Electrolyzer Market Size, Share, Trends, Industry Analysis Report

: By Technology, Application (Power Generation, Transportation, and Industrial), Capacity, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM3120

- Base Year: 2024

- Historical Data: 2020-2023

Electrolyzer Market Overview

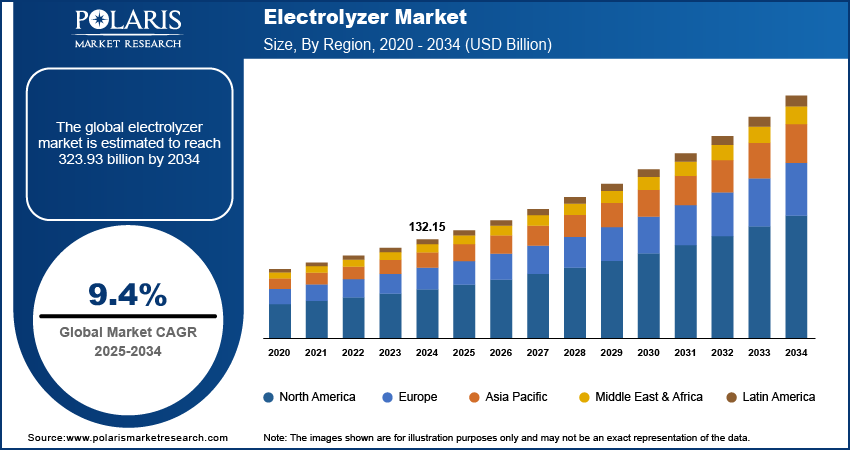

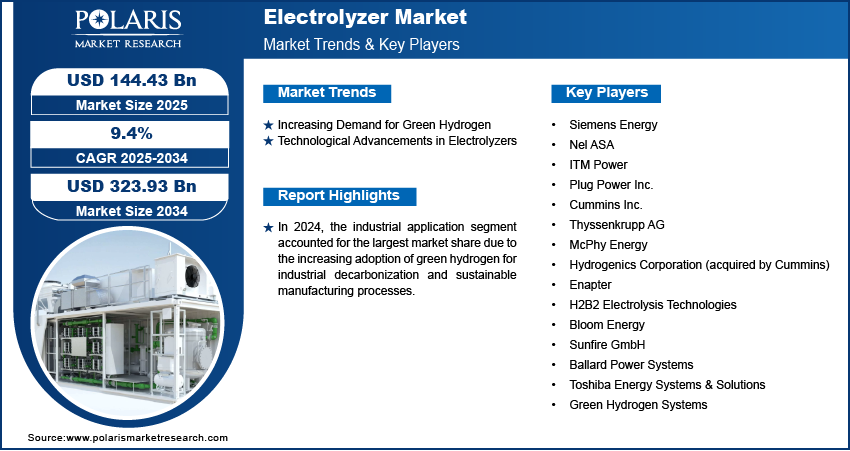

The global electrolyzer market size was valued at USD 132.15 billion in 2024. The market is expected to grow from USD 144.43 billion in 2025 to USD 323.93 billion by 2034, exhibiting a CAGR of 9.4% from 2025 to 2034.

The global electrolyzer market is a cornerstone of the hydrogen economy, facilitating the production of green hydrogen through water electrolysis powered by renewable energy sources. Electrolyzers are critical for decarbonizing industries such as power generation, transportation, and chemicals, as they enable the transition from fossil fuels to sustainable energy systems.

The rising adoption of green hydrogen in efforts to achieve net-zero carbon emissions is one of the key drivers of the electrolyzer market growth. Governments worldwide are supporting this transition with policies and subsidies. Additionally, the rising demand for clean energy solutions across industries, along with advancements in electrolyzer technologies that enhance efficiency and scalability, is driving market demand. The rapid growth in renewable energy installations, such as solar and wind power, is further contributing to the electrolyzer market expansion.

To Understand More About this Research: Request a Free Sample Report

The development of hydrogen refueling infrastructure is driving market growth, with increased investments in building supply chains to support hydrogen-powered vehicles. Moreover, the rise of industrial decarbonization efforts, particularly in heavy industries like steel and ammonia production, has created substantial electrolyzer market opportunities. By replacing fossil-based feedstocks with green hydrogen, these industries are driving demand for large-scale electrolyzers.

