EMEA Point-Of-Care Diagnostics Market Size, Share, Trends, Industry Analysis Report: By Product, End Use (Clinics, Hospitals, Home, Assisted Living Healthcare Facilities, Laboratory, and Others), and Region (Europe, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5486

- Base Year: 2024

- Historical Data: 2020-2023

EMEA Point-Of-Care Diagnostics Market Overview

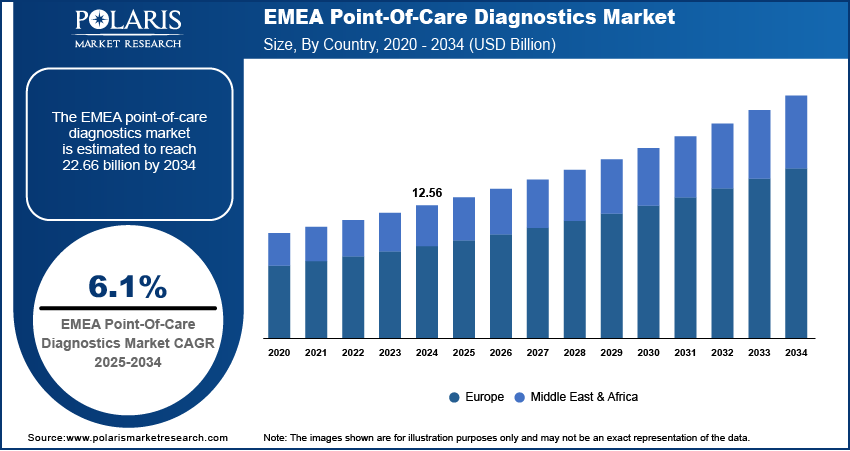

The EMEA point-of-care diagnostics market was valued at USD 12.56 billion in 2024. The market is expected to grow from USD 13.31 billion in 2025 to USD 22.66 billion by 2034, at a CAGR of 6.1% from 2025 to 2034.

Point-of-care (POC) diagnostics refer to medical testing conducted at or near the site of patient care, providing rapid results for timely clinical decision-making. The EMEA point-of-care diagnostics market is experiencing substantial growth, driven by the increasing need for decentralized healthcare solutions to manage the rising prevalence of chronic diseases, such as diabetes, cardiovascular conditions, and respiratory disorders. A November 2024 report by the European Environment Agency (EEA) stated that almost 420,000 people die from air pollution each year, with over 60% of these deaths related to chronic respiratory diseases. The growing burden of these long-term conditions necessitates frequent monitoring and timely diagnosis, making POC diagnostic tools essential for disease management. The shift towards patient-centric care, coupled with advancements in portable diagnostic technologies, further supports the adoption of POC solutions across various healthcare settings.

To Understand More About this Research: Request a Free Sample Report

The high incidence of infectious diseases in the EMEA region is driving increased demand for POC diagnostics, particularly for the rapid detection of conditions such as tuberculosis, malaria, and respiratory infections. The ability to deliver quick and accurate test results is crucial for early intervention and containment of infectious diseases diagnostic, reducing the risk of outbreaks and improving patient outcomes. For instance, in May 2022, QuantuMDx launched the Q-POC SARS-CoV-2, Flu A/B & RSV Assay, a rapid PCR respiratory panel for point-of-care testing. It delivers differential diagnosis in just 35 minutes, aiding triage, treatment, and infection control in healthcare environments. This capability is especially important in regions with limited access to centralized laboratories, where POC diagnostics play a vital role in strengthening healthcare infrastructure. As governments and healthcare providers prioritize early disease detection and prevention, the demand for efficient, on-site diagnostic solutions continues to rise, further fueling the EMEA point-of-care diagnostic market expansion.

EMEA Point-Of-Care Diagnostics Market Dynamics

Rising Demand for Home Healthcare

There is an increasing need for continuous health monitoring outside traditional clinical settings due to the growing aging population and the rising prevalence of chronic diseases. For instance, a July 2024 Eurostat report indicated that 35.0% of EU residents reported having a chronic health problem in 2023. POC diagnostic devices allow patients to conduct tests at home, reducing hospital visits and alleviating the burden on healthcare facilities. As patients and healthcare systems increasingly prioritize convenient, cost-effective, and timely medical testing, these devices are becoming essential. Moreover, advancements in user-friendly and connected diagnostic technologies have made at-home testing more accessible, allowing for real-time health tracking and early intervention. This shift towards decentralized healthcare is driving the adoption of POC diagnostics, supporting better disease management and improved patient outcomes.

