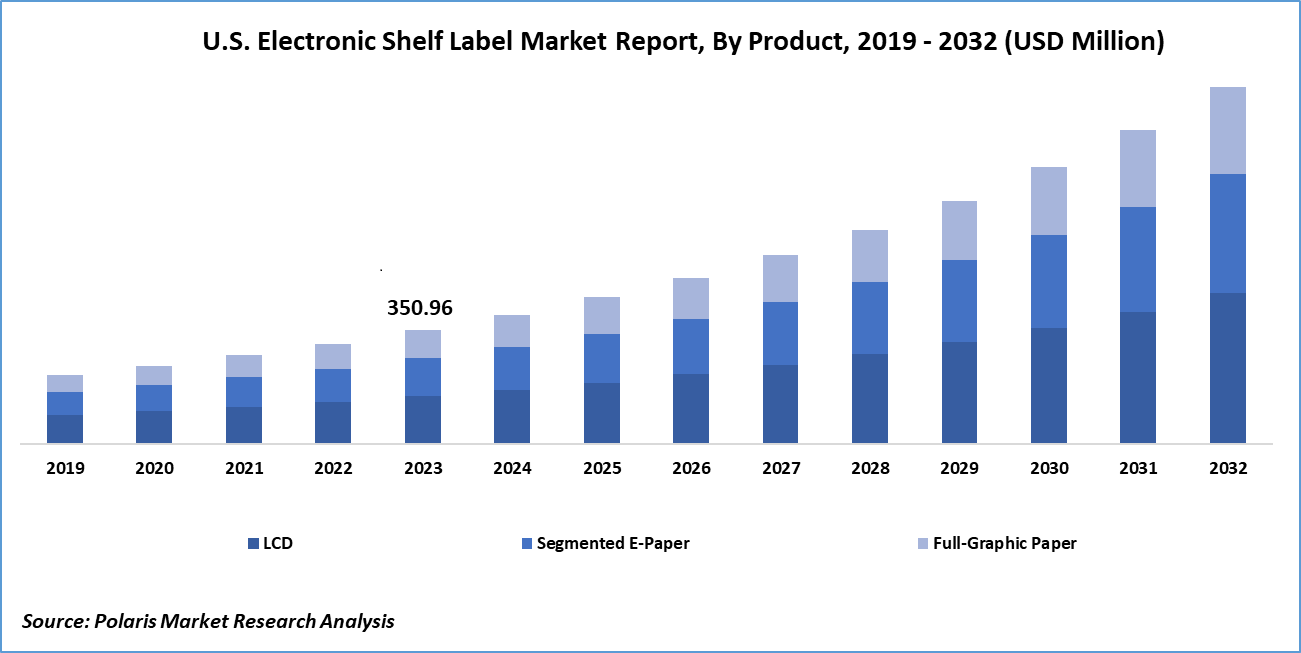

Electronic Shelf Label Market Share, Size, Trends, Industry Analysis Report, By Product (LCD, Segmented E-Paper, and Full-Graphic E-Paper); By Component; By Display Size; By Communication Technology; By Store Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 116

- Format: PDF

- Report ID: PM3861

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Global electronic shelf label market size was valued at USD 1,726.63 million in 2023. The market is anticipated to grow from USD 1,959.55 million in 2024 to USD 5,444.35 million by 2032, exhibiting a CAGR of 13.6% during the forecast period

Industry Trends

Electronic shelf labels (ESLs) refer to digital display systems used in retail settings that can replace traditional paper price tags on store shelves. These digital labels provide real-time information about product prices, promotions, and other details.

Electronic shelf labels (ESLs) revolutionize retail by dynamically displaying customizable product information, pricing, and details wirelessly connected to a central management system. Unlike paper labels, ESLs enable quick, automated updates in real-time, ideal for sales events or price adjustments. Energy-efficient designs, using technologies like e-ink, ensure extended battery life or power-efficient operation. These features enhance agility, streamline operations, and improve customer experiences in retail environments.

To Understand More About this Research: Request a Free Sample Report

Electronic shelf labels are often integrated with the retailer's Point of Sale (POS) system. This integration ensures that the information displayed on the electronic labels aligns with the information in the store's database. These labels help reduce pricing errors and inconsistencies by ensuring that the information displayed on the shelf matches the data in the store's pricing system.

