Electric Vehicle Fluids Market Share, Size, Trends, Industry Analysis Report, By Product (Engine oil, Coolants, Transmission fluids, Greases); By Vehicle Type; By Propulsion Type; By Fill Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 119

- Format: PDF

- Report ID: PM4963

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

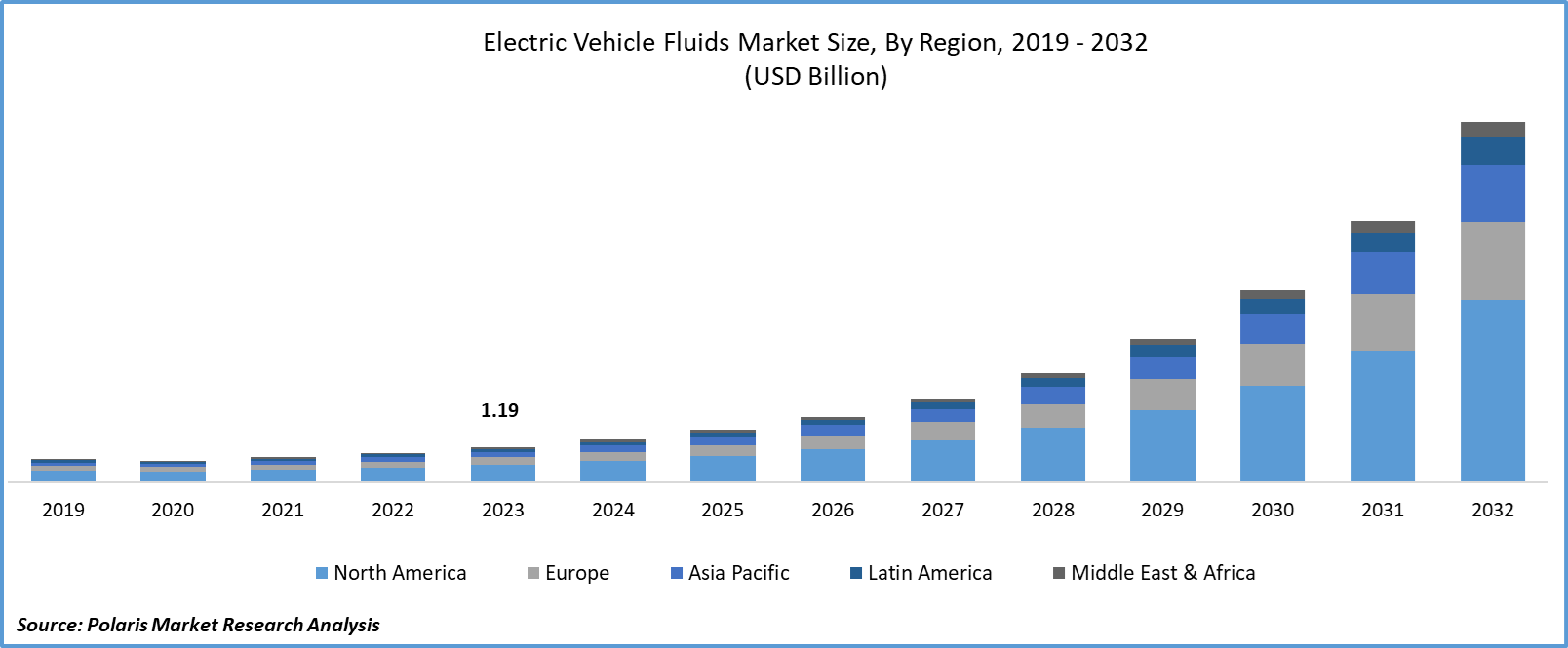

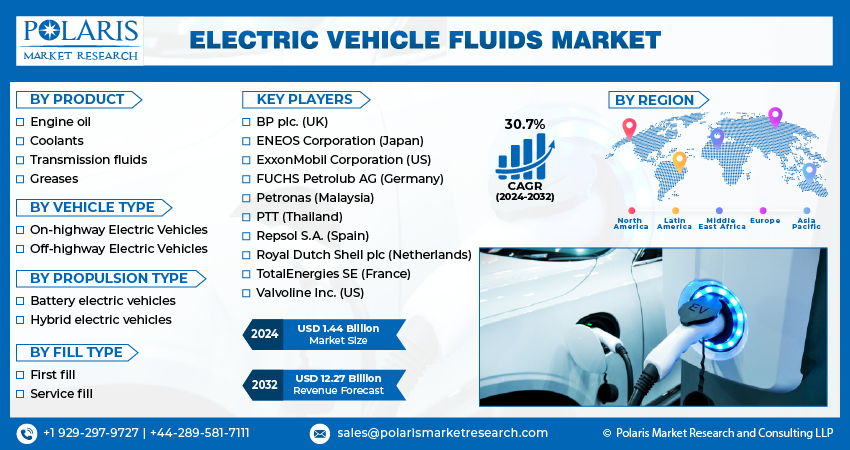

Electric vehicle fluids market size was valued at USD 1.19 billion in 2023. The market is anticipated to grow from USD 1.44 billion in 2024 to USD 12.27 billion by 2032, exhibiting the CAGR of 30.7% during the forecast period.

Market Overview

The rising production of advanced electric vehicles among individuals and the growing consumer willingness to adopt e-mobility over traditional oil-filled vehicles are creating significant growth opportunities for the electric vehicle fluids market. Additionally, the growing launch of new electric vehicle fluids aimed at reducing maintenance costs and boosting vehicle performance is likely to bolster market expansion in the next few years.

To Understand More About this Research: Request a Free Sample Report

- For instance, in January 2023, Valvoline expanded its product line with the launch of a new performance fluid pertaining to electric vehicles to increase battery shelf life and tackle other electric vehicle functioning problems. This is compatible with hybrid electric vehicles, battery electric vehicles, and plug-in electric vehicles.

Moreover, increasing efforts by the government and non-government organizations to fuel research and development activities, aiming to boost the production of efficient electric vehicles to boost economic activities and enhance the global electric vehicle market, are optimally influencing the electric vehicle fluids market. Additionally, increasing e-commerce solutions are increasing awareness about the available electric vehicle models and playing a significant role in driving electric vehicle consumption.

Growth Drivers

The Growing Consumption of Electric Vehicles

