceuticals Sector in Emerging Nations

Pharmaceutical companies use emulsifiers to enhance drug solubility, improve bioavailability, and ensure the stability of liquid and semi-solid medications. Increased funding is supporting the growth of biopharmaceuticals and dermatological products, both of which depend on emulsifiers for effective formulation. For instance, according to data published by the India Brand Equity Foundation, the foreign direct investment (FDI) inflows in the Indian drugs and pharmaceuticals sector reached USD 1,414 million between FY 2021-22. Moreover, with rising investments, pharmaceutical companies in emerging nations such as India and Brazil are formulating more complex drug delivery systems, such as nanoemulsions and controlled-release medications, which require high-performance emulsifiers. Thus, growing investments in the pharmaceuticals sector in emerging countries are driving the emulsifiers market expansion.

Increasing Demand for Agrochemicals

Emulsifiers help create stable agrochemical formulations by ensuring that oil and water-based components mix uniformly, which improves the consistency and performance of agrochemical products. Farmers and agricultural producers rely on emulsifiers to ensure the even distribution of active ingredients, leading to better crop coverage and reduced waste. Additionally, emulsifiers enhance the shelf life and stability of agrochemicals, making them more reliable for large-scale agricultural use. Thus, the rising demand for agrochemicals is propelling the emulsifiers market revenue.

Emulsifiers Market Segment Insights

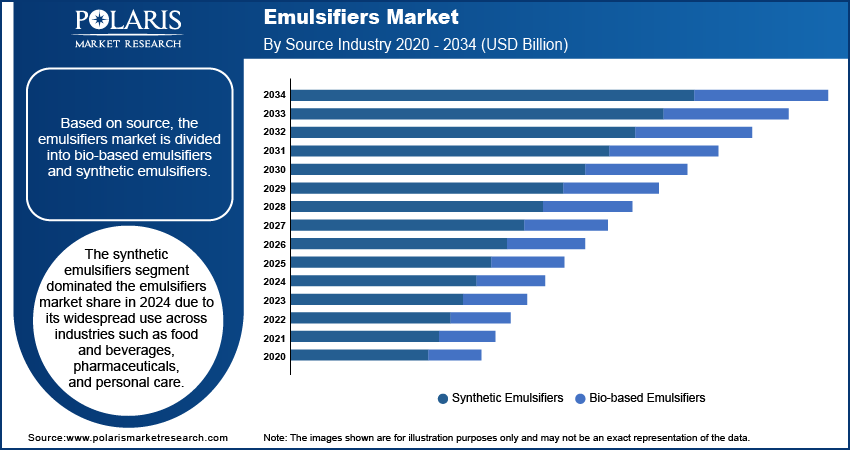

Emulsifiers Market Evaluation by Source Insights

Based on source, the emulsifiers market is divided into bio-based emulsifiers and synthetic emulsifiers. The synthetic emulsifiers segment dominated the market in 2024 due to its widespread use across industries such as food and beverages, pharmaceuticals, and personal care. Manufacturers prefer these additives for their cost-effectiveness, consistent performance, and ability to stabilize complex formulations. The food industry, in particular, relies heavily on synthetic options to enhance the texture and shelf life of processed products. Additionally, the personal care sector utilizes these compounds in skincare and cosmetic products to improve product consistency and application. Increased consumption of packaged foods, along with advancements in pharmaceutical formulations, further support the segment’s dominance in the market.

Emulsifiers Market Assessment by Application Insights

In terms of application, the emulsifiers market is segregated into food, cosmetics & personal care, oilfield chemicals, pharmaceuticals, agrochemicals, and others. The cosmetics & personal care segment is expected to grow at a rapid pace in the coming years owing to the rising demand for skincare, haircare, and beauty products. Consumers increasingly prefer high-performance formulations that offer smooth textures, prolonged stability, and enhanced sensory appeal. Natural and organic product trends have also driven the need for plant-based stabilizing agents as brands focus on cleaner ingredient labels and sustainability. Growing awareness of skin health, combined with the expansion of premium and functional beauty products, has encouraged manufacturers to develop innovative solutions that improve product application and effectiveness. Additionally, advancements in formulation technologies have enhanced the compatibility of stabilizers like emulsifiers with active ingredients, further strengthening their role in the cosmetics & personal care industry.

Emulsifiers Market Regional Analysis

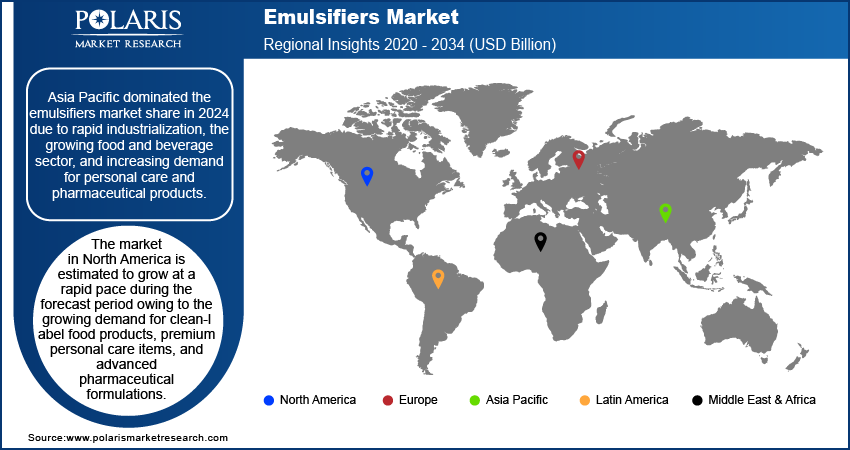

By region, the report provides the emulsifiers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the emulsifiers market share in 2024 due to rapid industrialization, the growing food and beverage sector, and increasing demand for personal care and pharmaceutical products. Rising disposable incomes and changing dietary habits have led to higher consumption of processed foods, driving the need for advanced emulsifiers. Expanding urban populations in countries such as China, India, and Japan have also increased demand for emulsifiers across multiple industries, including cosmetics, pharmaceuticals, and agrochemicals. The region’s strong manufacturing base, coupled with growing exports of food products and cosmetics, further drives the regional market expansion. Additionally, supportive government policies and investments in the pharmaceutical and agricultural sectors contribute to sustained growth. China dominates the regional market, benefiting from a vast consumer base, a well-established food processing industry, and increasing adoption of natural and synthetic stabilizing agents in various applications.

The North America emulsifiers market is estimated to grow at a rapid pace during the forecast period owing to the growing demand for clean-label food products, premium personal care items, and advanced pharmaceutical formulations. Consumers in the region prioritize natural and organic ingredients, pushing manufacturers to develop innovative emulsifiers derived from plant-based sources. The increasing popularity of functional foods and dietary supplements has further accelerated demand, as these products require enhanced texture, solubility, and stability. The US leads the North American market, benefiting from a well-developed regulatory framework, high consumer awareness, and significant investments in the food, health, and beauty industries.

Emulsifiers Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development in order to expand their offerings, which will help the emulsifiers market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The emulsifiers market is fragmented, with the presence of numerous global and regional market players. Major players in the market include Archer Daniels Midland (ADM); BASF; Cargill Incorporated; CLARIANT AG; Corbion N.V.; Croda International; Dow Chemical Company; DSM-Firmenich; Evonik Industries AG; International Flavors & Fragrances Inc. IFF; Kao Corporation; Kerry Group plc; Lasenor; Lonza Group AG; Lubrizol Corporation; Nikko Chemicals; Nouryon; Oleon NV; PALSGAARD; Puratos; Riken Vitamin Co., Ltd.; Solvay S.A.; Spartan Chemical; Stepan Company; and Vantage Specialty Chemicals.