Electronic shelf labels contribute to a more engaging and informative shopping experience for customers by providing accurate and up-to-date information about products and prices. Some ESL systems offer features that aid in inventory management, tracking stock levels, and providing alerts when products need restocking.

ESLs are adaptable to various retail settings, from grocery stores to electronics retailers, and can be customized to meet specific business needs. The automation of pricing updates and the elimination of manual label changes contribute to reduced labor costs for retailers. Electronic shelf labels enhance the efficiency of retail operations by providing real-time, accurate, and customizable information, ultimately improving the overall customer experience and operational effectiveness. This, in turn, enhances the electronic shelf label market growth over the forecast period.

Key Takeaways

- Europe dominated the market and contributed over 41% of electronic shelf label market share in 2023

- By product category, the LCD segment dominated the electronic shelf label market share in 2023

- By component category, the display segment is projected to grow with a significant CAGR over the electronic shelf label market forecast period

What are the Market Drivers Driving the Demand for the Electronic Shelf Label Market?

Increasing Trend of Retail Automation Bolstering the Electronic Shelf Label Market Growth

The rising trend toward retail automation has indeed been a significant driver for the electronic shelf label market growth. The adoption of Electronic Shelf Labels (ESL) in the retail sector reflects a broader trend towards digitization and automation. ESLs streamline pricing and product information updates, reducing manual efforts and errors associated with traditional paper labels. Integration with other automated retail systems enhances efficiency, while analytics capabilities offer valuable insights into customer behavior. ESLs facilitate dynamic pricing strategies and personalized promotions, enabling retailers to stay agile and competitive in the market.

The electronic shelf label market growth is driven by retailers recognizing the benefits of automation in improving store operations. Ongoing advancements in ESL technology, including improved display capabilities and energy efficiency, make these solutions increasingly attractive. By embracing ESLs and automation, retailers can enhance operational efficiency, reduce errors, and stay ahead in a rapidly evolving retail landscape. The growing retail sector, along with automation, helps to propel the electronic shelf label market growth.

Which Factor is Restraining the Demand for Electronic Shelf Label?

High Installation Costs are Likely to Hamper the Electronic Shelf Label Market Growth

The widespread adoption and growth of electronic shelf labels (ESLs) face challenges due to their high installation costs. The upfront expenses for hardware, software, digital labels, communication infrastructure, and backend systems can be substantial. Additional costs arise from establishing wireless communication infrastructure, training staff, integrating with existing systems, and ongoing technical support and maintenance. Customization for unique retailer needs can further inflate costs, impacting the overall total cost of ownership of ESL systems.

The significant upfront investment required for ESL implementation, including hardware, software, infrastructure setup, and staff training, presents a barrier to widespread adoption. Ongoing costs for technical support, maintenance, and customization add to the total cost of ownership, posing challenges to the growth of the electronic shelf labels market. Therefore, high initial costs and supporting infrastructure expenditures can hinder the growth of the electronic shelf labels market.

Report Segmentation

The market is primarily segmented based on product, component, display size, communication technology, store type, and region.

|

By Product |

By Component |

By Display Size |

By Communication Technology |

By Store Type |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market has been segmented on the basis of LCD, segmented e-paper, and full-graphic e-paper. The LCD segment held the largest electronic shelf label market share of around 40% in 2023. The electronic shelf label (ESL) market has experienced substantial growth with the introduction of LCD-type ESLs, leveraging Liquid Crystal Display (LCD) technology to provide retailers with dynamic and efficient pricing and information management solutions. These labels enable real-time updates across multiple shelves, enhancing operational efficiency and accuracy compared to static paper labels. Factors driving their adoption include the increasing trend of automation and digitization in retail, consumer demand for seamless shopping experiences, and the rise of specialty stores emphasizing curated selections and unique customer experiences.

The ability to remotely update prices and information, along with the dynamic display capabilities of LCD technology, aligns with retailers' priorities for operational efficiency, customer satisfaction, and sustainability. Collaborations and partnerships among companies, such as Pricer's LCD-based solutions, further contribute to the market's growth by offering versatile retail displays with enhanced promotional features. The environmental benefits of LCD-type ESLs, including reduced paper usage and manual interventions, also resonate with consumers' preferences for eco-friendly practices, driving their increasing popularity in the retail landscape.

