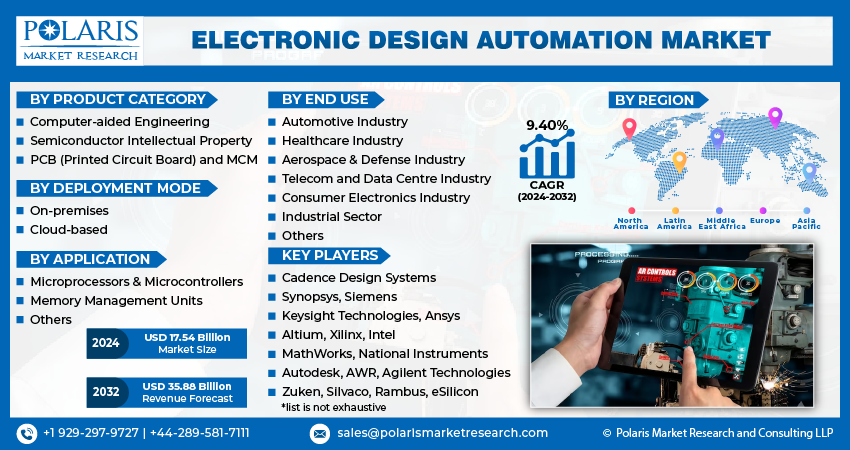

Electronic Design Automation Market Share, Size, Trends, Industry Analysis Report, By Product Category (CAE, Semiconductor IP, PCB and MCM, Services); By Deployment Mode; By Application; By End User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 112

- Format: PDF

- Report ID: PM3630

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

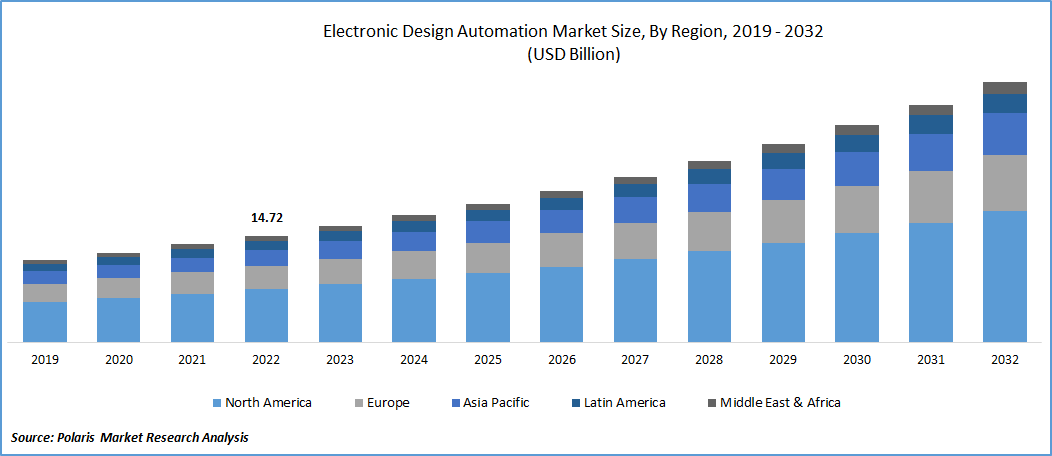

The global electronic design automation market was valued at USD 16.06 billion in 2023 and is expected to grow at a CAGR of 9.40% during the forecast period.

The increased demand for semiconductors and the semiconductor industry's growth drive technological advancements in the electronic design automation (EDA) field. As the complexity of semiconductor design increases, EDA tools evolve to address these challenges. EDA vendors invest in research and development to offer more sophisticated tools, algorithms, and methodologies that can meet the requirements of the expanding semiconductor market. The semiconductor industry's expansion fuels the EDA market's growth in the coming years.

To Understand More About this Research: Request a Free Sample Report

The automotive industry is a significant consumer of semiconductor chips of the overall chip demand. With the increasing integration of electronic components and advanced technologies in vehicles, such as ADAS, infotainment systems, and electric vehicle components, the demand for semiconductor chips in the automotive sector is on the rise. To meet this demand, EDA tools play a crucial role in designing and validating complex automotive systems. The growth of the automotive industry directly drives the need for EDA tools, stimulating the growth of the market. As a result, the demand for EDA tools will also continue to increase, providing opportunities for EDA vendors and fueling the growth of the electronic design automation market.

Industry Dynamics

Growth Drivers

As the increasing complexity of Integrated Circuits become more complex and advanced, the design process becomes more challenging. EDA tools provide efficient solutions for designing complex ICs, enabling designers to manage the complexity and achieve higher levels of performance, power efficiency, and functionality. The increasing demand for advanced electronic devices and technologies fuels the need for robust EDA solutions.

Also, The semiconductor industry constantly evolves with new technologies, architectures, and design methodologies. EDA vendors continually innovate and upgrade their tools to support the latest industry trends, such as the Internet of Things (IoT), artificial intelligence (AI), and 5G. Technological advancements in EDA tools, including simulation, synthesis, verification, and physical design, drive the growth of the EDA market. The automotive and aerospace sectors have seen a significant increase in electronic systems' complexity due to advancements in in-vehicle connectivity, autonomous driving, and avionics. EDA tools play a vital role in designing and verifying these complex systems, driving the demand for EDA solutions in these industries.

Report Segmentation

The market is primarily segmented based on product category, deployment mode, application, end use and region.

|

By Product Category |

By Deployment Mode |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Semiconductor IP segment is expected to witness fastest growth during the forecast period

The semiconductor IP segment is expected to have faster growth in the market. With the growing complexity of semiconductor designs, the demand for pre-designed and pre-verified IP blocks is rising. Semiconductor IP includes ready-to-use components such as processors, memory, interfaces, and specialized functions that can be integrated into custom chip designs. The availability of a wide range of IP blocks accelerates design cycles, reduces development costs, and enables faster time-to-market, driving the segment's growth.

By utilizing Semiconductor IP, design teams can avoid the need to develop complex components from scratch. This not only saves time but also reduces development costs significantly. Designers can focus on integrating and optimizing the IP blocks into their specific designs, improving overall design efficiency and accelerating product development. The cost and time savings associated with Semiconductor IP drive its adoption and contribute to the market's growth.

Cloud-based segment expected to have the largest market share in the upcoming year

Cloud-based segment holds the market's largest share in the study period. These tools offer remote access to design software, resources, and computing power from anywhere with an internet connection. This accessibility enables design teams to collaborate seamlessly, irrespective of their geographical locations. It also provides the flexibility to scale resources up or down based on project requirements, allowing for efficient resource utilization and increased productivity. Cloud-based EDA solutions typically follow a pay-as-you-go model, eliminating the need for significant upfront investments in hardware and software infrastructure. Users pay only for their resources and services, reducing capital expenses. This cost-efficient approach attracts small and medium-sized enterprises (SMEs) and start-ups with limited budgets, driving their adoption of EDA tools and expanding the market.

Microprocessors and Microcontrollers segment is expected to hold the larger revenue share in the coming years

The microprocessors and Microcontrollers segment will witness a larger revenue share in the coming years. The demand for high-performance microprocessors and microcontrollers is growing across various industries, including consumer electronics, automotive, telecommunications, industrial automation, and more. These advanced processors power various devices and systems, such as smartphones, laptops, IoT devices, automotive electronics, and embedded systems. These processors' design complexity and performance requirements drive the need for sophisticated EDA tools to design, optimize, and verify their functionality.

Automotive Industry segment is expected to hold the higher growth during forecast period

The Automotive Industry segment is expected to witness higher growth in the market. The automotive industry is rapidly transforming by integrating advanced technologies such as electrification, autonomous driving, connectivity, and driver-assistance systems (ADAS). These advancements have increased complexity in automotive designs, including developing complex electronic control units (ECUs), in-vehicle networks, sensors, and communication systems.

EDA tools are crucial in designing, simulating, and verifying these complex automotive systems. The rapid growth of electric vehicles has created new design challenges. EDA tools support the design of power electronics, battery management systems, motor control systems, and other components specific to electric vehicles. The optimization of power efficiency, range, and charging infrastructure requires advanced EDA capabilities to address the unique requirements of EV designs.

APAC registered with the highest growth rate in the study period

APAC is projected to witness a higher growth rate for the market. The region's semiconductor companies are investing heavily in research and development, leading to the design of cutting-edge semiconductor devices. The design complexity of advanced semiconductor chips requires sophisticated EDA tools, fostering the growth of the market in the region. The expansion of the semiconductor industry in China directly drives the demand for EDA tools and solutions. As semiconductor companies in China design and develop advanced chips, they rely on EDA tools for chip design, verification, and testing tasks. This robust semiconductor industry growth in China contributes to the overall expansion of the EDA market.

North America is expected to witness a larger revenue share in the market. Government initiatives in the region are creating new opportunities for the market. The enforcement of the CHIPS and Science Act in North America is driving the growth of the EDA market. As a result of the enactment of the CHIPS and Science Act of 2022, numerous companies have recently disclosed additional investments of approximately $50 billion in American semiconductor manufacturing. These increased investments in semiconductor manufacturing are expected to drive the demand for EDA tools and solutions, foster innovation, and create a favorable business environment for EDA companies operating in the United States.

Competitive Insight

Some of the major players operating in the global market include Cadence Design Systems, Synopsys, Siemens, Keysight Technologies, Ansys, Altium, Xilinx, Intel, MathWorks, National Instruments, Autodesk, AWR, Agilent Technologies, Zuken, Silvaco, Rambus, eSilicon, On Semiconductor, Microchip Technology, Infineon Technologies, EDA Direct, EMA Design Automation, Dassault Systèmes, Cirrus Logic, Cadabra Design Automation, Berkeley Design Automation, Aldec, Adesto Technologies, Atrenta, Blue Pearl Software, Carbon Design Systems, eASIC Corporation, Imagination Technologies, Jasper Design Automation, Lattice Semiconductor, Magma Design Automation, Sigasi, Sigrity, Sonnet Software & Verific Design Automation.

Recent Developments

- In April 2023, Cadence Design introduced new designs based on their “Cadence Integrity 3D-IC” platform. This TSMC 3D Blox standard is specifically designed for 3D design partitioning in complex systems.

Electronic Design Automation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.54 billion |

|

Revenue forecast in 2032 |

USD 35.88 billion |

|

CAGR |

9.40% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Category, By Deployment Mode, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cadence Design Systems, Synopsys, Seimens, Keysight Technologies, Ansys, Altium, Xilinx, Intel, MathWorks, National Instruments, Autodesk, AWR, Agilent Technologies, Zuken, Silvaco, Rambus, eSilicon, On Semiconductor, Microchip Technology, Infineon Technologies, EDA Direct, EMA Design Automation, Dassault Systèmes, Cirrus Logic, Cadabra Design Automation, Berkeley Design Automation, Aldec, Adesto Technologies, Atrenta, Blue Pearl Software, Carbon Design Systems, eASIC Corporation, Imagination Technologies, Jasper Design Automation, Lattice Semiconductor, Magma Design Automation, Sigasi, Sigrity, Sonnet Software & Verific Design Automation. |

FAQ's

The global electronic design automation market size is expected to reach USD 35.88 billion by 2032.

Top market players in the Electronic Design Automation Market are Cadence Design Systems, Synopsys, Siemens, Keysight Technologies, Ansys, Altium, Xilinx, Intel.

Asia Pacific contribute notably towards the global Electronic Design Automation Market.

The global electronic design automation market expected to grow at a CAGR of 9.3% during the forecast period.

The Electronic Design Automation Market report covering key are product category, deployment mode, application, end use and region.