Archer Daniels Midland Company (ADM), founded in 1902, is a prominent American multinational corporation specializing in food processing, with its headquarters located in Chicago, Illinois. The company has grown significantly over the years, operating more than 270 plants and 420 crop procurement facilities globally. ADM processes a wide range of agricultural products, including cereal grains and oilseeds, which are transformed into ingredients for various markets such as food, beverage, nutraceuticals, industrial applications, and animal feed. The company is involved in the production of emulsifiers and hydrocolloids, which are essential for enhancing texture and stability in food and beverage formulations. The emulsifiers offered by ADM are primarily derived from plant-based sources such as soy, canola, and sunflower.

CLARIANT AG is a global specialty chemicals company headquartered in Muttenz, Switzerland. Established in 1995, Clariant has evolved into a key player in the chemical industry, focusing on sustainable and innovative solutions across various sectors, including care chemicals, catalysts, and adsorbents. Clariant is dedicated to addressing contemporary challenges such as energy efficiency and resource conservation, with operations spanning more than 68 production sites worldwide. The company is structured into three main business units: Care Chemicals, Adsorbents & Additives, and Catalysts, allowing it to cater to specific market needs with precision. Clariant's portfolio includes a variety of emulsifiers that are derived from renewable resources, aligning with the company's commitment to sustainability.

List of Key Companies in Emulsifiers Market

- Archer Daniels Midland (ADM)

- BASF

- Cargill Incorporated

- CLARIANT AG

- Corbion N.V.

- Croda International

- Dow Chemical Company

- DSM-Firmenich

- Evonik Industries AG

- International Flavors & Fragrances Inc. IFF

- Kao Corporation

- Kerry Group plc

- Lasenor

- Lonza Group AG

- Lubrizol Corporation

- Nikko Chemicals

- Nouryon

- Oleon NV

- PALSGAARD

- Puratos

- Riken Vitamin Co., Ltd.

- Solvay S.A.

- Spartan Chemical

- Stepan Company

- Vantage Specialty Chemicals

Emulsifiers Industry Developments

October 2024: Clariant announced the global launch of Pickmulse, a new O/W surfactant-free emulsifier and encapsulation system based on Lucas Meyer Cosmetics’ breakthrough patented quinoa starch technology.

October 2024: BASF, a global chemical company, announced the launch of its new Emulgade Verde line of natural-based emulsifiers for personal care at SEPAWA Congress 2024.

November 2022: Solvay introduced a new emulsifier, Reactsurf 2490, to boost coatings and adhesives performance. According to Solvay, the common uses of Reactsurf 2490 include textile & nonwoven binders, paper coatings, paint binders, adhesives & sealants, and building & construction applications.

Emulsifiers Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Bio-Based Emulsifiers

- Synthetic Emulsifiers

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Lecithin

- Iconic Emulsifiers

- Mono- & Di-Glycerides

- Sorbitan Esters

- Stearoyl Lactylates

- Polyglycerol Esters

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food

- Cosmetics & Personal Care

- Oilfield Chemicals

- Pharmaceuticals

- Agrochemicals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Emulsifiers Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.48 billion |

|

Revenue Forecast in 2025 |

USD 11.27 billion |

|

Revenue Forecast by 2034 |

USD 22.12 billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global emulsifiers market size was valued at USD 10.48 billion in 2024 and is projected to grow to USD 22.12 billion by 2034.

The global market is projected to register a CAGR of 7.8% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are Archer Daniels Midland (ADM); Cargill Incorporated; CLARIANT AG; Corbion N.V.; Croda International; Dow Chemical Company; DSM-Firmenich; Evonik Industries AG; International Flavors & Fragrances Inc. IFF; Kao Corporation; Kerry Group plc; Lasenor; Lonza Group AG; Lubrizol Corporation; Nikko Chemicals; Nouryon; Oleon NV; PALSGAARD; Puratos; Riken Vitamin Co., Ltd.; Solvay S.A.; Spartan Chemical; Stepan Company; and Vantage Specialty Chemicals.

The synthetic emulsifiers segment dominated the emulsifiers market in 2024.