Rising greenhouse gas emissions are creating significant demand for electric vehicles in the global marketplace. According to the International Energy Agency, around 13% of the vehicles consumed globally are electric, which is expected to grow by 40 to 45% in the next 10 years. This trend is likely to support the growth of the electric field market in the next few years. Additionally, the significant uptick in the development of efficient fluid systems is further driving demand for electric vehicles with increasing convenience and efficiency.

Increasing Government Policies Supporting EV Consumption

Government support to limit global greenhouse gas emissions as part of the Paris agreement is anticipated to boost the adoption of e-mobility. Most nations are stepping forward with the introduction of incentive schemes to boost the consumption of electric vehicles. For instance, in March 2023, the Indian government announced the launch of an electric vehicle policy with an investment of USD 5 million to fuel electric vehicle production from manufacturers.

Restraining Factors

Resistance to Consume New Electric Vehicles

A higher rate of convenience associated with traditional oil-based electric vehicles and lower availability of charging stations are expected to limit the demand for electric vehicle fluids in the global market. Additionally, the limited longevity of battery capacity is discouraging users from purchasing electric vehicles, as it can cause obstacles for longer journeys. However, the growing production of performance fluids in the world is likely to propel electric vehicle consumption in the coming years.

Report Segmentation

The market is primarily segmented based on product, vehicle type, propulsion type, fill type, and region.

|

By Product |

By Vehicle Type |

By Propulsion Type |

By Fill Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Engine Oil Segment Is Expected to Witness the Highest Growth during the Forecast Period

The engine oil segment is projected to grow at a CAGR during the projected period, mainly driven by the increasing use of hybrid vehicles, which work on combustion engines and battery energy. Engine oil is used to lubricate engine components and promote the functionality of electric vehicles. The growing innovations in electric vehicle fluids are expected to stimulate market growth over the study period. For instance, in August 2023, Castrol announced the launch of the hybrid engine oil performance standard, Hyspec, with the increasing consumption of hybrid electric vehicles.

