Electronic Chemicals and Materials Market Share, Size, Trends, Industry Analysis Report, By Product (Liquid, Gaseous, Solid); By Application; By End-use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4855

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

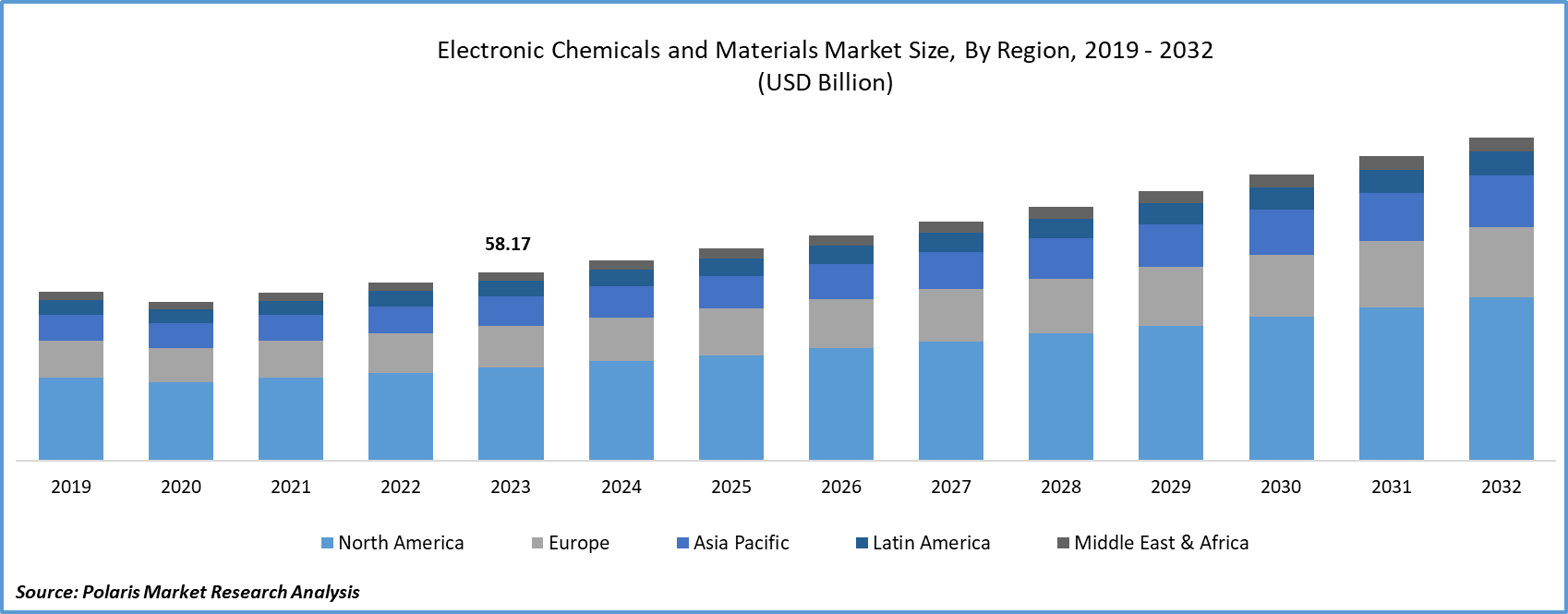

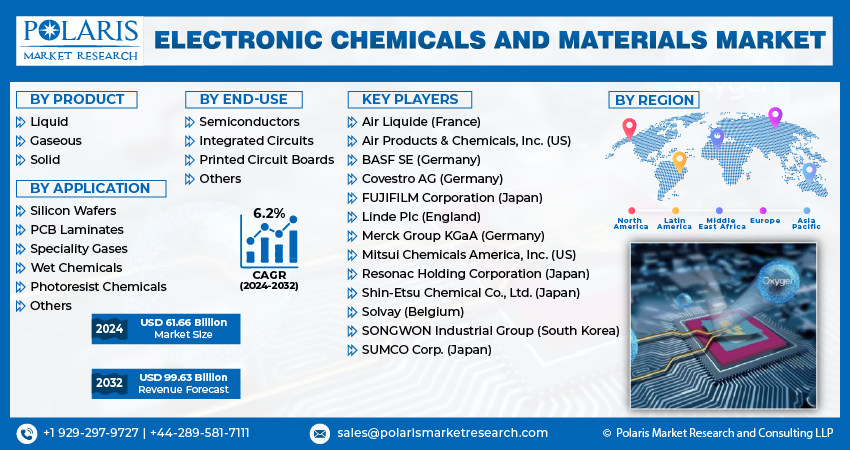

Electronic Chemicals and Materials Market size was valued at USD 58.17 billion in 2023. The market is anticipated to grow from USD 61.66 Billion in 2024 to USD 99.63 billion by 2032, exhibiting the CAGR of 6.2% during the forecast period.

Market Overview

The increasing global electronic needs are creating a diverse range of opportunities for the electronic chemicals and materials market, driven by its potential to ensure the effective functioning of devices. Electronic materials are used in the manufacturing of optical devices, computer chips, LED bulbs, memories, and displays, which are vital in the daily use of electronic gadgets such as smartphones, laptops, GPS appliances, and television.

The ongoing technological innovations in electronic devices are playing a major role in driving the demand for electronic chemicals and materials. As per the Consumer Technology Association 2024 report, the U.S. consumer technology industry is projected to reach USD 512 billion in 2024, a 2.8% growth from 2023. The growing consumer technology will optimally influence the demand for electronic chemicals and materials in the forecast period. Growing strategic acquisitions are strengthening the market expansion.

● For instance, in June 2023, Bain Capital Equity announced the acquisition of an agro- and specialty chemicals manufacturer, Porus Labs, with a value of INR 2400 crore, to expand its market position and utilize chemical production and development capabilities.

Moreover, countries are registering increasing demand for compound semiconductors, including India. For instance, in July 2023, the GaN Ecosystem Enabling Center and Incubator announced the installation of Oxford Instruments Plasma Technology to produce higher-power electronics. This will further propel the need for gallium nitride and other electronic chemicals in the region.

To Understand More About this Research: Request a Free Sample Report

Growth Drivers

Growing adoption of 5G technology

The surge in innovations in the 5G technology is changing the market dynamics. Specifically, autonomous car driving is integrated with AI, autonomous systems, Internet of Things (IoT). As per the 5G Americas, around 1.6 Bn 5G connections were acquired in Q3 of 2024 across the globe and are projected to reach 7.9 Bn by 2028. This is enforcing the critical need for conductivity and driving the demand for advanced electronic chemicals and materials.

Increasing production of semiconductors driving the electronics and chemicals market forward

The increasing efforts taken by several nations to become self-sufficient and fuel technological advancements for development are significantly contributing to the demand for electronic chemicals and materials. For instance, in March 2024, the Indian government introduced three new semiconductor production facilities worth INR 1.25 lakh crore within the country, 1in Assam & 2 in Gujarat. Such government initiative is likely to foster the production of semiconductors, thereby fulfilling the need for electronics and concerned chemicals in production activities.

Restraining Factors

Rising measures to promote environmental sustainability

The rising importance of the circular economy is significantly boosting the adoption of environmentally friendly materials in the global market. Consumers are showing a preference for products that undergo sustainable production processes along with ingredients.

- According to the World Health Organization, e-waste is estimated to reach 53.6 Mn tonnes worldwide in 2019. This trend is expected to limit the application of electronic materials and chemicals and the production of electronic products in the long run.

Report Segmentation

The market is primarily segmented based on product, application, end-use and region.

|

By Product |

By Application |

By End-use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Solid segment is expected to witness the highest growth during the forecast period

The solid segment is projected to grow at a CAGR during the projected period. This is primarily due to the uptick in the use of smartphones and televisions, which usually require solid electronic chemicals and materials for better functionality and efficiency. Moreover, the growing disposable income is creating demand for luxury goods and electronic consumables in the market, significantly supporting the need for solid-state chemicals.

The liquid segment held the largest revenue share. This dominance is primarily due to their ability to assist in the cleaning process of electronic appliances, mainly isopropyl alcohol. This is adopted by households driven by its potential characteristics, such as antibacterial and antiseptic properties, and effectively removes fingerprints, oils, & adhesives.

By Application Analysis

Silicon wafers segment accounted for the largest market share in 2023

The silicon wafers segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is primarily due to the increasing measures to promote silicon wafer manufacturing with the rising use of semiconductors in electronic devices.

- For instance, in January 2024, according to DigiTimes, Wafer Works and National Silicon Industry Group are widening their production capacities in China. This will further boost the growth of the electronic chemicals and materials market in the next few years.

By End-use Analysis

Semiconductors segment held the significant market revenue share in 2023

The semiconductor segment held a significant revenue share in 2023. This can be attributable to the growing production of electric vehicles, which stimulates the demand for semiconductors. The ongoing transition from oil-based vehicles to electric vehicles is facilitating a huge need for semiconductor production, subsequently influencing companies to enhance their potential capacity. For instance, in September 2023, Mitsubishi Chemical Company announced its plan to develop a new chip production facility in Japan.

Regional Insights

Asia Pacific region registered the largest share of the global market in 2023

The Asia Pacific region held the dominant market share in 2023. This is due to growing government policies to support electronic vehicle production and semiconductor manufacturing, primarily in Japan and India. For instance, in January 2024, Taiwan Semiconductor Manufacturing Company Limited announced the launch of a new chip-making factory in the US. This is promptly assisting companies to facilitate new production facilities, which, in a way, fuels the demand for electronic chemicals and materials. In 2023, the Japanese government announced an investment of USD 13 billion to fuel the production of semiconductors and Gen AI technology in the country.

Furthermore, in March 2024, RRP Electronics announced an investment of INR 5,000 crore in the outsourced semiconductor assembly and testing (OSAT) in Maharashtra. The increasing investments in semiconductor research activities will require adequate electronic chemicals and materials, driving market growth during the study period. Moreover, the Tamil Nadu government announced the new Semiconductor and Advanced Electronics Policy 2024 to promote the state's potential to export 40% of India's electronics at the Global Investors Meet. This will drive investments in electronics and semiconductor production, which may contribute to the growth of the electronic materials and chemicals market in the region.

The North American region is expected to be the fastest growing region, with a healthy CAGR during the projected period, owing to the growing manufacturing of electronic goods. The countries in the region, primarily the United States and Canada, are equipped with the major electronic product manufacturing giants, bolstering the need for chemicals and materials in the marketplace.

- For instance, in March 2023, EMD Electronics introduced a new facility in Arizona, US, to produce chemicals and materials for the manufacturing of semiconductors.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The electronic chemicals and materials market is consolidated. This can be attributable to the increasing collaborative frameworks, partnerships, and acquisitions. Furthermore, the rising demand for electronic chemicals in the industrial sector is propelling the production of chemicals in the global marketplace. For instance, in January 2024, Covestro entered into an agreement with Encina to transit circular raw materials, such as MDI, polycarbonate, and TDI.

Some of the major players operating in the global market include:

- Air Liquide (France)

- Air Products & Chemicals, Inc. (US)

- BASF SE (Germany)

- Covestro AG (Germany)

- FUJIFILM Corporation (Japan)

- Linde Plc (England)

- Merck Group KGaA (Germany)

- Mitsui Chemicals America, Inc. (US)

- Resonac Holding Corporation (Japan)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Solvay (Belgium)

- SONGWON Industrial Group (South Korea)

- SUMCO Corp. (Japan)

Recent Developments in the Industry

- In September 2023, Solvay, in collaboration with Shinkong, launched a new facility to produce electronic-grade hydrogen peroxide in Taiwan, which can produce 35,000 tons on an annual basis.

Report Coverage

The electronic chemicals and materials market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, end-use, and their futuristic growth opportunities.

Electronic Chemicals and Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 61.66 billion |

|

Revenue forecast in 2032 |

USD 99.63 billion |

|

CAGR |

6.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Electronic Chemicals and Materials Market Market report covering key segments are product, application, end-use and region.

Electronic Chemicals and Materials Market Size Worth $99.63 Billion By 2032

Electronic Chemicals and Materials Market exhibiting the CAGR of 6.2% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Electronic Chemicals and Materials Market are Increasing production of semiconductors