Electronics & Consumer Goods Plastics Market Size, Share, Trends, Industry Analysis Report: By Product [Bio-Based Polycarbonate, Liquid Crystal Polymer (LCP), Polyamide (PA), Polycarbonate (PC), Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS), Glass Filled Resin, and Thermoplastic Elastomers (TPE)], Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 117

- Format: PDF

- Report ID: PM1505

- Base Year: 2024

- Historical Data: 2020-2023

Electronics & Consumer Goods Plastics Market Overview

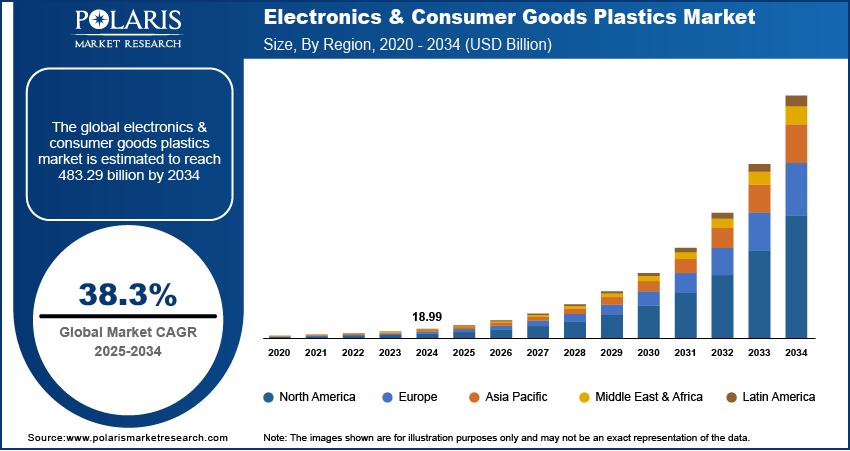

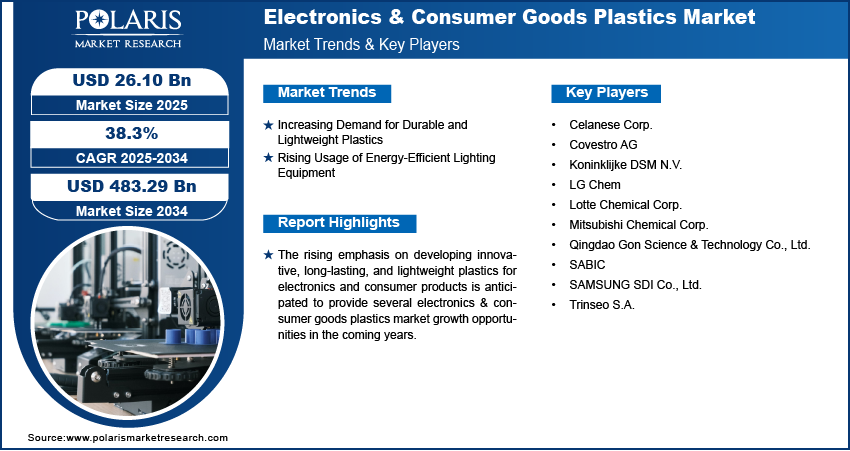

The global electronics & consumer goods plastics market was valued at USD 18.99 billion in 2024. The market is projected to grow from USD 26.10 billion in 2025 to USD 483.29 billion by 2034. It is projected to exhibit a CAGR of 38.3% from 2025 to 2034.

Electronic and consumer goods plastics are specialized materials used to produce electronic devices and home products. These plastics are engineered to provide durability, electrical insulation, heat resistance, and lightweight characteristics. In electronics, they are used for parts such as circuit boards, enclosures, and connectors. In consumer products, they are found in objects such as appliances, packaging, and toys.

The consumer electronics market is witnessing an increased demand for innovative, lightweight, and stable plastic materials. Technological innovations and the shift towards miniaturization have also created a greater need for plastics. These factors are driving the adoption of specialized plastics in consumer electronics, improving product performance and catering to changing design requirements.

To Understand More About this Research: Request a Free Sample Report

The rise of e-commerce and digitalization is boosting the demand for packaging materials, driving the growth of plastics in consumer products. This trend is anticipated to continue, fueling the electronics & consumer goods plastics market expansion as the need for packaging solutions increases. Growing awareness about minimizing carbon footprints and enhancing energy efficiency has prompted businesses to make investments in biodegradable and recyclable plastics for electronics and consumer products. This shift is expected to create several market prospects for eco-friendly products and sustainable packaging solutions during the forecast period.

Electronics & Consumer Goods Plastics Market Dynamics

Increasing Demand for Durable and Lightweight Plastics

Manufacturers are increasingly focusing on materials that provide durability without increasing weight, making plastics apt for lightweight items such as smartphones, laptops, and small devices. The workability of plastics presents another advantage, enabling a range of shapes and designs that improve product functionality and distinguish it in the market. The blend of sturdiness, ease of transport, and design versatility also make plastics an ideal material selection for consumer electronics. Thus, the rising demand for durable, lightweight materials is driving the electronics & consumer goods plastics market growth.

Rising Usage of Energy-Efficient Lighting Equipment

Swift urban development and advancements in LED technology have led to increased adoption of energy-efficient lighting equipment like LEDs. In contrast to CFL, incandescent, and halogen bulbs, LEDs provide superior lumen output with reduced wattage, encouraging manufacturers to create advanced LED lighting options. The rising demand for energy-efficient lighting consequently boosts the need for plastics in the lighting industry since they are crucial for creating durable, lightweight, and versatile LED fixtures and components. As a result, the growing preference for energy-efficient lighting equipment is boosting the electronics & consumer goods plastics market revenue.

Electronics & Consumer Goods Plastics Market Segment Insights

Electronics & Consumer Goods Plastics Market Evaluation Based on Product

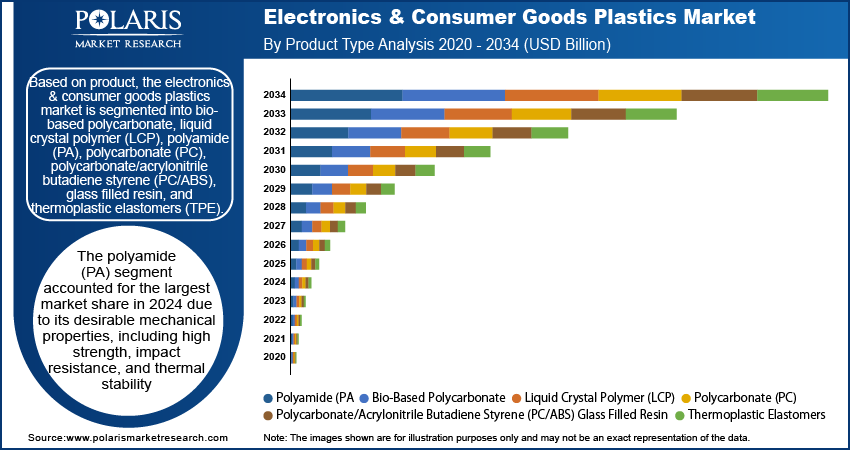

The electronics & consumer goods plastics market, by product, is segmented into bio-based polycarbonate, liquid crystal polymer (LCP), polyamide (PA), polycarbonate (PC), polycarbonate/acrylonitrile butadiene styrene (PC/ABS), glass filled resin, and thermoplastic elastomers (TPE). The polyamide (PA) segment accounted for the largest market share in 2024 due to its desirable mechanical properties, such as high strength, impact durability, and thermal resistance. PA can be designed in various forms, and its transparency and lightweight nature have made it a popular choice for crafting durable and aesthetically appealing devices. Its high use in the production of high-performance, portable electronic devices further contributes to the segment’s dominance in the global market.

Electronics & Consumer Goods Plastics Market Assessment Based on Application

The electronics & consumer goods plastics market, based on application, is segmented into appliances and white goods, laptop monitor enclosures, LCD panels, mobile phone bodies, portable hand-held devices, TV frames, wearables, and others. The mobile phone bodies segment dominated the market in 2024 due to the increasing demand for smartphones globally. Plastics such as polycarbonate, ABS, and polyamide are popular choices for custom mobile phone cases due to their strength, durability, and aesthetic qualities. Additionally, the growing demand for consumer products in developing markets drives the leading position of the segment in the global market.

Electronics & Consumer Goods Plastics Market Regional Analysis

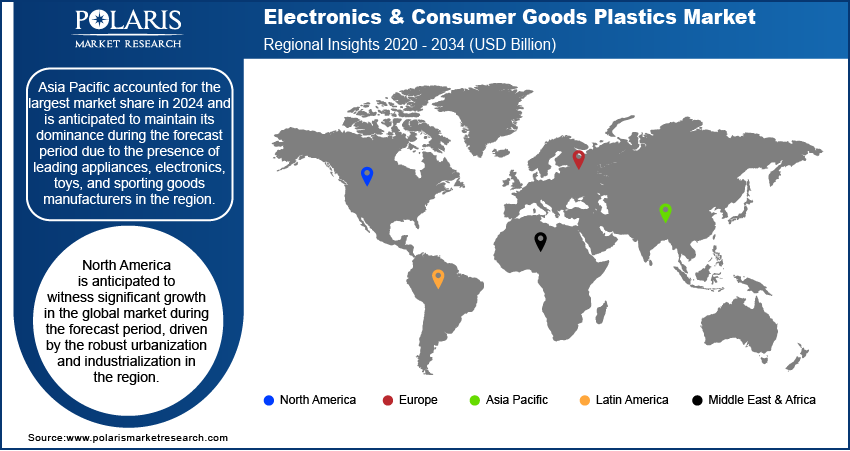

By region, the report offers the electronics & consumer goods plastics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest market share and is expected to maintain its dominance during the forecast period, owing to the presence of major appliances, electronics, toys, and sporting goods manufacturers across key regions such as Korea, Japan, India, and China. In addition, urbanization and shifting lifestyles have enhanced the demand for consumer electronics and household applications, impacting the regional market growth favorably.

The North America electronics & consumer goods plastics market is anticipated to witness significant growth in the global market during the forecast period. This is largely due to the robust urbanization and industrialization in the region. Rising government initiatives aimed at boosting the manufacturing of consumer goods and electronics are also expected to contribute to the regional market expansion.

Electronics & Consumer Goods Plastics Market – Key Players and Competitive Insights

The leading players in the market are introducing innovative products to cater to diverse consumer needs. Global players are also entering new markets in developing regions to expand their customer base and strengthen their industry presence. Additionally, they are undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The electronics & consumer goods plastics market report offers a market assessment of all the key players, including Trinseo S.A.; Covestro AG; Celanese Corp.; SABIC; Lotte Chemical Corp.; LG Chem; Mitsubishi Chemical Corp.; SAMSUNG SDI Co., Ltd.; Koninklijke DSM N.V.; and Qingdao Gon Science & Technology Co., Ltd..

List of Key Companies in Electronics & Consumer Goods Plastics Market

- Celanese Corp.

- Covestro AG

- Koninklijke DSM N.V.

- LG Chem

- Lotte Chemical Corp.

- Mitsubishi Chemical Corp.

- Qingdao Gon Science & Technology Co., Ltd.

- SABIC

- SAMSUNG SDI Co., Ltd.

- Trinseo S.A.

Electronics & Consumer Goods Plastics Industry Developments

September 2024: AkzoNobel developed a high-quality series of coatings that improve the reliability and effectiveness of utilizing recycled plastics in consumer electronics. These advanced coatings, designed for devices like computers, smartphones, and home appliances, provide durable protection and are uniquely designed for products crafted from post-consumer recycled (PCR) plastics.

January 2024: Covestro AG and Encina signed a long-term supply agreement to supply chemically recycled raw materials sourced from post-consumer end-of-life plastics. Under the agreement, Encina will provide Covestro with benzene and toluene.

Electronics & Consumer Goods Plastics Market Segmentation

By Product Outlook

- Bio-Based Polycarbonate

- Liquid Crystal Polymer (LCP)

- Polyamide (PA)

- Polycarbonate (PC)

- Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS)

- Glass Filled Resin

- Thermoplastic Elastomers (TPE)

By Application Outlook

- Appliances and White Goods

- Laptop Monitor Enclosures

- LCD Panels

- Mobile Phone Bodies

- Portable Hand-held Devices

- TV Frames

- Wearables

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electronics & Consumer Goods Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.99 billion |

|

Market Size Value in 2025 |

USD 26.10 billion |

|

Revenue Forecast by 2034 |

USD 483.29 billion |

|

CAGR |

38.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Electronics & Consumer Goods Plastics Industry Trends Analysis (2024) Company profiles/industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The electronics & consumer goods plastics market size was valued at USD 18.99 billion in 2024 and is projected to grow to USD 483.29 billion by 2034.

The market is projected to register a CAGR of 38.3% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

Trinseo S.A.; Covestro AG; Celanese Corp.; SABIC; Lotte Chemical Corp.; LG Chem; Mitsubishi Chemical Corp.; SAMSUNG SDI Co., Ltd.; Koninklijke DSM N.V.; and Qingdao Gon Science & Technology Co., Ltd.; and Others are a few key players in the market.

The polyamide (PA) segment accounted for the largest market share in 2024.

The mobile phone bodies segment dominated the market for electronics & consumer goods plastics in 2024.