By Vehicle Type Analysis

On-Highway Electric Vehicles Segment Accounted For the Largest Market Share in 2023

The on-highway electric vehicles segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is due to the increasing working population in urban areas, leading to an increase in disposable income and thereby driving the demand for electric vehicles globally. Furthermore, rising government initiatives to propel electric vehicle use by investing in the development of charging stations are likely to create significant demand potential for the global market.

Growing electric vehicle consumption is encouraging companies to establish charging stations. Electric vehicle sales in Gujarat, India, increased by 28%, reaching 88,619 from 10,885 in 2021, accounting for a 714% rise in past 3 years. Charging stations are growing from 200 in April 2023 to 600 in February 2024. The increased convenience with the increasing establishment of charging stations is anticipated to create new growth opportunities for the global electric vehicle fluids market.

By Propulsion Type Analysis

Hybrid Electric Vehicles Segment Held the Significant Market Revenue Share in 2023

The hybrid electric vehicles segment held a significant market share in revenue in 2023, which is highly accelerated due to the continuous rise in the production and consumption of hybrid electric vehicles. This is mainly attributable to its higher rate of convenience, as it can handle dual energy systems, that is, batteries and fuel. Additionally, the growing launch of electric vehicle fluids for electric vehicles is significantly supporting the expansion of the global electric vehicle fluids market. For instance, in November 2022, Total Energies announced the launch of its electric fluid range, Quartz EV Fluid for hybrid electric cars and Hi-Perf EV Fluid for electric bikes.

Regional Insights

Europe Region Registered the Largest Share of the Global Market in 2023

The Europe region held the dominant share in 2023. This is driven by the increasing government and non-government initiatives to promote cleaner energy use with the aim of limiting carbon emissions. The growing number of people consuming electric vehicles is significantly driving demand for batteries, and other solid materials and fluids. As per the International Energy Agency Global EV Vehicle Outlook (GRVO) Report 2023, around 40% of the electric vehicles sold are accounted for by battery propulsion systems in Europe, 25% in the United States, and 50% in China. This trend is expected to boost the demand for electric vehicle fluids in the coming years.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing measures to promote the electric vehicle industry, specifically in India and China. For instance, in December 2023, the Indian government announced the launch of a production-linked incentives scheme for automotive industries to promote domestic manufacturing of electric vehicles with an investment of INR 25,938 in the next 5 years.

Furthermore, in April 2024, the Indian Ministry of Heavy Industries announced the approval of the Electric Mobility Promotion Scheme for 11 electric vehicle manufacturers: Ola Electric, Bajaj Auto, Mahindra, and others, which has an investment of INR 500 crore to fuel electric vehicle production. This will increase the development of affordable electric vehicle manufacturing, driving demand for electric vehicle fluids over the study period.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The electric vehicle fluids market is consolidated and is expected to register competition due to several players' presence. Key players in the market are focusing on expansion activities to gain a competitive advantage over others. For instance, in October 2023, Shell Lubricants revealed its strategy to acquire MIDEL, and MIVOLT to promote their product offerings. Additionally, in December 2022, Gulf Oil Lubricants India Ltd. announced that it had entered into a partnership agreement with Altigreen to receive electric vehicle fluids.

Some of the major players operating in the global market include:

- BP plc. (UK)

- ENEOS Corporation (Japan)

- ExxonMobil Corporation (US)

- FUCHS Petrolub AG (Germany)

- Petronas (Malaysia)

- PTT (Thailand)

- Repsol S.A. (Spain)

- Royal Dutch Shell plc (Netherlands)

- TotalEnergies SE (France)

- Valvoline Inc. (US)

Recent Developments in the Industry

- In August 2022, Castrol, an oil company, entered a three-year collaboration contract with the China-based automobile manufacturer BYD to utilize its fluids in the electric vehicles it manufactured.

Report Coverage

The electric vehicle fluids market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, vehicle type, propulsion type, fill type, and their futuristic growth opportunities.

Electric Vehicle Fluids Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.44 billion |

|

Revenue forecast in 2032 |

USD 12.27 billion |

|

CAGR |

30.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |