Electrical and Electronic Adhesive Market Size, Share, Trends, Industry Analysis Report: By Product (Thermal Conductive, Electrically Conductive, UV Curving, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 125

- Format: PDF

- Report ID: PM5555

- Base Year: 2024

- Historical Data: 2020-2023

Electrical and Electronic Adhesive Market Overview

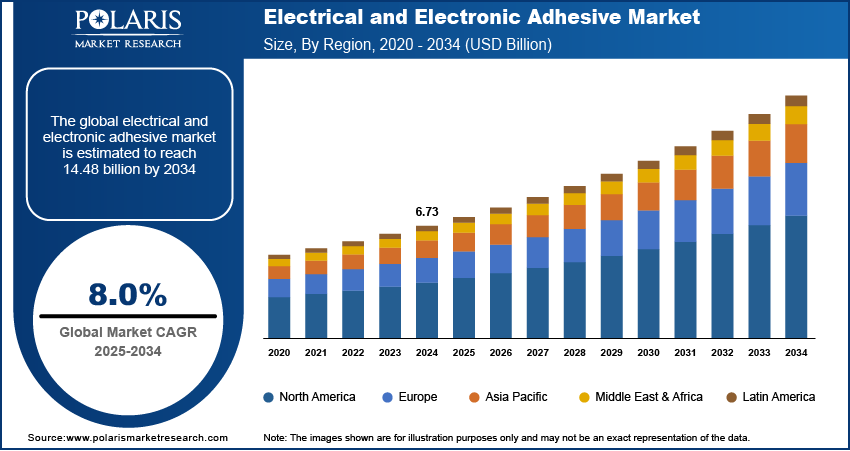

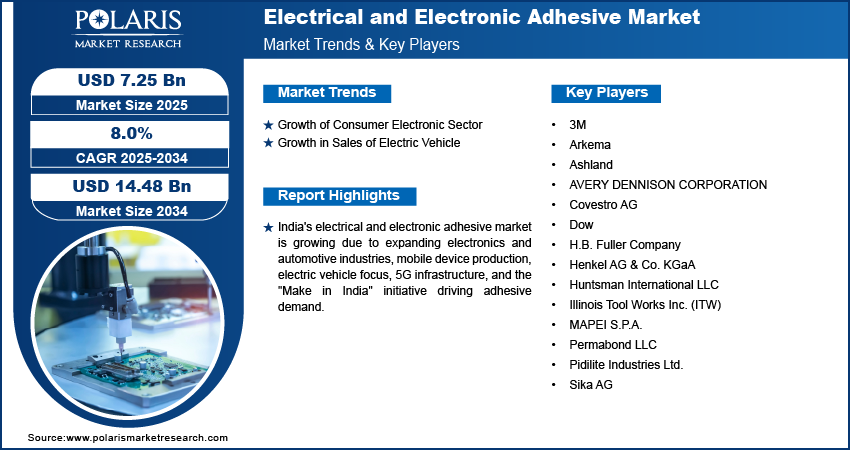

The global electrical and electronic adhesive market size was valued at USD 6.73 billion in 2024. The market is projected to grow from USD 7.25 billion in 2025 to USD 14.48 billion by 2034, exhibiting a CAGR of 8.0% during 2025–2034.

Electrical and electronic adhesives are specialized bonding materials designed to secure components in electronic devices while also providing insulation and conductivity properties. They are used in applications such as circuit boards, sensors, and power modules to ensure durability, performance, and protection from environmental factors.

The rollout of 5G networks has created a significant demand for advanced electronics and components, many of which require strong and durable adhesives. These adhesives play a crucial role in the assembly of antennas, circuit boards, and sensors, essential for 5G infrastructure. Since 5G technology operates at higher frequencies and involves more complex devices, the adhesives used must deliver superior performance, offering electrical insulation, heat resistance, and stability under high-frequency conditions. Additionally, the need for efficient adhesives is further increasing rapidly as telecommunications companies are expanding their 5G coverage, thereby driving the electrical and electronic adhesive market demand.

To Understand More About this Research: Request a Free Sample Report

The miniaturization of electronics is driving the electrical and electronic adhesive market development. Electronic devices are becoming smaller, more efficient, and more powerful, creating a need for adhesives that securely bond tiny, delicate components without adding unnecessary bulk. Products such as microchips, compact circuit boards, and sensors are packed into tighter spaces, requiring adhesives that offer durability, flexibility, and resistance to stress. The shift toward more compact devices, driven by consumer demand for lighter and smaller gadgets, is driving the demand for high-performance adhesives in the electronics industry, thereby fueling the electrical and electronic adhesive market growth.

Electrical and Electronic Adhesive Market Dynamics

Growth of Consumer Electronic Sector

The consumer electronics sector, particularly smartphones, tablets, laptops, and wearable devices, is experiencing rapid growth. According to the International Labor Organization, more than 3,756 enterprises operate in consumer electronics globally, showcasing growth in the consumer electronics sector. These devices are becoming more advanced and compact, driving manufacturers to seek high-performance adhesives to assemble smaller components. Such adhesives ensure secure bonding of delicate parts such as displays, batteries, and connectors. The high demand for consumer electronics, especially during new model releases, directly increases the demand for reliable adhesives. Hence, the growing consumer electronic sector propels the electrical and electronic adhesive market demand.

Growth in Sales of Electric Vehicles

Electric vehicles are becoming increasingly popular due to their environmental benefits and advancements in technology. According to the International Energy Agency, in 2023, the electric vehicle sales reached to 14 million cars. This growing EV demand is driving the rising demand for specialized adhesives. These adhesives play a critical role in bonding essential components such as battery packs, electronic control units, and power electronics. Furthermore, adhesive bonding helps reduce the vehicle's weight and improves energy efficiency, making it a vital part of modern EV design. Therefore, rising sales of electric vehicles (EVs) are contributing to the growth of the electrical and electronic adhesive market opportunities.

Electrical and Electronic Adhesive Market Segment Analysis

Electrical and Electronic Adhesive Market Assessment by Product Outlook

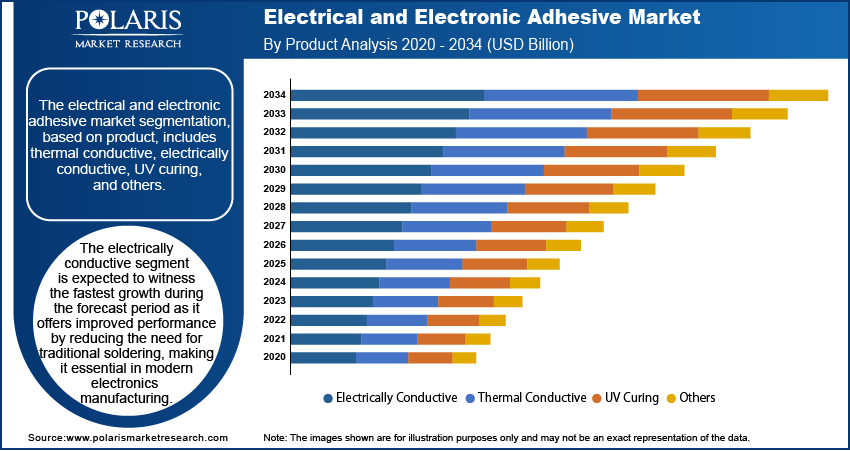

The electrical and electronic adhesive market segmentation, based on product, includes thermal conductive, electrically conductive, UV curing, and others. The electrically conductive segment is expected to witness fastest growth during the forecast period. Electrically conductive adhesives offer improved performance by reducing the need for traditional soldering, making them essential in modern electronics manufacturing. These adhesives are used in various applications such as circuit boards, sensors, and electronic components where efficient conductivity is crucial. Electronic devices are becoming smaller and more complex, driving the need for adhesives that both bond and conduct electricity. Additionally, advanced technologies such as 5G, electric vehicles, and wearable devices are further fueling this growing demand.

Electrical and Electronic Adhesive Market Evaluation by Application Outlook

The electrical and electronic adhesive market segmentation, based on application, includes surface-mount devices, potting & encapsulation, conformal coatings, and others. The surface-mount devices segment dominated the electrical and electronic adhesive market share in 2024. Surface mount technology plays a crucial role in attaching small components such as resistors and microchips to printed circuit boards (PCBs). These adhesives ensure secure bonding for compact and precise components, which are found in modern electronic devices such as smartphones, laptops, and wearables. The continuous inclination toward smaller and more efficient electronics is driving the growing demand for SMDs, thereby driving the segmental growth.

Electrical and Electronic Adhesive Market Regional Analysis

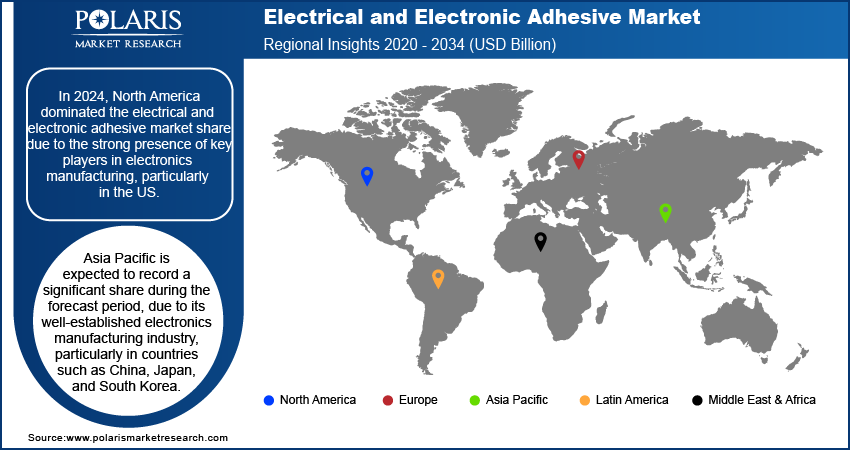

By region, the study provides the electrical and electronic adhesive market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the electrical and electronic adhesive market revenue share, due to the strong presence of key players in electronics manufacturing, particularly in the US. The demand for high-performance adhesives is driven by industries such as consumer electronics, automotive, and telecommunications, where innovation in products such as smartphones, electric vehicles, and 5G infrastructure is growing. Additionally, the region’s focus on sustainable manufacturing practices has led to a rise in demand for eco-friendly adhesives. North America’s advanced technological capabilities, coupled with increasing investments in electric vehicles and renewable energy, are boosting the electrical and electronic adhesive market expansion in North America.

Asia Pacific is expected to record a significant market share during the forecast period. The region's well-established electronics manufacturing industry, particularly in countries such as China, Japan, and South Korea, plays a significant role in this growth. A high concentration of leading electronics companies and manufacturers of smartphones, computers, and consumer gadgets has increased the demand for adhesives. Additionally, the growth of 5G networks, the rise of electric vehicle sales, and the expansion of wearable technology are driving the demand for specialized adhesives, thereby propelling the electrical and electronic adhesive market growth in Asia Pacific.

The India electrical and electronic adhesive market is experiencing substantial growth due to its expanding electronics and automotive industries. According to the International Organisation of Motor Vehicle Manufacturers, in 2023, automotive sales increased by 7.5% compared to 2022, showcasing growth in the automotive industry in India. Additionally, the rise in mobile device production, consumer electronics, and the government’s push for manufacturing under the "Make in India" initiative has driven demand for high-quality adhesives, thereby driving the growth of the electrical and electronics adhesive market in India.

Electrical and Electronic Adhesive Market – Key Players & Competitive Analysis Report

The electrical and electronic adhesive market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the electrical and electronic adhesive market trends by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the market are 3M, Arkema, Ashland, AVERY DENNISON CORPORATION, Covestro AG, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC, Illinois Tool Works Inc. (ITW), MAPEI S.P.A., Permabond LLC, Pidilite Industries Ltd., and Sika AG.

Dow's business is organized into several key segments, including packaging & specialty plastics, industrial intermediates & infrastructure, and performance materials & coatings. The packaging & specialty plastics segment focuses on polyolefins and serves markets such as food packaging, consumer durables, and mobility. Industrial intermediates & infrastructure provide essential chemicals for industrial applications, while performance materials & coatings offer materials for coatings, adhesives, and other specialized applications. Dow also produces basic plastics (e.g., polyethylene and polypropylene), basic chemicals (e.g., ethylene glycol and caustic soda), and performance chemicals for water purification and pharmaceuticals. The company operates globally, with a presence in over 160 countries. Its manufacturing sites are located in regions such as North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. Dow's silicone-based adhesives and sealants protect electronics from environmental stress and moisture. They offer advantages such as heat cure, hot melt, UV cure, and room-temperature options. DOWSIL EA 3500G sealant and innovative Thermal Radical Cure technology are also provided.

Arkema SA (Arkema) is a specialty chemicals and advanced materials company. The company offers adhesives, biobased materials, coatings, composites, health care, and sports equipment solutions. Its product portfolio includes technical polymers, filtration and adsorption, organic peroxides, biochemicals, fluoro gases, hydrogen peroxide, acrylics, coating resins, photocurable resins, rheology additives, and others. The company’s products are used in various sectors such as agriculture, air conditioning, automotive, chemicals, construction, coating, consumer goods, electrical, oil, health, packaging, plastics, pulp, rubber, sports, and water treatment. The company has operations in the US, Europe, Canada Mexico, and Asia. Arkema is headquartered in Colombes, France. Its product line caters to the electronics and electrical sector, offering solutions such as Pebax antistatic polymers, Rilsan polyamide resins for wire & cable, Platamid hot melt adhesives, and materials for wearable devices and device components.

Key Companies in Electrical and Electronic Adhesive Market

- 3M

- Arkema

- Ashland

- AVERY DENNISON CORPORATION

- Covestro AG

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc. (ITW)

- MAPEI S.P.A.

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

Electrical and Electronic Adhesive Industry Developments

In October 2024, Bostik's Born2Bond Ultra K85 adhesive was launched, achieving unmatched resistance to heat and humidity. It was processed using 60% bio-based materials, providing exceptional durability for consumer electronics industries and applications.

In June 2024, Avery Dennison’s new pressure-sensitive adhesive tape solutions for EV battery cell wrapping were launched, addressing arcing challenges with enhanced electrical insulation, corrosion resistance, and aesthetic options for battery packs.

Electrical and Electronic Adhesive Market Segmentation

By Product Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- Thermal Conductive

- Electrically Conductive

- UV Curing

- Others

By Application Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- Surface-Mount Devices

- Potting & Encapsulation

- Conformal Coatings

- Others

By Regional Outlook (Volume Kilotons, Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electrical and Electronic Adhesive Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.73 billion |

|

Market Size Value in 2025 |

USD 7.25 billion |

|

Revenue Forecast in 2034 |

USD 14.48 billion |

|

CAGR |

8.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The electrical and electronic adhesive market size was valued at USD 6.73 billion in 2024 and is projected to grow to USD 14.48 billion by 2034.

The global market is projected to register a CAGR of 8.0% during the forecast period.

North America had the largest share of the global market in 2024.

A few key players in the market are 3M, Arkema, Ashland, AVERY DENNISON CORPORATION, Covestro AG, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC, Illinois Tool Works Inc. (ITW), MAPEI S.P.A., Permabond LLC, Pidilite Industries Ltd., and Sika AG.

The surface mount device segment dominated the market share in 2024 as adhesives play a crucial role in attaching small components such as resistors and microchips to printed circuit boards (PCBs).

The electrically conductive segment is expected to witness the fastest growth during the forecast period as it offers improved performance by reducing the need for traditional soldering, making them essential in modern electronics manufacturing.