Electric Vehicle Market Size, Share, Trends, Industry Analysis Report: By Type (Scooters, Motorcycles, Three Wheelers, Passenger Cars, Buses, and Trucks), Propulsion Type, Drive Type, Vehicle Speed, Power Source, Vehicle Class, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 117

- Format: PDF

- Report ID: PM1361

- Base Year: 2024

- Historical Data: 2020-2023

Electric Vehicle Market Overview

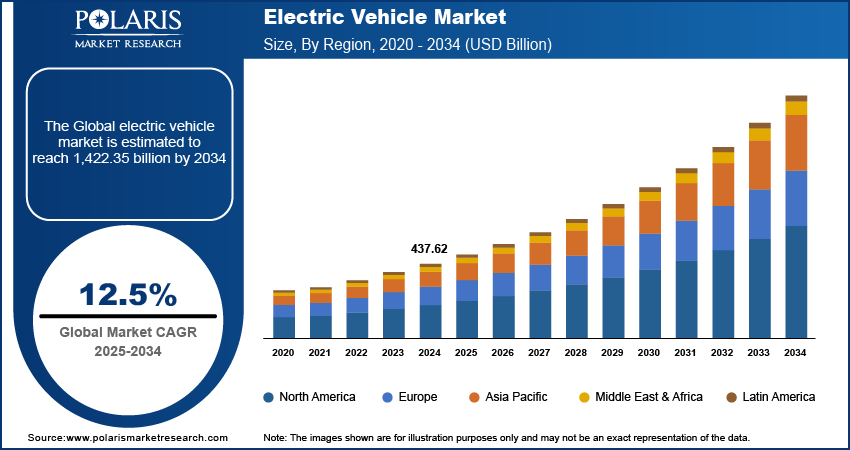

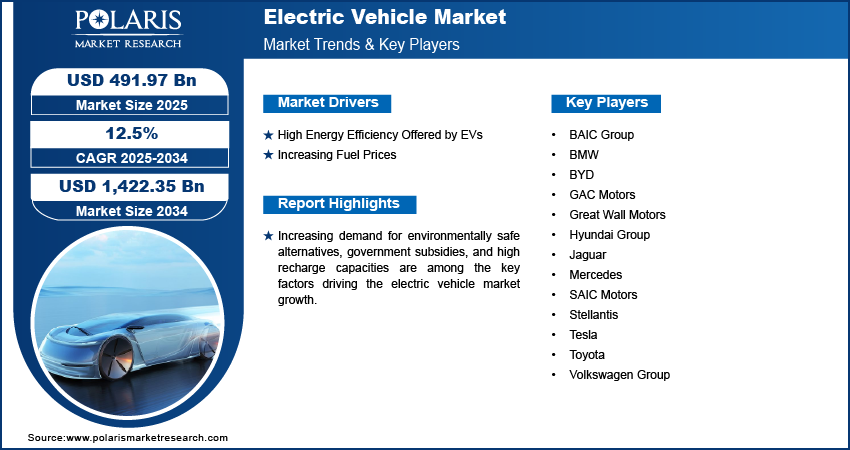

The global electric vehicle market size was valued at USD 437.62 billion in 2024. The market is anticipated to grow from USD 491.97 billion in 2025 to USD 1,422.35 billion by 2034, exhibiting a CAGR of 12.5% from 2025 to 2034.

An electric vehicle (EV) is a vehicle that relies on an electronic motor instead of an internal combustion engine for propulsion. It can be charged from an external source, such as a wall outlet or charging equipment. EVs have several advantages over traditional gas-powered vehicles, including decreased fuel costs, less maintenance, and lower environmental impact.

Increasing demand for environmentally safe alternatives, government subsidies, and high recharge capacities are a few key factors driving the electric vehicle market growth. Also, technological developments such as faster charging and cloud-connected charging devices reinforce the demand for electric vehicles.

To Understand More About this Research: Request a Free Sample Report

Many EV manufacturing plants are increasing their electronic car production capacity in response to the growing policy support. This policy support is beneficial to the market, as it implies that the supply of EVs will be able to catch up with the rising demand.

There has been a significant rise in the number of leading EV manufacturers, and EV sales have surged over the past two years. The COVID-19 pandemic acted as a catalyst for the adoption of remote, unguarded, and independent delivery technologies. This shift has led to increased demand for EVs for last-mile delivery. The increased demand for EVs can also be attributed to reduced battery costs and supportive regulations, which have helped reduce the overall ownership cost.