Growing Focus on Personalized Medicine

Personalized medicine relies on precise and timely diagnostic data to tailor therapies based on a patient’s unique genetic, biochemical, or physiological profile, as healthcare moves towards more targeted and individualized treatment approaches. POC diagnostic solutions provide rapid, on-site results that facilitate real-time clinical decision-making, ensuring treatments are optimized for each patient. The integration of biomarker-based testing and advanced molecular diagnostics within POC platforms improves their role in disease stratification, treatment monitoring, and therapeutic adjustments. The market acceleration is noticeable in the increasing number of strategic acquisitions and partnerships focused on expanding POC diagnostic capabilities. For instance, In January 2021, Thermo Fisher Scientific acquired Mesa Biotech for USD 550 million for Mesa’s PCR-based POC platform, which detects infectious diseases, such as SARS-CoV-2, flu, RSV, and Strep A, delivering accurate results in 30 minutes. Therefore, as healthcare providers increasingly adopt precision-driven care models, the demand for POC diagnostics is expanding, reinforcing their critical role in modern medical practice.

EMEA Point-Of-Care Diagnostics Market Segment Insights

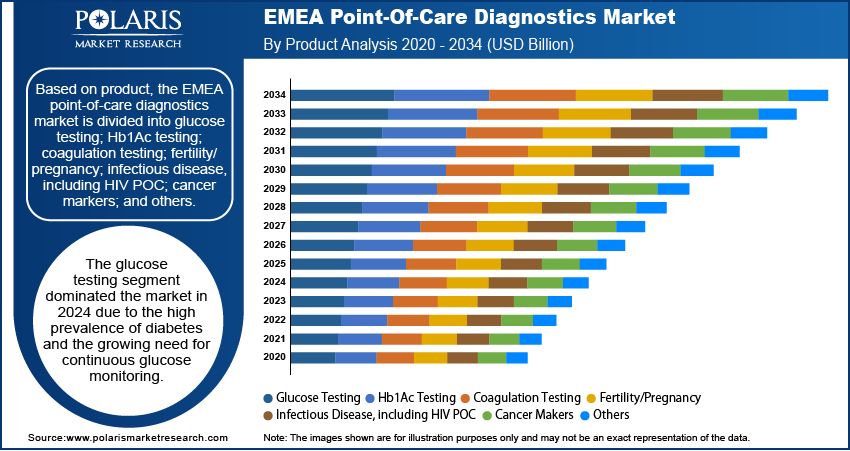

EMEA Point-Of-Care Diagnostics Market Assessment by Product Outlook

The EMEA point-of-care diagnostics market assessment, based on product, includes glucose testing; Hb1Ac testing; coagulation testing; fertility/pregnancy; infectious disease, including HIV POC; cancer markers; and others. The glucose testing segment dominated the market in 2024 due to the high prevalence of diabetes and the growing need for continuous glucose monitoring. POC glucose testing devices offer a convenient and rapid solution for both patients and healthcare providers, as diabetes management requires frequent and immediate blood sugar level assessments. The increasing adoption of self-monitoring blood glucose (SMBG) devices, supported by advancements in minimally invasive and non-invasive technologies, has improved patient compliance and facilitated more accurate and consistent monitoring. Additionally, the integration of digital health solutions, such as smartphone connectivity and cloud-based data tracking, has enhanced real-time diabetes management. Thus, as the burden of diabetes continues to rise across the EMEA region, the demand for reliable and accessible glucose testing solutions remains strong, reinforcing EMEA point-of-care diagnostics market development.

EMEA Point-Of-Care Diagnostics Market Evaluation by End Use Outlook

The EMEA point-of-care diagnostics market evaluation, based on end use, includes clinics, hospitals, home, assisted living healthcare facilities, laboratory, and others. The home segment is expected to witness the fastest growth during the forecast period, driven by the increasing shift towards decentralized and patient-centric healthcare. The growing preference for home-based testing is fueled by the growing incidence of chronic diseases, an aging population, and the need to reduce hospital visits and associated healthcare costs. Technological advancements have led to the development of compact, easy-to-use, and highly accurate POC diagnostic devices that enable real-time health monitoring from the comfort of home. Additionally, the expansion of telemedicine and remote patient monitoring solutions has supported the adoption of home-based diagnostics, allowing for timely medical interventions. As healthcare systems continue to emphasize preventive care and early disease detection, the home segment is poised for substantial growth.

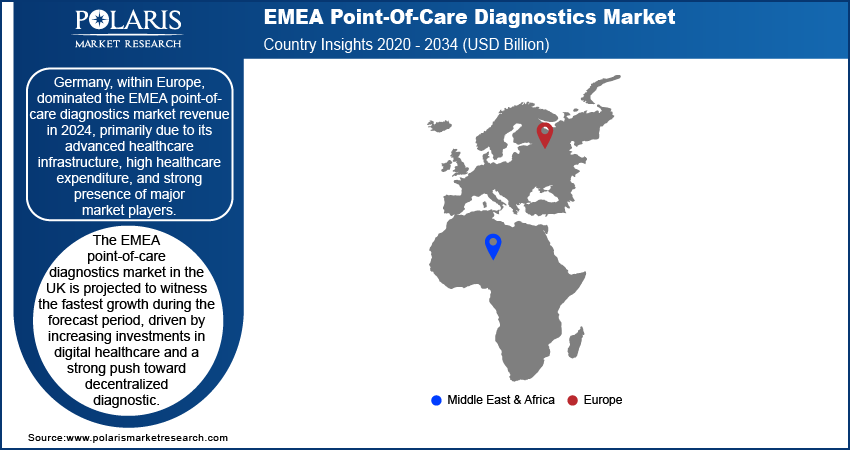

EMEA Point-Of-Care Diagnostics Market Regional Analysis

By region, the report provides the EMEA point-of-care diagnostics market insights Europe, and the Middle East & Africa. Within Europe, Germany dominated the EMEA point-of-care diagnostics market revenue in 2024, primarily due to its advanced healthcare infrastructure, high healthcare expenditure, and strong presence of major market players. The country’s well-established regulatory framework and widespread adoption of innovative diagnostic technologies have facilitated the integration of POC testing across various healthcare settings. Additionally, Germany’s aging population and the increasing burden of chronic and infectious diseases have increased the demand for rapid, decentralized diagnostic solutions. The country also benefits from a strong research and development ecosystem, fostering continuous advancements in POC diagnostics. For instance, in June 2023, Sysmex launched Europe’s first POC system for rapid antimicrobial susceptibility testing, delivering results in 30 minutes using urine samples. This innovation addresses antimicrobial resistance (AMR) by enabling timely, accurate treatment decisions in primary care settings. Germany has maintained its leadership position in the regional market, supported by government initiatives promoting digital health adoption and precision medicine.

The EMEA point-of-care diagnostics market in the UK is projected to witness the fastest growth during the forecast period, driven by increasing investments in digital healthcare and a strong push toward decentralized diagnostics. The UK healthcare system has been actively adopting POC testing to improve patient outcomes and reduce the burden on hospitals and primary care facilities. The rising focus on early disease detection, coupled with the growing adoption of home-based and remote diagnostic solutions, is further accelerating market growth in the UK. Additionally, advancements in molecular diagnostics and biomarker-based POC tests are supporting the expansion of personalized medicine initiatives in the country. The UK is positioned as a key growth market within the EMEA region, with government and private sector efforts focused on expanding access to rapid and efficient diagnostics.

