Elevators & Escalators Market Share, Size, Trends, Industry Analysis Report, By Type (Elevators, Escalators, Moving Walkways); By Service (New installation, Maintenance & Repair, Modernization); By Elevator Technology; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 112

- Format: PDF

- Report ID: PM2423

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

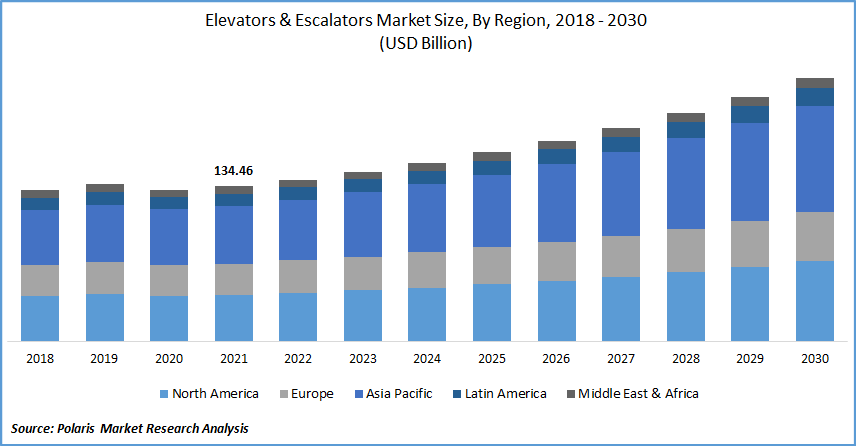

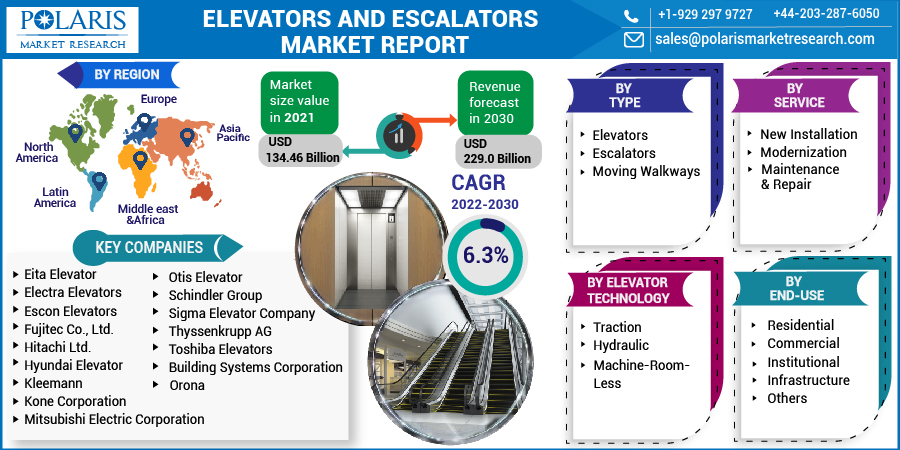

The global elevators & escalators market was valued at USD 134.46 billion in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. The key factors such as the rising adoption of modern safety features in escalators, technological advancements, and the rising construction sectors are driving the industry growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Various safety mechanisms, such as emergency escape features, safety brakes, door shuttering devices, door detectors, pit queues, and others, have resulted in more advanced escalator services, assisting market growth. The industrial and commercial sectors incorporate modern safety features in escalators such as skirt brushes to prevent objects from becoming entangled in escalators, step level monitors, lack step sensors, handrail alarm systems, and sensors to trigger an automatic stoppage in the case of emergency, and others.

Thus, the technologically advanced safety solutions make escalators accurate and effective in handling emergencies; the industry is growing rapidly worldwide. Furthermore, with the construction sector industry expanding, construction companies worldwide are focusing on lowering their energy consumption levels while also making plans to achieve green building accreditations such as Building Research Establishment Environmental Assessment Method (BREEAM) and Leadership in Energy and Environmental Design (LEED) for their projects.

This improvement emphasis on lowering overall energy consumption levels assists the industry growth. Furthermore, major industry players are expanding their footprint by enhancing their escalator production and operating capacity. However, maintenance and regular inspection costs are prohibitively expensive, acting as a elevators & escalators market restraint.

Industry Dynamics

Growth Drivers

The rapid increase in the launches of escalators by major players with the adoption of digital features is driving the industry growth during the forecast period. For instance, in March 2021, KONE Elevator India introduced the world's first ground-breaking category of digitally enabled KONE DX Class Elevators that will reinvent the elevator experience.

KONE DX Class guarantees an experience that integrates on every level, with constructed connectivity to improve people flow. Also, in February 2021, TKE, TK Elevator's emerging world brand, was launched. TKE's product portfolio includes everything from commodity elevators for the residential sector to cutting-edge, fully personalized solutions for country skyscrapers like New York's One World Trade Center.

In addition to this, its portfolio includes escalators and moving walks, passenger terminal bridges, stair and marketplace lifts, and tailor-made solutions and services for all product lines, encompassing a broad range of urban movements. The integrated intelligence that characterizes these escalators is provided by the Otis ONE IoT digital platform, native to both platforms. The platform can deliver performance reports and predictive insights. Thus, the digital platforms and solutions and advanced portfolio launched are driving the elevators & escalators market growth during the forecast period.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on type, service, elevator technology, end-use, and region.

|

By Type |

By Service |

By Elevator Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by End-Use

Based on the end-use industry segment, the residential segment is expected to be the most significant revenue contributor in the global elevators & escalators market. The rising complexity of living standards in emerging economies drives the global residential market. Emerging economies such as India, China, and Southeast Africa are experiencing unprecedented growth in urbanization as their populations migrate to cities in search of work.

As a result, high-rise buildings almost always equipped with smart escalators are becoming increasingly necessary to accommodate a sizable population in cities. Further, based on elevator technology, traction holds the highest share in the market. Traction lifts are more efficient than hydraulic lifts that can be used in all high-rise and mid-rise building structures.

As a result of the high concentration of people in China, manufacturers in the elevator and escalator market will push the revenues of traction elevators in high-rise buildings. Pneumatic elevators, on either hand, have received a lot of attention as they use a vacuum and a pressure regulator to move the elevator vehicle up and air to keep moving it down.

Geographic Overview

North America had the largest revenue share. U.S. is expanding steadily, owing to the early adoption of new technologies and the presence of a well-developed industrial sector. In the US, a strong financial foundation and a growing population catalyzed market growth. The expansion of the IoT and industrial sectors increases the demand for lifts.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2020. Factors such as easy availability of raw materials, low labor costs, and a relatively tight regulatory environment drive the Indian market. The construction industry is expanding due to rising spending and government initiatives. Rising urbanization and smart city development in India drive the demand for the industry. Companies are diversifying their revenue streams with the help of passenger boarding bridges and automated gate systems.

Globally, developing countries have high investments in subway and metro initiatives. For example, as of 2020, India has more than 1000 km of metro train system under construction, while China's subway network reached over 6000 km in 2019. Under the UDAN scheme, India is also building 21 greenfield airports. The advancement of such public transportation projects significantly creates a market for escalators because they allow for continuous people movement. In addition, Emaar Properties, an international real estate development company based in the United Arab Emirates, is planning to build a 500,000-square-foot shopping mall in Srinagar, India. Such promotional space exploration also drives growth.

Competitive Insight

Some of the major players operating in the global market include Otis Elevator, Electra Elevators, Escon Elevators, Fujitec Co., Ltd., Hitachi Ltd., Eita Elevator, Kleemann, Kone Corporation, Mitsubishi Electric Corporation, Orona, Hyundai Elevator, Schindler Group, Sigma Elevator Company, Thyssenkrupp AG, and Toshiba Elevators And Building Systems Corporation.

Elevators & Escalators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 134.46 Billion |

|

Revenue forecast in 2030 |

USD 229.0 Billion |

|

CAGR |

6.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Service, By Elevator Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Eita Elevator, Electra Elevators, Escon Elevators, Fujitec Co., Ltd., Hitachi Ltd., Hyundai Elevator, Kleemann, Kone Corporation, Mitsubishi Electric Corporation, Orona, Otis Elevator, Schindler Group, Sigma Elevator Company, Thyssenkrupp AG, and Toshiba Elevators And Building Systems Corporation |