Electric Vehicles Market Drivers

High Energy Efficiency Offered by EVs

EVs, which do not rely on traditional fuel sources such as gasoline, provide a more cost-effective alternative to traditional transportation. According to the US Department of Energy, an EV transforms over 50% of electrical energy from the grid to power the wheels. In contrast, there is only a 17% to 21% conversion of energy stored in gasoline in gas-powered motors. Thus, the high energy efficiency of EVs is catalyzing the electric vehicle market expansion.

Increasing Fuel Prices

Gasoline is a fossil fuel and is expected to be depleted in the future. The decrease in supply and availability of crude oil, along with fluctuating pricing strategies due to geopolitical tensions, result in rising fuel costs. In addition, the uneven taxation policies that vary across countries and regions further affect fuel pricing. Due to these factors, a large segment of the population globally is shifting its preference toward electric transportation, positively impacting the electric vehicle market growth.

Electric Vehicle Market Segment Insights

Electric Vehicles Market Insights by Propulsion Type

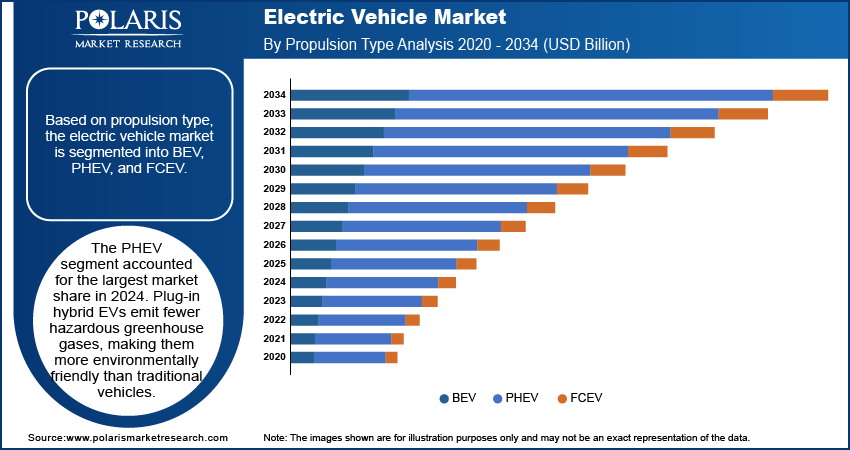

The EV market segmentation, based on propulsion type, includes BEV, PHEV, and FCEV. The PHEV segment accounted for the largest market share in 2024. The combination of electric and IC engine power enables the vehicle to travel long distances. As compared to traditional cars, plug-in hybrid EVs release fewer hazardous greenhouse gases, making them more environmentally friendly than traditional vehicles. While PHEVs are mostly used as passenger cars, they are also available in the form of light commercial vehicles, heavy commercial carriers, and two-wheelers in which these features are available. This versatility of PHEVs further propels the segment demand.

Electric Vehicle Market Insights by Power Source

The electric vehicle market segmentation, based on power source, includes less than 100 kW, 100 kW to 250 kW, and more than 250 kW. The 100 kW to 250 kW segment is anticipated to register the highest CAGR from 2025 to 2034. The segment's rapid growth is primarily driven by the growing adoption of electric buses and trucks, particularly for freight services and public transportation. Power outputs between 100 kW to 250 kW are commonly found in EVs, including passenger and light commercial vehicles such as pickup trucks, vans, and utility carriers.

Electric Vehicle Market Breakdown by Regional Insights

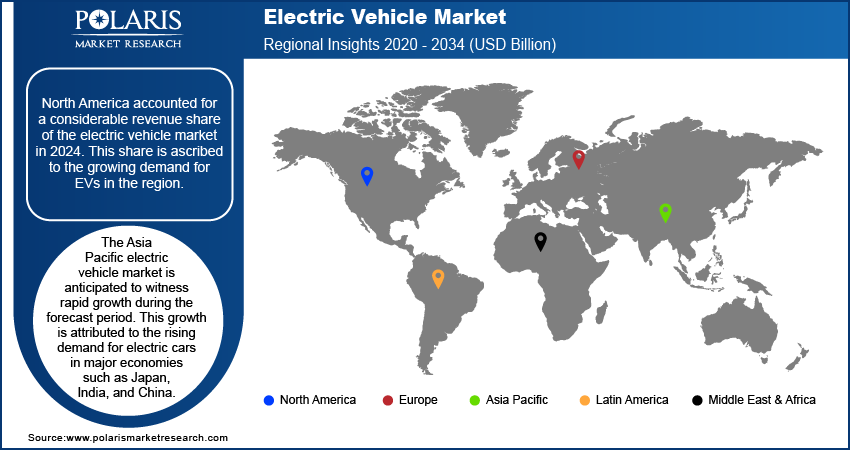

North America accounted for a considerable revenue share of the electric vehicle market in 2024. This share is ascribed to the growing demand for EVs in the region. In addition, several initiatives have been launched by automotive manufacturers, nonprofit organizations, policymakers, and charging network companies, including the formation of a new nonprofit organization named Veloz. These initiatives focus on innovations, attracting investments, marketing, and driving the adoption of electric vehicles in North America. These factors mentioned above increased the adoption of EVs in North America.

The Asia Pacific electric vehicle market is anticipated to witness rapid growth during the forecast period. This growth is attributed to the rising demand for electric cars in major economies such as Japan, India, and China. The presence of supportive regulations has prompted several EV companies to invest in the region. Besides, the increasing collaborations between major automotive manufacturers and tech companies to improve EV capabilities are anticipated to drive the upward trajectory of the regional market.

Electric Vehicle Market – Key Players & Competitive Insights

The top players in the EV market are focusing on research and development to enhance their products and services offerings and drive market demand. Besides, they are adopting various strategic initiatives, including collaborations, new product launches, mergers and acquisitions, and increased investments, to improve their global footprint. To expand and survive in a more competitive environment, the electric vehicle market must offer innovative solutions.

In recent years, the electric vehicles market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few key players in the market are BAIC Group, BMW, BYD, GAC Motors, Great Wall Motors, Hyundai Group, Jaguar, Mercedes, SAIC Motors, Stellantis, Tesla, Toyota, and Volkswagen Group.

List of Key Players in Electric Vehicles Market

- BAIC Group

- BMW

- BYD

- GAC Motors

- Great Wall Motors

- Hyundai Group

- Jaguar

- Mercedes

- SAIC Motors

- Stellantis

- Tesla

- Toyota

- Volkswagen Group

Electric Vehicle Industry Developments

June 2024: BYD announced the launch of its third electric vehicle, BYD Seal, in Japan. The rear-wheel-drive version of the vehicle has a cruising range of 640 km (398 miles), whereas the all-drive version offers a range of 575 km on a single charge.

April 2024: Tesla introduced the high-performance variant of the electric sedan Model 3. The new variant comes with a driving range of 296 miles and has 510 horsepower.

Electric Vehicle Market Segmentation

By Type Outlook

- Scooters

- Motorcycles

- Three-Wheelers

- Passenger Cars

- Buses

- Trucks

By Propulsion Type Outlook

- BEV

- PHEV

- FCEV

By Drive Type Outlook

- FWD

- RWD

- AWD

By Vehicle Speed Outlook

- Less Than 100 MPH (Max. Speed)

- 100MPH to 125MPH (Max. Speed)

- Above 125 MPH (Max. Speed)

By Power Source Outlook

- Less than 100 kW

- 100 kW to 250 kW

- More than 250 kW

By Vehicle Class Outlook

- Low Priced

- Mid-Price

- High Price

By End Use Outlook

- Personal

- Commercial

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electric Vehicle Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 437.62 billion |

|

Market Size Value in 2025 |

USD 491.97 billion |

|

Revenue Forecast by 2034 |

USD 1,422.35 billion |

|

CAGR |

12.5% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The electric vehicle market size was valued at USD 437.62 billion in 2024 and is projected to grow to USD 1,422.35 billion by 2034.

The market is projected to register a CAGR of 12.5% from 2025 to 2034.

North America accounted for the largest EV market share in 2024.

BAIC Group, BMW, BYD, GAC Motors, Great Wall Motors, Hyundai Group, Jaguar, Mercedes, SAIC Motors, Stellantis, Tesla, Toyota, and Volkswagen Group are among the key players in the market.

The PHEV segment accounted for the largest market share in 2024.

The 100 kW to 250 kW segment is anticipated to register the highest CAGR from 2025 to 2034.