Electrolyzer Market Dynamics

Increasing Demand for Green Hydrogen

With hydrogen being a critical element in reducing global emissions, industries are increasingly adopting electrolyzers for sustainable hydrogen production. Market analysis indicates significant growth in the use of electrolyzers for industrial applications, particularly in chemical manufacturing, fuel cell vehicles, and energy storage. The scalability and modularity of electrolyzers are crucial for meeting the rising demand for green hydrogen. Governments are also introducing initiatives to promote green hydrogen, offering subsidies, tax incentives, and direct investments. For example, the European Union’s Hydrogen Strategy aims to install substantial electrolyzer capacities. Thus, the growing demand for green hydrogen is boosting the electrolyzer market development.

Technological Advancements in Electrolyzers

The rapid advancement in technology, particularly in proton exchange membrane (PEM) and solid oxide electrolyzers, is driving improvements in energy efficiency, reduced operational costs, and scalability of electrolyzer systems. PEM electrolyzers, in particular, are gaining traction due to their ability to operate under high pressure, making them ideal for compact and high-demand applications such as hydrogen fueling stations. Additionally, the integration of digital monitoring solutions for optimizing electrolyzer performance has revolutionized operational efficiency. As a result, technological advancements have boosted the demand for electrolyzers, with electrolyzer market analysis indicating increased adoption across diverse applications.

Electrolyzer Market Segment Insights

Electrolyzer Market Assessment by Technology Outlook

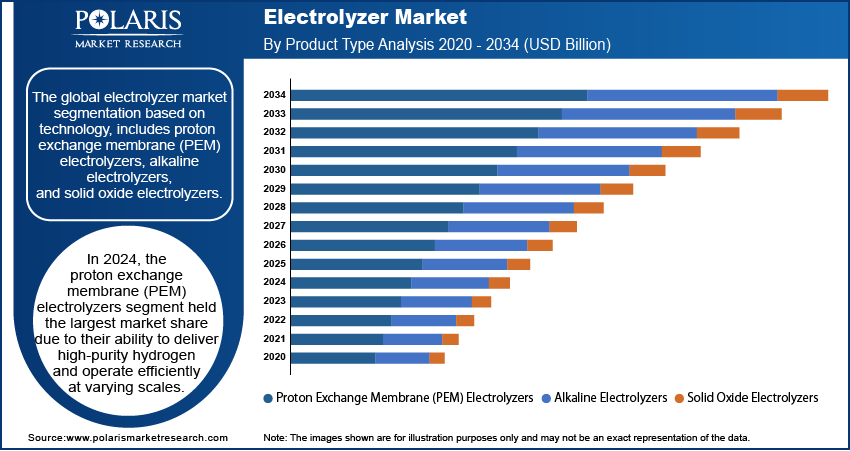

The global electrolyzer market segmentation, based on technology, includes proton exchange membrane (PEM) electrolyzers, alkaline electrolyzers, and solid oxide electrolyzers. In 2024, the proton exchange membrane (PEM) electrolyzers segment held the largest market share due to their ability to deliver high-purity hydrogen and operate efficiently at varying scales. These electrolyzers are highly suitable for integration with renewable energy sources, driving their adoption in green hydrogen projects. Moreover, advancements in materials, such as platinum-group metals, have enhanced the efficiency and durability of PEM electrolyzers, supporting the segment’s growth in the global market.

Electrolyzer Market Evaluation by Application Outlook

The global electrolyzer market segmentation, based on application, includes power generation, transportation, and industrial. In 2024, the industrial segment accounted for the largest market share due to the increasing adoption of green hydrogen for industrial decarbonization and sustainable manufacturing processes. Key industries such as chemicals, steel, and ammonia production are transitioning to green hydrogen to reduce their reliance on fossil fuels and meet stringent global emission regulations. The chemical industry is driving the demand for electrolyzers, as hydrogen is a critical feedstock for processes like ammonia synthesis and methanolv production. Furthermore, the steel industry is leveraging electrolyzers to produce green hydrogen for direct reduction of iron (DRI), a cleaner alternative to conventional coal-based methods. The scalability and efficiency of modern electrolyzer technologies, such as proton exchange membrane (PEM) and alkaline systems, have also enabled large-scale adoption in industrial applications.

Electrolyzer Market Regional Analysis

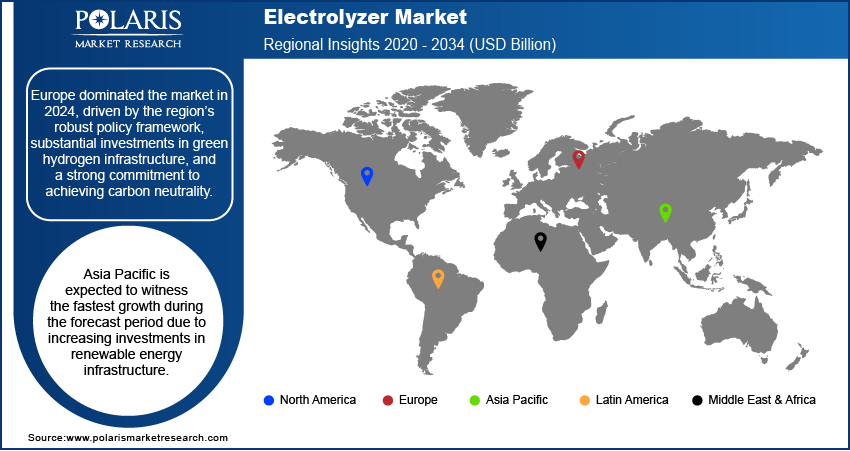

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share due to its robust policy framework, substantial investments in green hydrogen infrastructure, and a strong commitment to achieving carbon neutrality. For instance, in 2022, hydrogen made up less than 2% of Europe’s energy use, mainly for chemical production like plastics and fertilizers, with 96% sourced from natural gas, causing high CO2 emissions. The EU's REPowerEU Strategy targets 10 million tonnes of renewable hydrogen production and imports by 2030, aiming for hydrogen to meet 10% of energy needs by 2050. Renewable hydrogen is central to the EU's plans for decarbonizing industries, transportation, and achieving net-zero goals. This plan has been instrumental in driving electrolyzer market growth, with aggressive targets for installing large-scale electrolyzer capacities to support renewable hydrogen production. The region benefits from a well-established renewable energy base, particularly wind and solar, which is essential for powering electrolyzers sustainably. Additionally, Europe is home to several leading electrolyzer manufacturers, such as Siemens Energy and Nel ASA, which leverage advanced technologies to cater to the growing demand for green hydrogen. Significant investments in hydrogen valleys and cross-border hydrogen networks have further strengthened Europe’s position as a leader in the global market.

The Asia Pacific electrolyzer market is expected to witness the fastest growth during the forecast period due to increasing investments in renewable energy infrastructure, strong government policies promoting hydrogen adoption, and the rising demand for green hydrogen in industrial applications. For instance, Australia’s September 2024 Hydrogen Strategy targets a production capacity of at least 15 million tonnes of green hydrogen annually by mid-century, with the potential to export 1.2 million tonnes each year beginning in 2030. Countries such as China, Japan, South Korea, and India are leading the transition to hydrogen-based economies, driven by decarbonization goals and energy security concerns. Significant projects, such as hydrogen production facilities integrated with solar and wind power, are under development, further boosting regional market expansion. Additionally, the region’s rapidly growing industrial sectors, including chemicals and steel, are adopting green hydrogen to reduce carbon emissions, reinforcing the demand for advanced electrolyzer technologies.

Electrolyzer Market – Key Players and Competitive Insights

The competitive landscape of the electrolyzer market is characterized by intense competition among key players focusing on innovation, strategic collaborations, and capacity expansions to meet the surging demand for green hydrogen. Leading companies such as Nel ASA, Siemens Energy, ITM Power, and Plug Power dominate the market by leveraging advanced technologies like proton exchange membrane (PEM), alkaline, and solid oxide electrolyzers. These players are heavily investing in research and development to enhance efficiency, scalability, and cost-effectiveness, which are critical to driving electrolyzer market growth. Strategic partnerships with energy companies, governments, and industrial end-users further strengthen their market position. Additionally, the entry of new players and the expansion of existing ones into emerging markets contribute to increased competition. Government emphasis on hydrogen infrastructure development and supportive policies also create opportunities for both established companies and startups. This competitive environment is fostering rapid technological advancements, ensuring the market for electrolyzers remains dynamic and progressive.

Siemens Energy is engaged in the electrolyzer market, leveraging its advanced PEM electrolyzer technology to deliver efficient and scalable solutions for green hydrogen production. The company has been instrumental in large-scale projects such as the Westküste 100 in Germany, where renewable energy integration is at the forefront. Siemens Energy partners with global energy players to expand hydrogen infrastructure, strengthening its market presence.

Nel ASA is engaged in the electrolyzer market, known for its innovative alkaline and PEM electrolyzers. The company’s focus on large-scale green hydrogen projects has solidified its market position. Nel ASA’s fully automated electrolyzer production line aims to reduce costs and increase scalability, aligning with the growing global demand for electrolyzers.

List of Key Companies in Electrolyzer Market

- Siemens Energy

- Nel ASA

- ITM Power

- Plug Power Inc.

- Cummins Inc.

- Thyssenkrupp AG

- McPhy Energy

- Hydrogenics Corporation (acquired by Cummins)

- Enapter

- H2B2 Electrolysis Technologies

- Bloom Energy

- Sunfire GmbH

- Ballard Power Systems

- Toshiba Energy Systems & Solutions

- Green Hydrogen Systems

Electrolyzer Industry Developments

In October 2024, Accelera announced the opening of a new electrolyzer manufacturing facility in Spain, marking a pivotal step in Europe's energy transition. The company stated that the new facility will boost the production of green hydrogen systems, supporting the region's move towards sustainable energy

In July 2024, Siemens Energy received a contract to provide a 280-megawatt electrolysis system for EWE in Emden, Germany, set to commence operations in 2027. This facility will produce up to 26,000 tons of green hydrogen annually for various industrial applications and is part of EWE's “Clean Hydrogen Coastline” project, which includes four sub-projects.

In November 2023, Siemens Energy launched a gigawatt-scale electrolyzer manufacturing facility in Berlin, Germany, featuring cutting-edge robotics and digitalization for highly automated production. This plant aims to enhance sustainable manufacturing and drive the growth of the renewable hydrogen economy.

Electrolyzer Market Segmentation

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Proton Exchange Membrane (PEM) Electrolyzers

- Alkaline Electrolyzers

- Solid Oxide Electrolyzers

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Power Generation

- Transportation

- Industrial

By Capacity Outlook (Revenue – USD Billion, 2020–2034)

- <500 kW

- 500 kW–2 MW

- 2 MW

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electrolyzer Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 132.15 billion |

|

Market Size Value in 2025 |

USD 144.43 billion |

|

Revenue Forecast by 2034 |

USD 323.93 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The market was valued at USD 132.15 billion in 2024 and is projected to grow to USD 323.93 billion by 2034.

• The global market is projected to register a CAGR of 9.4% during the forecast period.

• In 2024, Europe accounted for the largest market share due to its robust policy framework, substantial investments in green hydrogen infrastructure, and a strong commitment to achieving carbon neutrality.

• Some of the key players in the market are Siemens Energy, Nel ASA, ITM Power, Plug Power Inc., Cummins Inc., Thyssenkrupp AG, McPhy Energy, Hydrogenics Corporation (acquired by Cummins), Enapter, H2B2 Electrolysis Technologies, Bloom Energy, Sunfire GmbH, Ballard Power Systems, Toshiba Energy Systems & Solutions, and Green Hydrogen Systems.

• In 2024, the proton exchange membrane (PEM) electrolyzers segment held the largest market share due to their ability to deliver high-purity hydrogen and operate efficiently at varying scales

• In 2024, the industrial segment accounted for the largest market share in the electrolyzer market due to the increasing adoption of green hydrogen for industrial decarbonization and sustainable manufacturing processes.