EMEA Point-Of-Care Diagnostics Market – Key Players & Competitive Insights

The competitive landscape combines leaders and regional players competing to capture EMEA point-of-care diagnostics market share through innovation, strategic alliances, and regional expansion. Players such as Roche Diagnostics, Abbott Laboratories, and Siemens Healthineers leverage robust R&D capabilities and extensive distribution networks to deliver advanced diagnostic solutions, instruments, and rapid testing platforms. Market trends indicate rising demand for solutions like molecular diagnostics and AI-integrated POC devices, reflecting advancements in diagnostic technology and healthcare delivery models. According to EMEA point-of-care diagnostics market analysis, the market for EMEA POC diagnostics is projected to grow, driven by increasing cases of chronic diseases, infectious outbreaks, and the need for rapid diagnostic solutions.

Regional companies capitalize on localized needs by offering cost-effective and tailored products, especially in emerging markets, such as the Middle East and Africa. Market competitive strategies include mergers and acquisitions, partnerships with healthcare institutions, and the introduction of innovative diagnostic products to address the growing demand for decentralized testing solutions. These developments underline the role of technological innovation, market adaptability, and regional investments in driving the POC diagnostics industry expansion. A few key market players are Abbott; BD; BIOMÉRIEUX; Danaher Corporation; F. Hoffmann-La Roche Ltd; Nova Biomedical; QIAGEN; Siemens Healthcare Private Limited; Trividia Health, Inc.; and Werfen.

F. Hoffmann-La Roche Ltd, commonly known as Roche, is a global healthcare company headquartered in Basel, Switzerland. Established in 1896, Roche specializes in developing innovative pharmaceuticals and diagnostics, focusing on areas such as oncology, immunology, infectious diseases, and central nervous system disorders. The company operates under two main divisions: Pharmaceuticals and Diagnostics. In the EMEA region, Roche's POC solutions play a crucial role in transforming healthcare delivery. These diagnostics allow rapid testing and immediate results at the site of patient care, thereby facilitating timely clinical decisions and improving patient outcomes. Roche's POC offerings include a range of tests for infectious diseases, chronic conditions, such as diabetes, and various biomarkers essential for patient management. The company's commitment to innovation is reflected in its robust research and development efforts, which aim to advance diagnostic technologies that enhance disease detection and monitoring capabilities across diverse healthcare settings in the EMEA region.

Abbott is an innovator in the field of POC diagnostics, particularly within the EMEA region. The company focuses on delivering rapid, accurate diagnostic testing solutions that empower healthcare professionals to make timely decisions. Abbott's POC testing technologies span critical health areas, including infectious diseases, cardiovascular health, and diabetes management. Abbott's devices improve patient care efficiency by providing immediate results. The company's commitment to advancing healthcare is reflected in its extensive product portfolio, which includes systems such as ID NOW for respiratory infections and Afinion for diabetes management. Abbott's innovations are transforming diagnostic accuracy and they are also addressing global health challenges by expanding access to testing in remote and underserved areas.

List of Key Companies in EMEA Point-Of-Care Diagnostics Market

- Abbott

- BD

- BIOMÉRIEUX

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Nova Biomedical

- QIAGEN

- Siemens Healthcare Private Limited

- Trividia Health, Inc.

- Werfen

EMEA Point-Of-Care Diagnostics Industry Developments

July 2024: EKF Diagnostics launched the Biosen C-Line glucose and lactate analyzer, featuring advanced connectivity and precise enzymatic sensor technology for accurate diabetes management and improved clinical decision-making in healthcare settings.

EMEA Point-Of-Care Diagnostics Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease, including HIV POC

- Cancer Makers

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Clinics

- Hospitals

- Home

- Assisted Living Healthcare Facilities

- Laboratory

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

EMEA Point-Of-Care Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.56 billion |

|

Market Size Value in 2025 |

USD 13.31 billion |

|

Revenue Forecast by 2034 |

USD 22.66 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The EMEA point-of-care diagnostics market size was valued at USD 12.56 billion in 2024 and is projected to grow to USD 22.66 billion by 2034.

The market is projected to register a CAGR of 6.1% during the forecast period.

Germany, within Europe, dominated the EMEA point-of-care diagnostics market revenue in 2024.

Some of the key players in the market are Abbott; BD; BIOMÉRIEUX; Danaher Corporation; F. Hoffmann-La Roche Ltd; Nova Biomedical; QIAGEN; Siemens Healthcare Private Limited; Trividia Health, Inc.; and Werfen.

The glucose testing segment dominated the market in 2024.