By Component Insights

Based on component category analysis, the market has been segmented on the basis of microprocessors, batteries, transceiver, displays, others. The display segment in the market is anticipated grow with a CAGR of 13.9% over the electronic shelf label market forecast period. The electronic shelf label (ESL) market has experienced significant growth driven by the demand for real-time price management and automation, enhancing operational efficiency and customer engagement in retail environments. Leveraging Internet of Things (IoT) technology, ESLs offer dynamic pricing strategies and integrate seamlessly with smart retail solutions, providing valuable insights for informed decision-making. E-ink displays, with their low power consumption and paper-like readability, have revolutionized ESLs by ensuring clarity, adaptability, and sustainability without continuous power supply, meeting the need for efficient inventory management and dynamic pricing updates. Additionally, their durability and sustainability aspects further contribute to their increasing adoption in ESLs, offering a competitive edge over traditional paper labels.

Regional Insights

Europe

Europe dominated the market and contributed over 41% of electronic shelf label market share in 2023. The region's market growth is fueled by the presence of key players providing ESL solutions and the rising labor costs. European retailers are increasingly adopting automated retail solutions like ESLs to cut operational expenses in their stores substantially. The market is expected to expand in the region, driven by the high adoption of full graphic e-paper displays and the concentration of a majority of electronics manufacturers. In Europe, companies like SES-imagotag, Displaydata, and Opticon Sensors Europe B.V. are at the forefront of innovation in Electronic Shelf Labels (ESL). These companies focus on developing and integrating advanced display platforms within ESL solutions, contributing significantly to the growth of the ESL market in the region.In November 2022, Pricer expanded its strategic collaboration with StrongPoint, a prominent grocery retailer offering intelligent solutions for retail stores, extending its geographic reach to the U.K. and Ireland.

North America

North America, led by the United States and Canada, is a pioneering market for electronic shelf labels (ESLs) due to substantial investments in the retail sector. With a digitally connected population, consumers are highly engaged with technology, enhancing the impact of ESL adoption. The region's retail and grocery industries prioritize ESL implementation to offer clear, real-time product information, aligning with the trend towards retail automation.

Competitive Landscape

The electronic shelf labels market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant electronic shelf labels market share.

Some of the major players operating in the global market include:

- Dahua Technology Co., Ltd.

- Displaydata Ltd.

- E Link Holding Inc.

- Hanshow Technology

- M2COMM

- Minew

- Opticon

- Pricer

- RAINUS

- SES-imagotag

- Shanghai Sunmi Technology Co., Ltd.

- Teraoka Seiko Co., Ltd.

Recent Developments

- In April 2023, Hanshow unveiled the Nebular Pro series of four-color ESLs, ushering in a new era of vibrant and innovative digital retail experiences at the "Revitalization and Excellence" product launch in China.

- In November 2023, RAINUS partnered with Toshiba Global Commerce Solutions, offering ESL technology for seamless dynamic pricing, enhancing store solutions, and addressing labor challenges in retail.

- In July 2023, ASDA collaborated with Avery Berkel and Hanshow to launch the UK's first sustainability trial store, integrating leading ESL technology and digital retail solutions for an enhanced shopping experience and promoting refillable solutions.

Report Coverage

The electronic shelf label market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, display size, communication technology, store type, and futuristic growth opportunities.

Electronic Shelf Label Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,959.55 million |

|

Revenue Forecast in 2032 |

USD 5,444.35 million |

|

CAGR |

13.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Component, By Display Size, By Communication Technology, By Store Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global electronic shelf label market size is expected to reach USD 5,444.35 Million by 2032

Key players in the market are RAINUS, SES-imagotag, Pricer, Displaydata Ltd., Dahua Technology Co., Ltd., Teraoka Seiko Co., Ltd

Europe contribute notably towards the global Electronic Shelf Label Market

Electronic Shelf Label Market exhibiting a CAGR of 13.6% during the forecast period

The Electronic Shelf Label Market report covering key segments are product, component, display size, communication technology, store type, and region.